The looming menace of pupil mortgage defaults is right here. With lower than six weeks till debtors formally default for the primary time in 5 years, the clock is ticking for schools to implement default aversion plans and restrict their 2024 Cohort Default Price (CDR). The Division of Training has made it clear it’s monitoring schools’ critical nonpayment charges as detailed within the Might fifth Pricey Colleague Letter.

Right here’s the place we stand:

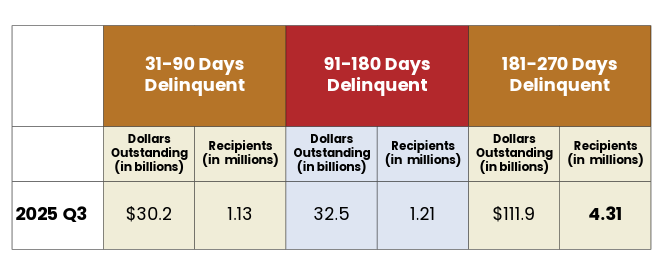

Debtors 181+ Days Delinquent are 7x Pre-COVID Figures

The most recent federal knowledge reveal that over 6 million pupil mortgage debtors are delinquent on their funds. Of explicit concern, the variety of debtors within the 181-270 Days Delinquent standing reached an unprecedented 4.31 million as of FY2025 Q3. This can be a huge improve in comparison with the common of simply 0.55 million debtors in the identical class between 2016 and 2020. This seven-fold improve in critical late-stage delinquency is a transparent warning signal.

Our CDR Well being Checks present {that a} majority of faculties have delinquency charges increased than ever earlier than. Many of those establishments at the moment are susceptible to seeing their 2024 CDR exceed 30%, which might jeopardize their Title IV eligibility.

IDR Backlogs and Servicer Modifications Are Including to Borrower Confusion

Borrower confusion is a significant component in these rising delinquency charges. Based on this latest court docket submitting exhibits that almost 1.4 million income-driven compensation (IDR) functions have been nonetheless pending as of July 31, with solely 300,000 processed in July. This four-and-a-half-month backlog supplies greater than sufficient time for a late-stage delinquent borrower to default whereas awaiting approval.

To make issues worse, some servicers have inspired debtors to resubmit their IDR functions, including to the executive burden and frustration. Moreover, MOHELA debtors could also be transferring to a brand new servicer, a kind of transition that may trigger extra chaos. The Client Monetary Safety Bureau (CFPB) has discovered that such transfers are liable to borrower knowledge loss or corruption, making it practically inconceivable for the brand new servicer to attach with transferred debtors. This surroundings of uncertainty and frustration solely exacerbates non-payment.

Third-Social gathering Servicers Like IonTuition Are Right here to Assist

As a university or college, ready for official default charges to rise is a method that places your establishment’s monetary stability and entry to federal support in danger.

IonTuition gives a strategic resolution to this disaster. Our default aversion plans empower your establishment to:

- Join with delinquent debtors, guiding them again into sustainable compensation choices to keep away from default

- Present personalised, professional counseling to assist college students navigate the complicated and ever-changing panorama of compensation plans.

- Considerably decrease your establishment’s CDR, defending your entry to federal funding.

The present excessive delinquency and non-payment charges are a transparent indication of a default disaster forward. Contact gross sales@iontuition.com at the moment to implement a default aversion plan.