Do your purchasers dictate what sort of enterprise you may have, or does your enterprise dictate the sorts of purchasers you serve?

Early in your profession as an advisor, you could have had comparatively few standards for accepting new purchasers. The extra property you may collect, the higher! However as your agency and repair providing have matured, you and your group might need assistance managing the e-book you’ve got constructed. Have you ever ever gone again to evaluate whom you are working with and the assets and time they require of you?

One methodology that might allow you to redirect your power towards the fitting folks and actions—and create extra room for progress—is constructing a consumer segmentation and repair mannequin. Here is how.

What is the Make-up of Your E-book?

Step one in constructing a consumer segmentation and repair mannequin is to grasp the folks in your present consumer base. Suppose when it comes to each quantitative standards (e.g., property below administration and income generated) and qualitative components (e.g., degree of belief, coachability, and referral historical past).

Additionally, think about what you do for them. Does everybody at present obtain the identical providers, akin to a monetary plan, an annual evaluation assembly, common outreach, and invites to consumer occasions? (Trace: If the reply is sure, put together for a change!)

Separating your purchasers into segments based mostly on clearly outlined standards and figuring out the providers you will ship to every one might help improve capability and construct scale.

A Technique for Consumer Segmentation

After you have a greater understanding of your present purchasers, it is time to begin categorizing them. There are a lot of methods advisors can strategy consumer segmentation. The secret is to seek out the one which works greatest for you and your enterprise, which implies having a imaginative and prescient on your agency and the best purchasers you wish to work with.

You might be accustomed to the segmentation strategy that locations purchasers into classes labeled “A,” “B,” “C,” or “D” based mostly on both income or AUM. Whereas this quantitative strategy helps to determine your most worthwhile purchasers, likelihood is you already know these purchasers effectively. So, what about the remainder of your e-book?

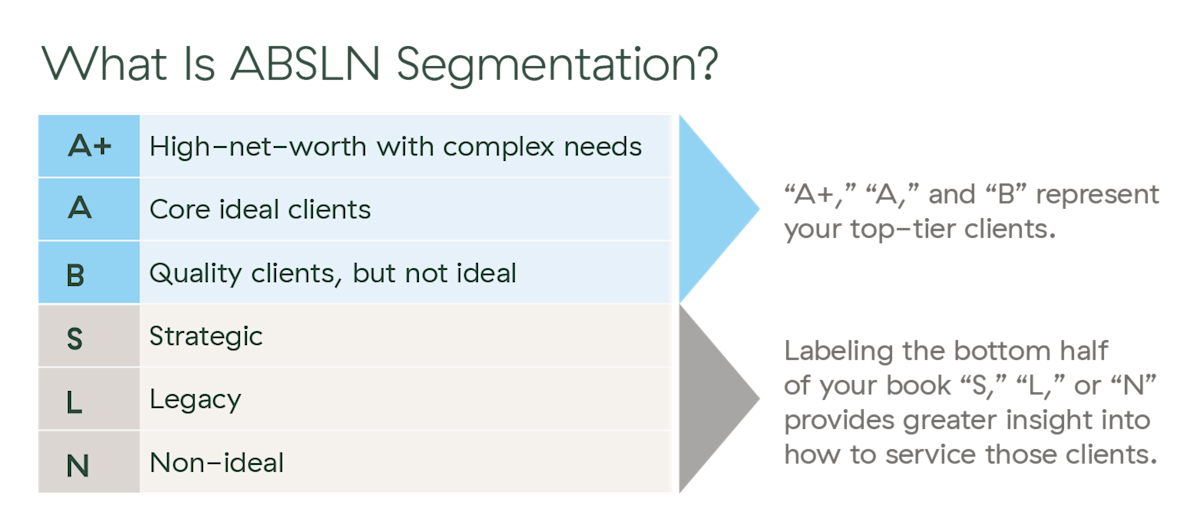

Commonwealth’s Enterprise Consulting group usually recommends our advisors use a extra holistic segmentation methodology referred to as the “ABSLN” methodology.

With the ABSLN segmentation methodology, you continue to determine your prime purchasers as “A+,” “A,” or “B” based mostly on the income they generate on your agency. For the underside tiers, although, you will use qualitative standards to put purchasers into segments labeled “S,” “L,” or “N.”

-

S/Strategic: People on this tier have the potential to develop into ultimate purchasers. Think about younger, excessive earners with sturdy financial savings, enterprise homeowners with illiquid wealth, or HENRYs (excessive earners, not wealthy but).

-

L/Legacy: These purchasers might have a legacy relationship that justifies offering continued service—for instance, “A” purchasers’ kids, widows, or private mates.

-

N/Non-ideal: These purchasers don’t match into every other segments. For them, you may proceed providing service, switch them to a junior advisor, or discontinue your relationship.

This strategy affords deeper perception into the sorts of purchasers at present in your e-book, which you’ll be able to then use to determine the sorts of providers you will ship to them.

From technique to motion. Just lately, I labored with a Commonwealth-affiliated advisor on some capability points. They had been questioning whether or not to rent a service advisor to handle the underside half of their e-book. Collectively, we used the ABSLN methodology to section their purchasers and analyze how a lot income every tier introduced it. It rapidly grew to become clear that hiring a brand new advisor would price them way over the property being managed. So, the advisor determined it would not make monetary sense to rent assist in that space.

By utilizing this evaluation, although, the advisor realized that lots of their current purchasers fell into the “non-ideal” class. They determined to reduce the providers they offered to that group and had been in a position to liberate a while, which was their authentic objective.

Pairing Segmentation with Companies

As soon as you’ve got completed the consumer segmentation train, you possibly can transfer on to constructing your consumer service mannequin, the place you will determine which providers you will ship to every section—and the way usually.

In case you’re like many advisors I work with, you could have your providers mapped out in your head. However belief me, it is price documenting them. Like with different processes, clear documentation will assist be certain that you persistently supply high-quality service.

To assist with choices about service choices, replicate on these questions:

Your outcomes may begin trying one thing just like the beneath grids, with all providers—together with funding administration, monetary planning, advertising and marketing initiatives, and consumer occasions—on the left and the tiers that could be eligible for every service on the proper.

If the full variety of hours you will spend to ship service throughout every consumer class would not align with the typical income earned from that class, you might want to regulate.

In fact, there’s no magic quantity for what number of consumer conferences to carry every year, and the variety of choices will fluctuate by advisor. Resolve what you possibly can present your purchasers whereas additionally being aware of your capability.

Now What? From Technique to Motion

You have segmented your purchasers and created a service mannequin. Now, it is time to implement your technique in your apply. This implies systematically evaluating each facet of your enterprise to determine the place to make changes.

Listed here are some questions to contemplate:

By aligning every space of the enterprise along with your new service mannequin, you will be higher positioned to draw extra ultimate purchasers and scale your enterprise.

Prepared for a Change?

When you do not have a deliberate consumer segmentation and repair mannequin, your purchasers can find yourself dictating how your enterprise runs. Why not attempt a distinct strategy? In any case, providing your purchasers an important service expertise should not come on the expense of your individual enterprise’s progress.

Taking time to finish these workout routines permits you to focus your power the place you want it most. The profit is extra time to handle extra relationships—primarily with ultimate purchasers. Plus, you’ll have the ability to help elevated income with fewer assets, which implies extra earnings heading on to your agency’s backside line. And that is a win-win.