A submit on our Dialogue Board lately known as consideration to 2 Closed Finish Funds: Barings Company Buyers (MCI) and Barings Participation Buyers (MPV).

Investopedia describes a closed-end fund as “a kind of mutual fund that points a set variety of shares by one preliminary public providing (IPO) to lift capital for its preliminary investments. Its shares can then be purchased and offered on a inventory trade, however no new shares will likely be created, and no new cash will movement into the fund.”

This construction means CEFs can commerce at a premium or low cost to their internet asset worth (NAV). The submit famous that each MPV and MCI have been long-term Nice Owl funds, which suggests they’ve persistently produced high risk-adjusted returns of their peer group, particularly the Martin Ratio, which is proportional to return over drawdown or “acquire over ache.” Martin Ratio is the premise for our MFO Score.

MFO Premium makes use of NAV for all threat and return metrics, together with the willpower of Nice Owls, and different designations like Three Alarm funds. Morningstar rankings too are NAV-based. With in the present day’s December replace, which displays rankings by month-ending November, an excellent month for US fairness funds, customers will have the ability to get hold of price-based metrics and rankings, which I discover significantly insightful. The metrics apply to CEFs, trade traded funds (ETFs), and trade traded notes (ETNs). Usually, open-ended funds commerce solely as soon as per day on the fund’s NAV. However CEFs, ETFs, and ETNs can commerce on an trade at a premium or low cost to their NAVs. Any variations are sometimes small and short-lived for the latter two automobiles, due to arbitrage throughout share creation or redemption.

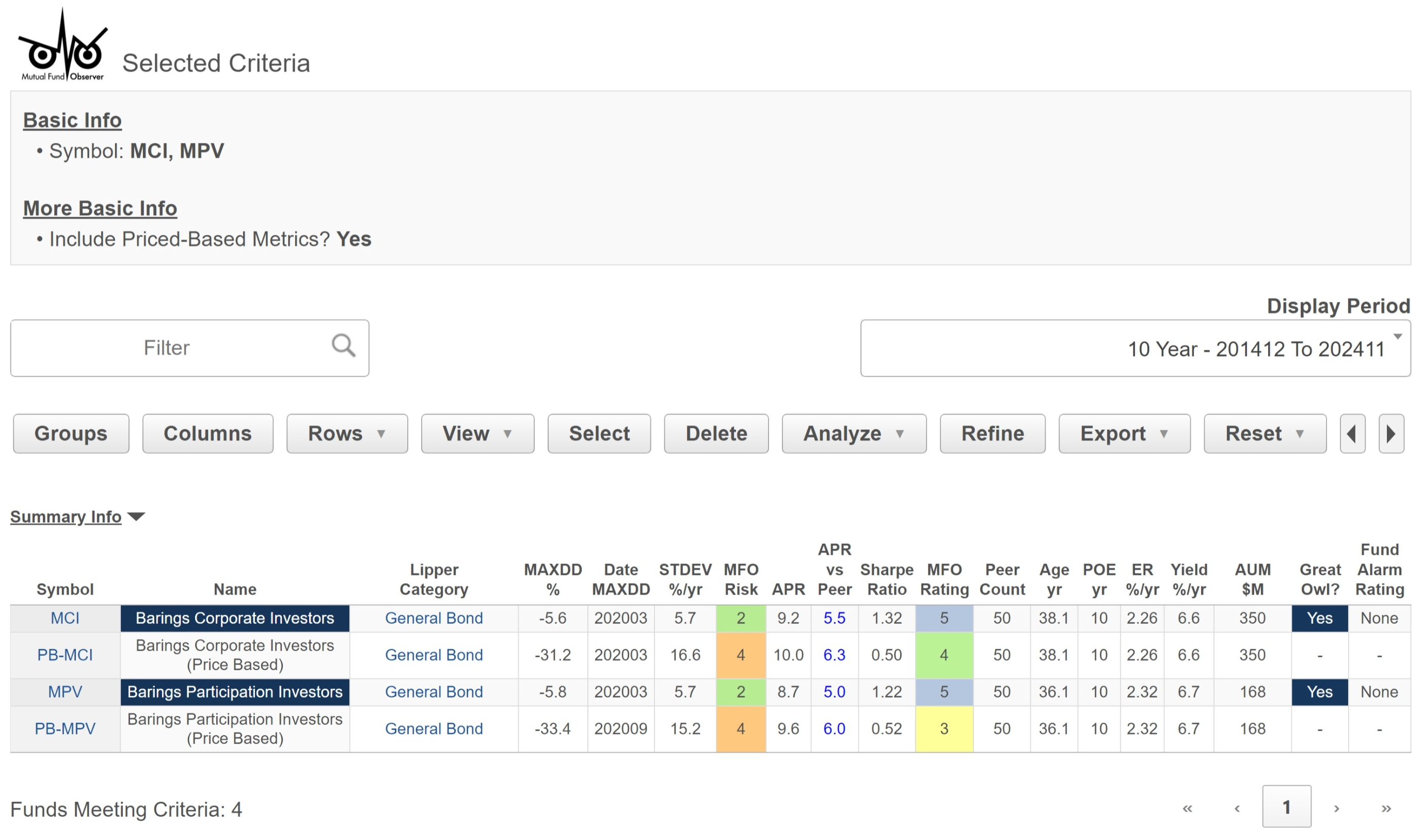

The MultiSearch desk under reveals the 10-year threat and return metrics for each MCI and MPV, plus their price-based companions, designated PB-MCI and PB-MPV, respectively, quick for Price Based. Customers can enter the companion ticker straight or just click on “Embrace Value-Based mostly Metrics” throughout search standards choice.

Comparability Desk of NAV-Based mostly versus Value-Based mostly Metrics

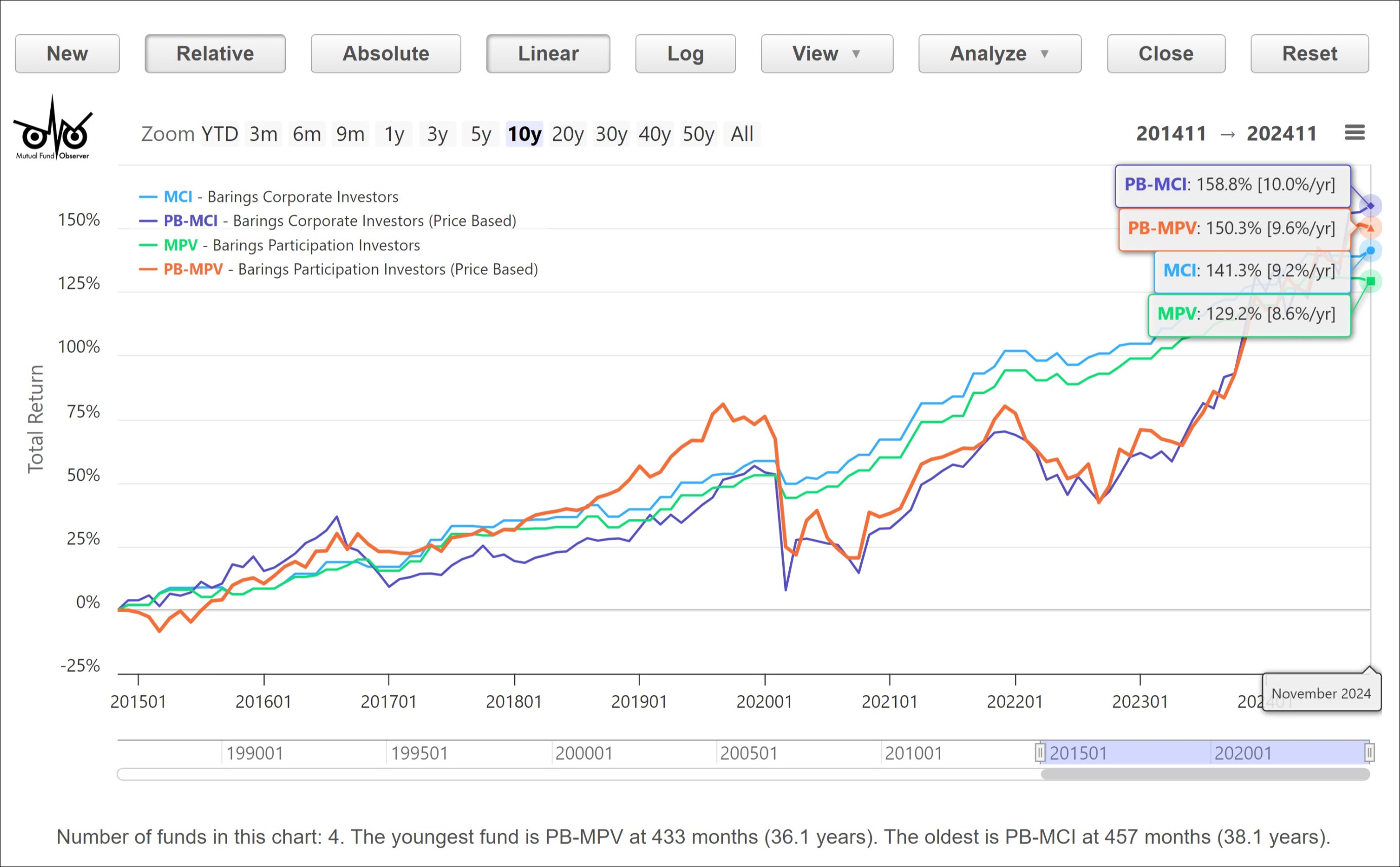

The priced-based metrics present considerably extra risky returns than the NAV-based. A part of what contributes to the distinction is that Barings updates the NAV for these funds not every day or month, however extra like every quarter, sometimes. The plot under depicts the elevated volatility effectively. Utilizing value alone, neither fund could be a Nice Owl; that stated, over the long term, absolutely the returns converge, which if “one treats this as a long-term funding,” as a board member steered, the distinction could also be muted.