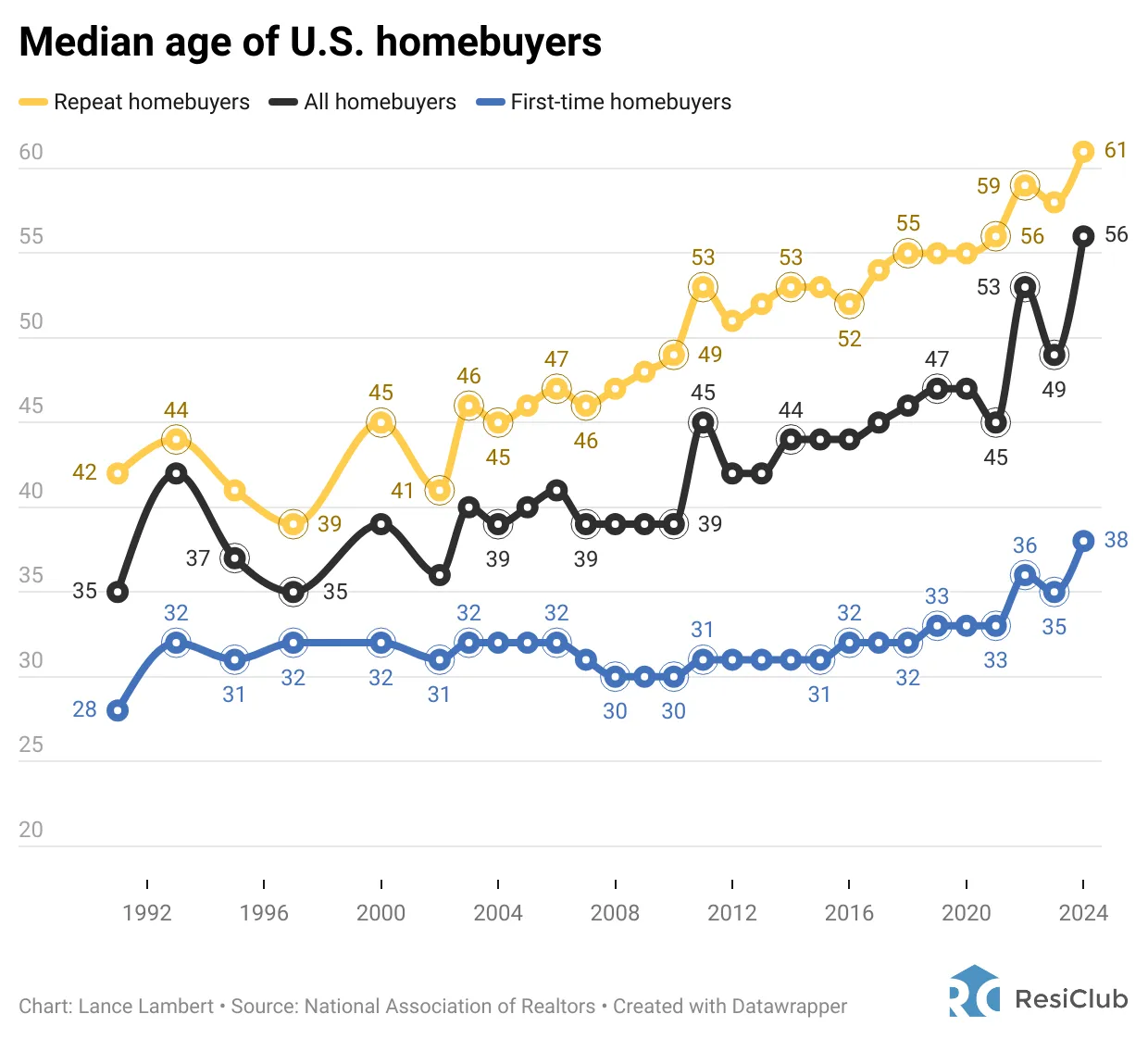

I just lately got here throughout an eye-opening chart by the Nationwide Affiliation of Realtors displaying that the median age of first-time U.S. homebuyers is now 38 years outdated. That’s a major leap from 30 years outdated between 2008 and 2010. In the meantime, the median age for repeat patrons has risen to 61 years outdated.

What’s going on right here?

These numbers astound me as a result of life is much too quick to delay shopping for a house for that lengthy. Most individuals purchase their first house with the intention of settling down. But when you’re solely making this dedication at 38, chances are you’ll not get to take pleasure in homeownership in the best way you had envisioned.

I perceive that rising house costs and excessive mortgage charges are the principle elements contributing to this development, making affordability more durable. Nevertheless, this put up is not focused at these the place affordability is their essential problem.

As a substitute, this put up is directed at those that can afford to purchase a house, however watch for the “good value” earlier than taking motion. The issue is that ready indefinitely can delay essential life milestones, making it more durable to retire early, begin a household, and totally take pleasure in the advantages of homeownership.

Your Diminishing Hopes Of Retiring Earlier than 60

Ready for the right value to purchase a house can push again your retirement timeline considerably. If you buy your first house at 38, you’ll doubtless take out a 30-year mortgage—in any case, about 95% of homebuyers do, though I favor an adjustable-rate mortgage (ARM) as a substitute. Matching your homeownership period with a decrease fixed-rate makes extra sense.

By the point your mortgage is paid off at 68, you could have already labored for 5 or extra years previous the normal retirement age. When you had purchased a house at 28 as a substitute, you’ll have had a paid-off home by 58, permitting for a way more versatile and fulfilling retirement.

After all, some folks may need aggressively saved and invested between 18-38 to realize monetary independence earlier than shopping for a house. Nevertheless, that may be a smaller share of the inhabitants. Making a house buy at 38 typically means depleting a major amount of money and investments, probably reversing any monetary independence they’d achieved.

I skilled this firsthand after buying our house in This autumn 2023 with money from inventory and bond gross sales. This resolution prompted my passive funding revenue to drop, leaving me on the worst level 25% in need of overlaying my desired family bills. Now, I have to spend the following 3-4 years making up for this deficit, delaying my monetary targets.

Beginning A Household Might Be Extra Tough

Many individuals goal to purchase a house earlier than having kids, in search of stability earlier than increasing their household. Nevertheless, delaying homeownership could make it more durable to begin a household at an optimum age.

Fertility challenges improve after age 35, and girls over this age are categorized as “geriatric” in maternity wards. My spouse and I skilled this firsthand in the course of the births of each our youngsters in San Francisco. Many {couples} in our community additionally struggled with conception as they waited longer to quiet down.

When you plan to purchase a house earlier than beginning a household however do not wish to danger fertility problems, I like to recommend starting your loved ones planning after you have monetary stability and the proper companion, moderately than ready for the “good” house buy.

A web price of a minimum of two instances your gross family revenue is an affordable benchmark earlier than having kids. Basically, the higher your wealth earlier than having kids, the much less pressured you will be. Have a web price aim earlier than having youngsters to maintain you targeted.

After all, it’s completely wonderful to begin a household and lease. Simply ensure you discover a place that’s owned by a landlord who desires long-term tenants.

The Flaws In Ready For The Good Worth

One of many largest causes folks delay homeownership is the idea that a greater value will come alongside. However market timing is sort of inconceivable. Even when you accurately predict a market backside, chances are you’ll battle to search out the proper house at the moment. And if the good house does seem, chances are high others will likely be bidding on it, driving up the value instantly.

As a substitute of attempting to time the market, purchase a house when you’ll be able to afford to take action. When you meet a minimum of two of my three home-buying guidelines within the 30/30/3 framework, you’re in a superb place. Moreover, make sure you plan to personal the house for a minimum of 5 years on account of excessive transaction prices.

Homeownership helps defend in opposition to inflation by stabilizing your housing prices. Renting indefinitely exposes you to lease will increase and instability. Whenever you personal, you’ve got management over your residing scenario and might benefit from the safety of not being compelled to maneuver on account of a landlord’s choices.

Whenever you lease, your return on lease is all the time unfavourable one hundred pc. Sure, you get a spot to remain, however nothing extra. You don’t get the choice to reside without cost or truly generate income from shelter.

Different Examples The place Ready For A Higher Worth Can Be Detrimental

Being cost-conscious is essential, however ready for the bottom potential value isn’t all the time the very best monetary resolution. Listed below are different areas the place ready can negatively affect your high quality of life:

1. Emotional Properly-Being & Relationships

Generally, spending extra for comfort—like taking a direct flight as a substitute of putting up with lengthy layovers—can considerably enhance your psychological and bodily well being. Hiring assist, resembling a nanny or home cleaner, can unencumber time to focus in your profession, household, or self-care. The associated fee is definitely worth the decreased stress.

2. Medical Therapy

Well being is priceless. Delaying mandatory medical therapy in hopes of a decrease value can result in extreme problems, larger bills, and worse outcomes. Preventative care, common check-ups, and well timed remedies get monetary savings and lives in the long term.

3. High quality Time & Experiences

Touring with family members, attending milestone occasions, and creating lasting reminiscences are invaluable. Skipping experiences like taking your youngsters to Disneyland or lacking out on a significant live performance to economize typically results in remorse. You may all the time earn extra money, however misplaced time is irreplaceable. You doubtless gained’t be capable to hike the 20 mile Incan path in your 70s.

4. Profession & Enterprise Alternatives

A convention, course, or networking occasion may change the trajectory of your profession. Ready for a value drop may imply lacking out on key connections or profession development alternatives.

5. Important Residence or Automobile Repairs

A minor leak at this time can flip into main water injury tomorrow. A small automotive problem can escalate into an costly breakdown. Ready for a “higher deal” on repairs typically ends in higher monetary losses down the highway.

6. Excessive-High quality Work Instruments

The proper gear can considerably enhance productiveness and earnings. A gradual laptop computer or outdated software program can waste hours of beneficial work time. I’m experiencing this firsthand with my 8GB MacBook Professional—it slows down continuously, killing my effectivity. A brand new one would pay for itself in improved productiveness, however I am unable to get myself to purchase a brand new one because it’s solely 5 years outdated.

7. Training & Talent Growth

Investing in studying can result in larger lifetime earnings. A ebook on investing and private finance may yield hundreds in future beneficial properties. Ready to avoid wasting $15 throughout a sale may lead to misplaced alternatives price 1,000 extra.

8. Spending On Well being & Health

A superb mattress, ergonomic chair, or health club membership can stop long-term well being points. Poor sleep or a sedentary way of life results in medical bills far exceeding the preliminary value of preventative measures. Are you actually going to sacrifice your sleep for 11 months to attend for that vacation mattress sale?

9. Childhood Milestones

Youngsters develop up rapidly. Skipping significant experiences to economize—resembling extracurricular actions, holidays, or perhaps a high quality preschool—can imply lacking out on key developmental alternatives.

If there’s one other factor price spending cash on, moreover a nice main residence, it is in your youngsters. As soon as they go away the home, 80% – 90% of the time you will ever spend with them will likely be gone for good.

10. Hiring Expert Professionals

Whether or not for house renovations, childcare, or monetary advising, ready for a lower cost can imply shedding entry to high expertise. Expert professionals are in excessive demand, and the most cost effective possibility is never the very best.

You Don’t All the time Have To Optimize For Financial savings – Pay Up For Comfort

As a substitute of all the time optimizing for financial savings, use your rising wealth to reinforce your way of life and comfort. Pay the additional 20 cents per gallon for gasoline as a substitute of driving 10 extra minutes to avoid wasting a couple of dollars. Select direct flights over layovers to avoid wasting time and cut back stress. Rent a home cleaner to unencumber hours for household, hobbies, or leisure. Working towards the behavior of utilizing your wealth to enhance your life is simply as essential as constructing it.

Earlier than shopping for my house in 2023, I analyzed the likelihood of it coming again in the marketplace if I didn’t transfer ahead. The soonest potential resale could be mid-2025, primarily based on the vendor’s plans. His daughter was graduating highschool in 2025 and he talked about he’d wish to transfer again to his nation of origin.

Nevertheless, I couldn’t predict if the value would nonetheless be inside attain. If the inventory market carried out effectively in 2024 and 2025, demand may push costs even larger, making it more durable for me to purchase. On the identical time, if I purchased the home I might lose out on additional inventory market beneficial properties. In the long run, I prioritized certainty over potential financial savings.

Though I in all probability would have made extra money by ready, I’ve no regrets. I didn’t put my life or my household’s consolation on maintain for 2 years

What Are Your Ideas?

Are you shocked by the rising median age of homebuyers? How a lot of it is because of affordability versus ready for higher costs? What different areas of life have you ever seen folks delay for monetary causes, solely to comprehend it wasn’t price it? Let me know your ideas!

Diversify Into Excessive-High quality Personal Actual Property

Shares and bonds are basic staples for retirement investing. Nevertheless, I additionally recommend diversifying into actual property—an funding that mixes the revenue stability of bonds with higher upside potential.

Take into account Fundrise, a platform that means that you can 100% passively put money into residential and industrial actual property. With virtually $3 billion in non-public actual property belongings below administration, Fundrise focuses on properties within the Sunbelt area, the place valuations are decrease, and yields are usually larger.

With a strong economic system, a robust inventory market, pent-up demand, and enticing costs, I anticipate business actual property costs to proceed to get better. I’ve personally invested over $300,000 with Fundrise, and so they’ve been a trusted companion and long-time sponsor of Monetary Samurai. With a $10 funding minimal, diversifying your portfolio has by no means been simpler.

Subscribe To Monetary Samurai

Pay attention and subscribe to The Monetary Samurai podcast on Apple or Spotify. I interview specialists of their respective fields and focus on a number of the most attention-grabbing matters on this web site. Your shares, rankings, and evaluations are appreciated.

To expedite your journey to monetary freedom, be part of over 60,000 others and subscribe to the free Monetary Samurai publication. Monetary Samurai is among the many largest independently-owned private finance web sites, established in 2009. Every part is written primarily based on firsthand expertise and experience.