The world appears to be altering at lightning pace, however generally I’m stunned by how little issues change. Let’s return a dozen years to 2012. Within the Nationwide Soccer League, the 2012 Baltimore Ravens and San Francisco 49ers led their respective conferences and headed into the playoffs as odds-on favorites to satisfy within the Tremendous Bowl. Democrats managed the White Home, however the incumbent wasn’t too in style. The Fed was energetic on the speed entrance. The economic system and inventory market have been rebounding strongly from a once-in-a-generation disaster. Sound acquainted?

My e book The Nice Wealth Erosion was additionally printed in 2012. On the time, I used to be shocked by the diploma to which traders have been lagging the inventory market indexes that they (and their advisors) have been purported to be monitoring. On the time, Dalbar analysis confirmed that over the earlier 20 years, fairness traders as a gaggle lagged the unmanaged S&P 500 index by 4.6% a 12 months on common. Quick ahead to right this moment and the efficiency hole has narrowed solely barely to 3.1%. With all of the advances in expertise, AI and supercomputing, why are energetic traders discovering it so exhausting to maintain tempo with the unmanaged, do-nothing method?

As was the case in 2012, there are 4 essential components driving this underperformance and thus erosion of wealth. You owe it to your shoppers to forestall these hidden components from decimating their wealth:

- Market Volatility

- Portfolio Building

- Bills and Charges

- Taxes

Because the previous saying goes: “The extra issues change the extra issues keep the identical.” Let’s have a look at these 4 components extra intently.

1. Volatility. Markets go up and markets go down. That is the immutable regulation of markets. Anybody who invests in securities should settle for this actuality. An investor have to be prepared to endure the randomness of market actions and never bail out each time a sudden drop comes alongside. As lots of you recognize, the largest features within the inventory market have a tendency to come back shortly after a big downturn. However your shoppers gained’t be there to seize these features if you happen to allow them to bail out on the first signal of bother. However there are methods to regulate the quantity of volatility inherent in each portfolio. The 2 most necessary inquiries to ask are: (a) “How a lot danger is your shopper shopping for?” and (b) “Are they shopping for the proper of danger?” As soon as you may reply that query for every shopper, you may transfer on to portfolio development.

2. Portfolio Building. There are two necessary inquiries to ask in relation to portfolio development. First, are there confirmed, constant methods to construct a portfolio that can ship long-term charges of return reflective of your shopper’s danger tolerance? Second, which technique is healthier for diversification: Proudly owning 15 or 20 shares, an array of mutual funds and ETFs with 200 to 500 shares or proudly owning the complete market? Let’s look to the daddy of recent portfolio principle, Harry Markowitz, who acquired a Nobel Prize for proving that diversification is the important thing to managing danger. He confirmed {that a} effectively allotted portfolio will safeguard your shopper in opposition to unexpected financial occasions and can profit from technological developments. His analysis confirmed broad diversification protects a portfolio from the ever-present tempo of change and that the fitting portfolio development allows you to diversify your shoppers correctly and to seize increased returns as soon as the market recovers from its inevitable declines.

3. Charges and Bills. John Bogel constructed his empire at Vanguard by considerably reducing the charges traders needed to pay for mutual funds and ETFs. And the trade adopted. So, if you happen to see your shoppers paying 2x to 3x greater than needed to realize the identical returns, would you continue to advocate these investments or funds? In fact not.

Keep in mind the 4.6% unfold between the market and the typical investor mentioned above? Analysis exhibits about 3% of that 4.6% unfold may very well be attributed to poor allocation and paying extra charges and buying and selling prices. The remaining 1.6% was as a result of improper portfolio administration and irrational investor conduct. A dozen years later that disparity largely stays. As was the case 12 years in the past, there are disclosed prices and undisclosed prices. The disclosed prices are described within the fund prospectus for issues like administration charges, promoting and administration. It’s the undisclosed charges that really have an effect on the underside line and so typically erode your shoppers’ returns.

These charges must do with commissions and the bid-ask unfold. They’re straight associated to portfolio turnover, particularly in down years. Certain, traders can not management these bills, however you may choose funds that decrease turnover. These charges are associated to the kind of funding car you choose to unfold your shoppers’ danger. Select correctly!

4. Taxation and Turnover. Clearly, in case your shopper’s cash is in a professional plan, an IRA or 401k, then taxes on accumulation usually are not a problem. The federal government will get its pound of flesh when your shopper begins taking distributions. Taxes are postponed till the account is liquidated or distributions are being made. However there are limitations positioned on how a lot an investor can allocate to a professional plan. Many traders produce other cash to take a position. This non-qualified cash is topic to taxation on the annual development. That is the place turnover turns into so necessary.

Portfolios with excessive turnover—akin to with actively managed funds—normally face excessive taxes and heavy bills on high of excessive administration charges. So now you’re not solely going through the present tax value, however the compounding impact of the fee in your shoppers’ portfolios. Assume a shopper earns 10% for the 12 months. If turnover is 100%, then it’s possible that 100% of any acquire is acknowledged for tax functions that 12 months. The features are taxed at abnormal revenue tax charges—40% for a lot of of your shoppers—as a result of these gross sales didn’t qualify for long-term capital features charges. This implies your shopper solely netted 60% to 75% of the acknowledged development that 12 months. However the subsequent 12 months, if their internet portfolio grows an extra 10%, what occurs? They don’t get 10% on the taxes they paid. That cash has been extracted from the portfolio. Your shopper solely will get the ten% on the remaining 60%. When this occurs 12 months after 12 months, their portfolio is dramatically impacted by the tax impact.

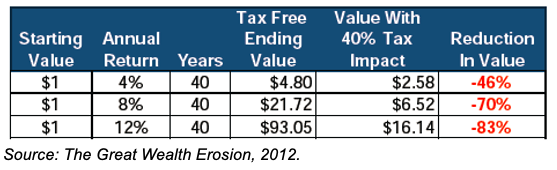

The desk under exhibits the influence taxes can have in your returns.

Contemplate how a portfolio by which solely a small fraction of the acquire is acknowledged can be impacted. If solely 20% of the acquire from the earlier instance is taxable, meaning 80% of the acquire would nonetheless be within the portfolio and would profit from any further development the next 12 months. You is perhaps scratching your head and questioning why one portfolio can be topic to taxes on 100% of the expansion whereas one other would solely be topic to taxation on 20%. The reply is turnover.

In response to Morningstar, the typical turnover fee for mutual funds can typically exceed 100%. Meaning 100% of any features annually are possible topic to the abnormal revenue tax fee. For the reason that positions have been held for lower than one 12 months, they don’t qualify for the 20% long run capital features tax fee. Backside line: Taxes are extraordinarily hazardous to your shopper’s wealth.

The 4 components described above: (1) volatility, (2) correct portfolio development, (3) charges and bills coupled with turnover and (4) taxes can cut back your shoppers’ portfolios by as a lot as 5% yearly. Right here’s why. In the event that they earn 10% on their non-qualified portfolio, however 5% is misplaced as a result of 4 wealth eroders, it takes greater than twice as lengthy to perform the identical final end result. That fifty% discount may have a dramatically destructive influence on the portfolio.

Conclusion

{Most professional} advisors and brokers don’t intentionally mismanage or ignore the 4 components. I do know this would possibly look like cash administration 101 to you. However proof from Dalbar, Morningstar and others suggests many advisors are both unaware of the position these 4 wealth eroders play or simply select to disregard them. As we’ve seen all through the NFL season, the groups nonetheless alive within the playoffs are those not afraid to return to fundamental blocking and tackling. It’s at all times the basics that win the day.

Dr. Man Baker, CFP, CEPA, MBA is the founding father of Wealth Groups Alliance (Irvine, CA).