In on a regular basis language, we use “chaos” to imply full dysfunction or randomness – like a toddler’s playroom after a protracted afternoon or a desk buried below scattered papers. This type of chaos implies there’s no underlying order or sample in any respect. It suggests a brief state of disarray that may be resolved or introduced again to order.

There may be, nevertheless, a second use of the time period. In chaos principle, “chaos” has a exact and fairly completely different that means. It describes techniques that seem random on the floor. These techniques are unpredictable intimately however nonetheless have an underlying order and produce recognizable patterns. This type of chaos is a everlasting state, intrinsic to the system’s nature, the place small modifications in preliminary situations can result in vastly completely different outcomes.

An incredible instance is my rubber duck. If I wander all the way down to the banks of the Mississippi River and fling my duck into the water, I will likely be utterly unable to reply the query “The place will your duck be in a single minute or one hour?” past “someplace within the river, probably.” However in case you had been to ask “The place will your duck be two months from now?” I may have extra confidence in say “visiting New Orleans.” I can’t say precisely the place or precisely when, however the river is a constrained system with predictable long-term tendencies.

An incredible instance is my rubber duck. If I wander all the way down to the banks of the Mississippi River and fling my duck into the water, I will likely be utterly unable to reply the query “The place will your duck be in a single minute or one hour?” past “someplace within the river, probably.” However in case you had been to ask “The place will your duck be two months from now?” I may have extra confidence in say “visiting New Orleans.” I can’t say precisely the place or precisely when, however the river is a constrained system with predictable long-term tendencies.

2025 may even see an intersection of each types of chaos: an intrinsically chaotic market system overlaid by the prospect of coverage chaos initiated by the brand new presidential administration. Within the weeks because the election, the president-elect has threatened 25% tariffs on items from Mexico and Canada, 10% tariffs on Chinese language items, and 100% tariffs on items from the BRIC nations, together with China, in the event that they undermine the US greenback. They could undermine the greenback by shifting change insurance policies to peg costs in opposition to a basket of currencies, reasonably than the greenback. That appears to replicate fears of erratic US insurance policies and burgeoning federal debt. A preliminary evaluation by the College of Pennsylvania concluded that Mr. Trump’s proposals would enhance the nationwide debt by $4.1 trillion if the whole lot went effectively and slightly below $6 trillion if it doesn’t. (What would possibly qualify as “going poorly”? Hostile responses from nations affected by tariffs and provide chain disruptions for US firms depending on factories in these nations. I’m setting apart prospects of conflict or local weather catastrophe.) Morningstar’s John Rekenthaler forecasts a short-term spike in inflation which will likely be compounded if the Federal Reserve turns into much less impartial, as Mr. Trump promised, since he favored zero rates of interest even throughout financial booms. In the meantime, crypto booms.

Mr. Rekenthaler’s evaluation of each candidates’ plans ends with the query, “What, me fear?” and a hyperlink to …

Fast recap: within the quick time period markets are extremely unpredictable (chaos principle) and prone to be exceptionally so within the fast future (Trump). In the long run, markets have predictable dynamics and central tendencies (just like the Mississippi River does) that give us better confidence the additional out we glance.

The query is, how do you persist by way of the shorter-term chaos with a purpose to proceed capturing the longer-term features?

Chaos and your portfolio

In case you are younger with a cushty profession trajectory and an inexpensive long-term plan, do nothing. Each Warren Buffett, Ben Carlson, and John Rekenthaler affirm the identical proposition: over lengthy intervals, nobody ever wins by betting in opposition to the US markets. And, over those self same lengthy intervals, nobody ever loses by betting with them. Briefly: in case you don’t want your cash for twenty-plus years make investments usually and cheaply in (principally) American shares, cease studying this essay now and get on with life. Your cash will likely be ready for you when the time comes.

Not all of us have the posh of that diploma of Cynical detachment from the world. 5 methods for the remainder of us to outlive chaos of each types.

-

Let different folks fear for you. Successfully responding to sudden modifications requires a level of obsession and entry to in depth knowledge that common traders don’t have. “I noticed this man on TikTok,” or “I learn Reddit,” or “I acquired a sense” is not an indication that you’ve got both ample knowledge or a clue about the right way to learn it. Should you don’t have the willingness to remain put, or the abilities and sources to dynamically modify place sizes primarily based on present market chaos ranges, rent somebody who does. It’s cash effectively spent.

There are 3 ways of doing that. One, rent a monetary advisor who has been by way of it earlier than and who hasn’t surrendered to the impulse to make change for the sake of change. Two, rent a fund supervisor who has been by way of it earlier than and who has a file of cautious adaptation to altering situations. Take into account:

-

FPA Crescent: Crescent is a reasonably aggressive allocation mutual fund that goals to generate equity-like returns over the long run whereas taking much less threat than the market and avoiding everlasting impairment of capital. The fund’s deal with investing in higher-quality companies with protecting moats, good returns on capital, and exemplary administration groups, mixed with its skill to adapt to market situations, makes it a gorgeous choice for traders in search of a steadiness between development and threat administration. The fund has a 30+ yr file, has averaged over 10% yearly since inception with one-third much less volatility than the inventory market, is an MFO Nice Owl Fund and has excessive insider dedication.

-

Leuthold Core Funding Fund. Leuthold Core Funding is a tactical asset allocation fund that goals to realize capital appreciation and revenue whereas minimizing threat by way of versatile portfolio administration. With a deal with business choice and the flexibility to regulate publicity throughout numerous asset courses, the fund has demonstrated sturdy efficiency, outperforming its Lipper Versatile Fund friends by 1.5% yearly over the previous decade with considerably decrease volatility. The fund’s disciplined, quantitative method to asset allocation and safety choice, mixed with its long-term observe file of capturing over 80% of the S&P 500’s annual returns whereas exposing traders to lower than 70% of the volatility, makes it a gorgeous choice for traders in search of a balanced method to threat administration and returns. Devotees of ETFs ought to contemplate Leuthold Core ETF (LCR).

Three, rent somebody who can sport the marketplace for you. The place FPA and Leuthold are balanced funds that principally tilt their portfolios as situations change, some funds – each long-short fairness and managed futures – try to actively, and typically dramatically, shift course with shifting situations. Sadly, most such funds are overpriced failures, and few have lengthy observe information. Among the many most promising choices is Standpoint Multi-Asset.

-

Standpoint Multi-Asset Fund. Standpoint seeks constructive absolute returns by way of an “All-Climate technique.” The fund holds a world fairness portfolio constructed from regional fairness ETFs. The technique additionally invests, each lengthy and quick, in change traded futures contracts from seven sectors: fairness indexes, currencies, rates of interest, metals, grains, tender commodities, and power. The managers try to take part in medium- to long-term traits in world futures markets and to supply an inexpensive return premium in change for assuming threat. The argument for Standpoint is very like the previous argument for managed futures: it might present absolute constructive returns with muted volatility even when the fairness markets appropriate, or the fixed-income markets are priced to return lower than zero within the fast future. “Our edge,” supervisor Eric Crittenden says, “is that we all know the right way to construct macro program with out the standard 2 & 20 charge construction.” It’s designed to be a everlasting piece of your portfolio: easy, sturdy, and resilient. Standpoint is attempting to supply an island of predictability that traders would possibly use to enrich and strengthen their core portfolios. With constructive absolute returns annually since inception (15.2% YTD in 2024), they’ve earned a spot in your due diligence checklist.

-

-

Enhance publicity to high quality firms. Mr. Buffett’s declaration, “It’s much better to purchase a beautiful firm at a good worth than a good firm at a beautiful worth,” is borne out by his enduring success and by loads of educational {and professional} analysis. As we famous in “The High quality Anomaly,”

The broadest sense of a high quality firm is one which makes use of its sources prudently: high quality firms are inclined to have little or no debt, substantial free money flows, regular and predictable earnings, and maybe excessive returns on fairness. Passive methods and plenty of energetic ones have a powerful backward focus: they restrict themselves to corporations which have shiny pasts, with out actively inquiring about their future prospects.

Nonetheless, the proof is compelling that high-quality shares bought at cheap costs are in regards to the closest factor to a free lunch within the investing world. Typically, it’s important to pay on your lunch a method or one other. The one rationale for purchasing crazy-volatile investments (IPOs, as an example) is the prospect of crazy-high returns. The one rationale for purchasing modest returns (three-month T-bills) is the promise of low volatility.

With high quality shares bought at an inexpensive worth (name it QARP), that tradeoff doesn’t happen. QARP shares supply each larger long-term returns and decrease volatility than run-of-the-mill equities.

Increased high quality investments won’t at all times lead the market, when animal spirits run wild, trash tends to dominate when it comes to pure returns. Take into account:

-

GQG Companions US Choose High quality Fairness or GQG Companions US High quality Dividend Revenue. Each are managed by Rajiv Jain, whose file of excellence stretches over a long time and whose agency is totally dedicated to investing in high-quality equities. GQG Companions primarily depends on elementary, reasonably than quantitative, analysis to judge every enterprise primarily based on monetary power, sustainability of earnings development, and high quality of administration. The funding technique is high quality first; from the pool of corporations that meet its high quality requirements, it goes on the lookout for undervalued firms with substantial dividends. GQG is extra usually a price than a development investor. We now have beforehand profiled GQG International High quality Dividend, now named High quality Dividend Revenue. The identical self-discipline applies throughout all GQG funds. For you, the important thing query is whether or not you need direct worldwide publicity in your portfolio at a time when tit-for-tat commerce wars are discouragingly attainable (and disruptive).

-

GMO US High quality ETF. The GMO ETF emulates the technique within the five-star GMO High quality Fund. Two variations: the ETF focuses solely on the US slice of the universe, and it doesn’t require a $750 million minimal preliminary funding (as High quality IV does). High quality has persistently been a high 10% performer. The ETF expenses 50 foundation factors.

-

-

Take into account a short-term excessive yield fund. These funds usually spend money on fixed-income securities whose returns are uncorrelated to the gyrations of the Fed. Quick-term high-yield bonds have offered comparable returns to the broader high-yield market however with considerably decrease volatility. That is partly as a result of “pull-to-par” phenomenon, the place bond costs converge in direction of their par worth as they method maturity, decreasing sensitivity to financial situations.

Over the course of a full market cycle, such funds are inclined to return about 4% per yr. Over the cycle that adopted the dot-com crash, 4.1%. International monetary disaster: 4.6%. Covid period: 4.3%. The 2 most compelling choices, primarily based on each Morningstar’s metrics and ours, are:

-

RiverPark Quick Time period Excessive Yield. Quick-Time period Excessive Yield invests in, effectively, short-term, high-yield debt securities. Its technique focuses on figuring out alternatives the place the credit score scores might not totally replicate an organization’s skill to satisfy its short-term obligations. The fund targets investments in firms present process or anticipated to bear company occasions, corresponding to reorganizations or funding modifications, which may improve their capability to repay debt. About to rejoice its 15th anniversary, the fund, the fund has the very best Sharpe ratio (over 5.0 since inception) in existence. That’s, it presents a greater risk-return tradeoff than any different fund or ETF. You would possibly anticipate returns of 3-5% with negligible draw back.

-

Intrepid Revenue. Intrepid Revenue Fund is a set revenue fund that primarily invests in U.S. company bonds, aiming to generate sturdy risk-adjusted returns and excessive present revenue whereas defending and rising capital. With a deal with draw back safety and threat management, the fund usually invests in smaller bond problems with lower than $500 million, focusing on companies with low leverage ratios and constant money flows1. The fund’s technique has demonstrated resilience whereas sustaining a comparatively concentrated portfolio of 15 to 70 high-yield securities. You would possibly anticipate returns of 4-5%.

-

-

Keep away from any investment that everybody is speaking about. They’re dumb in good occasions and disastrous in fraught ones. There are three issues with such investments.

-

They’re overpriced. Everybody will get excited, then they get silly which ends up in a “purchase first, remorse later” impulse that pushes the value of magical investments skyward. That results in volatility and decrease returns. Morningstar’s Jeff Ptak, in reviewing the most recent “Thoughts the Hole” research, warns:

Slender funds are often extra risky by their very nature, and our findings recommend a hyperlink between larger volatility and wider investor return gaps. However volatility apart, these methods are often larger upkeep, forcing traders to make purchase or promote choices at what might be fraught occasions.

-

The automobiles that convey them to you might be designed to switch wealth out of your account to the advisor’s account. To be clear: the individuals who supply these investments to you’ve gotten zero loyalty to the investments or to their traders. Zero. MFO has chronicled an enormous variety of ETF conversions the place, after 9 months, the Area Rock Exploitation ETF out of the blue turns into The AI Arbitrage Impact ETF.

-

Their finest returns are previous by the point you hear of them. The investing world is dominated by (a) obsessive folks with vastly extra sources than you and (b) passionate hucksters on TikTok whose job it’s to generate a following for themselves, not safety for you. That’s captured in The Rekenthaler Rule: “If the bozos find out about it, it doesn’t work anymore.” (I think we’re the “bozos” in query.)

Your funding purpose isn’t having one thing to brag about. Your purpose is to supply safety and assist meet your life objectives. Gradual and regular is sort of at all times a surer technique.

-

-

Curb your enthusiasm: Chaotic markets can set off worry and greed. Keep emotional self-discipline, stick with your funding plan, and keep away from impulsive choices primarily based on short-term market actions. The 2 best methods to execute this technique:

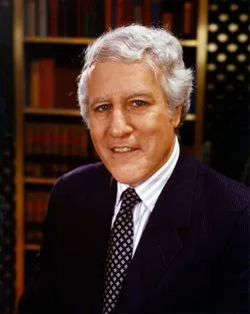

Deal with the fast, not the mediated. The worst day in market historical past was 19 October 1987 when the market fell 22.6% in someday. Hysteria, suspicion, and fears of a continued unraveling adopted. Into the maelstrom stepped Louis Rukeyser, the person who perfected the artwork of economic tv. Uncle Lou started his first present after the Nice Crash this manner:

Deal with the fast, not the mediated. The worst day in market historical past was 19 October 1987 when the market fell 22.6% in someday. Hysteria, suspicion, and fears of a continued unraveling adopted. Into the maelstrom stepped Louis Rukeyser, the person who perfected the artwork of economic tv. Uncle Lou started his first present after the Nice Crash this manner:Okay, let’s begin with what’s actually necessary tonight. It’s simply your cash, not your life. Everyone who actually beloved you per week in the past, nonetheless loves you tonight. And that’s a heck of much more necessary than the numbers on a brokerage assertion. The robins will sing. The crocuses will bloom. Infants will gurgle and puppies will curl up in your lap and drift off fortunately to sleep, even when the inventory market goes briefly insane.

And now that that’s all totally in perspective, let me say: ouch! And eek! And medic! Tonight, we’re going to attempt to make sense out of mass hysteria.

Put down your cellphone. Kill the damned notifications. Avoid the clatter on social media. Kiss your partner. Hug your youngsters. Stroll your pup. Strive a brand new recipe. Open the bottle of wine that you simply’ve been saving – for the previous decade! – for a sufficiently big day. Each day is particular (it’s, in any case, the one one you’ll be gifted immediately), so that you’re proper to rejoice it.

Learn historical past. It’s straightforward to conclude “That is the worst factor ever!!” provided that … effectively, you’re clueless about what else we’ve overcome. Which is to say, rather a lot.

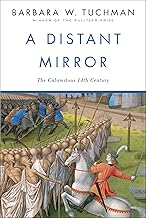

Get lost to your native used bookshop and discover a copy of Barbara Tuchman, A Distant Mirror: The Calamitous 14th Century (1978), a story woven across the household of a single French noble. William Manchester’s A World Lit Solely by Fireplace (1992) examines the transition from medieval to Renaissance Europe. Whereas its scholarship has confronted some criticism, it compellingly exhibits how humanity emerged from the “darkish ages” right into a interval of outstanding cultural and mental flourishing. For readers who object to the very time period “darkish ages” and suppose that Manchester was too destructive on a half millennium of human historical past, web page by way of Michael Gabriele, The Shiny Ages: A New Historical past of Medieval Europe (2021). The Heat of Different Suns (2010) by Isabel Wilkerson chronicles the Nice Migration by way of intimate private narratives. Like Tuchman, Wilkerson weaves particular person tales into broader historic actions, exhibiting how tens of millions of African People transcended systemic oppression to forge new lives.

Get lost to your native used bookshop and discover a copy of Barbara Tuchman, A Distant Mirror: The Calamitous 14th Century (1978), a story woven across the household of a single French noble. William Manchester’s A World Lit Solely by Fireplace (1992) examines the transition from medieval to Renaissance Europe. Whereas its scholarship has confronted some criticism, it compellingly exhibits how humanity emerged from the “darkish ages” right into a interval of outstanding cultural and mental flourishing. For readers who object to the very time period “darkish ages” and suppose that Manchester was too destructive on a half millennium of human historical past, web page by way of Michael Gabriele, The Shiny Ages: A New Historical past of Medieval Europe (2021). The Heat of Different Suns (2010) by Isabel Wilkerson chronicles the Nice Migration by way of intimate private narratives. Like Tuchman, Wilkerson weaves particular person tales into broader historic actions, exhibiting how tens of millions of African People transcended systemic oppression to forge new lives. Invoice Gates, must you care, is presently recommending Doris Kearns Goodwin’s An Unfinished Love Story. DKG is a Pulitzer Prize-winning historian and biographer who was married to the late Dick Goodwin. Goodwin was an adviser to US presidents for many years, from shaping Johnson’s Nice Society agenda to drafting Al Gore’s 2000 concession speech. Of it, Gates writes, “It’s laborious to disclaim the similarities between the Nineteen Sixties and immediately—a time of political upheaval, generational battle, and protests on school campuses. Whether or not you already know rather a lot in regards to the ’60s otherwise you’re simply dipping your toe into these waters, whether or not you need a deep dive into the artwork of political writing or a captivating story a couple of married couple who adored one another, you’ll get it from An Unfinished Love Story.” He describes “the teachings it presents about how leaders have tackled robust occasions” as “each comforting and interesting.”

Invoice Gates, must you care, is presently recommending Doris Kearns Goodwin’s An Unfinished Love Story. DKG is a Pulitzer Prize-winning historian and biographer who was married to the late Dick Goodwin. Goodwin was an adviser to US presidents for many years, from shaping Johnson’s Nice Society agenda to drafting Al Gore’s 2000 concession speech. Of it, Gates writes, “It’s laborious to disclaim the similarities between the Nineteen Sixties and immediately—a time of political upheaval, generational battle, and protests on school campuses. Whether or not you already know rather a lot in regards to the ’60s otherwise you’re simply dipping your toe into these waters, whether or not you need a deep dive into the artwork of political writing or a captivating story a couple of married couple who adored one another, you’ll get it from An Unfinished Love Story.” He describes “the teachings it presents about how leaders have tackled robust occasions” as “each comforting and interesting.”I’m presently studying Kathryn Olmsted, The Newspaper Axis: Six Press Barons Who Enabled Hitler (2022). Immaculate historic scholarship and one sobering passage:

These fashionable newspapers favored spectacle over substance, celeb over management, and polemics over sober debate. Probably the most profitable publishers found they might entice readers by highlighting race, nation and empire – themes that their advertisers may additionally assist. They may become profitable and achieve political energy by promoting an exclusionary imaginative and prescient of their nations “us” versus “them” … [their] emphasis on people, persona, power and ethno-nationalism may assist promote authoritarian politics. (3)

Backside Line:

Neither chaos nor adversity are new. Neither is overcoming them. Overcoming them begins with a easy admission: we’re the co-authors of chaos. Systemic chaos produces nervousness. Our choices both worsen the state of affairs or meliorate it. Treating the short-term as if it had been the long-term. Overreacting to deliberately sensationalized tales. Specializing in the world we will’t management, and the folks we’ll by no means meet, reasonably than on what we will management and the nice we do expertise.

A chaos-resistant portfolio stems from three choices on our half: (1) acknowledge the noise, (2) favor regular features over the phantasm of spectacular ones, and (3) step away from the noisemakers. In funds, select indolent. In your actual life, select energetic. Make a distinction the place you possibly can. Communicate up. Communicate kindly. Assume kindly. Hear to grasp. Volunteer. Donate. Smile on the little ones. Turn into an agent of anti-chaos and prosper!