Bank card sign-up bonuses are one of many quickest methods to earn free flights. However lately, banks have taken steps to cut back bank card churning — the American Categorical once-in-a-lifetime bonus coverage and Chase’s 5/24 rule are prime examples. Too many bank cards is usually a pink flag for lenders, and a few additionally are likely to draw back from candidates with credit score limits bigger than their incomes.

Luckily, bank cards are usually not the one technique of accumulating factors and miles. Except for increase your stability by flying, listed below are 10 simple methods to develop your airline mileage stash with out bank card purposes.

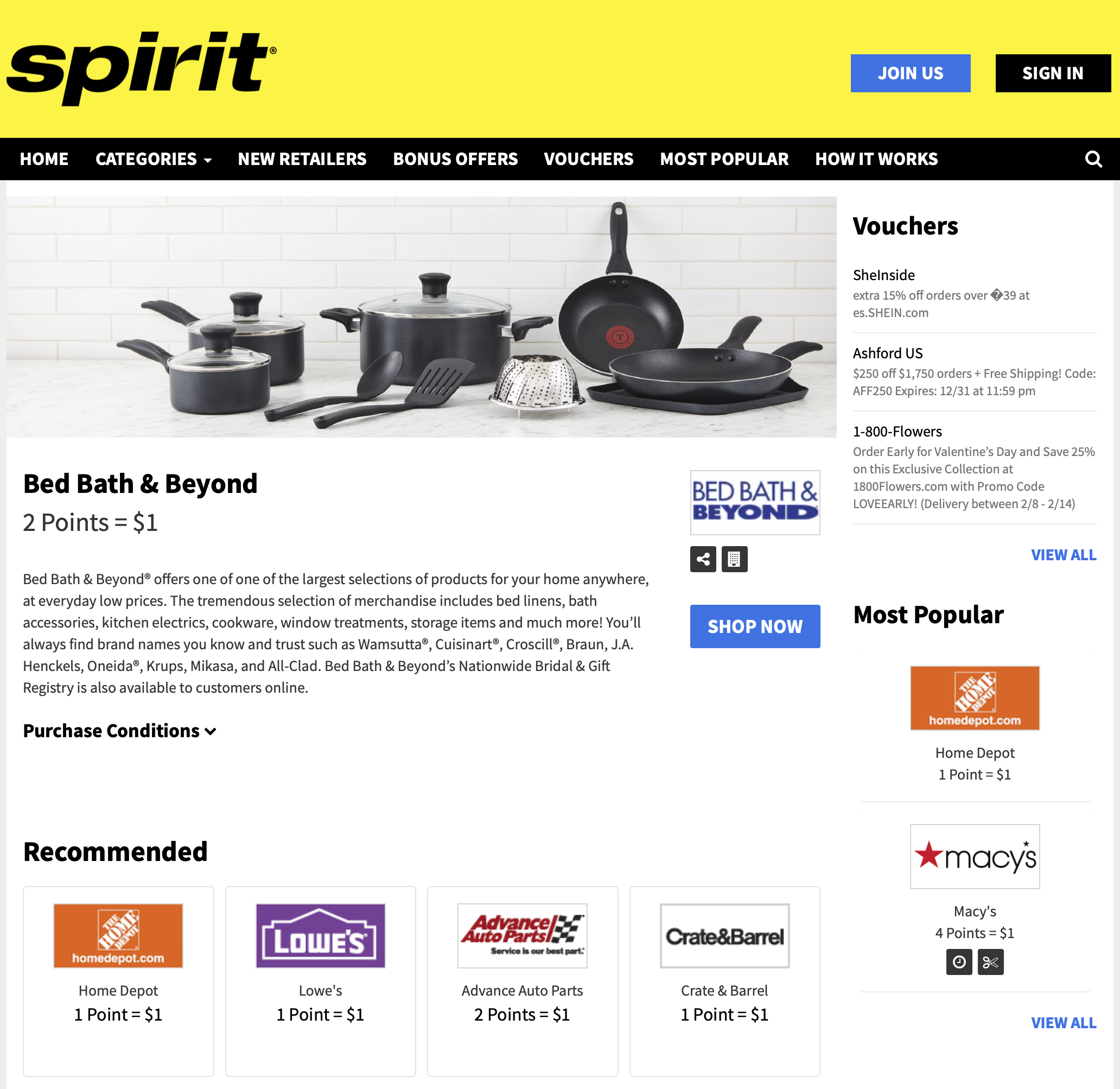

Use on-line purchasing portals

Many airways, together with banks and resort applications, provide on-line purchasing portals with anyplace from dozens to a whole bunch of taking part retailers. Some standard choices embrace Store By way of Chase, Southwest Fast Rewards Purchasing and American AAdvantage eShopping.

Once you click on via a purchasing portal earlier than making a purchase order, you are sometimes rewarded with further factors or miles per greenback on high of your common bank card rewards. Sure gadgets, reminiscent of a satellite tv for pc dish or cell phone service, might earn a hard and fast reward.

Listed here are some ideas:

- All the time test a web-based portal first.

- Store round. The bonus factors you’ll be able to obtain per greenback spent might fluctuate by portal.

- To save lots of time, use a purchasing portal aggregator, reminiscent of Evreward or Cashback Monitor. These websites present you bonus factors by retailer, permitting you to simply examine which airline, resort or cash-back portal has the very best bonus on the time.

- Throughout the interval main as much as main gifting holidays like Valentine’s Day and Mom’s Day, many portals run profitable bonus offers.

When you’re bodily at a retailer, you’ll be able to make the most of United Airways’ MileagePlus X app, which helps you to acquire further miles on in-person purchases at a number of retailers. The app can be utilized when purchasing on-line as properly.

Partake in eating applications

Many airways provide further factors or miles via eating rewards applications, and so they’re a good way to double dip. All you could do is join a program, register your bank card(s) and dine in or order takeout from a taking part restaurant. I wish to “set it and neglect it.” I do not actively search out taking part eating places, so it is all the time a pleasant shock if I occur to eat at one and get bonus factors for it.

Airline eating applications embrace:

Day by day Publication

Reward your inbox with the TPG Day by day publication

Be part of over 700,000 readers for breaking information, in-depth guides and unique offers from TPG’s consultants

Lodge chains reminiscent of Hilton, IHG and Marriott additionally provide eating rewards.

Associated: AAdvantage Eating program: Earn American miles and Loyalty Factors at native eating places

Open checking and financial savings accounts

When you acquire American AAdvantage miles or Citi ThankYou Rewards factors, you’ll be able to open checking and financial savings accounts to extend your stash.

With a financial savings account at Bask Financial institution, you’ll be able to earn 2.5 AAdvantage miles, in lieu of curiosity, for each greenback you save yearly. Miles accrue each day and are awarded month-to-month based mostly in your common month-to-month stability. For instance, for those who preserve a mean stability of $10,000 over the course of a yr, you’ll earn 25,000 miles.

Citibank has been recognized to run focused or public affords to earn AAdvantage miles or ThankYou factors once you open a checking or financial savings account. Provides and necessities might fluctuate by individual and/or location. You may sometimes have to deposit the required sum and hold it within the account for a set time interval (normally within the 60-to-90-day vary), after which you may obtain a bit of miles or factors posted to your AAdvantage or ThankYou account.

As all the time with monetary merchandise, test the rates of interest and costs towards opponents to make sure you are not paying for the additional miles with considerably increased prices. Miles earned via financial institution accounts are seen as curiosity revenue, which implies you’ll obtain a 1099 kind and might want to report your miles earned to the IRS.

Reserve rental automobiles

Most of the main automotive rental corporations accomplice with airways, permitting you to earn airline miles in your rental once you ebook utilizing a particular promotion code. Avis, Alamo, Price range, Hertz and Nationwide are some frequent ones that accomplice with a number of airways.

One factor to bear in mind is that a number of automotive rental corporations tack on surcharges for incomes airline miles, so it’s possible you’ll pay extra to earn these miles than for those who booked a automotive with out the airline promotion code. It is vital to do your homework earlier than you permit residence, moderately than on the counter.

Associated: Greatest automotive rental websites to ebook your subsequent highway journey

Take surveys

You probably have a versatile schedule and/or an abundance of leisure time, you’ll be able to earn miles by finishing surveys on varied matters. Some taking part airways embrace:

Simply bear in mind that you will have to reply plenty of inquiries to earn a small variety of miles this manner, so think about the worth of your time. This is probably not the very best technique for racking up miles, but it surely’s a fast strategy to high off your account for those who’re brief a number of miles for a redemption.

Pay taxes

Dealing with a hefty tax invoice? You possibly can earn factors or miles for it through the use of your bank card to pay the IRS by way of one among its three licensed fee processors. This feature solely is smart for those who pay your assertion in full each month, however there are hidden benefits: Charging your tax invoice might allow you to fulfill the minimal spending requirement for a sign-up bonus, or it could facilitate assembly a spending threshold that offers you further perks.

All three processors cost charges, so do the maths and ensure it is smart in your scenario:

Ship flowers

Whether or not you are a real romantic or only a considerate individual, sending flowers to somebody could be a superb strategy to rack up factors and miles. Many airways accomplice with FTD, Teleflora and/or 1-800-Flowers, however as soon as once more, double-check to be sure you’re not paying extra for the privilege of incomes factors and miles.

Store round and be alert for offers round vacation durations reminiscent of Christmas, Valentine’s Day and Mom’s Day. It is common to earn 30 miles per greenback for brightening somebody’s life.

Buy actual property

Shopping for a house could be intimidating, however United affords a strategy to ease the ache by incomes miles on this enormous buy. The airline companions with Rocket Mortgage to offer you 25,000 miles once you shut or refinance a house mortgage.

Nevertheless, when making such a major monetary choice, the rate of interest, factors and costs are far more vital than incomes miles. So, you’ll want to store round for the very best phrases earlier than going this route.

Reap the benefits of focused affords

Be looking out for focused bonus level affords by way of electronic mail or snail mail for bank cards you already maintain. These are sometimes simple to finish with only a small quantity of effort. Prior to now, I’ve obtained affords for bonus factors from Chase for including a card to a cell pockets, choosing paperless statements and making a small variety of contactless expenses.

American Categorical has been recognized to ship cardmembers focused affords, reminiscent of 10,000 Membership Rewards factors only for enrolling within the Pay Over Time prolonged financing characteristic.

Enroll in enterprise frequent flyer applications

Many miles collectors are unaware that some airways have separate enterprise loyalty applications. Better of all, the factors or miles you accumulate as a enterprise are along with the advantages you earn as a person. This potential to double dip makes these applications significantly engaging for sole proprietors and homeowners of small and medium-size companies.

- AAdvantage Enterprise awards 1 AAdvantage mile per greenback spent on flights booked for enterprise functions via an American-owned channel.

- SkyMiles for Enterprise awards 1 to 10 SkyMiles per greenback spent on flights with Delta and a few of its SkyTeam accomplice airways. The precise quantity will rely on the fare class booked.

- United PerksPlus makes use of a sophisticated components for incomes factors that may then be transformed to MileagePlus miles. The quantity you earn relies on each the fare class and whether or not you fly out of a hub or non-hub metropolis.

Needless to say many of those applications have necessities for incomes miles, such at least yearly spend or variety of enrolled vacationers.

Associated: Full information to the AAdvantage Enterprise program

Backside line

Even for those who’ve already maxed out all of your potential airline bank card sign-up bonuses, there are nonetheless some ways to build up airline factors and miles, even past the choices listed right here. Simply ensure that the affords you think about are value your money and time so that you simply’re not spending sources chasing further rewards for greater than they’re value.