The temporary’s key findings are:

- Whereas monetary readiness measures recommend many might fall quick in retirement, most retirees say they’re happy with their lives.

- To discover this disconnect, the evaluation opinions present measures of goal and subjective well-being throughout many datasets.

- The outcomes present that the target measures – similar to well being and revenue – are typically poor predictors of reported satisfaction.

- This discovering means that survey responses on satisfaction present little assist to policymakers involved with monetary safety.

- Thus, new methods to seize well-being might concentrate on whether or not retirees want to chop spending and the way they reply to emergencies and expense shocks.

Introduction

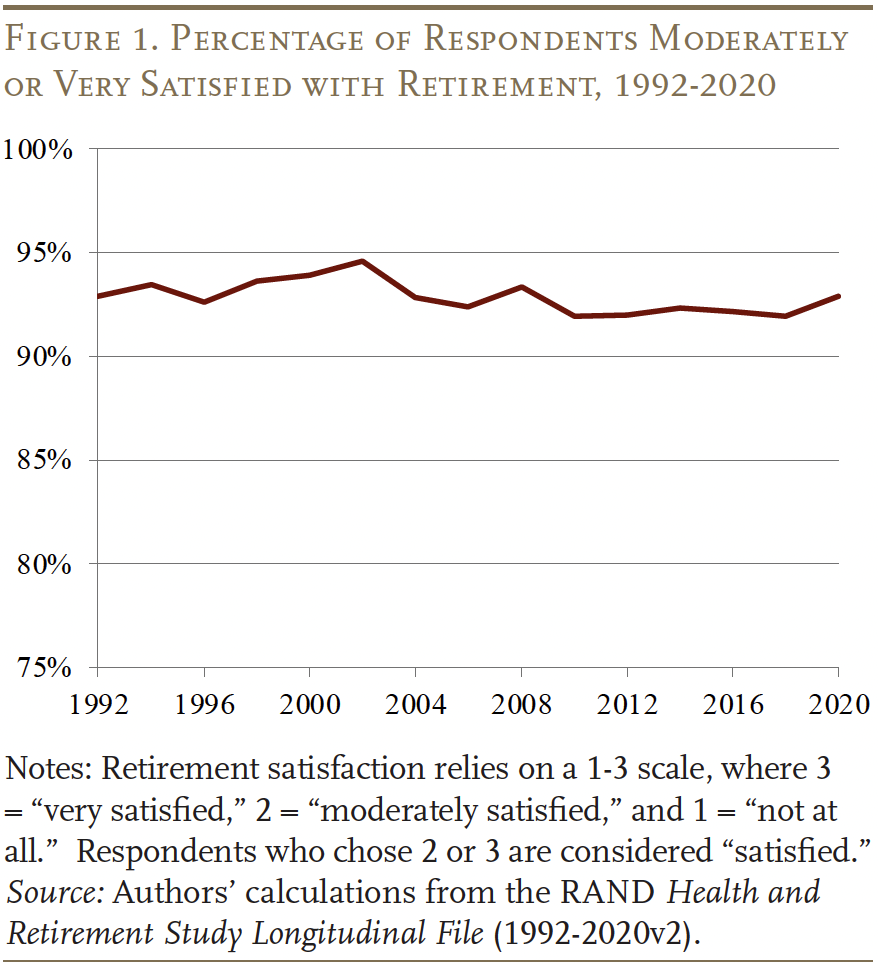

Measures of retirement preparedness usually recommend {that a} substantial share of U.S. households aren’t on monitor to keep up their lifestyle in retirement. And lots of retirees report remorse for not saving sufficient.1 But, when requested about their life satisfaction, the overwhelming majority – 92 p.c – of retired households say that they’re “very happy” or “reasonably happy.” In reality, gerontologists and psychologists have discovered a weak correlation between older People’ monetary circumstances and retirement satisfaction.2 These conflicting indicators recommend that monetary or life satisfaction questions don’t present a whole evaluation of how retirees are literally doing. Whereas a complete evaluation of retirement well-being could also be onerous to seize in a single easy query, it’s unclear what a very good measure would embody.

This temporary represents step one in the direction of growing a extra complete measure of satisfaction that features monetary in addition to different elements. The evaluation begins by assessing the extent to which varied measures of well-being are constant throughout quite a lot of public surveys. It then evaluates the extent to which subjective assessments are according to goal measures of well-being.

The dialogue proceeds as follows. The primary part supplies an summary of the prevailing measures of well-being and the datasets used within the evaluation. The second part compares the varied subjective well-being measures to see if they’re constant throughout datasets. The third part examines the connection between subjective and goal measures of well-being to see which of the target measures are higher predictors of life satisfaction. The ultimate part concludes that goal bodily well being is the one reasonably good predictor of life satisfaction and the one monetary element that issues for satisfaction is non-mortgage debt. Besides, the connection between each measures and life satisfaction is small.

Present Measures of Properly-being

Surveys that ask older adults about life satisfaction have persistently proven that the overwhelming majority of retirees are fairly happy and comfortable. This development has been comparatively steady over time (see Determine 1 for an instance).

Goal measures of retirement well-being, nevertheless, recommend that a big portion of retirees wouldn’t have the assets to keep up their pre-retirement lifestyle. Certainly, to keep up their life-style, many retirees depend on bank cards and forego any monetary buffer for emergencies. One rationalization for this disconnect between life satisfaction and goal monetary measures is that retirees’ life satisfaction shouldn’t be actually associated to monetary measures however slightly different points of well-being.

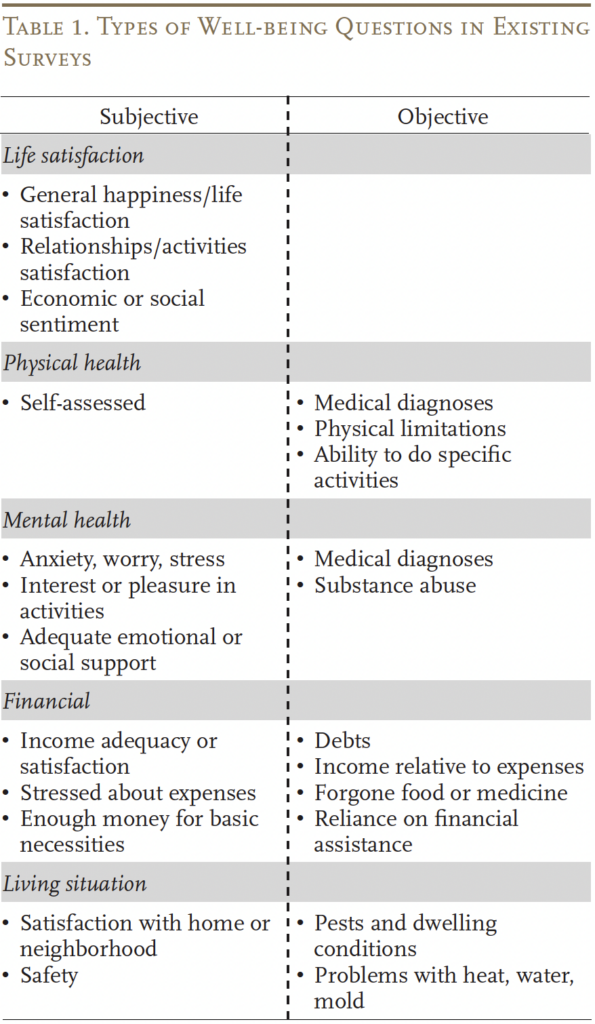

Fortuitously, a number of surveys embody an array of questions on completely different aspects of retirement well-being – monetary, bodily well being, psychological well being, and dwelling state of affairs – that transcend easy self-assessments of life satisfaction. Desk 1 exhibits a pattern of these kind of questions.3

Information

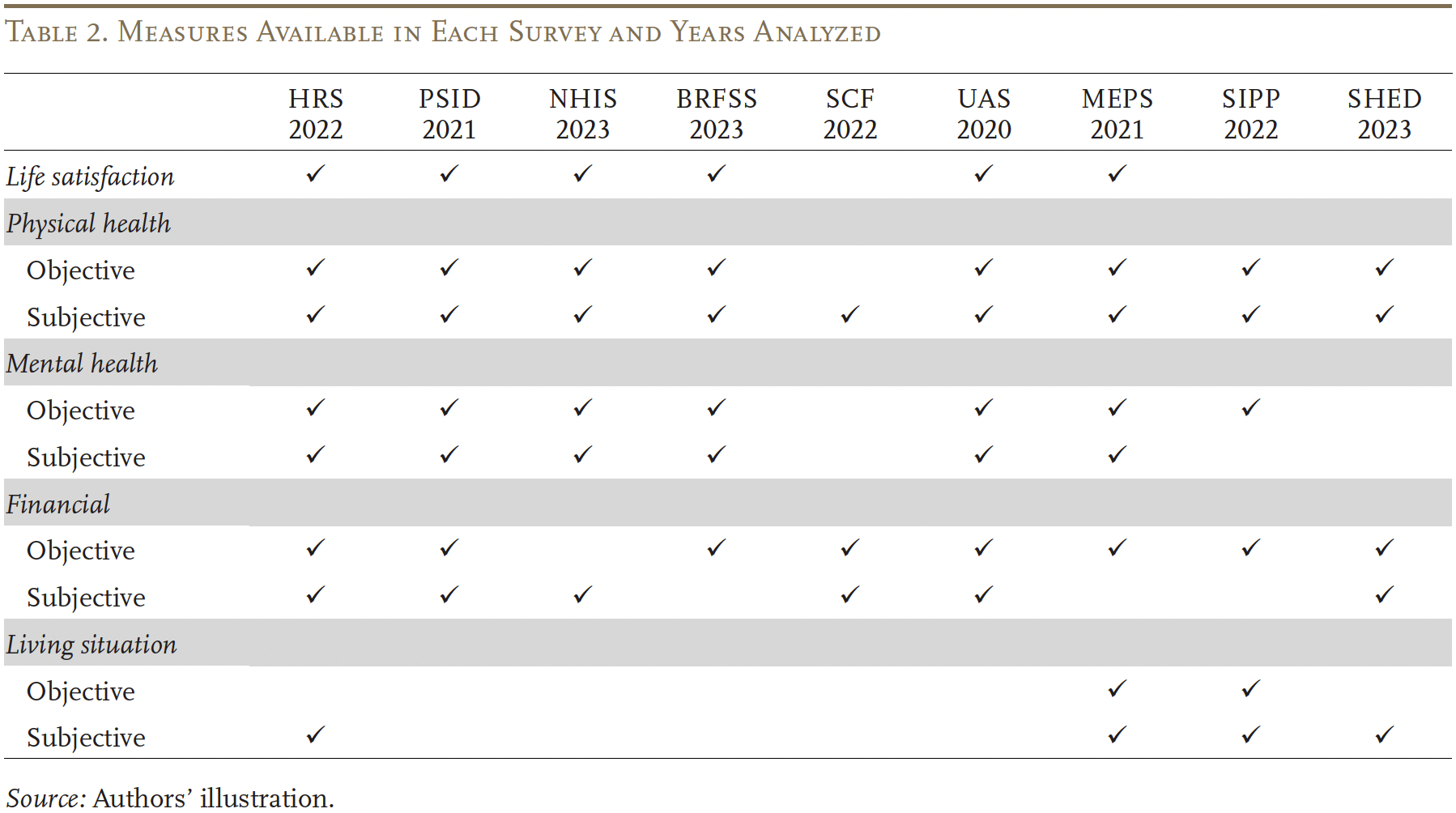

The questions come from quite a lot of publicly obtainable surveys together with: the Well being and Retirement Examine (HRS), Panel Examine of Revenue Dynamics (PSID), Nationwide Well being Interview Survey (NHIS), Nationwide Well being Behavioral Threat Issue Surveillance System (BRFSS), Survey of Client Funds (SCF), Understanding America Examine (UAS), Medical Expenditure Panel Survey (MEPS), Survey of Revenue and Program Participation (SIPP), and the Survey of Family Financial Decisionmaking (SHED).4 Desk 2 summarizes which measures can be found in every dataset. We use the newest obtainable yr for every dataset. For a short description of every survey, see the Appendix.

Do Surveys Have Constant Measures of Properly-being?

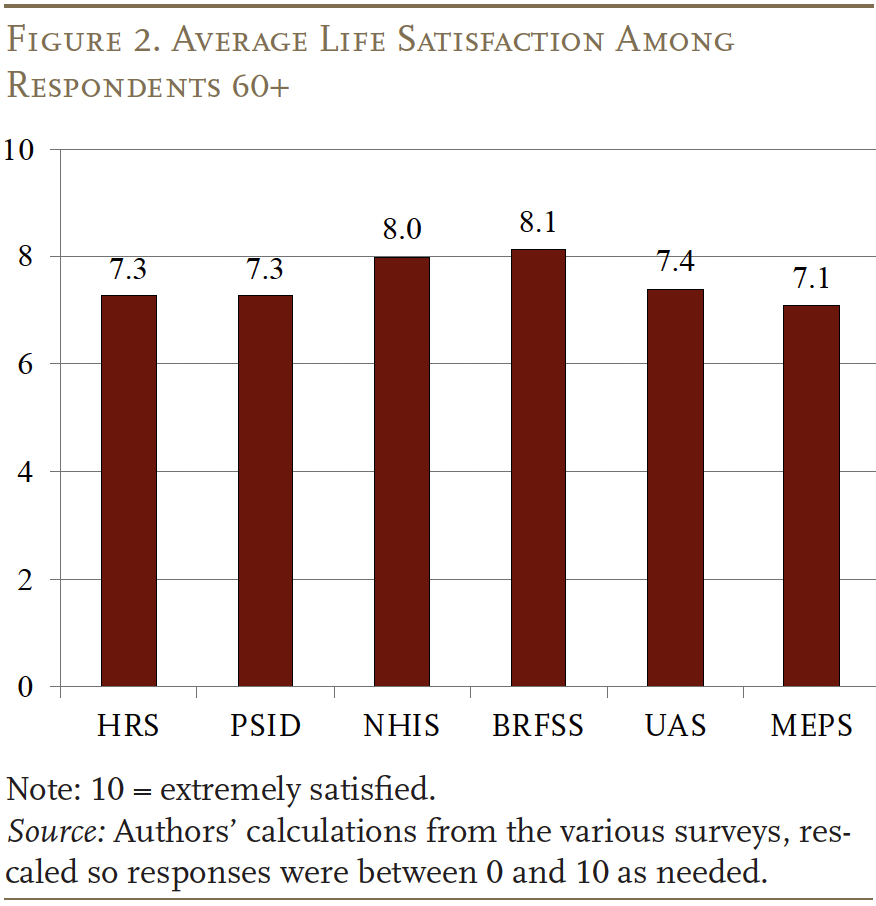

The primary query is whether or not respondents present constant assessments to varied measures of well-being throughout surveys. The broadest measure is life satisfaction. Right here, older adults supplied pretty constant responses, hovering round 7-8 on a 10-point scale, the place 10 represents being extraordinarily happy.5 The bottom ranking is 7.1 from the UAS – a comparatively new survey carried out by the College of Southern California – and the best is 8.1 within the BRFSS – a survey that tracks health-related dangers, power circumstances, and use of preventative providers (see Determine 2). Throughout varied surveys, older adults appear to report being pretty happy with their lives.

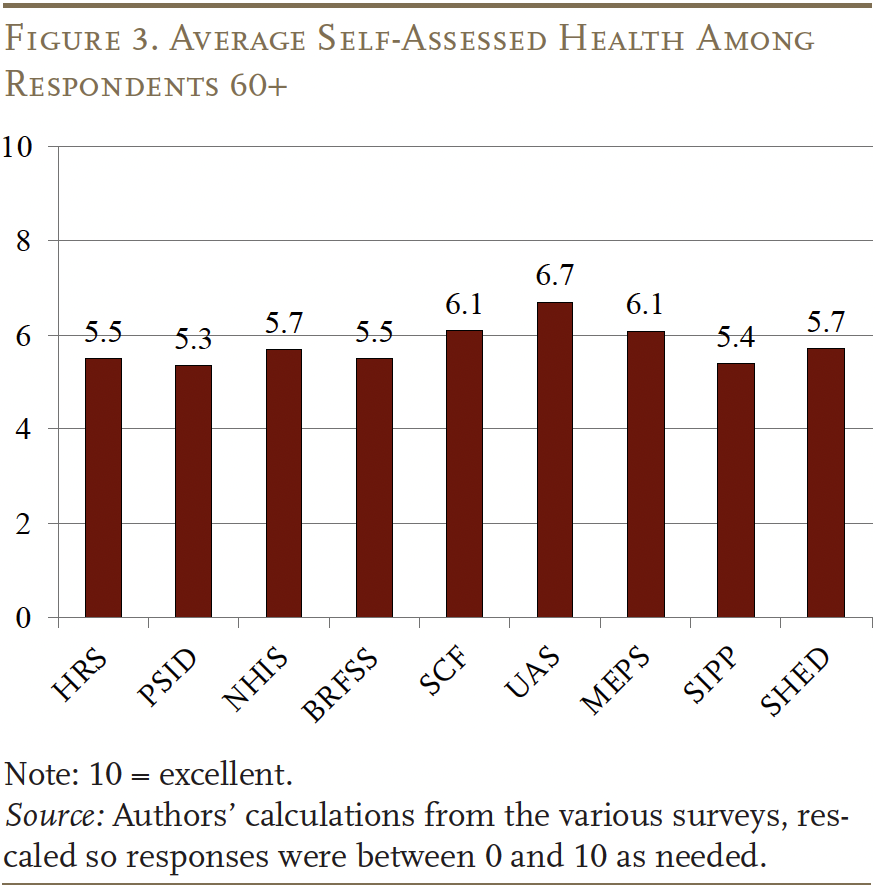

One other measure of well-being is self-assessed well being. Equally, responses are pretty constant throughout surveys, typically hovering between 5.5 and 6.5 on a 10-point scale, the place 10 is extraordinarily wholesome. The bottom is 5.3 from the PSID and the best is 6.7 from the UAS (see Determine 3). Throughout varied surveys, older adults appear to report extra average ranges of satisfaction with their well being when put next with life satisfaction.

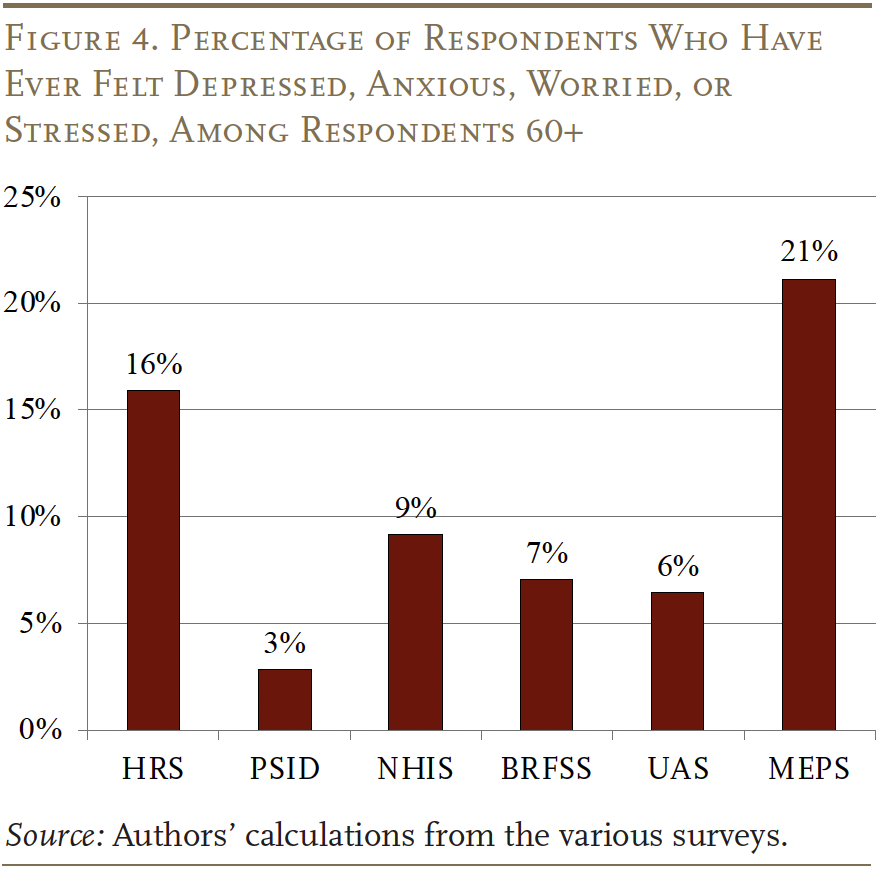

Measures of subjective psychological well being are rather less constant throughout surveys, doubtless as a result of they ask barely completely different questions.6 Surveys that ask concerning the frequency of stress or whether or not somebody felt depressed for 2 weeks in a row – such because the HRS and the MEPS – slightly than commonplace medical assessments present a a lot increased share of older adults reporting poor psychological well-being (see Determine 4).

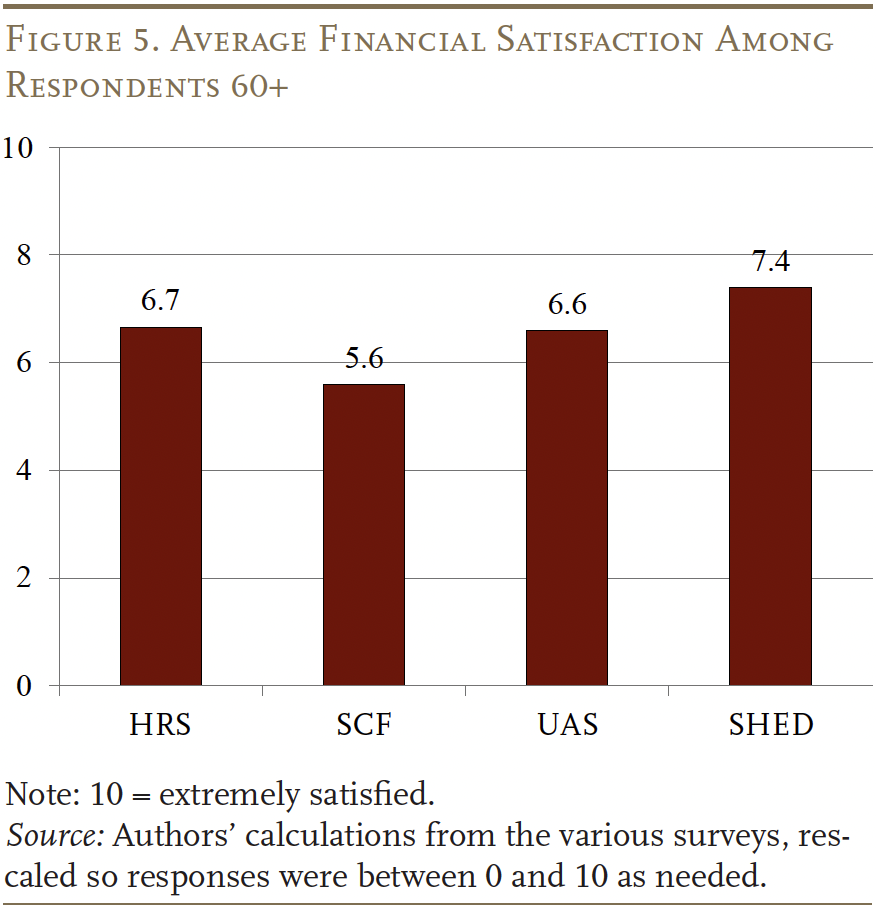

Shifting to subjective monetary satisfaction, responses from older adults are additionally considerably constant – though not as constant as life satisfaction or self-assessed bodily well being (see Determine 5). The SCF, which exhibits decrease ranges of economic satisfaction, asks whether or not respondents are happy with their retirement revenue whereas the opposite surveys ask about their satisfaction with their present family revenue or monetary state of affairs. It isn’t clear why asking about retirement revenue would possibly elicit a comparatively extra pessimistic response. Older adults additionally usually tend to report decrease ranges of economic satisfaction than life satisfaction.

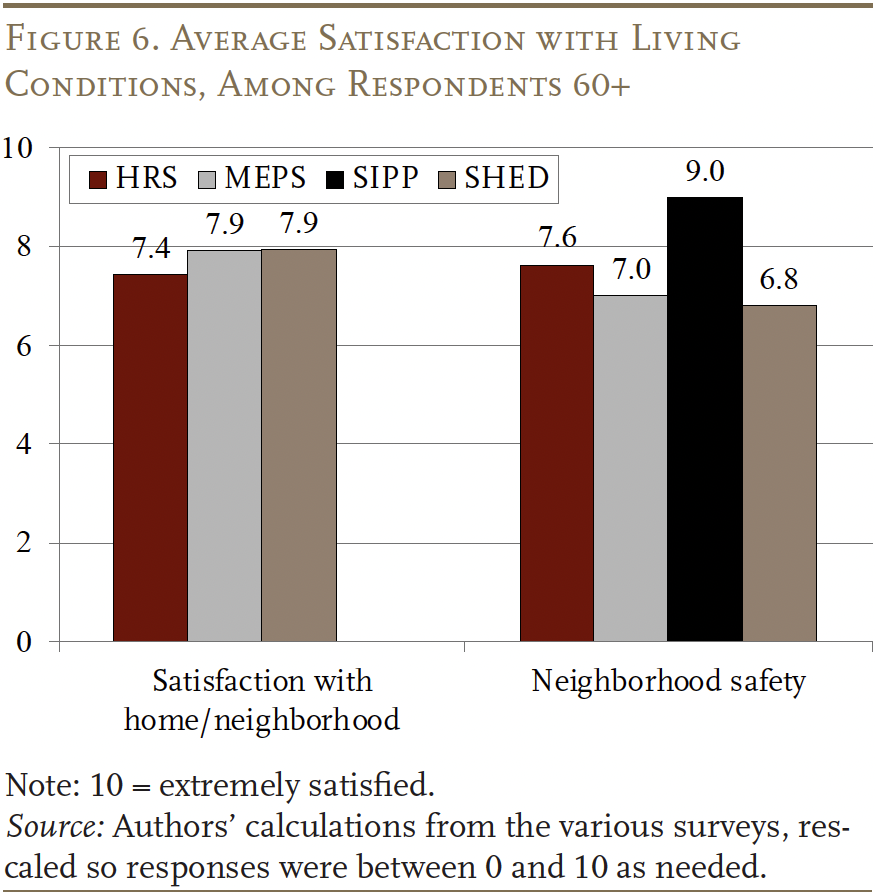

A number of surveys additionally ask older adults about their satisfaction with their dwelling state of affairs – some surveys ask about their house and neighborhood whereas others ask about security. As soon as once more, the responses are pretty constant (see Determine 6). The one exception is the SIPP, the place respondents are very happy (9 on a 10-point scale) with their neighborhood security.

A smaller variety of surveys ask about household satisfaction and whether or not respondents are frightened about operating out of meals. The satisfaction rating for household state of affairs was about 7.5 within the HRS and the UAS. By way of operating out of meals, the PSID and the NHIS confirmed that solely 0.5 p.c had been involved.

The outcomes up to now present that older adults’ responses to completely different classes of well-being questions are pretty constant throughout surveys, with most variation attributable to variations in what’s being measured or query phrasing.

How Do the Subjective and Goal Measures Evaluate?

The important thing query for this research is how the subjective measures of well-being examine with the target ones. This train includes estimating regressions to see how properly modifications within the goal measures predict completely different responses for subjective measures.

Life Satisfaction

The primary group of regressions estimated the connection between life satisfaction and 4 goal measures: 1) bodily well being; 2) psychological well being; 3 monetary safety; and 4) dwelling state of affairs.

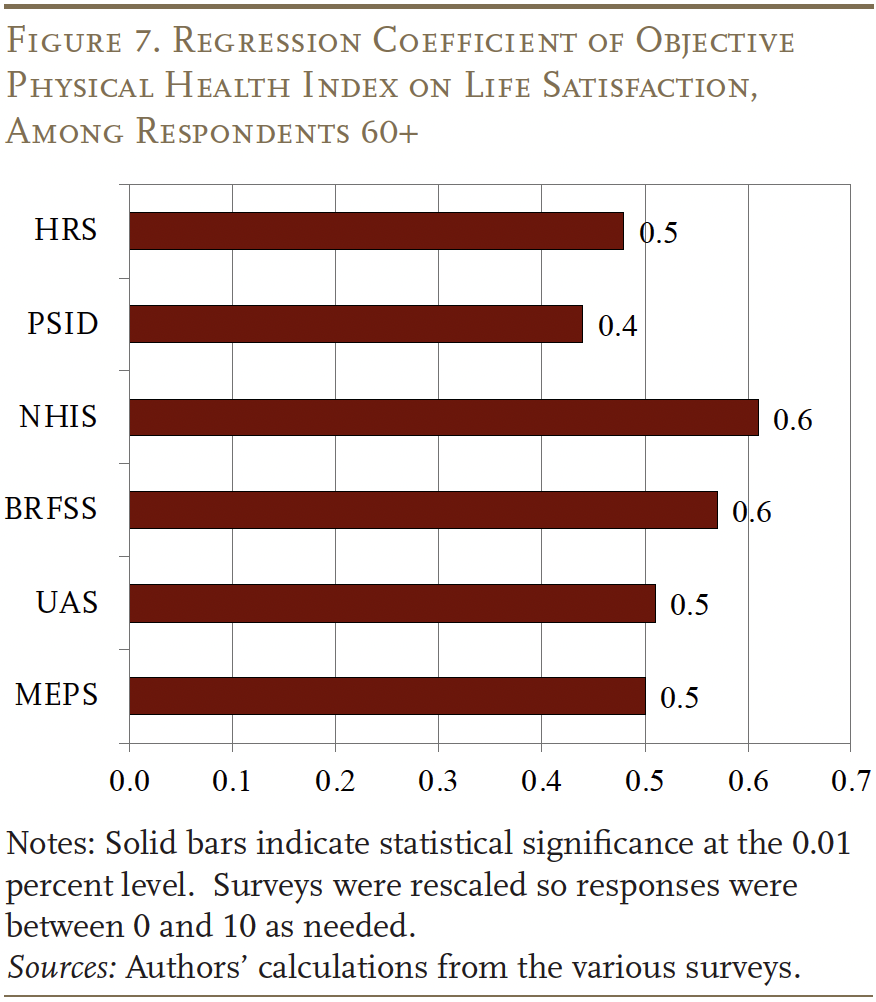

Bodily Well being Index. Goal bodily well being will be captured in quite a lot of methods, similar to whether or not somebody wants assist with actions of every day dwelling, has a critical power situation similar to most cancers, had a well being shock similar to a stroke or coronary heart assault, or has critical points with eyesight or listening to. We mix quite a lot of well being circumstances and diagnoses right into a bodily well being index, utilizing the primary principal element of the varied circumstances to measure older adults’ bodily well being.7 The connection between people’ bodily well being index and life satisfaction throughout completely different surveys is proven in Determine 7.

Not surprisingly, the coefficients are all optimistic – that’s, the more healthy somebody is, the upper their life satisfaction. Whereas the outcomes are all statistically vital, the magnitude is kind of modest, as a one-standard-deviation enchancment in well being is related to nearly a half-point enchancment in life satisfaction on a 10-point scale. For instance, transferring from the twenty fifth percentile of well being to the seventy fifth percentile is related to solely a 0.5-point enchancment in life satisfaction within the HRS.

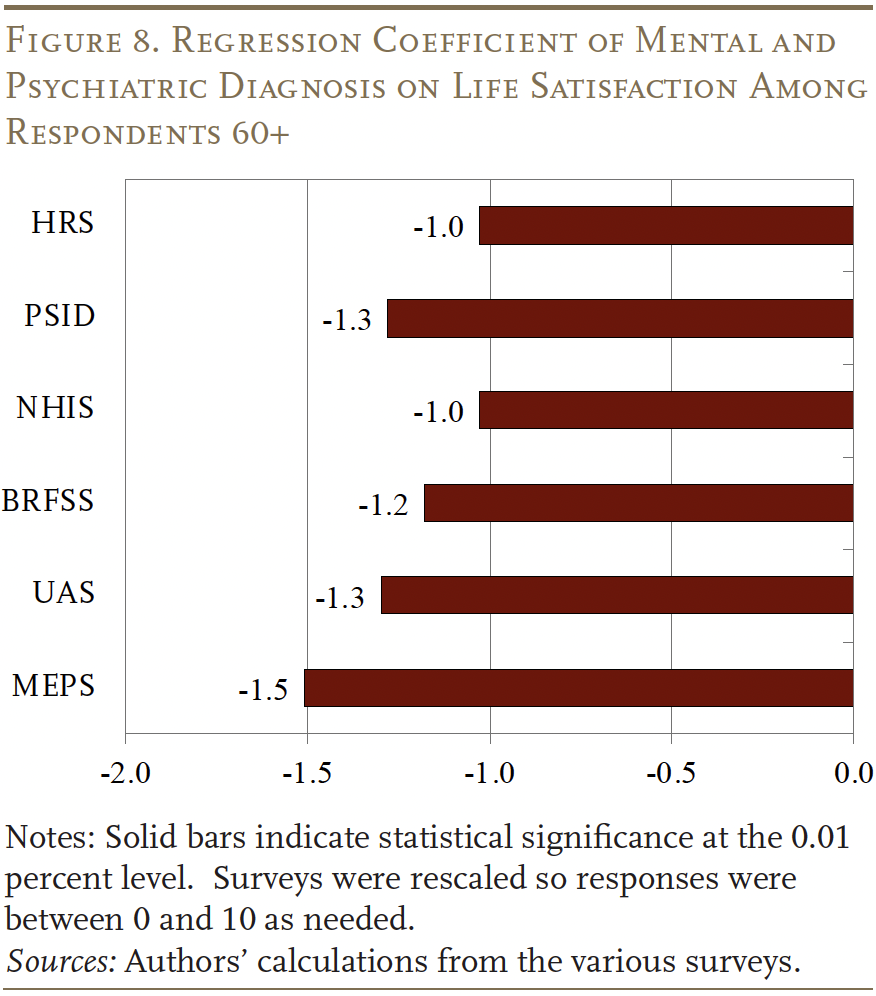

Psychological Well being. Goal psychological well being is measured by whether or not somebody was identified with circumstances similar to melancholy or anxiousness. Not surprisingly, such a analysis is negatively correlated with life satisfaction (see Determine 8). The correlation is bigger than bodily well being circumstances and can be statistically vital throughout all surveys. Even so, the outcomes present {that a} critical psychological well being analysis is just related to a 1.0-1.5-point discount in life satisfaction on a 10-point scale.

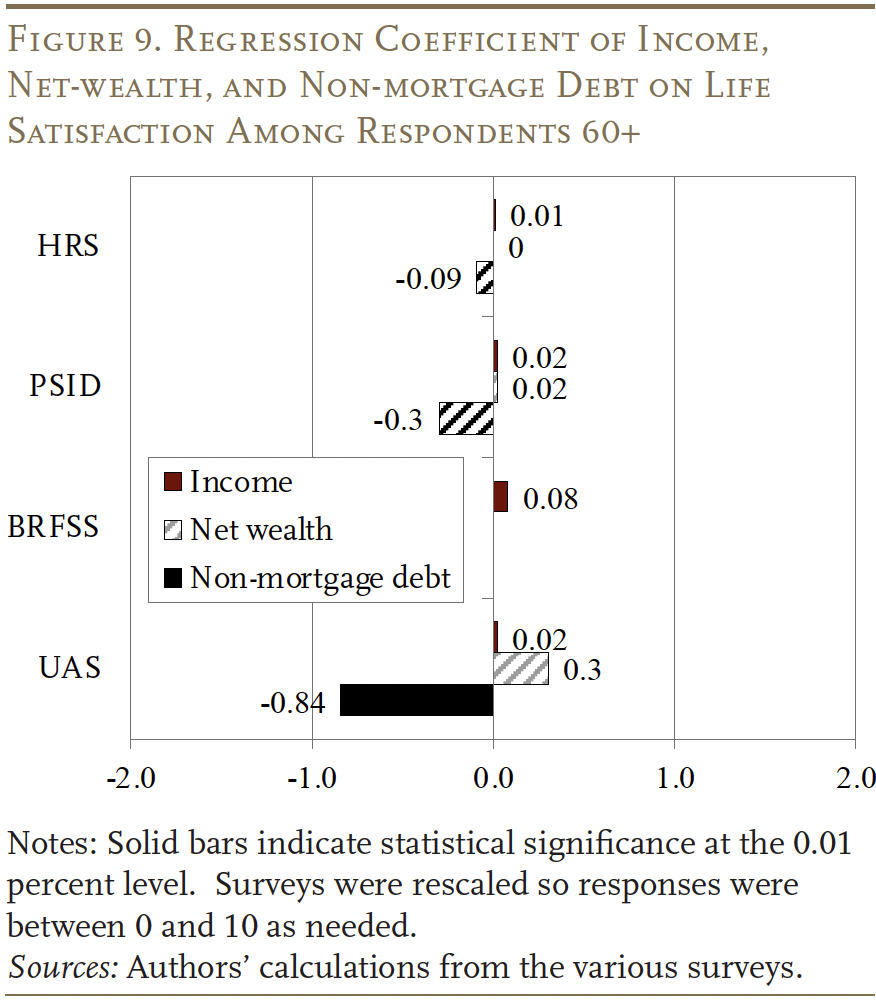

Monetary. The evaluation makes use of three measures of goal monetary well-being: 1) family revenue; 2) family internet wealth; and three) non-mortgage debt. Each revenue and wealth are elements of retirement revenue adequacy, and non-mortgage debt represents the monetary stress a family is perhaps beneath as a result of debt funds. Family revenue is measured in $10,000 increments, family internet wealth in $1 million increments, and non-mortgage debt in $100,000 increments. Curiously, the correlation between varied monetary measures and life satisfaction is just about zero and sometimes not vital throughout most surveys (see Determine 9). The one exception is non-mortgage debt – primarily bank card debt – within the UAS survey.8 This weak correlation raises doubts concerning the suitability of life satisfaction survey responses as a measure of the success or failure of retirement revenue coverage, because the measure appears unresponsive to the target monetary state of affairs of retirees.

Dwelling State of affairs. Goal dwelling circumstances will be measured by whether or not older adults have issues similar to mould, pests, or warmth and water points at house. Just one survey, the MEPS, permits us to match the target dwelling circumstances with life satisfaction. The coefficient between the 2 can be small, -0.95, albeit statistically vital.

The easy regressions present that goal well being measures – each bodily and psychological – are extra predictive of life satisfaction than monetary or dwelling circumstances, though not one of the completely different measures are very strongly associated to life satisfaction.

Goal vs. Subjective Measures inside Class

Goal and subjective well-being questions might need a stronger correlation inside classes.

Bodily and Psychological Properly-being. Not surprisingly, regressions of our bodily well being index on self-assessed well being present that goal bodily well being is a greater predictor of self-assessed well being than of life satisfaction, though nonetheless average.9 Curiously, the affiliation of getting a psychological well being analysis on self-reported subjective psychological well being is far smaller.10

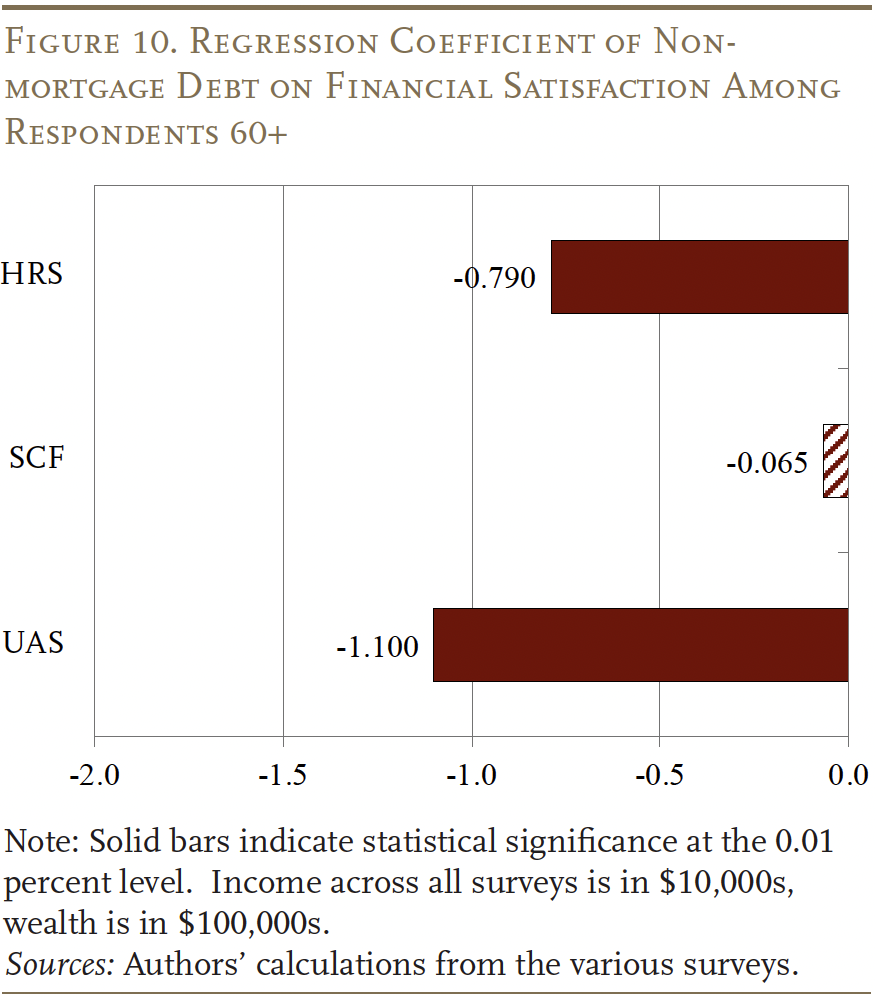

Monetary Properly-being. Equally, the correlation of revenue or wealth on monetary satisfaction, though bigger than on life satisfaction, can be small. Our regressions present {that a} $10,000 improve in annual revenue solely predicts a rise of economic satisfaction by 0.01 to 0.05 on a 10-point scale. Equally, a $1 million improve in wealth can be solely related to a 0.3- to 0.8-point improve in monetary satisfaction on a 10-point scale.11

What’s extra essential to older households’ monetary satisfaction is how a lot non-mortgage debt they personal (see Determine 10). Households are roughly 1-point (out of 10) much less financially happy for each $100,000 in non-mortgage debt they personal.

Dwelling State of affairs. As soon as once more, just one survey, the MEPS, permits a comparability of goal and subjective dwelling circumstances. Having mould, pest, and/or water/heating issues is related to a discount of a respondent’s satisfaction with their dwelling commonplace by 1.25 on a 10-point scale. The outcomes are statistically vital.

Conclusion

Surveys that ask older adults about life satisfaction have persistently proven that the overwhelming majority of retirees are very happy and comfortable. Nevertheless, measures of retirement preparedness usually recommend {that a} substantial share of U.S. households might want to reduce their spending in retirement and plenty of retirees report remorse for not saving sufficient. This disconnect makes it onerous to evaluate how frightened people and policymakers must be about households falling quick in retirement.

The evaluation on this temporary exhibits that the disconnect happens as a result of goal monetary measures – similar to revenue and internet wealth – are poor predictors of older adults’ self-reported life satisfaction. Goal well being and non-mortgage debt are barely higher predictors of life satisfaction. Besides, every extra $100,000 in non-mortgage debt is just related to a 1-point lower in life satisfaction on a 10-point scale, and transferring from the twenty fifth percentile of well being to the seventy fifth percentile is related to solely a 0.5-point enchancment

The weak relationship between goal monetary outcomes, and even well being outcomes, and life satisfaction means that survey responses on satisfaction are a poor take a look at of retirement revenue coverage. Future analysis might assemble a greater measure of well-being in retirement that captures whether or not households must make cuts of their spending and the way they deal with emergencies and expense shocks.

References

Company for Healthcare Analysis and High quality. Medical Expenditure Panel Survey 2021, 2023. Rockville, MD.

Chen, Anqi, Siyan Liu, and Alicia H. Munnell. 2023. “What Are the Implications of Rising Debt for Older People?” Problem in Transient 23-20. Chestnut Hill, MA: Heart for Retirement Analysis at Boston School.

Hansen, Thomas, Britt Slagsvold, and Torbjørn Moum. 2008. “Monetary Satisfaction in Outdated Age: A Satisfaction Paradox or A Results of Gathered Wealth?” Social Indicators Analysis 89: 323-347.

Hurwitz, Abigail and Olivia S. Mitchell. 2022. “Monetary Remorse at Older Ages and Longevity Consciousness.” Working Paper w30696. Cambridge MA: Nationwide Bureau of Financial Analysis.

Isaacowitz, Derek M. 2022. “What Do We Find out about Growing older and Emotion Regulation?” Views on Psychological Science 17(6): 1541-1555.

RAND. Well being and Retirement Examine Longitudinal File, 1992-2020v2. Santa Monica, CA.

College of Michigan. Panel Examine of Revenue Dynamics, 2024. Ann Arbor, MI.

College of Southern California. Understanding America Examine, 2024. Los Angeles, CA.

U.S. Board of Governors of the Federal Reserve System. Survey of Family Economics and Decisionmaking, 2024. Washington, D.C.

U.S. Board of Governors of the Federal Reserve System. Survey of Client Funds, 2023. Washington, DC.

U.S. Census Bureau. Survey of Revenue and Program Participation, 2023. Washington, DC.

U.S. Heart for Illness Management. Behavioral Threat Issue Surveillance System, 2024. Atlanta, GA.

U.S. Heart for Illness Management. Nationwide Well being Interview Survey, 2024. Atlanta, GA.

Appendix: Description of Datasets

Well being and Retirement Examine (HRS). The HRS is a family panel survey, carried out biennially since 1992, that interviews a nationally consultant pattern of about 20,000 individuals ages 50+ and their spouses. The survey has quite a lot of questions, together with not less than one query in every of the subjective and goal classes present in Desk 1, except for goal dwelling state of affairs. It has essentially the most complete set of questions on varied measures of well-being.

Panel Examine of Revenue Dynamics (PSID). The PSID can be a family panel survey, carried out biennially since 1968, that collects in-depth data on households in addition to their youngsters over time. Just like the HRS, the survey contains quite a lot of questions on varied goal and subjective measures of well-being. The one exception is that it doesn’t ask respondents about their subjective or goal satisfaction with their dwelling state of affairs or atmosphere.

Nationwide Well being Interview Survey (NHIS). The NHIS has been amassing data on the well being standing, healthcare entry, and well being behaviors of people since 1963. It contains measures of each goal and subjective bodily and psychological well being in addition to subjective monetary satisfaction.

Behavioral Threat Issue Surveillance System (BRFSS). The BRFSS tracks health-related danger behaviors, power well being circumstances, and use of preventive providers amongst people. BRFSS completes greater than 400,000 grownup interviews every year, making it the biggest constantly carried out well being survey system on the planet. The BRFSS contains goal and subjective measures of bodily well being, psychological well being, and monetary well-being.

Survey of Client Funds (SCF). The SCF is a triennial survey carried out by the Federal Reserve that gives complete knowledge on family stability sheets, revenue, pension, and different socioeconomic traits of households. Whereas the SCF is essentially the most complete public survey on family finance, it solely accommodates questions on retirement revenue satisfaction and goal monetary well-being.

Understanding America Examine (UAS). The UAS is a comparatively new nationally consultant survey carried out by the College of Southern California to trace a variety of social, financial, and well being behaviors throughout various populations. The UAS accommodates measures of goal and subjective bodily well being and monetary well-being. It additionally contains questions of subjective psychological well being.

The Medical Expenditure Panel Survey (MEPS). The MEPS is a nationally consultant, longitudinal dataset from 1996 to the current on well being standing, healthcare utilization, and healthcare expenditures for people. In extra to goal and subjective well being measures, the MEPS additionally contains data on goal monetary wellness, psychological well-being, and respondents’ dwelling state of affairs.

Survey of Revenue and Program Participation (SIPP). The SIPP is a nationally consultant longitudinal survey that interviews people on a month-to-month foundation, over a three-to-four yr interval. The SIPP contains measures on subjective and goal well being, in addition to goal monetary wellness. It additionally asks respondents concerning the security of their neighborhood.

Survey of Family Economics and Decisionmaking (SHED). The SHED is an annual survey carried out by the Federal Reserve to assemble knowledge on monetary well-being and focuses on matters similar to revenue, financial savings, debt, entry to monetary providers, and people’ experiences with financial hardship amongst households. Along with goal measures of economic well-being, the SHED additionally contains questions on goal and subjective well being and goal dwelling circumstances.