As getting a faculty diploma will get dearer by the 12 months, increasingly college students are counting on federal scholar loans to maintain the dream alive. And if you get your award letter you may see listings for each sponsored and unsubsidized scholar loans.

Nonetheless, all of the language that’s used to explain the various kinds of loans out there to you may sound like coded jargon, sure?

On this publish, we’re going create a dent in that cloud of confusion.

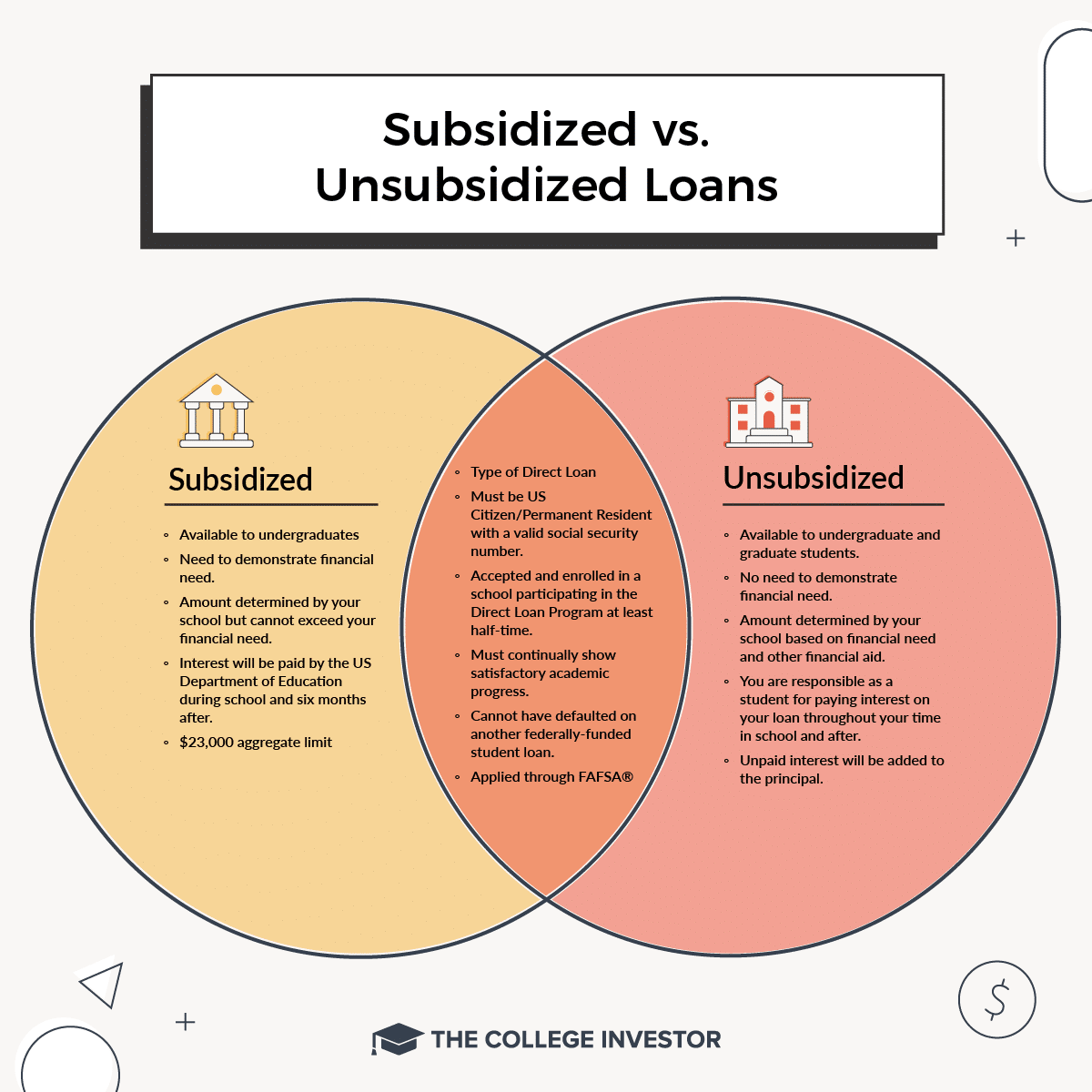

At this time we’ll discuss in regards to the variations between the phrases “Backed” and “Unsubsidized scholar loans” in the case of the Federal Direct Scholar Mortgage Program.

The William D. Ford Direct Mortgage Program is the biggest mortgage program provided by the USA Division of Training. It is mainly the “legislation” that defines what can and cannot be finished with scholar loans.

The Backed and Unsubsidized loans are two of the 4 varieties of Direct Loans. These are the commonest varieties of loans that undergraduates will get. Let’s break down what they imply, what you should know, and choices if you should borrow extra.

Backed Scholar Loans

In case you qualify for Federal Direct Backed Scholar Loans, you must undoubtedly take benefit, as they’re one of many finest scholar loans you will get.

Unsubsidized Scholar Loans

Who Is Eligible For Direct Loans?

There are a number of elements to pay attention to in the case of qualifying for direct loans. There are additionally limits to how a lot you may borrow with Direct scholar loans.

One thing to notice: Most males college students must be registered with the Selective Service as a way to obtain Federal Assist.

How A lot Can You Borrow?

There are totally different borrowing limits relying on in the event you’re a dependent scholar or impartial scholar. The bounds additionally change based mostly on what 12 months of college you are in.

If the quantity your college determines is greater than you really need, it’s also possible to borrow much less cash – one thing that may turn out to be useful if it’s your objective to repay your scholar loans sooner.

When your mortgage is awarded, it will likely be despatched on to your college who will then apply the cash to your college account to pay tuition and charges.

Here is the present scholar mortgage borrowing limits:

|

$5,500 – No Extra Than $3,500 Backed |

$9,500 – No Extra Than $3,500 Backed |

|

|

Second 12 months Undergraduate |

$6,500 – No Extra Than $4,500 Backed |

$10,500 – No Extra Than $4,500 Backed |

|

Third 12 months Undergraduate And Past |

$7,500 – No Extra Than $5,500 Backed |

$12,500 – No Extra Than $5,500 Backed |

|

Skilled And Graduate |

Word: All graduate {and professional} college students are thought-about impartial college students. Additionally, graduate {and professional} college students aren’t eligible for sponsored loans.

There’s additionally a complete mortgage restrict it’s important to comply with:

Dependent College students: $31,000, with not more than $23,000 sponsored

Impartial College students: $57,500 for undergraduates, with not more than $23,000 sponsored

Skilled and Graduate College students: $138,500 for skilled and graduate college students, with not more than $65,500 sponsored. These mortgage limits embrace any combination loans taken out throughout undergraduate research.

How A lot Time Do You Have To Pay Off Your Direct Loans?

With the Unsubsidized scholar mortgage, upon getting graduated from college, you might have a six-month “grace interval” the place you don’t essentially must make funds in your mortgage though you’ll have to pay any curiosity you accrued on the quantity you borrowed.

Typically, Backed scholar mortgage debtors is not going to have to fret about funds till the grace interval is over.

Your compensation interval begins a day after the grace interval ends – this holds each for Backed and Unsubsidized scholar mortgage debtors.

Since you completely don’t need to miss when your compensation begins, it is necessary that you simply talk clearly together with your mortgage servicer to get particulars the precise date your compensation interval begins, how a lot you should be paying and the strategies of funds.

If for some purpose, you might be unable to pay the curiosity through the six-month grace interval (underneath the Unsubsidized program) , the curiosity quantity will likely be capitalized. Because of this the curiosity quantity will likely be added to the principal which may probably enhance the quantity it’s important to pay every month.

Usually you’ll have between 10-25 years to repay your scholar loans.

In case you resolve to consolidate your loans utilizing the Direct Consolidation Program this time interval is prolonged as much as 30 years.

For each the Backed and Unsubsidized loans, you might have the chance to make use of income-based compensation applications like PAYE and REPAYE.

What If You Want To Borrow Extra?

Many individuals see these sponsored and unsubsidized scholar mortgage limits for undergraduates and do not know the way they’ll afford to pay for school. And that is a rational concern in the event you have been planning to borrow the total value of faculty. However keep in mind, paying for school is a pie – and there are numerous totally different slices to select from.

For the total breakdown of the “finest” option to pay for school, try this text: The Finest Means To Pay For School.

In case you’re already exhausted different choices, and know your ROI on schooling, then you may take a look at non-public loans.

We advocate college students store and evaluate non-public mortgage choices earlier than taking them out. Credible is a wonderful alternative as a result of you may evaluate about 10 totally different lenders in 2 minutes and see what you qualify for. Try Credible right here.

We even have a full comparability software on the Finest Non-public Loans To Pay For School right here.

Key Takeaways

We might love to listen to your ideas within the feedback!