Is it doable to acquire life insurance coverage protection as a smoker?

Sure, it’s doable to get life insurance coverage protection as a smoker. Nevertheless, life insurance coverage premiums are sometimes greater for people who smoke than for non-smokers. It’s because smoking is related to the next threat of assorted ailments, together with coronary heart illness, lung most cancers, and respiratory diseases. Insurers alter premiums to mirror this elevated threat.

Regardless of the upper value, life insurance coverage stays essential for people who smoke. The elevated well being dangers related to smoking might make life insurance coverage probably extra necessary for people who smoke than for non-smokers.

Whereas acquiring life insurance coverage protection as a smoker could also be dearer, it stays a significant monetary device to guard your family members and guarantee their monetary well-being within the face of elevated well being dangers. Contemplating the potential well being dangers and the worth of monetary safety for your loved ones, acquiring life insurance coverage is a prudent resolution for people who smoke.

Listed here are a couple of the explanation why Life Insurance coverage is so necessary for people who smoke:

Monetary Safety: Life insurance coverage offers monetary safety in your family members within the occasion of your demise. For people who smoke, who face an elevated threat of untimely demise resulting from smoking-related diseases, having life insurance coverage might be important to make sure that their households are financially safe after their passing.

Overlaying Excellent Money owed: When you have excellent money owed similar to a mortgage, loans, or bank card balances, life insurance coverage can assist cowl these monetary obligations, stopping your family members from being burdened with the debt.

Earnings Alternative: In case you are the first breadwinner in your loved ones, life insurance coverage can change your earnings, guaranteeing that your loved ones can preserve their way of life even after your demise.

Is acquiring specified severe sickness protection an possibility for people who smoke?

Sure, getting specified severe sickness protection is an possibility for people who smoke. Nevertheless, it’s necessary to bear in mind that the premiums for this protection are sometimes greater for people who smoke as a result of elevated well being dangers related to smoking. People who smoke can nonetheless safe this invaluable safety, which offers monetary help within the occasion of a lined vital sickness analysis, serving to them handle medical bills and associated prices throughout a difficult time.

Critical sickness cowl offers a lump sum fee in case you are recognized with a vital sickness lined by your coverage, which may embrace circumstances like most cancers, coronary heart illness, and stroke. For people who smoke, the danger of creating these severe well being circumstances is notably greater, making severe sickness cowl a invaluable complement to conventional life insurance coverage.

Whereas the premiums for severe sickness cowl can also be greater for people who smoke, the peace of thoughts and monetary safety it offers might be properly definitely worth the funding.

Study extra about Critical Sickness cowl by studying our articles:

Can life insurance coverage be reviewed in case you quit smoking?

Sure, in lots of instances, life insurance coverage might be reviewed and probably adjusted in case you quit smoking. If you stop smoking, your well being improves, and this may have a optimistic affect on the premiums you pay in your life insurance coverage protection.

If you happen to bought your present life insurance coverage whereas nonetheless a smoker and stop within the meantime, you might be able to save a whole lot of euros per yr because of your new non-smoker standing.

Right here’s how the assessment course of sometimes works:

Ready Interval

Many insurance coverage firms require a ready interval of sometimes 12 months after you stop smoking earlier than they contemplate you a non-smoker.

Qualifying for Non-Smoker Phrases and Proof of Non-Smoking

If you happen to at the moment maintain a life insurance coverage coverage and wish to change to non-smoker phrases with the identical insurance coverage supplier, you are able to do so, nevertheless it requires a dedication to stay tobacco-free.

Re-categorisation as a non-smoker with the identical life insurance coverage supplier requires you to observe their particular procedures and pointers for transitioning to non-smoker phrases. This may increasingly contain assembly their standards for a delegated smoke-free interval, present process a cotinine check, and submitting the mandatory documentation.

Nevertheless, in case you select to discover your life insurance coverage choices via LowQuotes, you may provoke a brand new software, bypassing the necessity for in depth documentation and assessments associated to your smoking standing. This may simplify the method and probably prevent effort and time.

Premium Adjustment

When you meet the insurer’s standards for non-smoker standing, your life insurance coverage coverage might be reviewed and adjusted accordingly. At this level, you may anticipate to see a discount in your premiums. Non-smoker charges are considerably decrease than smoker charges for a similar protection.

Remember that the particular procedures and necessities for these changes could range between insurance coverage firms, so it’s a good suggestion to seek the advice of with considered one of our monetary advisors to completely perceive the method.

How a lot can I save on life insurance coverage premiums by quitting smoking?

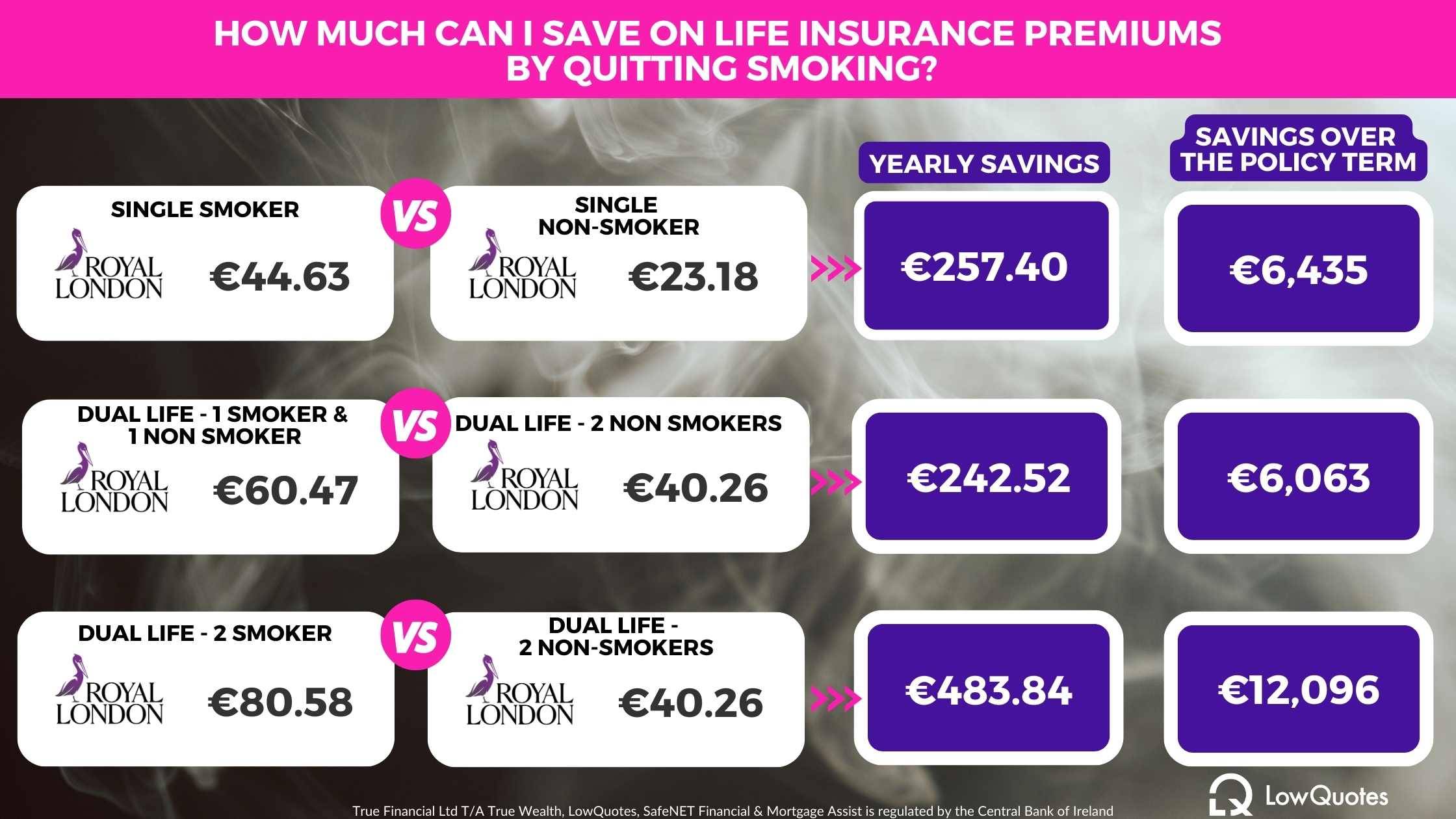

If you stop smoking and may present proof of your smoke-free standing, you could turn out to be eligible for non-smoker charges. The precise financial savings will range primarily based on elements like your age, the sort and quantity of protection you’re searching for, and the insurance coverage firm you select. Nevertheless, right here’s an estimate: Non-smoker charges are sometimes about half and even lower than what people who smoke pay for a similar protection.

Instance:

Let’s take, as an example, people who’re 37 years outdated and searching for protection of €300,000 for a time period of 25 years as of September 2023.

As you may see beneath, giving up smoking can result in annual financial savings of a whole lot and even 1000’s over the course of your coverage.

If you happen to’ve just lately stop smoking and already maintain a life insurance coverage coverage, get in contact with us. We are able to assessment your coverage and discover alternatives for higher charges. And in case you’re nonetheless a smoker, this is a superb second to think about making that optimistic change.