The rising challenges dealing with larger schooling current important threats to varsity budgets. Proposed legislative modifications and a looming default disaster threaten to pressure institutional sources.

To guard larger schooling budgets, faculties should put together in opposition to these points:

Elimination of Grad & PLUS Loans

The potential elimination of Graduate and Dad or mum PLUS loans may create a monetary support hole for college kids, creating income loss for faculties.

Graduate applications, usually very important income sources for larger ed, would face instability. Schools should discover various funding fashions to offset these losses, doubtlessly increasing their institutional mortgage applications to assist graduate college students.

Elimination of Backed Loans

Previous and present finances proposals have floated the concept of ending federally backed loans whereas an undergraduate is at school and through grace durations.

Ending backed mortgage curiosity means college students accrue curiosity at school, main to larger mortgage balances after commencement, or if the scholar drops out. This might deter enrollment and improve monetary support wants, each can be detrimental to larger schooling budgets.

Proposed Cap on Undergraduate Title IV Loans

Capping undergraduate Title IV loans may result in enrollment declines, immediately affecting larger schooling budgets.

Establishments should discover methods to bridge funding gaps and put together to supply various financing.

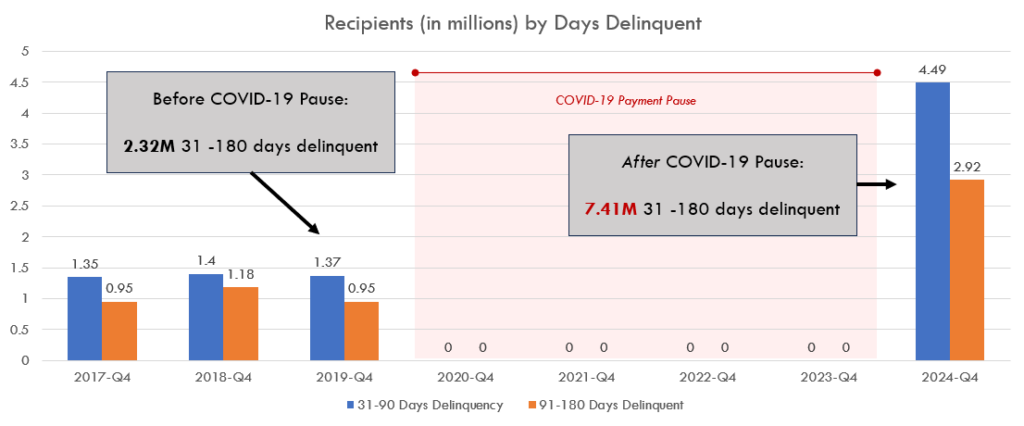

The Looming Default Disaster

The rising delinquency disaster, with hundreds of thousands of debtors vulnerable to default, considerably threatens Title IV eligibility for establishments. Excessive default charges set off institutional penalties and jeopardize federal funding.

The first technical defaults for the reason that finish of the on-ramp interval will start on June twenty eighth.

School Price Discount Act Name for Penalties from Defaults

The School Price Discount Act would impose direct penalties on faculties with excessive default charges, severely impacting larger schooling budgets.

ION’s default aversion options turn into important to keep away from these penalties, making them a cost-neutral funding.

Elimination of SAVE and Discount of PSLF Write-Offs

Limitations to mortgage forgiveness applications may affect profession decisions and deter college students from looking for public service choices. Likewise, the elimination of the SAVE income-driven reimbursement plan may trigger many college students to rethink whether or not larger schooling is an inexpensive possibility for them. Faculties ought to prioritize affordability of their strategic enrollment course of to make sure extra college students observe by way of on their begins.

Price-Impartial Options to Defend Larger Training Budgets

ION’s complete options provide a cost-neutral strategy to managing these challenges, particularly when carried out collectively:

- Non-public Mortgage Servicing: Effectively handle personal mortgage portfolios, decreasing administrative burdens, minimizing default dangers, and bettering reimbursement charges.

- Default Aversion: Implement proactive methods to scale back defaults, avoiding expensive penalties and defending federal funding.

By partnering with ION, faculties can mitigate the monetary dangers related to coverage modifications and in the end defend and optimize their larger schooling budgets. The return on funding from ION’s providers makes it a cost-neutral possibility for faculties.