Welcome, fellow finance adventurers! As we navigate the ever-changing panorama of recent enterprise, there’s one buzzword you’ve seemingly heard echoing within the halls of enterprises far and vast – digital finance transformation. It’s not only a fancy time period thrown round at board conferences however an important pivot that’s shaping the world of enterprise finance as we all know it.

Simply as Lewis and Clark couldn’t have explored the American West with out their trusty compass, companies right this moment can’t anticipate to stride confidently into the long run with out embracing digital transformation. It’s the information that may lead us by way of the wilderness of outdated practices and into the promised land of effectivity, accuracy, and strategic perception.

Whether or not you’re a seasoned CFO or a small enterprise proprietor taking your first steps into the digital realm, this information will present the instruments it’s good to rework your monetary operations efficiently. So buckle up, seize your metaphorical compass, and let’s dive into the thrilling world of digital finance transformation.

Fast Overview

Finance transformation is a strategic initiative to enhance the effectivity, effectiveness, and agility of an organization’s monetary capabilities. This entails modernizing programs, automating processes, and redefining roles and obligations inside the finance crew.

The first objectives are to streamline processes, scale back working prices, enhance accuracy and timeliness of economic information, improve compliance, and supply strategic insights to drive enterprise development.

Understanding Digital Finance Transformation

Earlier than we soar into the deep finish, let’s take a second to know what digital finance transformation actually means.

In its easiest phrases, digital transformation is the method of utilizing digital expertise to enhance and automate monetary operations and processes. It’s like giving finance organizations a tech-savvy makeover to make it extra environment friendly, correct, and strategically insightful.

Think about your enterprise as a traditional automotive. It’s dependable, it’s carried out an excellent job to this point, however it’s beginning to present its age. You’re spending extra time fixing it than truly driving it. Now, think about taking that traditional automotive and becoming it with a state-of-the-art electrical engine, a GPS system, and even a self-driving function. That’s digital transformation – it’s about upgrading your enterprise with the most recent expertise to drive it ahead extra effectively and successfully.

Now, let me share a bit story from my very own expertise. After I first heard about digital transformation, I used to be working as a finance supervisor at a mid-sized firm. We had been nonetheless utilizing spreadsheets for all the things, and once I say all the things, I imply all the things. The mere point out of “digital transformation” despatched shivers down my backbone, conjuring up photographs of robots taking up our jobs and complicated software program we’d by no means be capable of perceive.

However as daunting because it appeared, sticking to our previous methods was turning into more and more unsustainable. Our processes had been gradual, error-prone, and didn’t present the strategic insights we wanted to drive the enterprise ahead. It was clear that the finance operate wanted to vary, however the path ahead was shrouded in uncertainty and concern of the unknown.

The Want for Finance Transformation

Now that we’ve gotten our toes moist with digital transformation in finance, let’s discover why it’s not only a nice-to-have however essential in right this moment’s enterprise panorama.

Within the age of digital expertise, the tempo of enterprise has accelerated like a sports activities automotive on an open freeway. Selections must be made quicker, information must be processed faster, and monetary insights must be out there on the drop of a hat. Sticking to conventional, guide strategies of managing funds is like making an attempt to compete in a Components 1 race with a horse-drawn cart. Positive, it’d get you there finally, however you’ll be left consuming the mud of your opponents who’ve embraced the facility of digital transformation.

However don’t take my phrase for it, let’s have a look at some real-life examples of finance organizations that rolled out digital applied sciences.

Netflix’s Digital Transformation

Ever heard of a bit firm known as Netflix? In fact, you might have! However do you know that their success is partly attributable to their early adoption of digital instruments? Again when Blockbuster was nonetheless a factor (relaxation its soul), Netflix’s finance operate was already leveraging the facility of knowledge analytics for strategic decision-making, serving to it anticipate viewer preferences and make smarter funding selections. Right now, they’re a streaming big with over 200 million subscribers worldwide.

Domino’s Finance Transformation

One other shining instance is Domino’s Pizza. Sure, the pizza firm! They remodeled their finance operate by integrating superior analytics and AI applied sciences, which helped enhance their gross sales forecasting and useful resource allocation. This led to extra environment friendly operations and elevated profitability, proving that even essentially the most conventional companies can profit from a tech makeover.

So, whether or not you’re within the leisure trade, meals service, or every other sector, digital finance transformation is a key ingredient for achievement within the Twenty first-century enterprise world. It’s not about changing people with robots, however enhancing our capabilities and permitting us to deal with what we do greatest – strategizing, innovating, and driving development. So, let’s roll up our sleeves and prepare to dive into the nitty-gritty of how one can digitally rework your finance operate!

Step-by-Step Information to Digital Finance Transformation

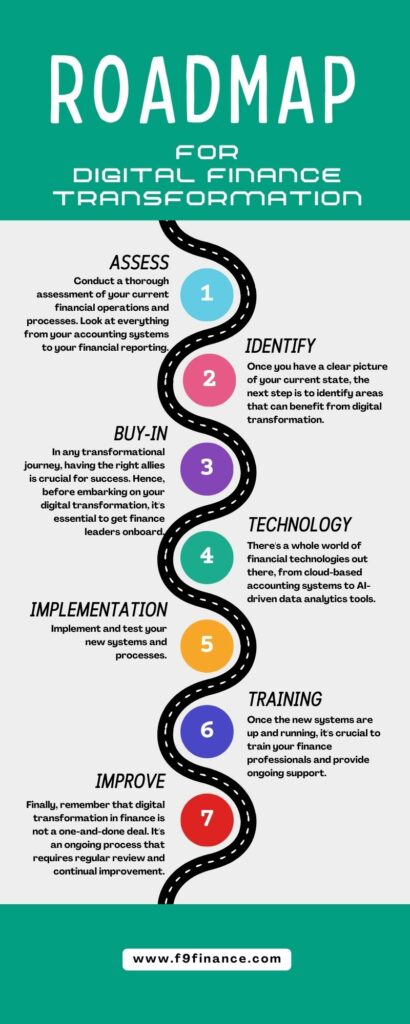

Step 1: Assessing Your Present Monetary Panorama

Earlier than you plot a course to your vacation spot, you first have to know the place you’re ranging from. Conduct an intensive evaluation of your present monetary operations and processes. Take a look at all the things out of your accounting programs to your monetary reporting. And bear in mind, that is like cleansing out your storage – it’s going to look worse earlier than it will get higher! A standard pitfall at this stage is getting overwhelmed by the sheer quantity of mud bunnies (or in our case, outdated spreadsheets) you’ll uncover. However concern not! That is a necessary step in the direction of your digital transformation journey.

Step 2: Figuring out Alternatives for Enchancment

Upon getting a transparent image of your present state, the following step is to determine areas that may profit from digital transformation. This will really feel akin to discovering a needle in a haystack, however belief me, that needle is price its weight in gold. Keep in mind, Rome wasn’t inbuilt a day, and neither will your digital finance transformation. It’s okay to begin small and regularly increase your scope as you turn out to be extra snug.

Step 3: Get Finance Leaders Onboard

In any transformational journey, having the precise allies is essential for achievement. Therefore, earlier than embarking in your digital transformation, it’s important to get finance leaders onboard. These leaders play an important function in driving change, embracing new applied sciences, and fostering a tradition of innovation. Additionally they function influencers who can rally the crew, construct consensus, and overcome resistance to vary.

Step 4: Deciding on the Proper Applied sciences

Now comes the enjoyable half – looking for new finance expertise! Properly, it’s not precisely like a spree on the mall, however it may be simply as thrilling. There’s a complete world of economic applied sciences on the market, from cloud-based accounting programs to AI-driven information analytics instruments. I bear in mind feeling like a child in a sweet retailer once I first began exploring these applied sciences. However bear in mind, it’s not about getting the shiniest toy, however the one that most closely fits your enterprise wants.

Step 5: Implementing the Modifications

Implementing new applied sciences and operational processes is like assembling a chunk of IKEA furnishings. It may appear daunting at first, with all these components and directions, however as soon as you are taking it step-by-step, you’ll begin to see the large image. And similar to that IKEA bookshelf, the satisfaction you’ll really feel as soon as all the things is in place will make all of the exhausting work price it.

Step 6: Coaching and Assist

As soon as the brand new programs are up and working, it’s essential to coach your finance professionals and supply ongoing help. This stage typically appears like herding cats – everybody’s working in several instructions, and there’s all the time one who can’t determine the way to log in! However with persistence, observe, and a wholesome dose of humor, your crew will quickly be navigating the brand new programs like professionals.

Step 7: Overview and Continuous Enchancment

Lastly, keep in mind that digital transformation in finance is just not a one-and-done deal. It’s an ongoing course of that requires common assessment and continuous enchancment. This may sound like an uphill battle, however bear in mind each step brings you nearer to the summit. And the view from the highest – a streamlined, environment friendly, and data-driven finance operate – is unquestionably definitely worth the climb!

Fast Recap

We’ve come a good distance in our finance transformation journey! We began by defining this considerably intimidating time period, evaluating it to upgrading a traditional automotive with state-of-the-art options. We then delved into why companies have to embrace this transformation, drawing on the success tales of Netflix and Domino’s Pizza as shining examples of what could be achieved.

We walked by way of the step-by-step strategy of digital transformation, from assessing your present monetary panorama (and dusting off these hidden spreadsheets), to figuring out alternatives for enchancment, deciding on the precise applied sciences, implementing modifications, coaching your workers, and regularly reviewing and bettering your new programs. We’ve had a number of laughs alongside the way in which, evaluating the implementation course of to assembling IKEA furnishings and the coaching section to herding cats!

It’s been a curler coaster trip, however bear in mind, each curler coaster has its ups and downs, and it’s the fun of the trip that makes it price it. Digital finance transformation could seem daunting at first, however with every step, you’ll be bringing your enterprise nearer to elevated effectivity, accuracy, and strategic insights.

Incessantly Requested Questions

What’s the method to finance transformation?

Finance transformation is a strategic method that entails redesigning and modernizing an organization’s monetary processes, programs, and organizational construction. It goals to enhance effectivity, scale back prices, improve accuracy, and supply higher information for decision-making.

What are finance transformation greatest practices?

Greatest practices embrace conducting an intensive evaluation of present monetary operations, figuring out areas for enchancment, deciding on the precise applied sciences, implementing modifications systematically, offering complete coaching and ongoing help, and commonly reviewing and bettering the brand new programs.

What do finance transformation consultants do?

Finance transformation consultants information companies by way of the method of remodeling their monetary capabilities and could be a nice useful resource for digital transformation traits. They provide knowledgeable recommendation on the choice and implementation of recent applied sciences, help in change administration, and assist set up new processes and procedures.

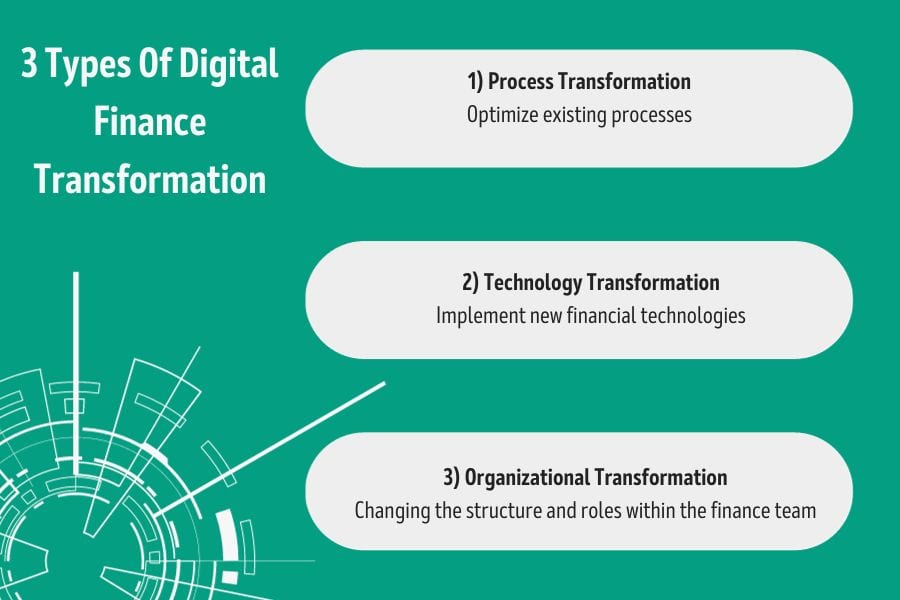

What are the sorts of finance transformation?

There are three major sorts: Course of transformation (optimizing present processes), expertise transformation (implementing new monetary applied sciences), and organizational transformation (altering the construction and roles inside the finance crew).

Why is monetary transformation wanted?

Monetary transformation is required to maintain tempo with the quickly altering enterprise setting. It permits corporations to function extra effectively, make quicker and better-informed selections, and acquire a aggressive benefit.

What’s the function of economic transformation?

Monetary transformation performs an important function in enhancing the operational effectivity of an organization’s finance operate, enabling it to ship extra strategic worth and drive enterprise development.

What are the 4 major areas of digital transformation?

The 4 major areas are enterprise processes, enterprise fashions, area ecosystems, and cultural/organizational change.

What’s FinTech digital transformation?

FinTech digital transformation entails making use of digital applied sciences (like blockchain, AI, and cloud computing) within the monetary providers sector to enhance service supply, improve buyer experiences, and drive innovation.

What are the challenges of digital transformation within the finance trade?

Challenges embrace resistance to vary, lack of digital expertise, delicate information and privateness issues, regulatory compliance points, and the complexity of integrating new applied sciences with present programs.

How is digitalization altering finance?

Digitalization is making the finance sector quicker, extra environment friendly, and extra data-driven. It’s automating routine duties, offering real-time insights, and enabling finance groups to play a extra strategic function in enterprise decision-making.

What’s a finance goal working mannequin?

A finance goal working mannequin is an in depth blueprint of how an organization’s finance operate ought to function sooner or later to attain strategic aims. It outlines the specified state of processes, programs, expertise, roles, and tradition inside the finance crew.

Have any questions? Are there different matters you want to us to cowl? Go away a remark beneath and tell us! Additionally, bear in mind to subscribe to our Publication to obtain unique monetary information in your inbox. Thanks for studying, and comfortable studying!