On July 4th, President Donald Trump signed the One Massive Stunning Invoice (“Massive Invoice”) into legislation. The largest adjustments for debtors embrace new limits on how a lot they’ll borrow in federal pupil loans, large adjustments to each present and future debtors’ reimbursement choices, and adjustments that may make it tougher for debtors who have been harmed by their faculties to get debt aid. Sadly, for a lot of low-income debtors, these adjustments will make paying for faculty much more troublesome. As well as, the invoice has adjustments taking place on many various timelines, including much more complexity to an already complicated system. This weblog explains what the invoice will imply for present and future pupil mortgage debtors and lays out when these adjustments will doubtless happen.

What Does This Invoice Do?

- The Massive Invoice creates a brand new income-driven reimbursement plan.

- The Massive Invoice will finish the SAVE Plan and different income-driven reimbursement plans, leaving solely the Earnings-Based mostly Reimbursement (IBR) Plan and RAP Plans after July 1, 2028.

- The Massive Invoice adjustments debtors’ reimbursement choices in the event that they borrow any loans after July 1, 2026.

- The Massive Invoice ends most Mother or father PLUS debtors’ entry to any Earnings-Pushed Reimbursement plan.

- The Massive Invoice Ends the Grad PLUS mortgage program and creates new limits on how a lot college students and fogeys can borrow in federal pupil loans.

- The Massive Invoice makes it tougher for debtors to get aid after their college closes or their college harmed them.

- The Massive Invoice will permit debtors to rehabilitate loans as much as two instances to take away them from default.

1. The Massive Invoice creates a brand new income-driven reimbursement plan.

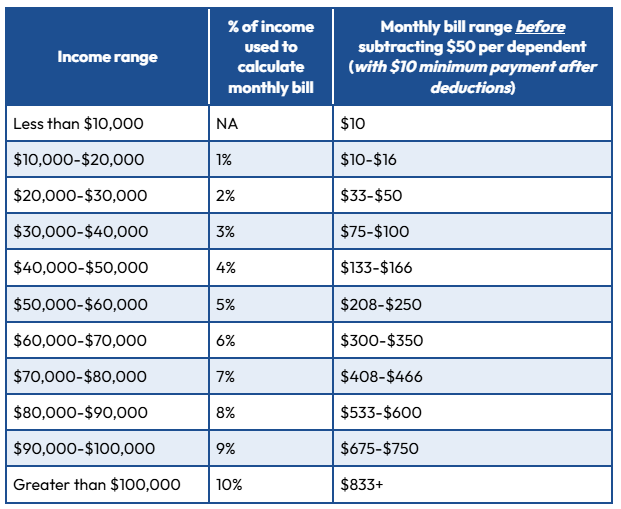

The Massive Invoice creates the Reimbursement Help Plan, or RAP plan, a brand new income-driven reimbursement plan that could be very totally different from the prevailing IDR plans. Not like the prevailing IDR plans, even the poorest pupil mortgage debtors should make a minimal fee of at the very least $10 a month, no matter whether or not or not they fall beneath the federal poverty line and no matter their household dimension. Month-to-month funds will likely be calculated as a proportion of the borrower’s complete earnings (utilizing adjusted gross earnings, or AGI) minus $50 per 30 days per dependent:

Just like the SAVE plan, the RAP plan will waive any curiosity not coated by the borrower’s month-to-month fee. Moreover, not like SAVE or different present plans, the RAP plan will scale back debtors’ principal by as much as $50 if the fee doesn’t accomplish that.

The RAP plan is considerably costlier for debtors than the SAVE plan, however may even be costlier than the opposite present IDR plans for low-income debtors.

Not like present IDR plans that present cancellation after 10-25 years, the RAP plan will solely present cancellation after 30 years of qualifying funds.

The Massive Invoice specifies that the RAP plan needs to be out there to debtors starting on July 1, 2026.

2. The Massive Invoice will finish the SAVE Plan and different income-driven reimbursement plans, leaving solely the Earnings-Based mostly Reimbursement (IBR) Plan and RAP Plans after July 1, 2028.

Along with creating a brand new IDR plan, the Massive Invoice instructs the Division of Schooling to eradicate the PAYE, ICR, and SAVE plans by July 1, 2028 – and it might occur sooner. After these plans are eradicated, debtors whose loans have been all disbursed earlier than July 1, 2026 may have the next reimbursement choices:

- Normal Reimbursement Plan

- RAP

- Earnings-Based mostly Reimbursement (IBR)

- Graduated and Prolonged Plans

For many debtors, the required month-to-month funds in these plans will likely be considerably greater than funds within the SAVE Plan. This can due to this fact be an costly change for a lot of debtors to take care of.

The Invoice makes small adjustments to the Earnings-Based mostly Reimbursement plan in order that extra present debtors will likely be eligible for it. On account of the Invoice, debtors not have to indicate that they’ve a “partial monetary hardship” to be eligible for the plan. Moreover, as mentioned beneath, the Invoice will permit sure Mother or father PLUS mortgage debtors to enroll in IBR – although they’ll have to leap by means of hoops first.

In any other case, IBR stays unchanged for present debtors: Debtors that took on loans earlier than July 1, 2014 will likely be in “previous IBR,” that means that their month-to-month funds will likely be calculated as 15% of any earnings they earn above 150% of the federal poverty pointers for his or her household dimension (with $0 funds for debtors who earn lower than 150% of the rules), and they’ll obtain cancellation after 25 years of qualifying funds. Debtors that took on loans between July 1, 2014 and July 1, 2026 will likely be in “new IBR” that means that their month-to-month funds will likely be 10% of any earnings they earn above 150% of the federal poverty pointers for his or her household dimension (once more, with $0 funds for individuals who earn lower than 150% of the rules), and they’ll obtain cancellation after 20 years of qualifying funds.

If debtors enrolled in one of many eradicated plans (SAVE, PAYE, or ICR) don’t select one other reimbursement plan by the point these plans are eradicated, then their Direct Loans taken out for their very own training will likely be positioned within the RAP plan and any FFEL loans and any Direct Consolidation loans that repaid a Mother or father PLUS mortgage will likely be positioned within the IBR plan.

3. The Massive Invoice adjustments debtors’ reimbursement choices in the event that they borrow any loans after July 1, 2026.

Debtors that tackle any new mortgage — together with debtors that consolidate an present federal mortgage —on or after July 1, 2026 will solely be eligible for 2 reimbursement plans: the usual reimbursement plan or the RAP plan.

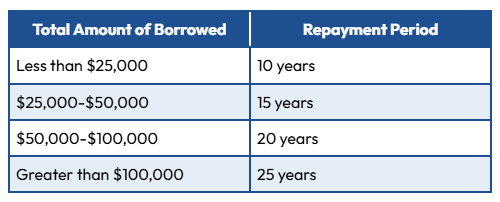

The Massive Invoice adjustments normal reimbursement for loans issued on or after July 1, 2026 and determines the reimbursement size based mostly on the entire quantity borrowed.

Debtors pursuing Public Service Mortgage Forgiveness (PSLF) ought to word that whereas funds in a 10-year normal plan qualify for forgiveness, funds in normal plans with reimbursement durations longer than 10 years don’t qualify. Because of this, debtors that tackle greater than $25,000 in loans after July 1, 2026 will solely be capable of use the RAP plan to make qualifying funds in the direction of PSLF.

As well as, debtors that take out loans after July 1, 2027 will be unable to make use of the financial hardship or unemployment deferments to pause funds if they can’t afford them. As well as, debtors will solely be capable of be in lots of forbearances for as much as 9 months throughout a 2-year interval. These new limits on suspending funds in instances of economic misery, mixed with eliminating $0 funds for brand new debtors residing in or close to poverty, imply that financially distressed debtors may have fewer choices to keep away from falling behind and into default.

4. The Massive Invoice ends most Mother or father PLUS debtors’ entry to any Earnings-Pushed Reimbursement plan.

The Massive Invoice considerably adjustments Mother or father PLUS debtors’ reimbursement choices. Solely Mother or father PLUS debtors that consolidate their loans earlier than July 1, 2026 and are enrolled in any IDR plan between now and July 1, 2028 will likely be eligible for an income-driven reimbursement plan after the SAVE, ICR, and PAYE plans are eradicated on or earlier than July 1, 2028. These debtors will likely be eligible for the Earnings-Based mostly Reimbursement (IBR) plan. They won’t be eligible for RAP. Present Mother or father PLUS debtors who don’t soar by means of these hoops in time will likely be locked out of income-driven reimbursement choices, which might make it very troublesome to handle their loans if they can’t afford fastened funds.

Debtors that tackle new Mother or father PLUS loans or consolidate their present Mother or father PLUS loans after July 1, 2026 will solely be eligible for the brand new normal reimbursement plan. If debtors consolidate or tackle Mother or father PLUS loans after July 1, 2027 these loans won’t be eligible for the financial hardship or unemployment deferments and can solely be eligible for as much as 9 months of many forbearances in a 2 yr interval. This might imply elevated hardship and defaults for low-income Mother or father PLUS debtors sooner or later.

Mother or father PLUS debtors ought to contemplate consolidating now, earlier than July 1, 2026, and enrolling within the Earnings-Contingent Reimbursement (ICR) Plan in order that they’ll protect their means to make diminished funds in an IDR plan sooner or later.

5. The Massive Invoice Ends the Grad PLUS mortgage program and creates new limits on how a lot college students and fogeys can borrow in federal pupil loans.

The invoice ends the Grad PLUS mortgage program, a sort of mortgage for graduate {and professional} faculties that beforehand allowed college students to borrow as much as the complete value of attendance, for any debtors beginning a program on or after July 1, 2026.

The invoice additionally provides a variety of new limits on how a lot college students and fogeys can borrow in federal pupil loans, with restricted exceptions for college students which have already borrowed loans and are at present enrolled.

6. The Massive Invoice makes it tougher for debtors to get aid after their college closes or their college harmed them.

Federal pupil mortgage debtors are entitled to mortgage cancellation in sure conditions the place their college engaged in misconduct (the Borrower Protection program) or closed earlier than they accomplished (the Closed Faculty Discharge program). The invoice doesn’t finish these aid applications, however does make adjustments to this system guidelines that may make it tougher for debtors to entry aid. Particularly, in 2022, the Division of Schooling made enhancements to the principles for each of those applications to make it simpler for eligible college students to obtain aid. The Invoice makes it in order that these rule enhancements solely apply to loans issued after July 1, 2035. That signifies that present loans will likely be topic to the older guidelines that make it tougher for debtors to get aid.

7. The Massive Invoice will permit debtors to rehabilitate loans as much as two instances to take away them from default.

Presently, debtors can solely use a rehabilitation settlement to take away their loans from default as soon as. Beginning July 1, 2027, debtors will be capable of use rehabilitation to exit default twice.

What ought to debtors do now?

When you have loans now, little is altering instantly — however you must ensure your entire contact data is updated on studentaid.gov and together with your mortgage servicers, and preserve an eye fixed out for coming adjustments.

Whereas the invoice adjustments pupil mortgage debtors’ rights, the adjustments received’t occur instantly – most won’t occur till July 2026 or later. For now, debtors’ reimbursement choices stay the identical. Nonetheless, the Division will doubtless start altering its pupil mortgage guidelines over the subsequent yr, and people rule adjustments might impression your mortgage state of affairs. It is best to just remember to are receiving updated data from the Division of Schooling and out of your pupil mortgage servicer.

If you’re at present enrolled within the SAVE plan, you must also count on that when that plan is eradicated your month-to-month funds will doubtless enhance. Think about using the Pupil Mortgage Simulator to estimate your month-to-month fee in Earnings-Based mostly Reimbursement (IBR), since that plan will stay out there to present debtors. You might need to start fascinated about whether or not there are adjustments you can also make to your price range to accommodate the next month-to-month pupil mortgage fee.

If you have already got loans, taking over loans (or consolidating) after July 1, 2026 might make your reimbursement choices worse.

Lastly, when you have Mother or father PLUS loans, contemplate whether or not it is sensible to consolidate these loans earlier than July 1, 2026 and enroll within the Earnings-Contingent Reimbursement (ICR) plan to protect your eligibility to make funds based mostly in your earnings.