Medical units firm InMode (NASDAQ:INMD) has fallen out of favor with traders prior to now two years for varied causes, which we’ll clarify under. Nevertheless, now that it’s down 76% from highs, the inventory appears to be like poised for upside. In our opinion, InMode has two main catalysts that might ship shares notably increased within the blink of a watch. These two catalysts embody the potential for an activist investor to take a stake within the firm and push for buybacks or for InMode to lastly make an acquisition.

These sound like generic catalysts that may apply to any firm, however we’ll illustrate why they’re essential for INMD particularly. Nonetheless, even when these catalysts don’t materialize, InMode remains to be buying and selling at a low valuation and might rise ultimately. Due to this fact, we’re bullish on the inventory.

What Does InMode Do?

InMode describes itself as a “main world supplier of progressive, minimally-invasive aesthetic and wellness options, with robust model recognition.” In easier phrases, INMD sells high-tech units for health and beauty remedies, together with procedures like pores and skin tightening. Its clientele primarily contains professionals within the healthcare sector, corresponding to plastic surgeons, dermatologists, gynecologists, and different medical specialists. The corporate is headquartered in Israel.

As many individuals are obsessive about how they give the impression of being (particularly as a consequence of social media), it is a money-making business. In truth, the corporate’s web revenue within the trailing 12 months sits at $180.5 million.

Earlier than Explaining the Catalysts, Right here’s What You Have to Know

Earlier than diving into what can ship INMD inventory increased, it’s essential to study why it has been underperforming the market. On prime of this, it’s key to take a look at its flawless stability sheet, as that’s what makes the 2 aforementioned catalysts attainable.

Why Has INMD Inventory Been Falling?

InMode was liked by the market up till late 2021, as you possibly can see within the chart under. So what occurred? Properly, the primary issues that despatched INMD decrease had been rising rates of interest and the general market falling in 2022. However many shares have recovered since then, whereas InMode inventory hasn’t. So, what offers?

First, the corporate has lowered its steering in current months. Previous to October 2023, InMode anticipated FY2023 to come back in at $530-$540 million. This expectation then received lowered to $500-510 million in mid-October, and it received lowered once more in December to $485-495 million earlier than getting revised barely increased to $495-505 million on January 16. EPS steering was revised decrease as effectively prior to now few months. These revisions damage traders’ confidence in administration’s projections.

On prime of this, the Israel-Hamas conflict added extra uncertainty to the inventory, because it’s headquartered in Israel. Nonetheless, INMD launched an announcement in October saying that it doesn’t anticipate to be affected by the conflict. Particularly, InMode acknowledged, “We don’t anticipate any interruption to manufacturing. Our stock ranges globally and in Israel are enough and embody parts and subassemblies for the following three quarters.” Due to this fact, we’re not too nervous about this danger.

Subsequent, right here’s one of many extra essential factors. Buyers are pissed off with the corporate’s deliberate determination to not purchase again its personal shares (you’ll find this frustration on social media), particularly for the reason that inventory trades at a low ahead P/E ratio of 9.2x based mostly on 2023 estimates (with extra earnings progress forward), and the corporate has loads of money readily available. This brings us to our subsequent level — InMode’s robust stability sheet.

InMode’s Stability Sheet is Flawless

InMode has a $675.85 million money place as of the latest quarter. This contains money and money equivalents, marketable securities, and short-term financial institution deposits. It additionally has $0 in debt. InMode’s money pile has been rising through the years because the agency rakes in earnings, however administration has determined to avoid wasting this cash for a possible acquisition as an alternative of shopping for again shares.

Now that you understand this key data, let’s have a look at the 2 catalysts that may ship InMode increased.

Catalyst #1: Potential Activist Investor Involvement, Share Buybacks

To be clear, we don’t know or haven’t heard of any activist traders who wish to take a big stake in InMode. So, it’s not as if the market is anticipating activists to become involved. Nevertheless, given its massive money place and low valuation, it’s very attainable that INMD inventory will catch a big investor’s consideration.

If this occurs and the investor convinces (or forces) the corporate to purchase again its inventory, shares will possible spike, as buybacks are what many shareholders are hoping for. For context, InMode’s money place makes up 35% of the corporate’s market cap, which means that loads of shares might be repurchased with out utilizing debt. This could decrease the share rely, driving earnings per share (EPS) increased.

Catalyst #2: InMode Lastly Makes an Acquisition

As talked about above, InMode isn’t eager on spending its money except it finds an organization that’s adequate to accumulate. Acquisitions carry dangers, as administration groups could overestimate how good the opposite firm is. Nevertheless, InMode’s administration could be very conservative, so in the event that they do make a purchase order ultimately, it could possible be a fantastic firm that’s extremely worthwhile like InMode.

In truth, in Could 2023, InMode’s CEO acknowledged, “Any firm that we’ll purchase shouldn’t dilute the shareholders. It needs to be accretive and never dilutive. And it’s not straightforward. It’s not straightforward due to the profitability construction of InMode. So we’re very cautious within the evaluation that we’re doing on corporations that we want or that we’re exploring a chance to do M&A.”

If the corporate makes an acquisition that’s large enough to excite traders, the inventory can spike.

Is INMD Inventory a Purchase, In accordance with Analysts?

On TipRanks, INMD is available in as a Reasonable Purchase based mostly on three Buys and three Sells assigned prior to now three months. The common INMD inventory worth goal of $30.50 implies 31.2% upside potential.

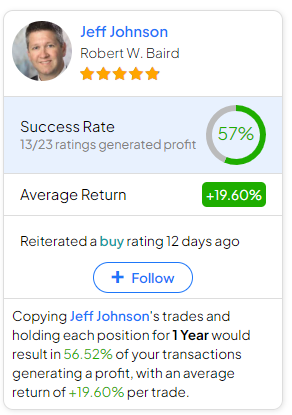

For those who’re questioning which analyst it’s best to observe if you wish to purchase and promote INMD inventory, essentially the most worthwhile analyst overlaying the inventory (on a one-year timeframe) is Jeff Johnson of Robert W. Baird, with a median return of 19.6% per ranking and a 57% success fee. Click on on the picture under to be taught extra.

The Takeaway

InMode is a worthwhile firm buying and selling at a low valuation. Aside from exterior components that despatched shares decrease, traders have merely grow to be pissed off with the corporate’s money stability, because it retains rising with out being put to make use of. Nevertheless, this leaves traders with upside potential, because it’s possible that ultimately, the money can be utilized for buybacks or an acquisition. However, the inventory can rise even when the corporate’s money stability retains rising, as its 9.2x ahead P/E a number of implies a ten.9% earnings yield.