IHG One Rewards Traveler Credit score Card overview

The IHG One Rewards Traveler Credit score Card is IHG’s no-annual-fee card possibility. With this card, you will earn 5 factors per greenback at IHG resorts and resorts in addition to 3 factors per greenback at fuel stations, month-to-month payments and eating places with this card. Whereas the IHG Traveler Card gives some helpful IHG-related perks, it might not be the only option for you. Card Score*: ⭐⭐1/2

*Card Score is predicated on the opinion of TPG’s editors and isn’t influenced by the cardboard issuer.

IHG gives two private cobranded Chase playing cards to assist prospects rack up factors and maximize their stays. One in every of these playing cards is the no-annual-fee IHG One Rewards Traveler Credit score Card. The IHG One Traveler Card actually has extra to supply to IHG loyalists than most no-annual-fee lodge playing cards, but it surely might not be your best option.

The IHG One Rewards Traveler Credit score Card is for vacationers who need to earn IHG factors on their purchases with out incurring an annual charge. Particularly, this card is finest in the event you stick with IHG incessantly and can use the cardboard’s fourth reward evening profit.

Specifically, if you are going to use one among your Chase 5/24 slots on an IHG One Rewards bank card, the IHG One Rewards Premier Credit score Card is a greater possibility for most individuals.

The advisable credit score rating for this card is above 670. Now, let’s take a better take a look at the IHG One Traveler Card so you’ll be able to resolve whether or not it’s best for you.

Associated: Earn further factors at your favourite eating places with IHG One Rewards Eating

IHG One Rewards Traveler execs and cons

| Execs | Cons |

|---|---|

|

|

IHG One Rewards Traveler Card welcome provide

At present, the IHG Traveler Card gives a sign-up bonus of 100,000 bonus factors after spending $2,000 on purchases inside three months of account opening. TPG values IHG One Rewards factors at 0.05 cents every, making this bonus value $500.

This is not fairly the finest provide we have seen on this card (120,000 bonus factors), but it surely meets our standards for a proposal value leaping on.

Day by day Publication

Reward your inbox with the TPG Day by day publication

Be part of over 700,000 readers for breaking information, in-depth guides and unique offers from TPG’s specialists

It’s possible you’ll be eligible for the IHG One Traveler Card (and its sign-up bonus) in the event you fulfill all the following necessities:

- Do not at the moment have a private (not enterprise) IHG One Rewards card

- Have not earned a sign-up bonus on a private IHG card within the final 24 months

- Are underneath Chase’s 5/24 rule

Associated: The last word information to bank card software restrictions

IHG One Rewards Traveler advantages

As with even the finest no-annual-fee playing cards, the IHG One Traveler Card would not provide many luxurious perks. This is a fast overview of the cardboard’s most important advantages and perks.

Fourth reward evening profit

Every time you redeem factors for a keep of 4 or extra nights, each fourth evening will price zero factors. As soon as you are a cardholder, this low cost might be mechanically utilized once you redeem IHG factors for eligible stays.

Save 20% on level purchases

You will get a 20% bonus everytime you purchase IHG factors together with your card. However you’ll be able to’t mix this low cost with different promotions, resembling when IHG factors are on sale. And IHG typically gives a a lot better 100% bonus once you buy factors. So, though I typically purchase IHG factors when the 100% bonus drops the acquisition worth to 0.5 cents per level, I do not discover the 20% low cost interesting.

Computerized Silver standing (with a path to Gold)

IHG One Traveler cardholders will get pleasure from automated Silver Elite standing within the refreshed IHG One Rewards program. This tier features a 20% bonus on lodge stays, precedence check-in and factors that do not expire.

As well as, you should buy your strategy to Gold Elite standing once you spend $20,000 in your card every calendar yr. This tier features a 40% bonus on lodge stays and rollover elite nights for standing the next yr.

No overseas transaction charges

Many bank cards do not cost overseas transaction charges; nevertheless, there are few playing cards on that listing with out an annual charge. In case you journey overseas incessantly, it is value having a minimum of one bank card that does not cost overseas transaction charges.

Associated: How you can maximize longer lodge stays through the use of a free evening profit

Incomes factors on the IHG One Rewards Traveler

If you use your IHG One Traveler Card to make purchases, you will earn:

- 5 factors per greenback at IHG resorts and resorts (2.5% return, primarily based on TPG’s valuations)

- 3 factors per greenback at fuel stations, month-to-month payments and eating places (1.5% return)

- 2 factors per greenback on every thing else (1% return)

These returns aren’t nice, even in comparison with different no-annual-fee playing cards.

The two.5% return at IHG resorts and resorts is not dangerous. However you are able to do a lot better with quite a few purchases utilizing a number of sub-$100 annual charge playing cards. For instance, the $95 annual charge Chase Sapphire Most well-liked Card earns 2 factors per greenback (for over a 4% return) on journey purchases. And the $95 annual charge Capital One Enterprise Rewards Credit score Card (see charges and charges) earns 2 miles per greenback for a 3.7% return on nearly all purchases.

The IHG One Traveler Card additionally is not a good selection for many different purchases. In spite of everything, it solely supplies a 1.5% return at fuel stations and eating places, plus a 1% return on different purchases. A number of easy, cash-back bank cards provide a 2% return on all purchases. For instance, you’ll be able to earn 2% per greenback on all purchases — 1% once you purchase and 1% once you pay — with the no-annual-fee Citi Double Money® Card (see charges and charges).

Associated: The most effective bank cards for every bonus class

Redeeming factors on the IHG One Rewards Traveler

There are a lot of choices for redeeming IHG One Rewards factors. Not surprisingly, you will get the very best worth out of your factors once you redeem for IHG lodge stays.

TPG values IHG factors at simply 0.5 cents every. Nevertheless, it is doable to maximize redemptions with the IHG One Rewards program and get rather more worth out of your factors. Listed below are a number of methods you are able to do so.

IHG has dynamic award pricing, however there are some good offers to be discovered. Nevertheless, one draw back to dynamic pricing is that it is best to extra rigorously think about when to make use of your factors versus money for a keep. I have a tendency to make use of factors once I can get higher than 0.5 cents per level of worth. And I nearly all the time use factors once I e book a keep of 4 nights or longer to make the most of the IHG One Traveler Card’s fourth reward evening profit. Conversely, I have a tendency to make use of money when IHG is providing a profitable lodge promotion.

IHG One Rewards factors can go a great distance in some areas. Listed below are a few of my favourite IHG properties within the U.S. bookable for 10,000 factors. And, in the event you’re able to journey internationally, listed below are among the finest worldwide IHG properties bookable for 10,000 factors.

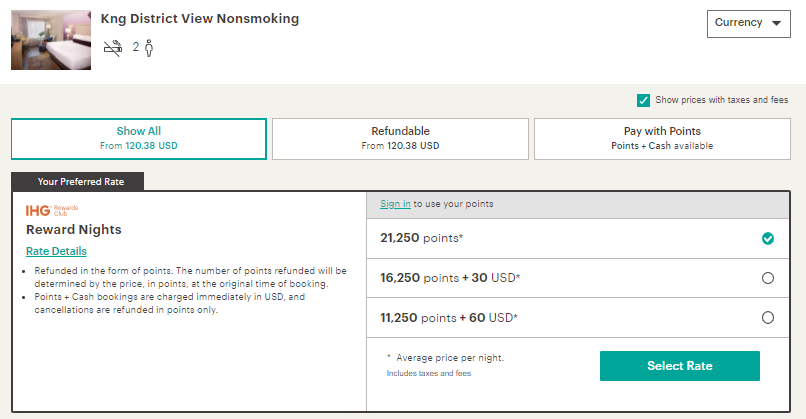

You can also use a mix of Factors + Money to e book stays. For a given room, you will usually see a chart with reductions from the complete nightly award fee in increments of 5,000 factors.

On a Factors + Money reserving, you are basically shopping for the additional factors wanted to finish the redemption. So, in the event you cancel your room, your refund might be given solely in factors. I hardly ever e book Factors + Money charges because it’s often a greater worth to make use of simply factors. Nevertheless, it is value checking to see whether or not the mathematics works out on every reserving.

TPG senior bank cards editor Matt Moffitt likes to make use of his IHG One Rewards factors for four-night award stays. Given he has the IHG One Rewards Premier Enterprise Credit score Card, he will get the fourth evening free on award redemptions. He often targets Vacation Inn and Vacation Inn Categorical properties to stretch his factors however sometimes splashes out on a Kimpton or InterContinental property.

Associated: How you can earn and redeem factors with IHG One Rewards companions

Transferring factors on the IHG One Rewards Traveler

IHG One has greater than 40 airline switch companions, however we advocate avoiding this redemption possibility when doable. Factors switch at an almost 5:1 ratio on the decrease aspect. The switch course of can also be cumbersome, as you can not do it on-line and should name the IHG One Rewards service heart. IHG typically is sluggish to course of factors switch; some have mentioned it took as much as six weeks for the factors to switch.

It’s also possible to switch your factors to different IHG One members beginning at $5 per 1,000 factors and free for Diamond and IHG Enterprise Rewards Program members as much as 500,000 factors per calendar yr.

Which playing cards compete with the IHG One Rewards Traveler?

For IHG loyalists, you might not be enticed by lodge bank cards from different chains. Nevertheless, different playing cards are value contemplating as alternate options to the IHG One Traveler card.

For extra choices, try our full listing of the very best lodge bank cards.

Associated: The most effective bank cards for IHG stays

Is the IHG One Rewards Traveler value it?

In case you keep at IHG properties a number of occasions per yr however need elevated perks when touring, this card could also be a pleasant addition to your pockets. Contemplating this card has no annual charge, this card is a no brainer if you’re beneath 5/24 and wish entry-level IHG One standing and the fourth evening free when reserving with factors.

Associated: 7 methods to earn extra IHG One Rewards factors in your subsequent redemption

Backside line

The IHG One Rewards Traveler Credit score Card is not a nasty possibility. You will get a 2.5% return at IHG resorts and resorts and some IHG-related perks for no annual charge. For vacationers who sometimes go to IHG properties however need entry to the fourth-night-free profit, this can be a strong addition to your pockets. Nevertheless, in the event you’re searching for further perks throughout your stays, you will be disillusioned with this card’s restricted advantages.

Apply right here: IHG One Rewards Traveler Credit score Card