An everyday theme round these components is “No one Is aware of Something.”

Particularly, no one is aware of what is going to occur sooner or later. That is true about fairness and bond markets, particular firm shares, and financial knowledge sequence. We have no idea which geopolitical sizzling spot will erupt in turmoil; we don’t know the place or when the subsequent pure catastrophe will hit. We stay clueless as to what sports activities groups will win all of it or who would be the MVP for any league. One of the best movies, books, and music releases are unknown prematurely.

This shouldn’t be a radical or contrarian outlier place, but it feels that method. We hardly know something about subsequent week, even much less about subsequent month, and virtually nothing about subsequent yr.

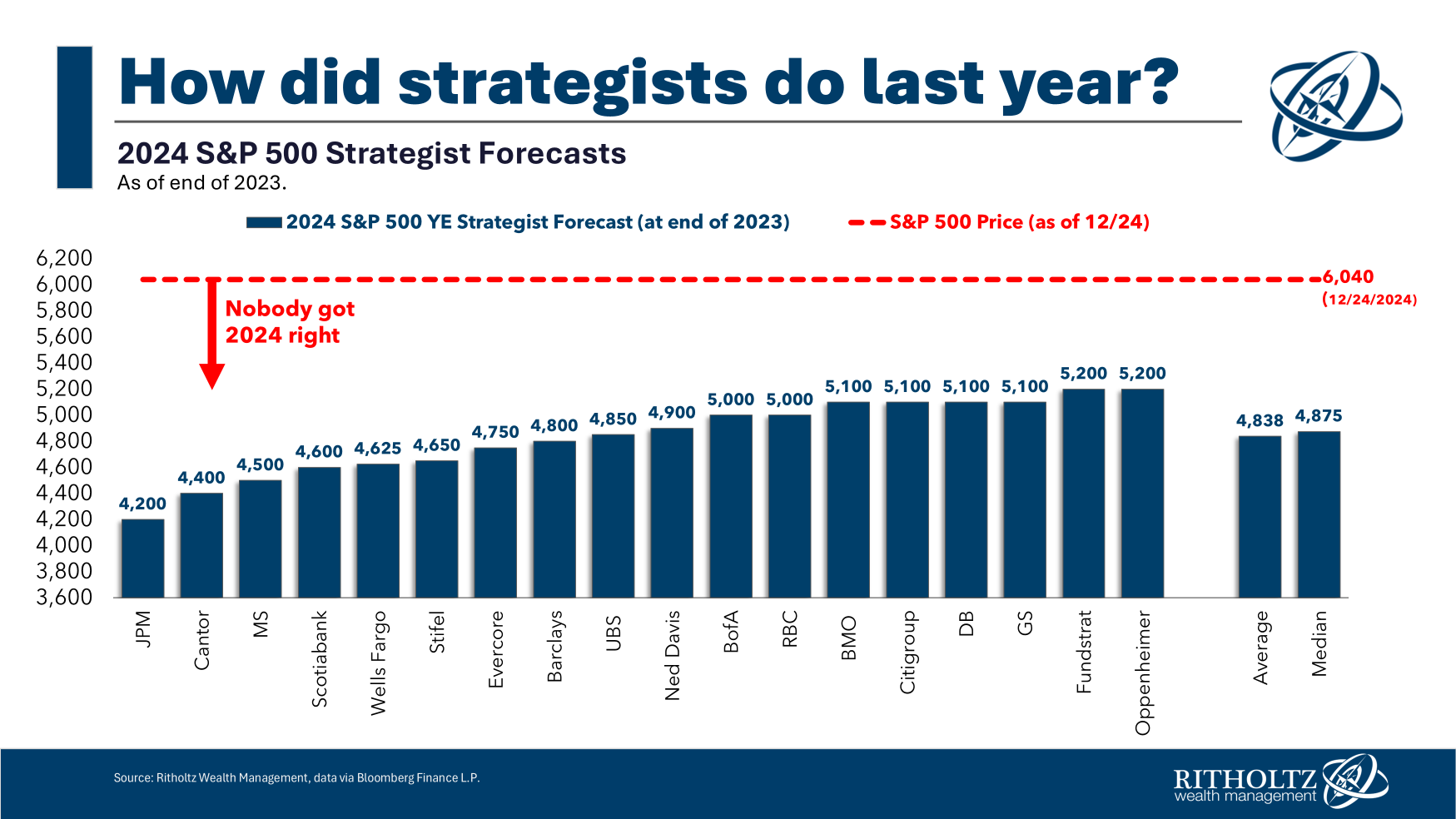

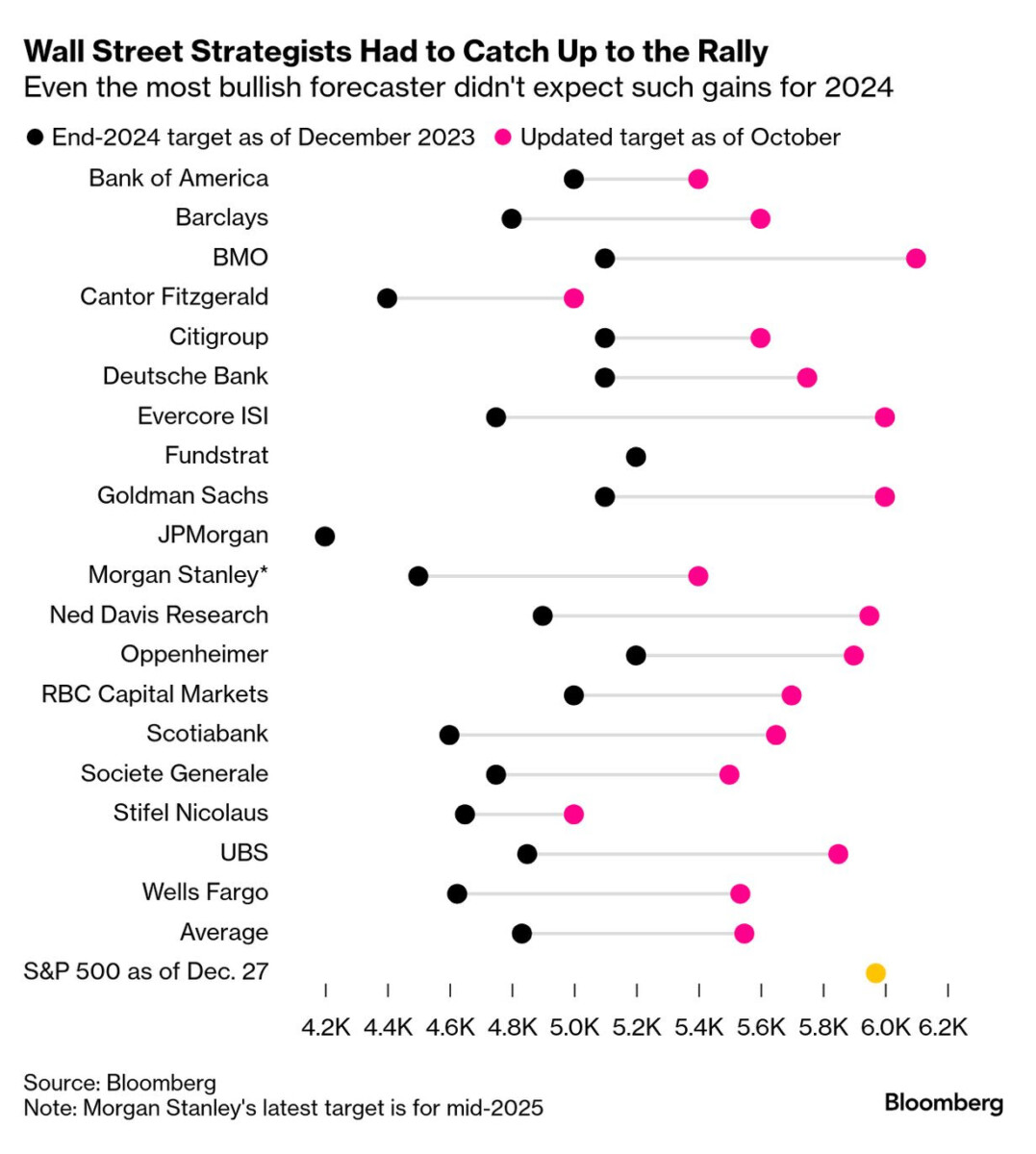

It’s very true for strategists and forecasters at massive brokers and banks. Think about this December 29, 2024, year-end evaluation in Bloomberg:

“By this time final yr, the inventory market’s rally had blown previous even probably the most optimistic targets, and Wall Road forecasters have been satisfied it couldn’t sustain the dizzying tempo.

In order strategists at Financial institution of America Corp., Deutsche Financial institution AG, Goldman Sachs Group Inc., and different huge corporations despatched out their requires 2024, a consensus took form: After surging greater than 20% as synthetic intelligence breakthroughs unleashed a tech-stock increase and the financial system stored defying the doomsayers, the S&P 500 Index would seemingly scratch out solely a modest acquire. Because the Federal Reserve shifted to chopping rates of interest, Treasuries have been seen as ripe to provide equities a run for his or her cash.”

Because the chart above exhibits, all the foremost Wall Road brokerage and financial institution strategists didn’t anticipate how properly the market would do in 2024 (Bloomberg’s chart under). Strategists don’t do these forecasts exceptionally properly, however this yr, they have been extra-terrible:

Solely a part of the issue is that these of us are dangerous at this; the larger concern is that they do all of it. Its kinda like Phrenology, the pseudoscience feeling bumps on folks’s cranium to foretell their persona traits. It’s not that there are higher or worse phrenologists, however fairly, why was anybody doing phrenology?

Equally, there are quite a few issues with forecasting. I’ll focus on why biases and cognitive errors result in prediction errors in an upcoming publish. For right now, let’s simply give attention to how variable the longer term is. Random occasions can and can fully derail the most effective laid plans we might make. Even probably the most well-ordered, considerate forecasts flip to mush when randomness strikes. And randomness is served up day by day.

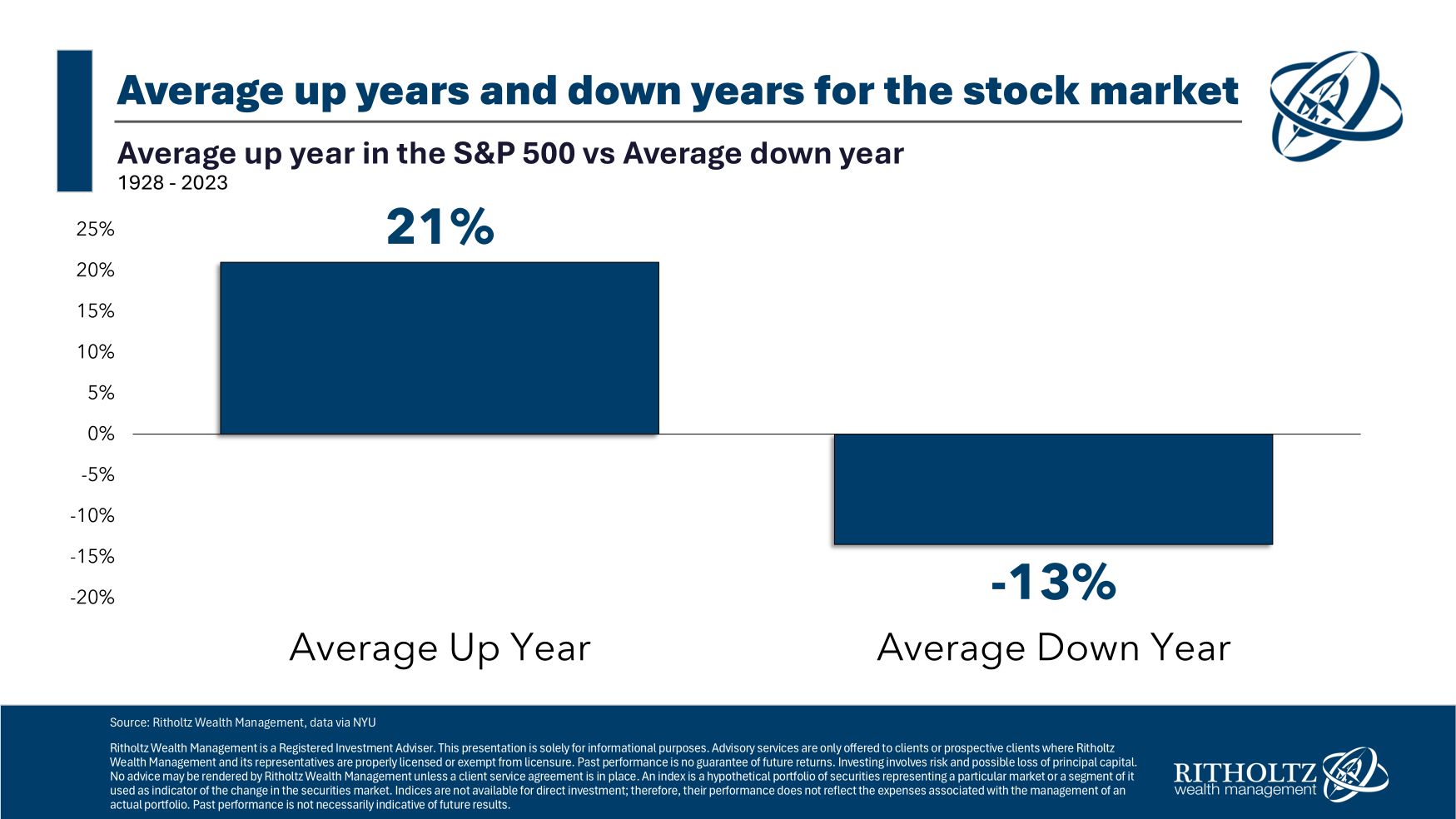

Professor Philip Tetlock defined tips on how to make higher forecasts by urging us to make use of what we do know to paint our decision-making course of. My colleague Ben Carlson put this to make use of just lately. He defined one of many inherent errors within the inventory worth prediction course of by noting the annual common is totally deceptive. Merely guessing it is going to be the annual common virtually ensures you can be improper.

As an alternative, take into consideration a two step course of: Will it’s an up or a down yr? After you have decided if it’s going to be a constructive or unfavorable yr (!), then make your greatest guess:

“Double-digit strikes in each instructions are the norm. In reality, in 70 of the previous 97 years, the U.S. inventory market has completed the yr with double-digit good points (57x) or double-digit losses (13x).”

Here’s what that appears like over the previous 95 years:

My recommendation is to skip the forecasting altogether — however in case you should make a guess, then strive the 2 step course of. Certain, it provides one other option to get it improper, but it surely additionally means you’ve gotten a greater probability of getting it proper.

One final reminder: All forecasts are advertising and marketing. Or, as John Kenneth Galbraith noticed, “The one operate of financial forecasting is to make astrology look respectable.”

~~~

Public Enemy’s thirteenth album was titled “Man Plans, God Laughs.” The title is predicated on a Yiddish proverb: “Der mentsh trakht un bought lakht.” It’s a blunt commentary about our incapacity to forsee the longer term.

In “How Not To Make investments” (coming March 18!) I spill a variety of ink discussing the various foolish issues folks do, together with counting on forecasts and predictions. That is very true for these made by analysts who should not working to offer you good investing recommendation however fairly are hoping to drum up enterprise for secondaries and IPOs. Not solely do many traders take note of this guesswork, however some change their portfolios in response to them. This has confirmed to be an unproductive technique.

As a lot as I would like you to purchase HNTI, I’ll save a few of you the $29 bucks with this abstract: “Have a monetary plan, stick with it, handle your habits, apply good data hygiene, and let the markets be just right for you over time.”

If you wish to learn extra of the enjoyable particulars, properly, than order the e-book. I promise you’ll discover it each entertaining and informative.

Supply:

S&P 500’s 2024 Rally Shocked Forecasters Anticipating It to Fizzle

By Alexandra Semenova and Sagarika Jaisinghani

Bloomberg, December 29, 2024

See additionally:

My 12 months-Finish Inventory Market Forecast (December 10, 2024)

All these 2025 mortgage charges forecasts are actually improper

By Mike Simonsen

Housing Wire, December 19, 2024

Beforehand:

Coming March 18: “How Not To Make investments” (November 18, 2024)

No one Is aware of Something, The Beatles version (September 26, 2024)

Some Ideas About Forecasting and Why We Stink at It (November 1, 2017)

Say it with me: “No one Is aware of Something” (Might 5, 2016)

Market forecasters ought to admit the errors of their methods (Washington Publish, January 18, 2015)

No one Is aware of Something (Full archive)

~~~

If you wish to study extra about how the e-book was made, any associated media appearances or background, get distinctive bonus materials, or simply ask a query, you may enroll right here: HNTI -at-RitholtzWealth.com.

Please pre-order a replica right now!