E-commerce and cloud big Amazon (NASDAQ:AMZN) seems to be set to ascend to the subsequent decade of development. After I gave Amazon a Purchase ranking final 12 months, the AWS phase was going through macro headwinds. I used to be optimistic that they have been solely non permanent and that AWS would rebound. The current This fall outcomes proved simply that. The inventory has since gained 70%+, however I proceed to be bullish on AMZN primarily based on reaccelerated development throughout AWS (fueled by AI), e-commerce, and its promoting enterprise, in addition to margin and cash-flow growth.

This fall Earnings Beat Pushed by Strong Momentum Throughout All Segments

On February 1, Amazon reported robust This fall outcomes pushed by sturdy momentum throughout all income segments, together with E-Commerce (document vacation procuring season), Promoting, and Cloud. Adjusted earnings of $1.00 per share handily beat analysts’ estimate of $0.80. Additionally, the determine was an enormous 3,233% larger than final 12 months’s determine of a mere $0.03 per share.

Additional, internet gross sales jumped 14% year-over-year to $170 billion. Area-wise, North America gross sales grew 13% year-over-year, with Worldwide phase income development at 17% (in fixed forex).

The most important focus of the This fall outcomes was AWS (Amazon Net Providers), which witnessed an inexpensive rebound. AWS internet gross sales grew 13% year-over-year to $24.2 billion. Additional, there was a major working margin growth from 24.3% within the prior-year quarter to 29.6% presently. Significantly noteworthy is that working revenue jumped 383% year-over-year to $13.2 billion, and the working margin jumped to 7.8% in comparison with only one.8% a 12 months in the past.

It’s not simply the margin growth that impressed traders in This fall, it was an enormous leap in money flows that reassured traders that Amazon’s fundamentals stay intact. This fall free money flows grew to $36.8 billion in comparison with money outflows of $11.6 billion a 12 months in the past. Margin growth, coupled with sturdy free money flows, implies robust returns for traders within the years to return.

What’s extra, the corporate gave out a better-than-expected Q1 outlook concerning its working revenue. Working revenue steering of $8-12 billion ($10 billion on the midpoint) got here in forward of the $8.8 billion consensus estimate and can also be a lot larger in comparison with $4.8 billion generated within the first quarter of 2023. It’s no surprise then that the spectacular earnings have taken the inventory worth round 8% larger, getting nearer to its all-time excessive of ~$188 seen in 2021.

It’s value noting, nonetheless, that Q1 gross sales are anticipated to develop between 8-13% year-over-year and be within the vary of $138-143.5 billion, simply barely under the consensus estimate of $142.1 billion

Right here’s one other factor value noting: cashing in on the inventory worth rally, Amazon’s Founder and Govt Chairman, Jeff Bezos, just lately offered $6 billion value of AMZN shares in a number of trades. Actually, the corporate disclosed that Bezos has enabled a buying and selling plan that may permit him to promote a whopping 50 million shares value round $9 billion earlier than January 31, 2025.

AWS Will Drive Future Returns; AI Would be the Propeller

AI and cloud computing will proceed to enhance and spur demand for one another. Additional, the cloud optimization noticed in 2023 because of recessionary fears is now over, and cloud computing is as soon as once more experiencing important development throughout the business, as evidenced by studies from varied firms. Amazon’s AWS now reportedly stands on the cusp of a $100 billion annual run price.

AWS is a cloud computing enterprise that gives choices to enterprises to scale up or down primarily based on demand. Amazon’s AWS continues to be the market chief in cloud computing. Microsoft’s Azure is the chief competitor of AWS and Microsoft’s (NASDAQ:MSFT) excellent cloud numbers throughout its current earnings name reaffirm a vivid future for every little thing cloud.

In the course of the earnings name, CEO Andrew Jassy highlighted, “Within the scheme of a $100 billion annual income run price enterprise, it’s nonetheless comparatively small, a lot smaller than what will probably be sooner or later, the place we actually imagine we’re going to drive tens of billions of {dollars} of income over the subsequent a number of years.”

Additional, the AWS backlog is rising at a quick tempo. Administration additionally highlighted that AWS is snowballing with an elevated worldwide footprint in additional nations. Furthermore, newer partnerships, particularly in generative AI, will foster accelerated development within the coming years. This provides us the long-term roadmap for the expansion of AWS, additional catapulted by AI.

Amazon’s Valuation Isn’t Costly, Both

As Amazon homes a number of companies beneath its radar, I imagine the EV/EBITDA ratio is the very best metric to judge the inventory’s valuation. Being an business chief, the corporate has traditionally traded at excessive multiples. At current, nonetheless, Amazon inventory is buying and selling at round 13.7x EV/EBITDA (on a ahead foundation) in comparison with its personal five-year historic common of 21x. This means an enormous 35% low cost.

For the sake of comparability, Amazon is buying and selling at a price-to-sales (P/S) ratio of three.1x. In distinction, cloud computing and tech big Microsoft trades at a P/S of 13.2x, whereas social networking firm Meta Platforms (NASDAQ:META) trades at a P/S of 8.9x.

Subsequently, I imagine the inventory is buying and selling at a sexy valuation and presents an amazing shopping for alternative, given the robust development potential throughout varied verticals.

Is Amazon Inventory a Purchase, In keeping with Analysts?

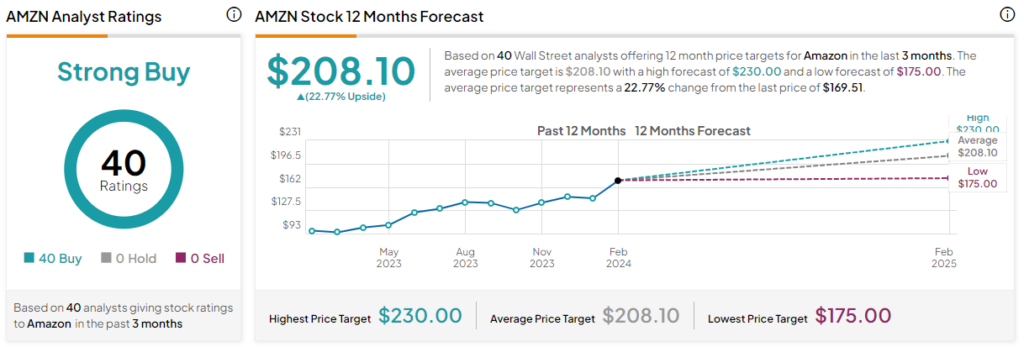

The Wall Road group is clearly optimistic about Amazon inventory, with a majority having raised their worth targets on the inventory post-earnings. Total, the inventory instructions a Robust Purchase consensus ranking primarily based on 40 unanimous Purchase scores. The common AMZN inventory worth goal of $208.10 implies a 22.8% upside potential from present ranges.

Conclusion: Contemplate AMZN Inventory for Its Lengthy-Time period Development

Amazon inventory was one of the vital battered shares within the tech crash of 2022. The inventory misplaced half of its market cap, primarily because of the double bother of e-commerce deceleration and a cloud computing slowdown. Nevertheless, bygones are bygones. This fall Cloud numbers have been reassuring and trace that AWS is ready to steer Amazon’s development story within the coming years, additional pushed by AI tailwinds.

Moreover, there are different areas of worthwhile development, together with e-commerce, Amazon Prime memberships, in addition to a robust promoting enterprise. On prime of that, revenue margins are anticipated to increase materially, aided by cost-cutting initiatives. Amazon’s current outcomes instill confidence in traders as soon as once more that it is able to embark on a number of years of development forward. Subsequently, I’ll purchase the inventory at present ranges.