I’ve identified Josh for practically 15 years.

Regardless of his writing in public that complete time, internet hosting two weekly exhibits on our YouTube channel, and displaying up on CNBC 3 times every week, you don’t know him. Public persona apart, he’s surprisingly non-public. I do know him in addition to anybody moreover Sprinkles and possibly Batnick.

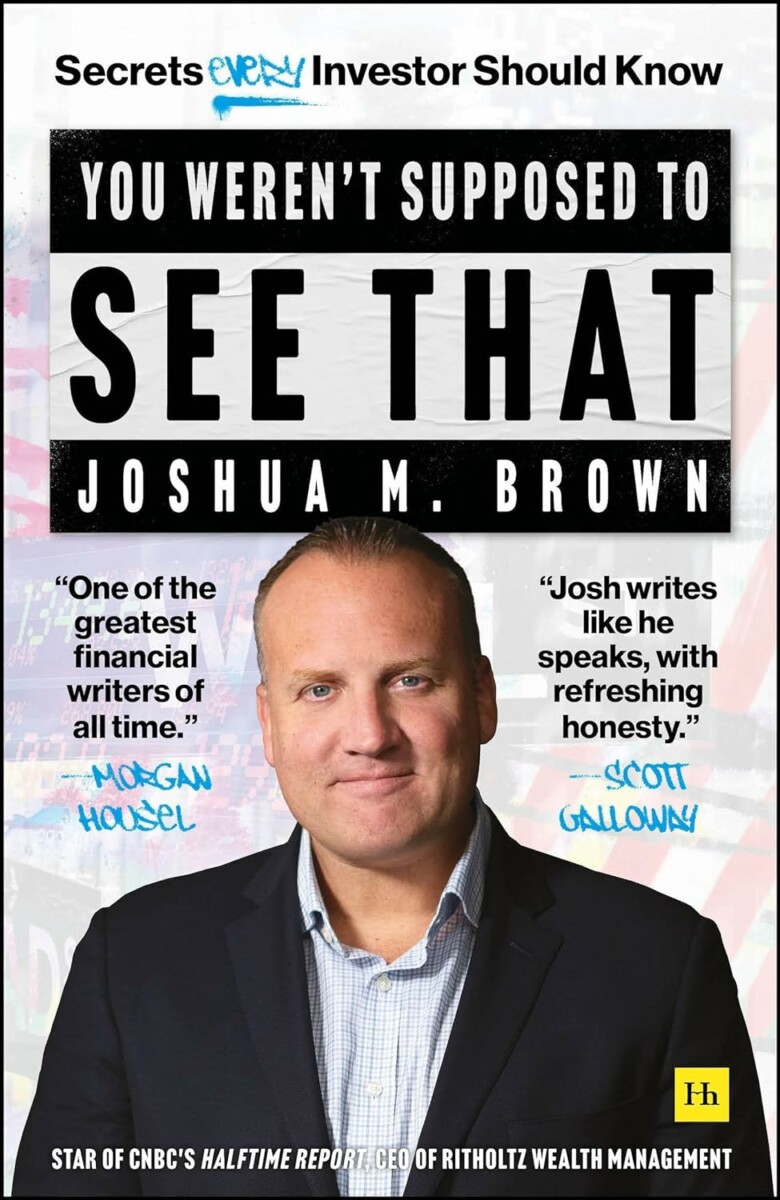

I’m going to share three issues about Josh that you simply don’t know. I’m comfy outing him as a result of he already outed himself in his fabulous new e-book, “You Weren’t Supposed To See That.”

It’s not like another finance (fin-nance?) e-book I’ve ever learn: Compulsively devourable, superbly written, and fairly revealing.

Somewhat than write a straight up overview, I’m going to make use of quotes from his e-book as an excuse to share three issues about my associate you ought to know.

1. He’s a unprecedented historian of Wall Avenue and the monetary companies business:

There are few those that have a greater understanding of this business than Josh. Not simply due to his private experiences as a stockbroker or an advisor, or as a supervisor of as soon as a brokerage agency and now an RIA – however due to his deep curiosity about what makes this business tick.

He sees what others miss – he dives into the information, understands the personalities, and is an astute pupil of human conduct. All of that comes via within the e-book.

Within the chapter “When every thing that counts can’t be counted,” he explains why shopping for ever dearer shares is each the important thing to outperforming — and why no mutual fund supervisor is able to doing it:

“You don’t go dwelling to Greenwich out of your Park Ave workplace in an excellent temper when the market makes it some extent to remind you of how vestigial your abilities have change into day after day.”

He explains the influence of free capital, the delicate shift from worth to progress, away from laborious property and in direction of mental property.

Nevertheless it’s the information that drives how altering enterprise methods influence our understanding of market conduct. From “The Relentless Bid” comes the primary clarification that resonates as to how and why the market’s character modified a lot within the 2010s:

“Morgan Stanley wealth administration took in a large $51.9 billion in price solely asset flows for the total yr 2013; 37% of Morgan Stanley wealth administration’s complete consumer property at the moment are in price primarily based accounts a report excessive.

Financial institution of America Merrill Lynch’s wealth division had equally astounding outcomes: $48 billion in flows to long run AUM in 2013; the brokerage reported that 44% of its advisers had half or extra of their consumer property underneath a price=primarily based relationship.

Wells Fargo Advisors mentioned on the finish of 2013 it had $375 billion in managed account property, roughly 27% of the $1.4 trillion in complete AUM…”

As he observes, it wasn’t the shift from lively to passive – that had been ramping up for many years – relatively, it was the changeover from transactional fee enterprise to a fee-based fiduciary mannequin that made all the distinction.

Josh shares even deeper insights into the investing business, in “8 Classes from Our First 12 months.” We had been all a bit overwhelmed in yr one, however he was clear-eyed concerning the challenges forward.

This additionally will get mirrored in his shows on Wall Avenue – should you ever get an opportunity to see one, Don’t-Stroll-Run to be in that viewers. Not solely are his decks hilarious, however you’ll go away a lot extra knowledgeable about this business than you may think about.

2. Josh has one of many highest EQs of anybody you’ll ever meet. (This issues rather a lot).

This manifests in a few fascinating methods: First, he has zero tolerance for bullshitters, charlatans, assholes, and anybody making an attempt to separate trustworthy traders from their cash. (All of us share this trait in widespread). However he has an uncanny capability to see into folks’s souls and choose them for who they are surely deep down inside.

That is an enormously useful ability when you’re hiring folks. I’ve misplaced rely of the variety of instances that 30 seconds into an interview, I’ve gotten a side-eyed look from him that claims “Loser. I’m out.” It’s uncanny. Through the years, I’ve realized to belief his instincts as he has invariably been proper.

Second, his EQ is revealed in who he’s keen to belief: Friends he has on The Compound & Pals, the associates we affiliate with, and numerous companies we do enterprise with. Its evident in his admiration for folks like David Tepper:

“In each market second, there’s one man – and it’s at all times a person – who’s deified by his friends and the media; an anointed one in each sense of the time period. His each phrase is held on, his pronouncements are the day’s dialogue, his off-the-cuff remarks change into the enterprise press’s entrance web page headlines the next day. David Tepper now occupies this place within the firmament, wholly and fully…

All of his perception into who’s worthy of your time (or not) is on show within the e-book; oh, and he names names:

“David Tepper is turning into at the moment’s Hedge Fund God. He’s youthful than Soros and Cooperman, much less cantankerous than Loeb and Icahn, can declare increased returns than Einhorn and Ackman, carries not one of the regulatory taint of Steve Cohen, and has all the garrulous authenticity that nearly none of his friends possess when in a public setting.”

I can get starry-eyed about any individual’s large media profile or historical past at legendary companies like Goldman Sachs, Merrill Lynch, or Morgan Stanley. He suffers from none of that. In case you are worthy, he lets us know; in case you are an asshole, you can’t conceal from him.

“Laborious move, subsequent candidate.”

3. He’s an anguished poet, not a finance bro.

That is the deepest, darkest secret I’m sharing with you at the moment. And it’s his worst-kept secret as a result of all it’s essential to do is learn the attractive, elegant prose that flows from his pen. It’s not simply the insights however his eloquence that’s unmatched in monetary writing. Ignore the Lengthy Island accent and the TV persona – simply learn the phrases he writes.

From The New Concern & Greed:

“Livermore had rivals and counterparties you noticed because the enemy, however it was small and it was shut quarters. A knife battle. This factor at the moment is nuclear warfare. No survivors. It’s a Squid Sport occasion on a world scale. Thousands and thousands of anonymous, faceless strangers in a web-based surroundings that actually is aware of no spatial or geographic limitations. It’s an surroundings by which the wealthiest most profitable gamers like Chamath and Steve Cohen could possibly be publicly—day by day—accosted by the mob throwing fistfuls of horseshit at them from the alleyways. I don’t know if the heuristics Livermore performed the sport by can be so simply utilized…”

Brutal honesty.

To actually see the place the poet prospers, try the shortest chapter within the e-book: “I Did Every little thing I Was Supposed To Do.” Somewhat than reiterate the lively versus passive debate, he tells the story from the attitude of the shedding aspect of that debate, the true one who is getting steamrolled by the Relentless Bid:

“I may clarify how folks don’t care concerning the alternative to outperform by 100 foundation factors yearly. How the SPIVA scorecard calls us assholes each 90 days. So do the bloggers, however they don’t wait 90 days, they simply go in all day lengthy. I may inform her how all of the brokers that used to promote our funds switched careers, they’re all monetary advisors now, they don’t ship consumer cash into something they may must defend. Cowl your individual ass. Nobody ever has to defend an index. It’s an absurd proposition. It’s like having to defend the climate. No person ever has to reply for the climate. The S&P 500 is the climate…”

Most of us don’t take into consideration the poor bastard on the opposite aspect of our trades, calling his spouse to inform her he simply received sacked. Josh does…

~~~

Do your self a favor, and get your self a replica of this e-book. Learn it slowly. You gained’t remorse it.