We, too, ought to restore stability to our system, however inequality precludes an across-the-board enhance.

Denmark lately raised its retirement age to 70 for Danes born in 1971 or later. Ought to we do the identical factor? The reply is two-fold.

On the one hand, Congress ought to enact laws to revive stability to our Social Safety system, which faces an analogous enhance in prices in 10 years as Denmark does. Our advantages at present exceed our revenues, and the shortfall is roofed by cash within the belief fund. In 2033, the reserves within the belief fund shall be exhausted and retirement advantages shall be lower by 23 % to match incoming revenues. To keep away from such a big and abrupt profit lower, Congress should enact a package deal that eliminates this system’s shortfall. And Congress ought to act sooner quite than later to alleviate the nervousness of many older Individuals and to distribute the burden in an equitable vogue amongst totally different cohorts.

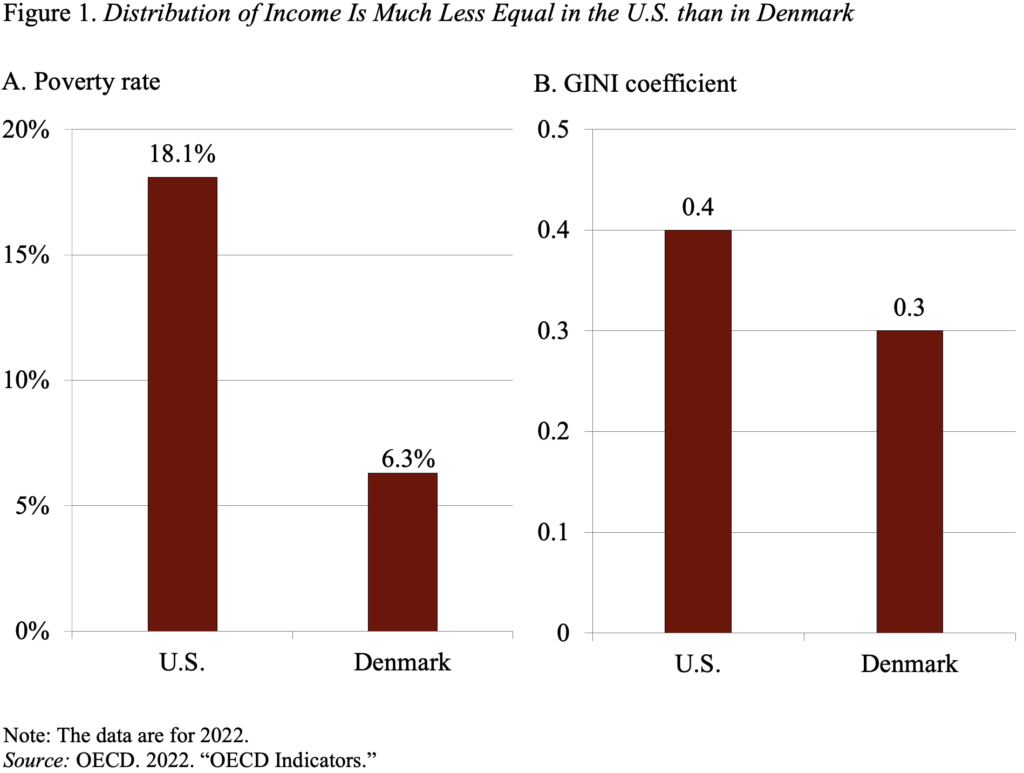

Alternatively, the U.S., not like Denmark, shouldn’t be ready to enact an across-the-board enhance within the retirement age, as a result of now we have a way more unequal society than Denmark. In line with the OECD, the poverty charge within the U.S. is sort of thrice increased than in Denmark, and a extra complete measure of inequality – the Gini coefficient — reveals a way more unequal distribution of family earnings general (see Determine 1). (A Gini coefficient of zero signifies that earnings is distributed equally amongst all households and a worth of 1 signifies that one family receives all of the earnings.)

The inequality in earnings interprets instantly into inequality in life expectancy. Keep in mind the argument for the next retirement age is predicated on the premise that individuals are dwelling longer, so why not have them work longer. Sure, on common now we have skilled beneficial properties in life expectancy, however these beneficial properties have been primarily loved by the highest half of the earnings distribution.

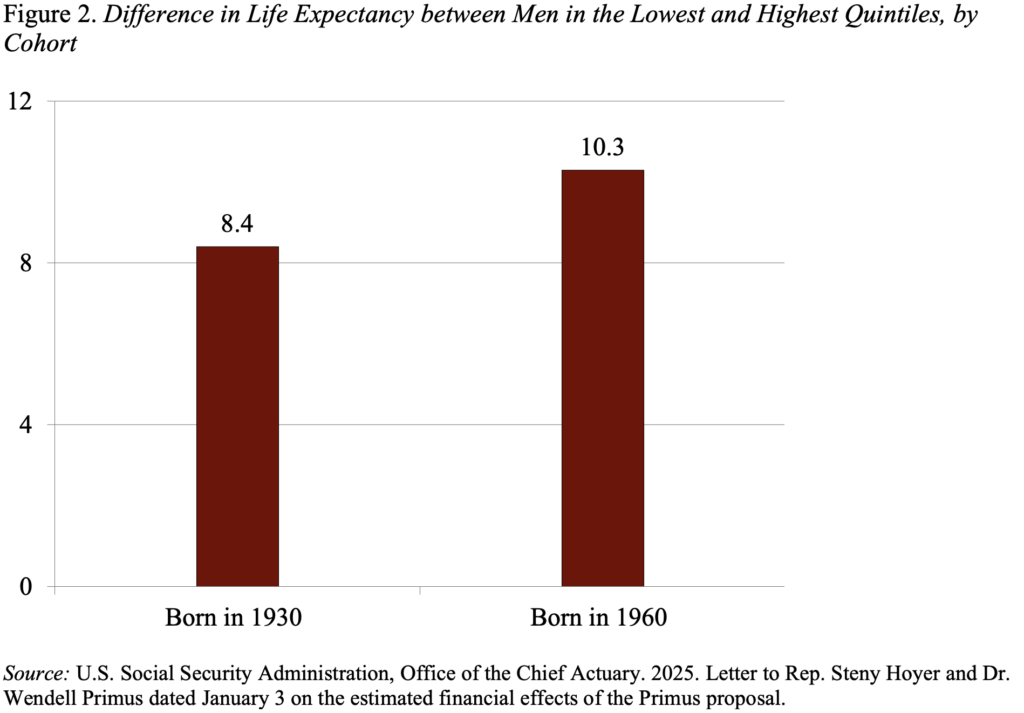

A latest research by the Social Safety actuaries, which helps an intensive physique of proof, drives this level house in spades. For the file, the actuaries’ numbers in all probability understate the connection between earnings and life expectancy for 2 causes. First, these calculations exclude all staff who obtained advantages below the incapacity insurance coverage program – a low-earning group with low life expectancy who would have lowered the underside quintile estimate much more. Second, not like earlier research that checked out life expectancy at age 50, these numbers pertain to life expectancy at age 62; eliminating those that die between 50 and 62 produces a more healthy group general. Regardless of these biases, their evaluation of all staff claiming retirement advantages confirmed that life expectancy rises systematically with earnings and the hole has been widening (see Desk 1).

The outcomes present that whereas life expectancy has elevated general from 18.1 years for males born in 1930 to twenty.9 years for males born in 1960, the beneficial properties for the highest 20 % had been greater than twice as nice as these for the underside 20 %, and the distinction between the 2 teams elevated in order that males within the high now could be anticipated to stay 10 years longer than males on the backside (see Determine 2). That’s, males within the backside 20 % of the earnings distribution are anticipated to stay to about 77, whereas males within the high are projected to stay to about 88.

Due to the massive discrepancy in life expectancy, commentators have proposed rising the complete retirement age solely for individuals who might work longer. That’s, solely the highest 20 % of every cohort would work till 70, and the rise can be scaled in order that low earners would retain the present retirement age of 67.

The underside line is that Denmark’s enhance within the retirement age reinforces the truth that we have to restore stability and confidence in our Social Safety program. However the U.S. can not undertake the identical choices as Denmark as a result of life expectancy and the beneficial properties in life expectancy fluctuate dramatically by earnings and our distribution of earnings may be very unequal.