The transient’s key findings are:

- IRAs have been created to assist these with out an employer plan to save lots of, however most IRA belongings are merely rollovers from 401(ok)s, not new contributions.

- Not too long ago, although, the share of households contributing to an IRA has ticked up – slightly bit for low-income employees and lots for these beneath 40.

- The rise in low-income contributors may effectively be as a consequence of state auto-IRA initiatives, which have broadened entry to workplace-based plans.

- The surge in youthful contributors is most definitely as a consequence of new fintech platforms that promote IRAs to tech-savvy Millennials.

- However these youthful contributors are likely to have a 401(ok) too, so IRAs stay primarily a approach for these with a plan to realize extra tax-advantaged saving.

Introduction

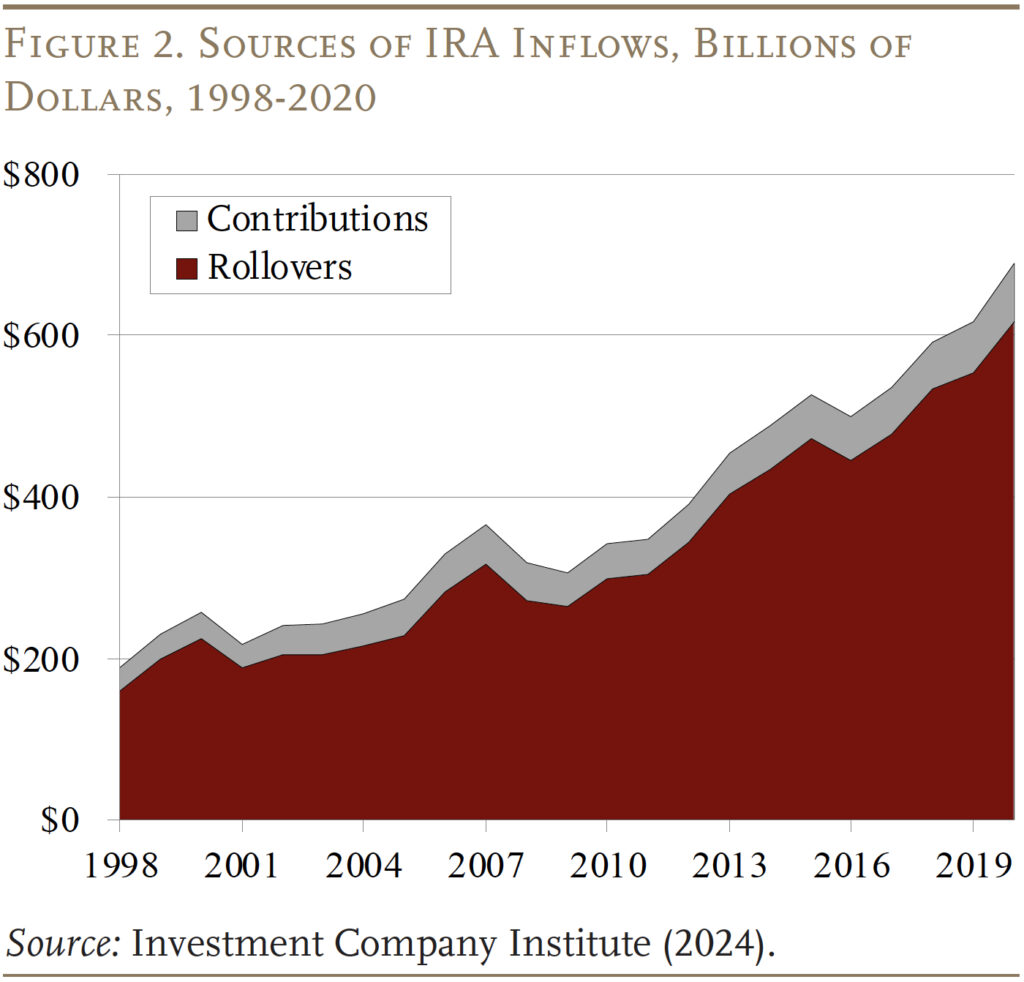

Particular person Retirement Accounts (IRAs), which maintain over half of whole non-public retirement belongings, have been launched as a approach for employees with out an employer-sponsored plan to save lots of for retirement in a tax-advantaged account. As an alternative, they’ve been primarily used as a automobile for rollovers from employer-sponsored plans, with direct contributions historically accounting for less than a small share of annual inflows.

Lately, nevertheless, two developments may have affected contributions: 1) the unfold of state auto-IRA packages, which enroll employees with out protection right into a Roth IRA; and a couple of) the expansion of fintech platforms providing, and generally incentivizing, IRA contributions. If IRA contributions have elevated and that enhance is pushed by auto-IRA packages, it might imply that IRAs are actually fulfilling their authentic intent of offering retirement financial savings for the uncovered. If the rise is pushed by fintech platforms, in style among the many younger, higher-income, and tech-savvy, it might imply that IRAs are nonetheless primarily a automobile for individuals who have already got financial savings to realize extra tax benefits. This can be a good time to reassess the sample of contributions to IRAs.

The dialogue proceeds as follows. The primary part gives a short historical past of IRAs. The second part describes the inflows into IRAs, paperwork the latest enhance within the share of households contributing, and describes the 2 developments – state auto-IRA packages and fintech platforms – that could be driving the latest enhance in IRA contributions. The third part assesses the significance of those initiatives by exploring modifications within the traits of IRA contributors.

The outcomes counsel that auto-IRAs, the place whole accounts are solely about a million, could have contributed to the small uptick in contributions among the many households within the lowest third of the earnings distribution. The principle motion, although, appears to have been spurred by fintech, which seems to have sharply elevated contributions amongst youthful households within the prime third of the earnings distribution who have already got a 401(ok)-type plan. Thus, IRAs stay primarily one other tax-advantaged saving choice for these with present retirement belongings somewhat than a mechanism for rising protection.

A Temporary Historical past of IRAs

Conventional IRAs have been launched in 1974 beneath the Worker Retirement Earnings Safety Act (ERISA). The purpose was to allow these with out employer-sponsored retirement plans to save lots of in a tax-deferred vogue. That’s, the federal government doesn’t tax the unique contribution to an IRA nor the returns on these contributions till the funds are withdrawn from the plan. Withdrawals from conventional IRAs earlier than age 59½ are usually topic to a 10-percent penalty and folks should start to withdraw their funds by age 73 in accordance with the present required minimal distribution (RMD) guidelines.

Though eligibility was initially restricted to these with out pensions, it was expanded in 1981 to embody all employees. It quickly grew to become evident, nevertheless, that whereas IRAs have been provided to all, they have been getting used primarily by higher-income individuals. Consequently, Congress considerably tightened IRA provisions within the Tax Reform Act of 1986. These modifications made contributions to IRAs totally tax deferred just for individuals who weren’t energetic individuals in an employer-sponsored plan or whose adjusted gross earnings (AGI) fell under sure thresholds.1

The Taxpayer Aid Act of 1997 made extra modifications, together with the creation of the Roth IRA.2 In distinction to the normal IRA, preliminary contributions to Roth IRAs should not tax deductible, however funding earnings accrue tax free and no tax is paid when the cash is withdrawn. As well as, holders of Roth IRAs don’t face any RMD. Whereas conventional and Roth IRAs could sound fairly completely different, actually they provide just about equivalent tax advantages over any given time interval.3

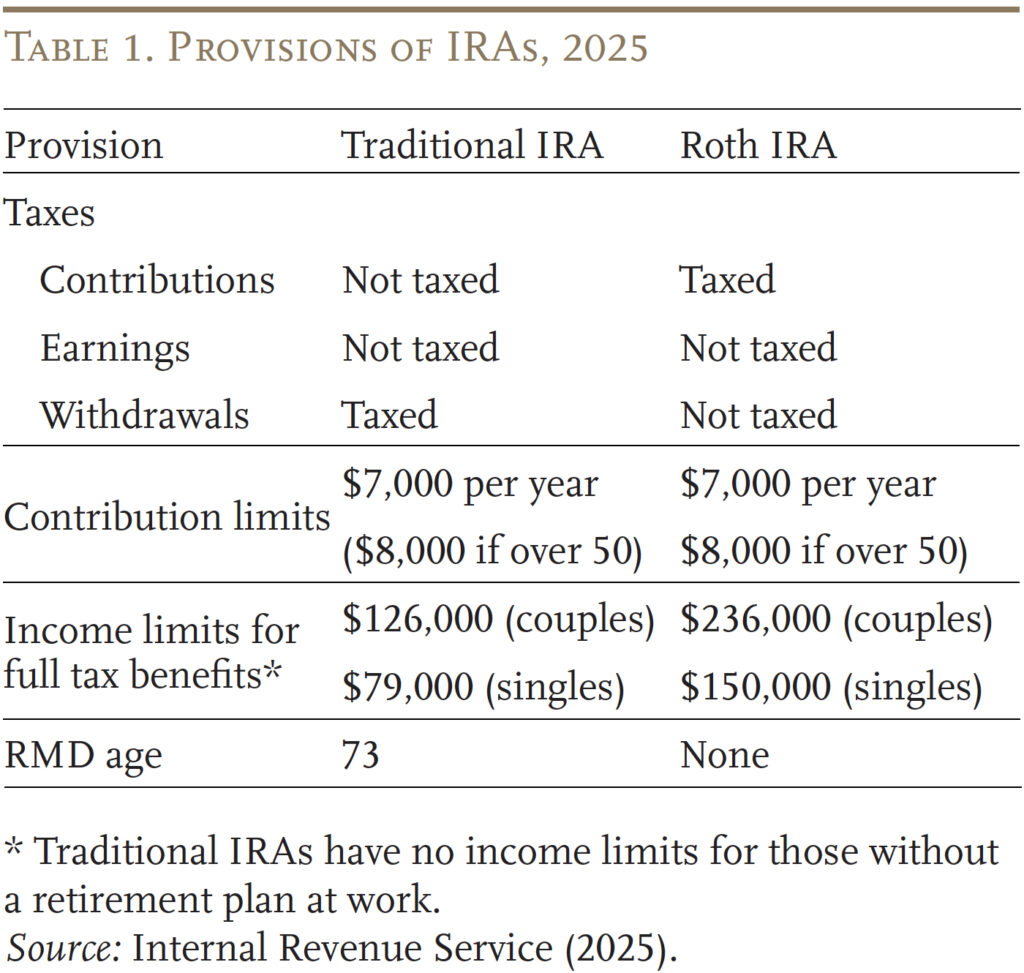

In 2001, each conventional and Roth IRAs allowed a most contribution of $2,000. The Financial Development and Tax Aid Reconciliation Act of 2001 raised these limits progressively to $5,000 and listed them for inflation yearly in $500 increments. The laws additionally permitted people ages 50 and over to make “catch up” contributions.4 Consequently, contribution limits in 2025 are $7,000 for many and $8,000 for these over 50. Desk 1 summarizes the present provisions for conventional and Roth IRAs.

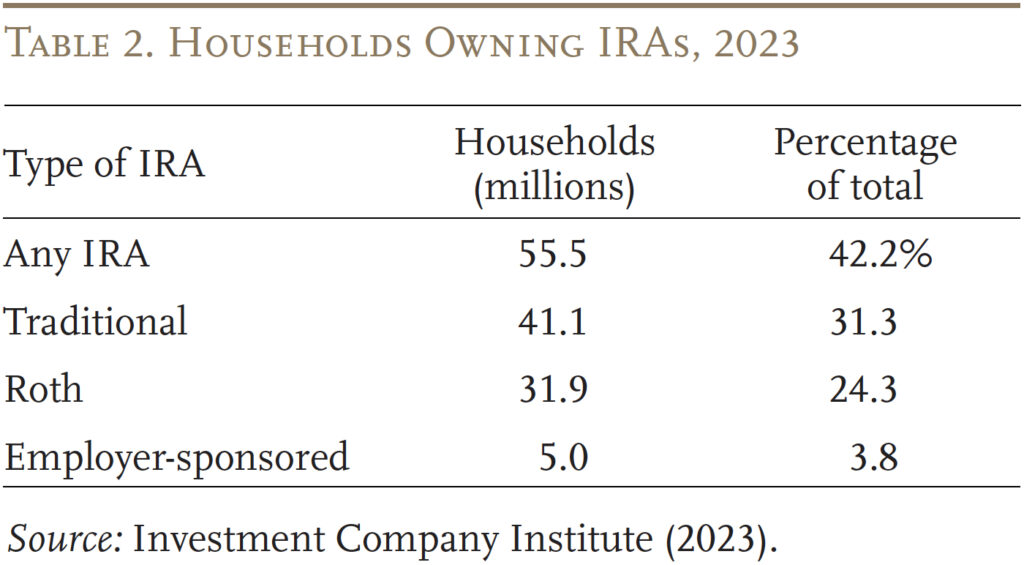

In 2023, in keeping with the Funding Firm Institute, 55.5 million households – 42 p.c of whole households – owned an IRA (see Desk 2). Households with conventional IRAs proceed to outnumber these with Roths. Observe that the odds with the assorted kinds of IRA don’t add to “any IRA” as a result of many households have multiple sort of account.

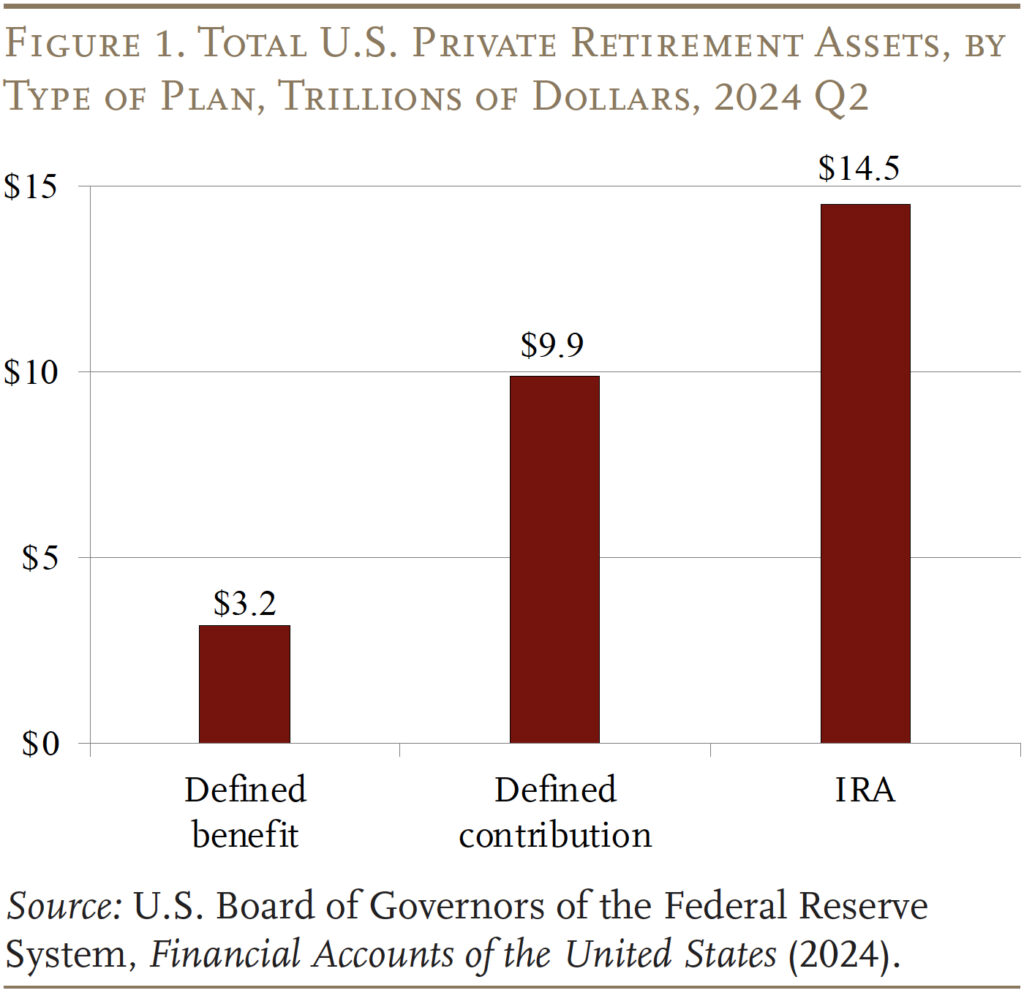

As we speak, belongings in IRAs account for over half of all belongings in non-public sector retirement plans, far exceeding these in both outlined profit or outlined contribution plans (see Determine 1).

Inflows to IRAs

Many of the new cash flowing into IRAs every year is rolled over from employer-sponsored retirement plans somewhat than coming from particular person contributions (see Determine 2). The main purpose for rollovers is that employees don’t need to depart their cash with their outdated employer, however usually face troublesome and time-consuming hurdles when making an attempt to maneuver cash to their new employer’s 401(ok). Since they need to protect the tax-favored therapy of their financial savings, most employees roll over to an IRA. Employees additionally like the concept of consolidating a lot of retirement accounts in a single location or having access to extra funding choices.

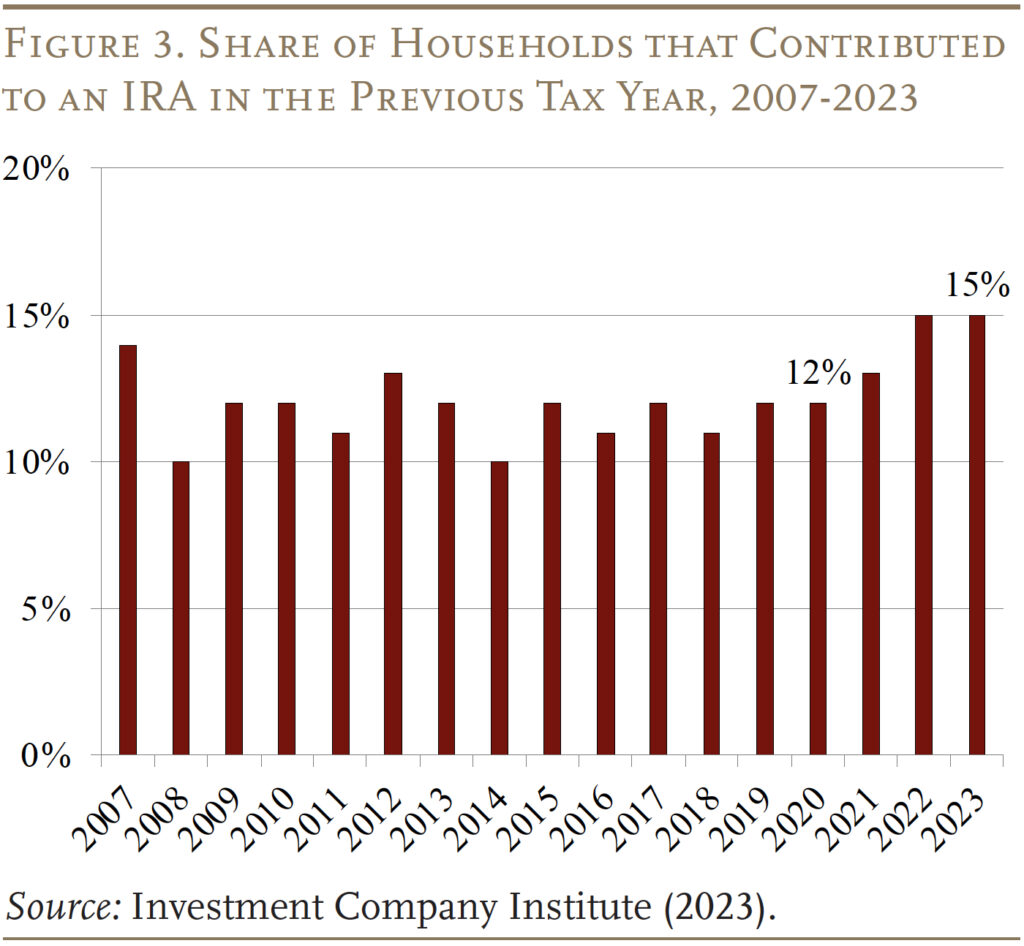

Regardless of the significance of rollovers, in 2023, a couple of third of households that owned a conventional or Roth IRA – 15 p.c of whole households – contributed to their account within the earlier tax 12 months. As proven in Determine 3, this share has ticked up lately.

Two potential developments might be behind the latest progress in IRA contributions: 1) the rise within the variety of states launching auto-IRA packages for uncovered employees; and a couple of) fintech corporations providing attractive bonuses for opening a brand new IRA.

State Auto-IRA Packages

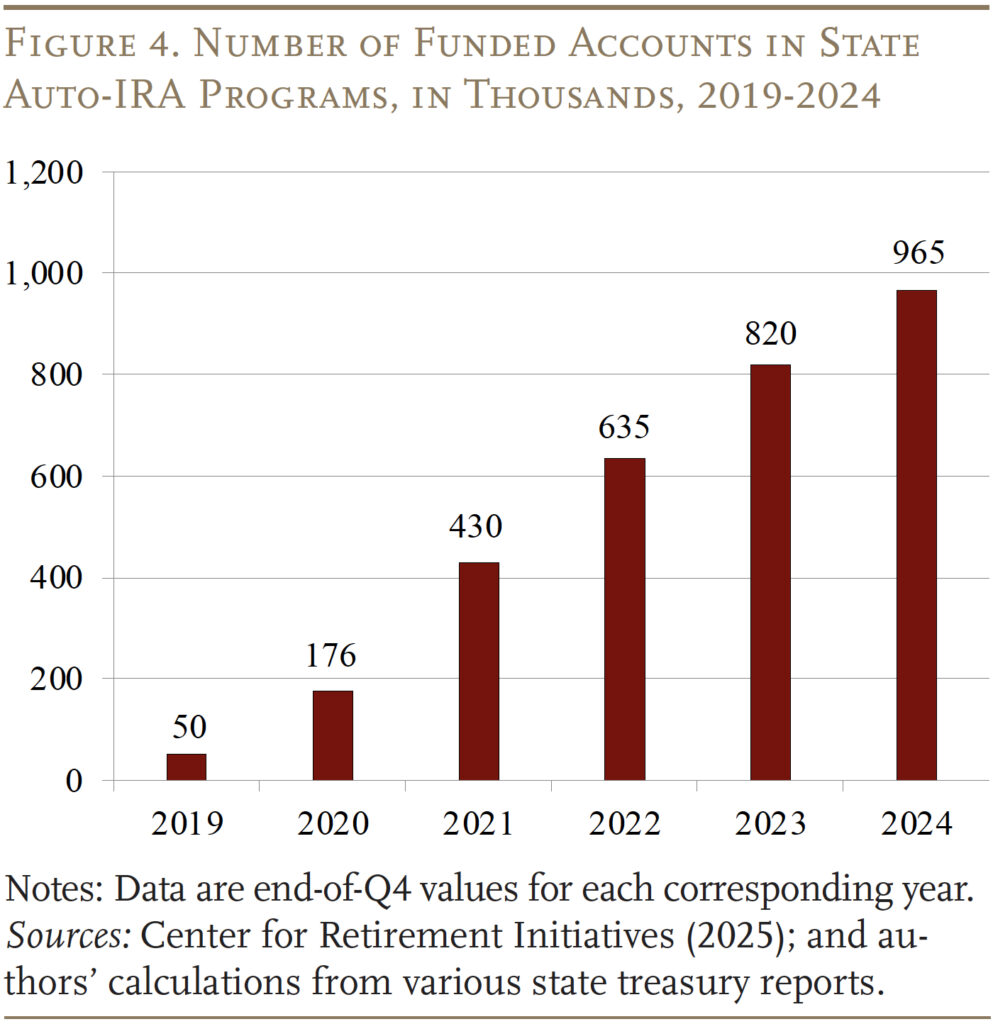

State auto-IRA packages have gained steam over the previous 5 years. These packages mandate that employers that don’t provide their very own retirement plan should mechanically enroll their employees in an IRA. At present, 11 states have launched obligatory packages.5 Between 2019 and 2024, the variety of funded accounts in these state auto-IRA packages grew from 50,000 to 965,000 (see Determine 4). IRAs are fulfilling their authentic objective for individuals of state packages, permitting employees with out a office plan to save lots of somewhat than serving merely as a rollover automobile. Most of the individuals are low- and moderate-income employees, so auto-IRA packages had solely reached $1.8 billion in belongings by the top of 2024.6

Fintech Firms

Fintech corporations have grown in recognition lately, significantly amongst youthful buyers. Initially, these corporations centered on particular person brokerage accounts, drawing in buyers by slicing down the prices and complexities of investing. For the reason that pandemic, many have begun to supply attractive bonuses for transferring or contributing belongings to an IRA.7 Robinhood, for instance, introduced it might offer IRAs in December 2022. By December of 2024, simply two years later, it had about 1.2 million accounts with over $13.1 billion in belongings.8 After all, a lot of the cash within the accounts is probably going rollovers, however some is also new contributions. Certainly, fintech corporations have instructed that their platforms may also help gig employees save for retirement.9

The query is whether or not the state auto-IRA and fintech initiatives have altered the composition of contributors.

Traits of IRA Contributors As we speak

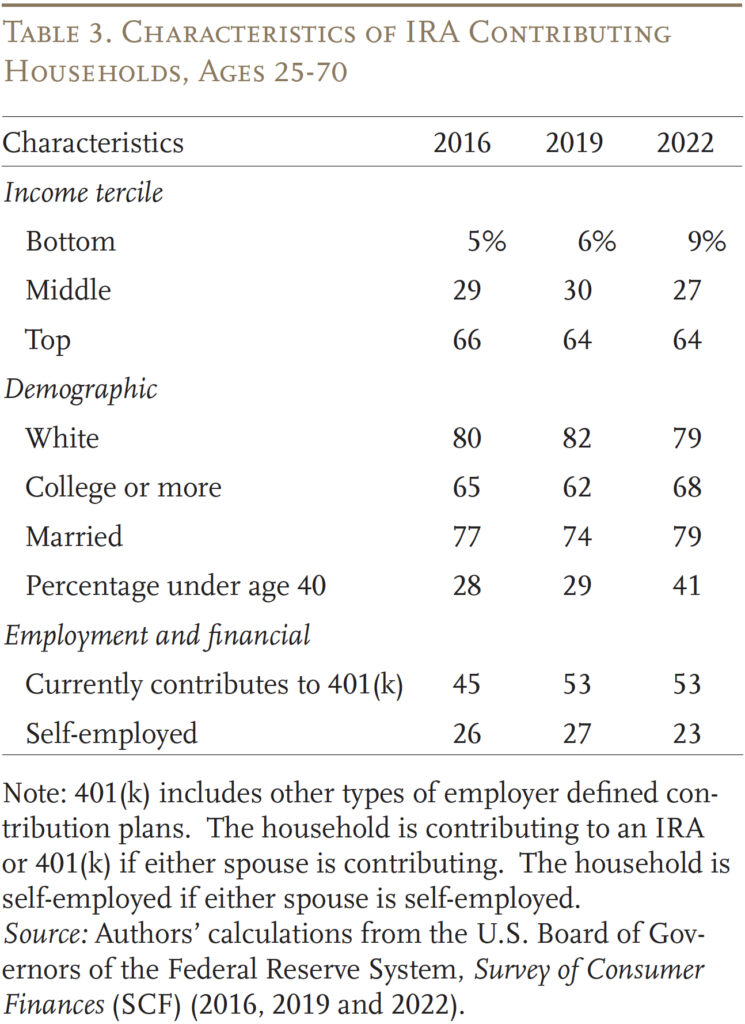

To reply this query, the evaluation shifts to the Federal Reserve’s Survey of Client Funds. Desk 3 reveals the traits of IRA contributing households for 2016, 2019, and 2022. At first, the sample seems a lot the identical throughout the years. Contributors to IRAs are usually a reasonably privileged group. About two-thirds of those households are within the prime third of the earnings distribution, and they’re principally White, married, and school educated. Two modifications, nevertheless, stand out. First, the share of contributors within the backside third of the earnings distribution rose from 5 p.c to 9 p.c and, second, the share of contributors beneath age 40 elevated from 28 p.c to 41 p.c. Are these modifications associated to the auto-IRA and fintech initiatives?

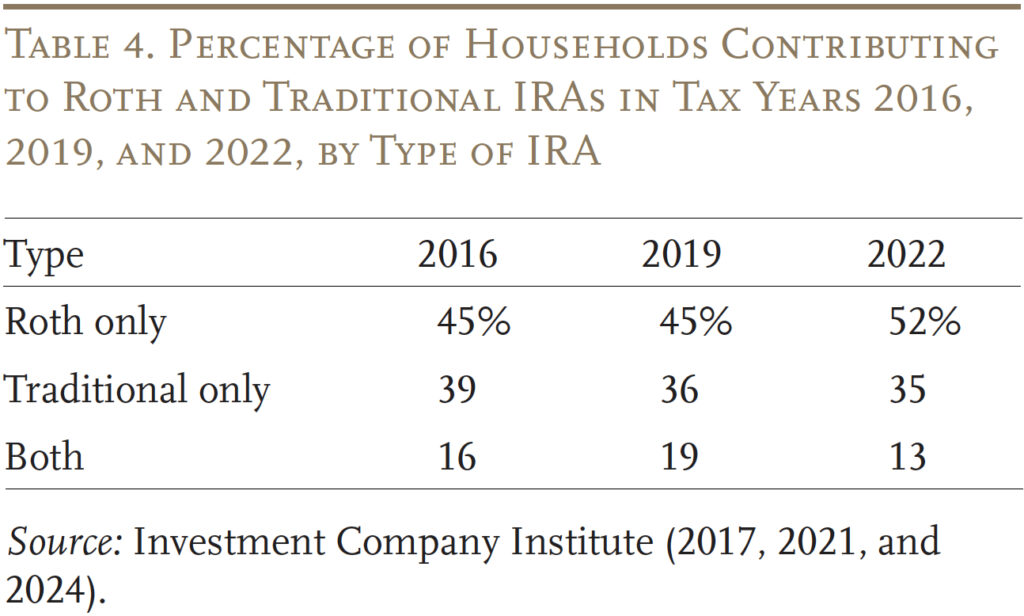

One piece of proof that auto-IRAs and fintech may need facilitated the expansion of IRA contributions is that “Roth solely” contributors now account for a majority of whole contributors (see Desk 4). Decrease-earning uncovered employees and younger employees have a tendency to learn extra from Roth accounts.

However how a lot of an impression may every initiative have had? The impression of the brand new auto-IRA packages should by definition be modest, because the whole variety of contributors is simply about a million – in comparison with 20 million IRA contributing households in 2022. But, these packages may effectively clarify the rise between 2019 and 2022 within the share of contributions coming from the underside third of the earnings distribution – households in 2022 with incomes beneath $52,000. These are seemingly new savers who’re having access to tax-advantaged choices by means of Roth IRAs.

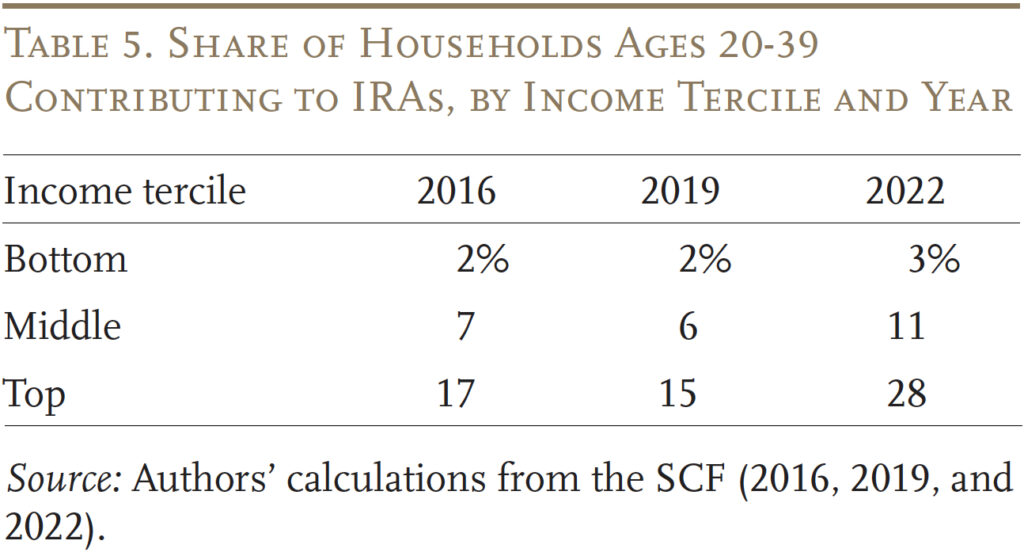

Equally, fintech should absolutely clarify the shift within the age distribution of contributors – usually, solely younger tech-savvy buyers flip to their cell telephones to save lots of for retirement. However who’re these new younger IRA contributors? As proven in Desk 5, the rise within the share of under-40 households contributing is concentrated among the many prime earnings tercile – the third of households with the very best incomes. The center tercile additionally reveals a modest enhance – albeit from actually low ranges.

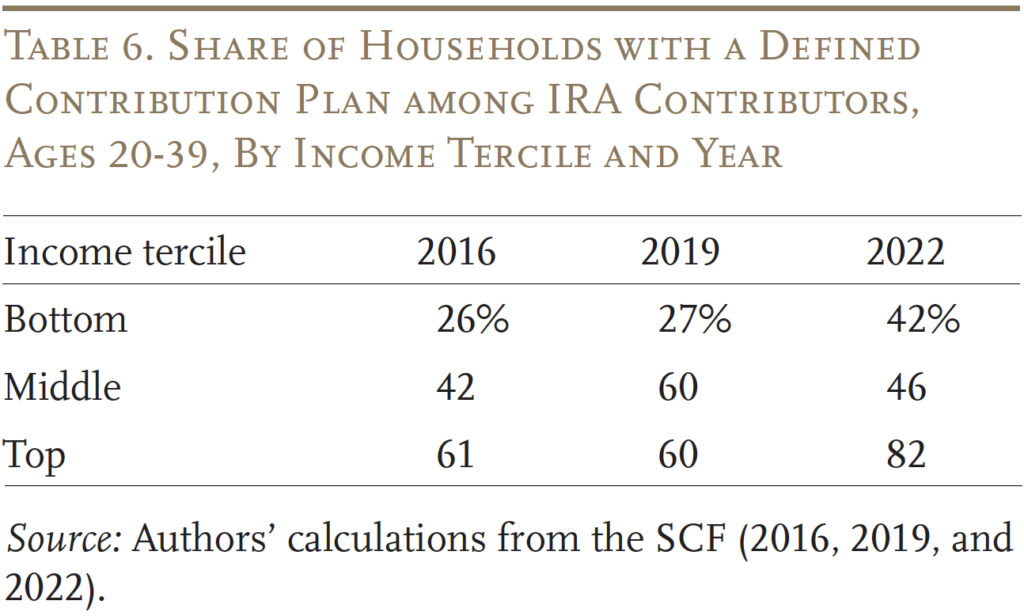

The query stays whether or not the fintech-inspired progress in contributions has produced a rise in protection or simply allowed households which can be already coated easy accessibility to a different account. Desk 6 reveals that for the highest tercile – the place with all of the motion – 82 p.c of contributors already had a 401(ok)-type plan. The underside line appears to be that if know-how makes it very easy to contribute to tax-advantaged financial savings accounts, the tech-savvy with cash will benefit from the chance.

Conclusion

IRAs have been launched to assist employees with out an employer-sponsored plan to save lots of for retirement in a tax-advantaged account. As an alternative, they’ve been primarily used as a automobile for rollovers from employer-sponsored retirement plans, with direct contributions – historically from high-income households – accounting for less than a small share of annual inflows.

Lately, the unfold of state auto-IRA packages and the expansion of fintech platforms may have elevated contributions, modified the composition of contributors, and maybe improved the share of employees with entry to tax-advantaged saving. Certainly, the share of households contributing to IRAs did enhance between 2019 and 2022. Auto-IRAs, the place whole accounts are solely about a million, could have contributed to the small uptick in contributions among the many households within the lowest third of the earnings distribution. The principle motion, nevertheless, appears to have been spurred by fintech, which seems to have sharply elevated contributions amongst youthful households within the prime third of the earnings distribution. Most of those households, nevertheless, have already got a 401(ok)-type plan. Thus, IRAs stay primarily a approach for these with retirement belongings to realize extra tax-advantaged saving somewhat than a mechanism for rising the share of employees with entry to work-based financial savings plans.

References

California State Treasurer. 2024. “Participation Stories.” Sacramento, CA: CalSavers Retirement Financial savings Board.

Middle for Retirement Initiatives. 2025. “State Program Efficiency Knowledge.” Washington, DC: Georgetown College, McCourt Faculty of Public Coverage.

Colorado Division of the Treasury. 2024. “Colorado SecureSavings Annual Report April 2024.” Denver: CO.

Connecticut Workplace of the State Comptroller. 2024. “Retirement Safety Program Month-to-month Knowledge Stories.” Hartford, CT.

Illinois State Treasurer. 2024. “Safe Alternative Efficiency Dashboards.” Springfield, IL: Illinois Safe Alternative.

Inner Income Service. 2025. “Retirement Plan and IRA Required Minimal Distributions FAQs.” Washington, DC: U.S. Division of the Treasury.

Funding Firm Institute. 2024. “The US Retirement Market, First Quarter 2024.” Washington, DC.

Funding Firm Institute. 2017, 2020, and 2023. “The Position of IRAs in U.S. Households’ Saving for Retirement.” ICI Analysis Perspective. Washington, DC.

Maryland Small Enterprise Retirement Financial savings Board. 2024. “MarylandSaves Month-to-month Dashboard Stories.” Baltimore, MD.

Munnell, Alicia H. and Anqi Chen. 2016. “May the Saver’s Credit score Improve State Protection Initiatives?” Subject in Temporary 16-7. Chestnut Hill, MA: Middle for Retirement Analysis at Boston School.

Oregon State Treasury. 2024. “Month-to-month OregonSaves Program Knowledge Stories.” Salem, OR: Oregon Retirement Financial savings Board.

Robinhood Markets, Inc. 2025. “Earnings Presentation, Fourth Quarter 2024.” (February 12). Menlo Park, CA.

Topoleski, John J. 2008. “Conventional and Roth Particular person Retirement Accounts (IRAs): A Primer.” CRS Report 7-5700. Washington, DC: Congressional Analysis Service.

U.S. Board of Governors of the Federal Reserve System. Monetary Accounts of the USA: Stream of Funds Accounts, 2024. Washington, DC.

U.S. Board of Governors of the Federal Reserve System. Survey of Client Funds, 2016, 2019, and 2022. Washington, DC.

Virginia Joint Legislative Audit and Evaluation Fee. 2024. “Virginia529 Oversight Report 2024.” Richmond, VA.