Personal fairness is illiquid, has excessive charges, and hasn’t produced excessive returns for state/native plans

The president simply issued an govt order to encourage including non-public fairness and personal credit score — in addition to different different investments — as choices to 401(okay) plans.

The Division of Labor (DOL) is tasked with conducting this aim. Some recommend the enlargement might be restricted to 10% to twenty% of target-date funds, the default funding choice in most 401(okay) plans, however the aim could also be broader.

My view is: Why trouble? So far as I can see, the one occasion pushing for personal fairness in 401(okay) plans is the private-equity trade. Furthermore, non-public fairness comes with quite a few negatives, and our research on the efficiency of state and native pension plans present that the addition of personal fairness has not elevated the return or lowered the volatility in these plans.

To this point, the DOL has issued two letters that cautioned fiduciaries however didn’t preclude anybody from introducing non-public fairness into 401(okay)s. The primary, in June 2020, was in response to an software on behalf of Pantheon Ventures and Companions Group soliciting DOL’s views. After repeating – uncritically – all of the candidates’ arguments in favor of personal fairness, the company did observe that personal fairness investments are typically extra difficult, have longer time horizons, are much less liquid, and have larger charges than conventional investments. Nonetheless, it concluded that fiduciaries wouldn’t violate their duties underneath ERISA solely by providing an asset fund with a personal fairness part.

One yr later, involved that the prior administration’s letter might be seen as broadly endorsing non-public fairness in 401(okay) plans, the company issued a press release of clarification. This letter burdened the warning within the earlier letter concerning the fiduciary expertise, information, and expertise required to pick and monitor non-public fairness choices. It additionally reiterated that the DOL had not endorsed or advisable the inclusion of personal fairness, and fiduciaries ought to be cautious of promoting efforts saying in any other case. Why change positions now?

My view is that folks ought to put money into stuff they perceive, and personal fairness is just not a clear funding. Furthermore, it takes years for returns to be realized, and contributors who go away early can have paid larger charges for nothing. Personal fairness merely provides pointless danger to retirement saving.

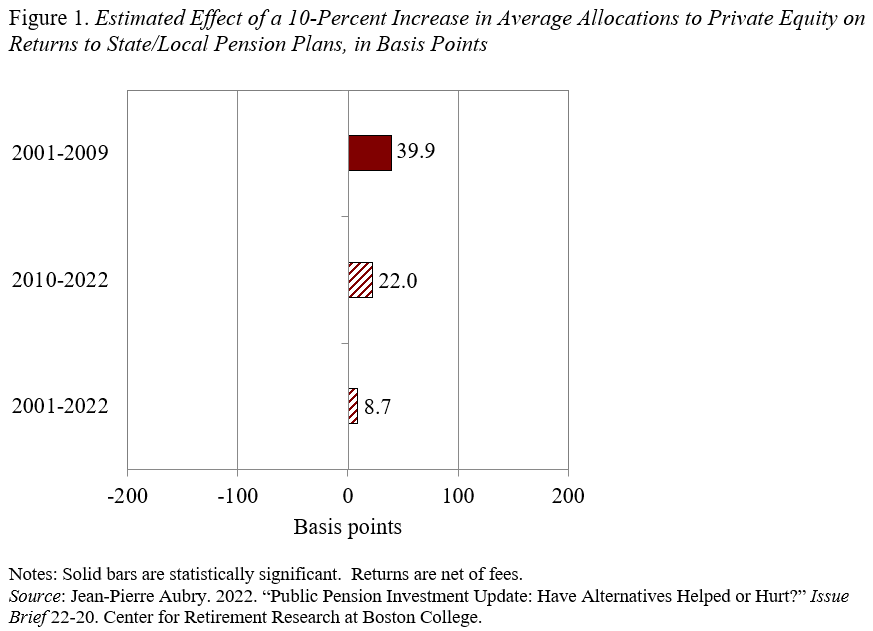

Additional, it isn’t obvious that personal fairness produces excellent returns in retirement plans. Whereas one research concluded that growing non-public fairness holdings in 401(okay)s would have boosted returns by a small quantity, that evaluation led to 2020, earlier than the run-up within the inventory market. And the outcomes of our 2022 research confirmed that holding extra non-public fairness wouldn’t have elevated returns for state and native pension plans over the interval 2001-2022. Sure, non-public fairness helped earlier than the monetary disaster, nevertheless it has not had a statistically vital impact since then (see Determine 1). And provided that the train might not have totally accounted for charges in non-public fairness and that the inventory market has soared since 2022, non-public fairness might have even had a dampening impact on total portfolio returns, relative to conventional fairness.

Furthermore, by way of diversification, non-public fairness didn’t have a statistically vital impact on volatility. Sure, the non-public fairness guys get wealthy, nevertheless it’s not clear that contributors in retirement plans profit. Why ought to fiduciaries trouble to take such an enormous danger?

One probably persuasive argument for introducing a minimum of a small quantity of personal fairness in 401(okay) plans is that firms are more and more financing actions via non-public fairly than public capital, in order that plan contributors have entry to solely a sliver of market exercise. It’s not simple to get numbers on the inroads made by non-public fairness and credit score, however the very best estimates accessible recommend that in 2023 non-public fairness accounted for round 10 % of the fairness market and personal credit score for about 7 % of the non-public debt market (see Determine 2). My view on these numbers is that plan contributors have loads of entry to fairness and credit score markets within the type of acquainted publicly-traded shares and bonds. Glad to speak when non-public fairness and credit score quantities to 30-40 % of the overall. Till then, in my e book the dangers related to non-public fairness far outweigh any potential positive aspects.