For a lot of international locations, the financial impression of the COVID-19 disaster has been steep. The U.Okay. noticed its largest drop in GDP since 1710, and the U.S. hasn’t seen a GDP decline this massive since 1946. China, alternatively, managed to eke out a bit of progress. So, what does all this imply for investing in a post-pandemic world?

From an funding standpoint, a bulk of the straightforward cash has already been made, for the reason that fairness markets have factored in a lot of the reopening commerce. This implies buyers needs to be selective as economies get better and fundamentals meet up with valuations. Listed below are 5 investing themes for the post-pandemic world to remember.

1) A Much less China-Centric Provide Chain

For the previous 4 many years, globalization has been one of many world’s strongest financial drivers. China has grow to be a crucial component in most international provide chains, ensuing within the “Chinaization” of worldwide commerce. However strains between China and the remainder of the developed world reached a excessive through the pandemic. As firms and international locations deglobalize, they could retreat from a reliance on China’s provide chains—however not from the remainder of the world. Some provide chains may get reshored, whereas others could transfer to different shores.

2) Not A lot Room to Run in Tech

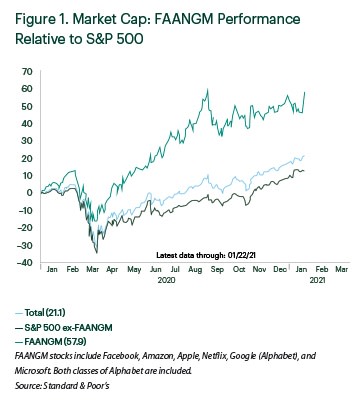

The substantial progress of enormous expertise firms (e.g., Fb, Google, Amazon, Tencent, and Alibaba) makes them a strong a part of the financial ecosystem. And COVID-19 solely strengthened outperformance by these index heavyweights. Simple financial coverage and pandemic-related successful services and products elevated their profitability, justifying their share worth beneficial properties. It’s attainable that further optimistic developments for these firms will exceed expectations, resulting in additional appreciation of their inventory costs—however these must be surprising modifications not but accounted for within the present inventory costs (see chart beneath).

Right here, it’s vital to keep in mind that tech firms are common targets for debate about consolidated energy and regulatory scrutiny. Buyers needs to be aware that potential elevated antitrust enforcement, excessive valuations, and elevated leverage and buying and selling brought on by monetary improvements similar to Robinhood may very well be indicators that mega-cap expertise shares are overvalued.

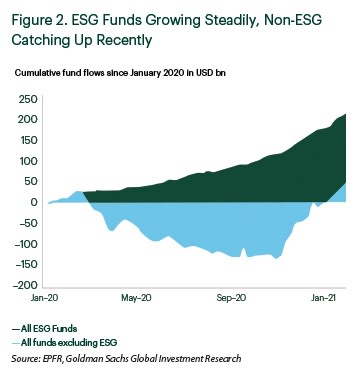

3) Progress of “Really feel-Good” Investing

Environmental, social, and company governance (ESG) investing noticed an exponential rise in curiosity through the pandemic. Since January 2020, ESG funds have acquired $215 billion internet inflows from mutual fund buyers globally (see chart beneath)—a pattern that’s prone to proceed. Beginning this 12 months, all Ideas for Accountable Funding signatories should incorporate ESG issues into a minimum of 50 p.c of their AUM, which totals round $100 trillion (as of March 31, 2020).

The favored MSCI ACWI ESG Common Index outperformed the mainstream MSCI ACWI Index by roughly 1.5 p.c by way of the third quarter of 2020, and ESG-centric funding methods usually carried out effectively. It may very well be argued that the ESG funds have been merely loading up on different well-established elements that additionally did effectively into the downturn (e.g., high quality or low leverage). In time, an in depth danger attribution shall be wanted to disclose whether or not there was any true “alpha” in ESG or if ESG was simply borrowing returns from different elements.

4) The Progress Vs. Worth Conundrum

Earlier than the current market downturn, the valuation dispersion between progress and worth was very huge, as is attribute of a bubble interval. Previous recessions noticed a pivot from momentum-winners into worth names the place there was help from dividend or e-book worth. This time round, efficiency of worth elements was very poor early within the cycle, and the valuation dispersion widened additional through the downturn, reaching an all-time peak. Decision of a number of uncertainties within the latter a part of the 12 months led to a rotation into worth, with many buyers calling this the tip of a decade-long onslaught on worth.

Sure conventional components of worth are structurally challenged and in a long-term secular decline, so we must be cautious of worth traps. One other attention-grabbing phenomenon is an easy supply-demand dynamic when it comes to the variety of worth and progress shares. The expansion universe has shrunk in measurement to historic lows, whilst demand for progress shares from buyers is excessive. This dynamic may translate into increased asset costs for progress shares and fewer differentiation amongst progress managers.

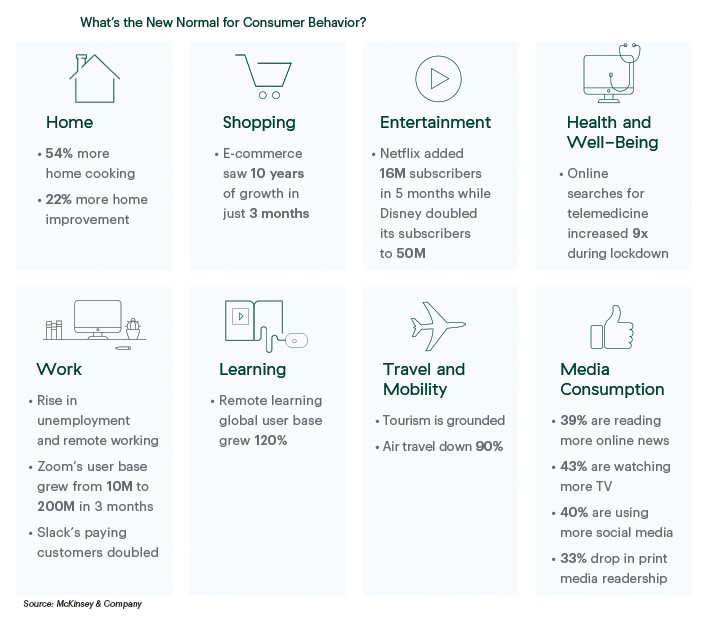

5) New Regular for Client Habits

A few of the current modifications in shopper habits are prone to be sticky and speed up secular traits that started even earlier than the disaster, similar to:

-

Individuals spending extra time at residence—working from residence, studying from residence, consuming at residence, and touring far much less

-

Speedy rise in on-line options, with elevated e-commerce penetration, web TV adoption, and companies similar to telemedicine

In fact, pent-up demand may reverse a few of these traits as we emerge from the pandemic. However as soon as the preliminary surge wanes, customers could return to their pandemic-period habits (see chart beneath).

Thus far, tech giants have benefited from these modifications with speedy share worth beneficial properties. These tech giants is also the enablers for his or her successors. This shift may benefit smaller rivals not simply within the U.S. but additionally in much less developed international locations, the place the delta of progress is quicker and larger.

Alternatives in a Submit-Pandemic Age

The pandemic has sparked speedy improvement and evolution in nearly each facet of individuals’s lives throughout the globe, which has opened up new investing alternatives. By taking note of these investing themes for the post-pandemic world—the place firms, buyers, and customers are prone to shift behaviors, for both the brief time period or long run—you possibly can assist place portfolios for no matter lies forward.

free obtain

How Commonwealth’s Funding Analysis Group Can Make a Distinction for You and Your Shoppers

Discover ways to put our consultants to give you the results you want.