What’s the Labor Division considering?

The U.S. Division of Labor (DOL) simply rescinded 2022 steering that discouraged fiduciaries from together with cryptocurrency choices, similar to bitcoin, in 401(okay) retirement plans. DOL stated that it was simply taking the company’s thumb off the dimensions and was “neither endorsing, nor disapproving of” fiduciaries who determine to incorporate crypto choices on their 401(okay) menu. However, come on, why would DOL go to all this bother if to not enhance the inclusion of bitcoin and different cryptocurrencies in 401(okay)s accounts?

Bitcoin in 401(okay)s is a horrible thought. Contributors don’t perceive the product, it’s a speculative and unstable funding, straying from conventional investments is unlikely to boost returns, and it’s most likely not a prudent choice for 401(okay)s.

Numerous hype – and confusion

Bitcoin receives loads of hype, however folks don’t perceive what it’s. It’s a bizarre product. It’s a type of digital foreign money that makes use of blockchain expertise to help transactions between customers, however that foreign money additionally has a price that seems to fluctuate considerably. Warren Buffett famously stated he wouldn’t purchase all of the bitcoin on the earth for $25. Bitcoin doesn’t produce any money stream, so it doesn’t generate any returns for the traders. The one approach traders can generate a revenue is to promote it again for a better worth. It’s far more like playing than a productive funding.

For some that playing has paid off (see Determine 1). Nevertheless it’s been a wild experience. And it’s not clear the place it goes from right here.

You could possibly do higher in an index fund

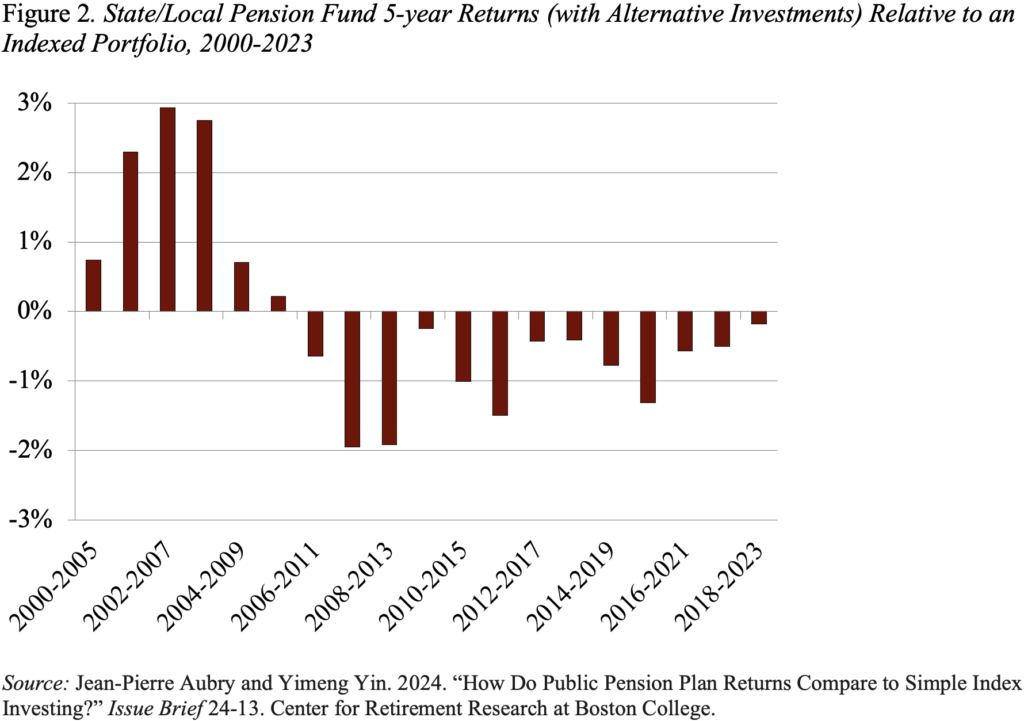

What’s fairly clear, nonetheless, is that transferring away from conventional shares and bonds doesn’t essentially result in greater returns. A number of research have appeared on the funding efficiency of state and native pension plans, which have more and more shifted from conventional property to alternate options, similar to non-public equities, hedge funds, actual property, and commodities and in contrast that efficiency to returns from a hypothetical listed portfolio of 60 p.c shares and 40 p.c bonds. Analysis has discovered that public pensions might get greater after-fee returns by investing within the passive index fund. The most complete evaluation, which finds no positive aspects from alternate options over the complete interval from 2000 to the current, exhibits giant shortfalls for the reason that international monetary disaster. In brief, no proof exists that exotica produces greater returns, and it might nicely harm.

Too dangerous for 401(okay) plans

Lastly, a minimum of one professional argues that on authorized grounds bitcoin shouldn’t be provided in 401(okay)s presently. To fulfill ERISA’s fiduciary requirements, the brink consideration is the overall acceptability of the asset class to a broad group of traders. On this case, probably the most related broad group of traders can be the trustees of outlined profit plans. Most outlined profit plans don’t spend money on bitcoin. And 401(okay) trustees needs to be extra cautious by way of investments than trustees of outlined profit plans. Outlined profit plans contain giant piles of capital managed by skilled fiduciaries with very long time horizons; 401(okay) plans contain small accounts managed by unsophisticated traders with shorter time horizons. It is unnecessary to supply an asset class to 401(okay) contributors earlier than it has been accepted by the skilled trustees of outlined profit plans.

In brief, including bitcoin to the menu of 401(okay) plans isn’t prudent, it introduces pointless threat, and it’s unlikely to enhance returns. DOL shouldn’t be opening the door to any such exercise. The company needs to be defending 401(okay) contributors, not placing retirements in play.