The transient’s key findings are:

- When COVID hit, it sharply decreased employment charges for older staff, elevating issues that many is perhaps compelled into early retirement.

- Nonetheless, accounting for inhabitants growing older, employment for staff ages 55+ has absolutely rebounded to match pre-COVID developments.

- This return to regular, although, masks some stunning variations by demographic teams – these initially hit hardest by COVID have greater than recovered.

- Particularly, Black and Hispanic people are working greater than earlier than COVID, whereas White staff and faculty graduates are working a bit much less.

Introduction

The impact of main occasions on the economic system is usually long-lasting. For instance, the Nice Recession triggered a big enhance within the share of older staff – outlined right here as these ages 55 and over – who needed to work however had given up even in search of a job. That share didn’t return to regular till 2019, almost a decade after the recession had ended.1 The COVID-19 pandemic was a really totally different form of financial shock: extra extreme, shorter, and accompanied by a well being disaster. Provided that working longer remains to be the easiest way for a lot of staff to make sure a safe retirement, the query is: how did the pandemic alter the trail of older staff’ employment?

This transient addresses the query utilizing the Present Inhabitants Survey from 2016 to 2025 – roughly 4 years on both aspect of the pandemic. The evaluation will study the image for all older staff after which for staff with totally different demographic traits. Such an examination is worth it, for the reason that shock of the pandemic seemed very totally different in several sectors of the economic system. For instance, leisure and hospitality – whose staff typically have much less training and are usually Black or Hispanic – skilled preliminary job losses adopted by a surge in demand as financial stimulus took maintain. White-collar industries, then again, skilled much less of a change in demand however noticed a serious shift to distant work.

The transient proceeds as follows. The primary part supplies background on what is thought about COVID’s impression on the labor marketplace for older staff. The second part analyzes how that labor market has advanced for the reason that pandemic for all older staff whereas the third part focuses on demographic subgroups. The ultimate part concludes that accounting for the growing older of the 55+ inhabitants, the general employment charge of older staff is again to its pre-pandemic degree. However this return to regular masks attention-grabbing variations throughout demographic teams. These most affected by the early levels of the pandemic – particularly Black and Hispanic people – are working greater than previous to COVID. The reverse is true for a lot of different teams, particularly staff ages 70+. As Social Safety’s looming monetary shortfall makes the subject of working longer extra salient, a greater understanding of those modifications – and the way possible they’re to be everlasting – is essential.

Background

Within the direct lead-up to the pandemic, employment of older staff appeared comparatively static. For instance, within the 5 previous years, the share of those staff employed hovered just under 40 p.c.2 The onset of the pandemic introduced drastic modifications and an array of analysis on older staff. Research on the early levels of the pandemic pointed to sharp will increase in employment exit usually and retirement particularly.3 These remaining within the labor drive skilled giant will increase in unemployment, particularly within the very early months of the pandemic.4 Normally, all of those impacts had been bigger for these with much less training and Black and Hispanic people.5 Bucking this pattern, these with disabilities really noticed employment enhance to decades-long highs, because the elevated availability of distant work eliminated some boundaries to employment.6

However regardless of this preliminary analysis focus, older staff’ restoration from the pandemic has acquired considerably much less consideration. Maybe probably the most related latest examine discovered that the share of the U.S. inhabitants figuring out as retired returned to its pre-pandemic pattern as early as 2023.7 However, retirement is just one cause for not working. Different researchers have discovered that employment remained beneath pre-pandemic ranges for at the least some teams of older staff, contradicting a return to normalcy.8 Given the dearth of settlement on the persistence of any COVID employment impact and the truth that any restoration might differ throughout teams in unexplored methods, the following part appears to the info.

The Total Development

To look at how the chance of a person being employed has modified following COVID, this transient makes use of the month-to-month Present Inhabitants Survey, limiting the pattern to these ages 55+.9 The evaluation proceeds in three steps. First, a regression is run with employment because the dependent variable utilizing information from the interval prior to the pandemic. This regression consists of essential determinants of employment like the person’s age, training, race/ethnicity, gender, and self-reported well being standing (outlined as having a bodily or cognitive issue). Subsequent, this regression is used to foretell the chance that folks within the post-COVID interval would have labored in the event that they acted similar to individuals who had been in any other case comparable previous to the pandemic. Lastly, this prediction is in comparison with what really occurred. The train asks: are in any other case comparable folks now working roughly than anticipated based mostly on the years previous the pandemic?

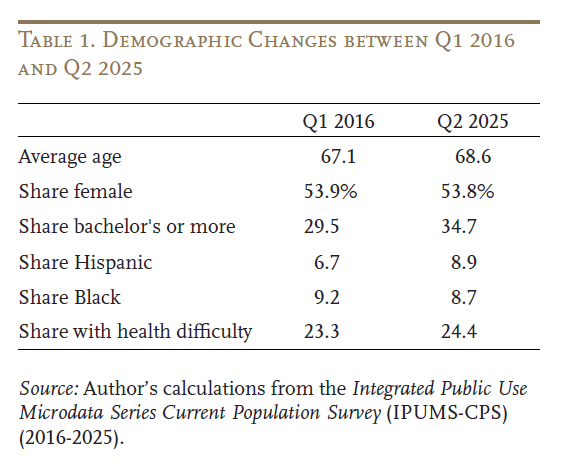

Desk 1 makes it clear why such an method is required. Most significantly, since 2016, the inhabitants of these ages 55+ has elevated in age by one and a half years. As folks age, they’re much less prone to work, all else equal. So, failure to account for this growing older may make it seem that employment has dropped because of the pandemic when the story can be a easy growing older of the inhabitants. Then again, the older inhabitants can also be extra educated, and extra educated folks are inclined to work longer. Ignoring rising training may make it appear like the post-COVID interval triggered extra work, when actually the inhabitants was simply extra educated.

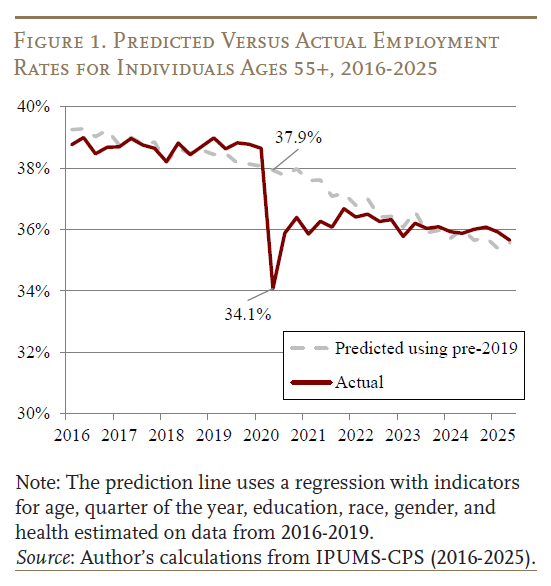

Determine 1 plots the expected employment share (dashed grey line) and the precise one (crimson line). The anticipated line reveals how employment would have been anticipated to step by step decline because the inhabitants of these ages 55+ modified over time. As a substitute, because of the pandemic, a pointy decline occurred in Q2 2020, when the precise line fell 10.2 p.c beneath the expected degree (34.1 p.c versus 37.9 p.c). Nonetheless, the determine additionally reveals how the precise line step by step returned to regular by late 2022. Right now, the precise employment charge virtually completely matches the expected one, suggesting that, apples-to-apples, older staff are employed as typically as earlier than the pandemic.

OK, so the general image is of a return to regular. However the prior analysis on the pandemic and older staff prompt appreciable variability within the pandemic’s preliminary impression throughout totally different demographic teams. Does that variability exist for the restoration?

Evaluation by Subgroup

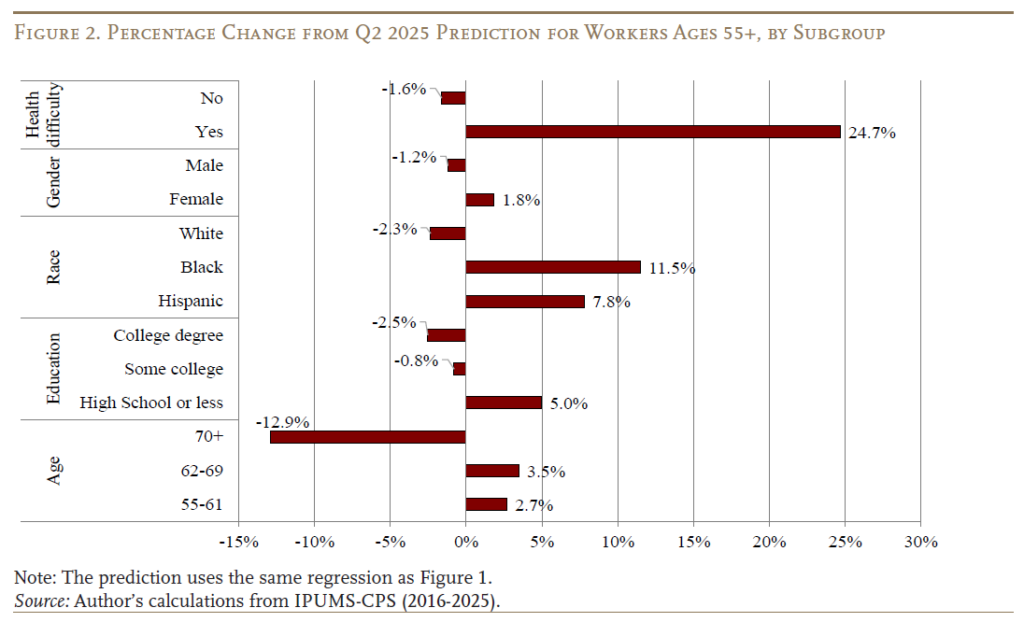

To investigate the post-pandemic restoration in additional depth, the identical predictions had been used inside teams outlined by key demographic traits. Determine 2 reveals the outcomes of this train. To supply each the course and relative magnitude of the change, outcomes are introduced as the share distinction between the precise and predicted employment charge for the group in query.

Among the outcomes are as anticipated. Maybe the simplest one to clarify is the numerous enhance within the chance of employment for many who self-report experiencing any bodily or cognitive issue – an almost 25-percent increased worth than predicted based mostly on pre-COVID information. In any case, these people are more than likely to profit from the rise within the availability of distant work that has endured after the pandemic.10 The truth that people ages 70+ are a lot much less prone to work – a 12.9-percent decrease worth than predicted – additionally is smart on condition that any remaining COVID-19 well being issues are prone to be higher for this inhabitants. Plus, this group of older staff might have been particularly affected by the expansion in actual asset values that has occurred for the reason that pandemic, permitting them to stay retired.11

What could also be considerably sudden is that the teams most negatively affected by the preliminary levels of the pandemic have seen their employment get well after which some. Certainly, Black and Hispanic people are considerably extra prone to work relative to the predictions. Then again, these with a university diploma and White staff are much less prone to be employed regardless of being much less impacted by the preliminary part of the pandemic.

For Black and Hispanic staff, the consequence appears to be pushed by two associated details. The primary is a good labor market characterised by quick wage development and excessive charges of job openings in two industries – leisure & hospitality and commerce & transportation – that disproportionately make use of staff from the underside half of the wage distribution.12 The second reality pertains to retirement conduct amongst these teams – Black and Hispanic staff have shifted in the direction of conduct indicative of longer careers.

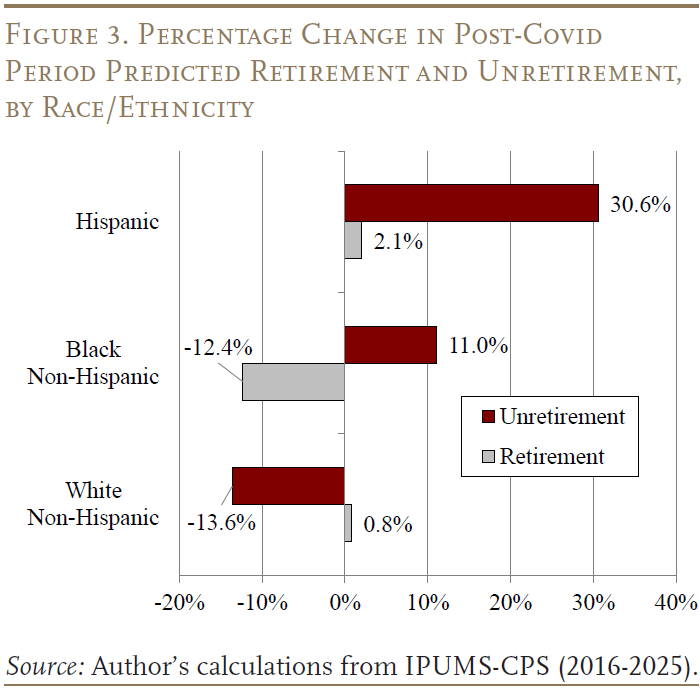

As an instance this reality, Determine 3 adjusts the prediction train above from one present employment to modifications in labor drive standing over time. Particularly, Determine 3 exploits the longitudinal side of the CPS to look at: 1) the percentages that somebody is retired one 12 months after working; or 2) the percentages that somebody is working one 12 months after being retired (i.e., unretired). Like Figures 1 and a pair of, Determine 3 predicts unretirement and retirement based mostly on the identical demographic elements.13 As a result of the longitudinal pattern is significantly smaller and retirement and unretirement are inherently noisy behaviors, Determine 3 appears on the common for the complete post-COVID interval. Relative to predictions based mostly on pre-COVID information, Black staff have considerably decrease charges of retirement post-pandemic – a large 12.4-percent decrease worth. And, each Black and Hispanic retirees have increased charges of unretirement. Black staff had been 11.0 p.c extra prone to unretire and Hispanic staff 30.6 p.c extra possible. No such sample exists for White staff, who’re in reality a lot much less prone to unretire than previous to COVID (though not proven, the sample is comparable for college-educated staff).

What’s attention-grabbing about Determine 3 is that labor market situations weren’t precisely unhealthy within the post-COVID interval for White staff both. Though not as buoyant as for Black and Hispanic staff, unemployment charges for White people had been unusually low and job opening charges unusually excessive. But, retirement conduct is sort of totally different. Future analysis ought to discover why these discrepancies exist. Are Black and Hispanic staff extending their careers for constructive causes, i.e., the great labor market and a want to proceed work? Or, do Black and Hispanic staff need to retire on the identical charges as their White counterparts, however are financially unable to take action?

Conclusion

When the economic system shut down in April 2020, the employment of older staff dropped dramatically. This decline sparked concern from policymakers that many older staff can be compelled into early retirement. This worry was aggravated by the truth that the impression of recessions can typically be long-lasting. Practically a decade after the Nice Recession, many older staff nonetheless discovered themselves discouraged from in search of employment regardless of the will to work.

The outcomes right here recommend that this sad final result has not occurred. As soon as adjusting for demographic modifications, the employment of older staff has returned to its pre-COVID degree. Nonetheless, attention-grabbing variations exist round this return to regular. These most affected by the preliminary part of the pandemic appear to have recovered after which some. Conversely, White staff and the extra educated are much less prone to work than previous to the pandemic, even accounting for growing older. Future analysis ought to think about why these totally different patterns are occurring, given that each one staff have confronted a good labor market within the post-pandemic years. It is going to even be essential to think about what would occur to older staff’ employment ought to the tight labor market that has adopted the pandemic come to an finish.

References

Coile, Courtney and Haiyi Zhang. 2022. “Recessions and Retirement: New Proof from the COVID-19 Pandemic.” PRC Working Paper 2022-20. Philadelphia, PA: Pension Analysis Council.

Bedu Kyle, and Craig Copeland. 2024. “Traits in Labor Pressure Participation and Employment of Individuals Ages 55 or Older.” Washington, DC: Worker Profit Analysis Institute.

Carroll, Daniel R. and Christopher J. Walker. 2025. “Compression within the Wage Distribution In the course of the Submit-Covid-19 Labor Market.” Financial Commentary 2025-06. Cleveland, OH: Federal Reserve Financial institution of Cleveland.

Sofa, Kenneth, Robert Fairlie, and Huanan Xu. 2020. “Early Proof of the Impacts of COVID-19 on Minority Unemployment.” Journal of Public Economics 192.

Davis, Owen F., Laura D. Quinby, Matthew S. Rutledge, and Gal Wettstein. 2023. “How Did COVID-19 Have an effect on the Labor Pressure Participation of Older Staff within the First 12 months of the Pandemic?” Journal of Pension Economics and Finance 22(4): 509-523.

Faria-e-Castro, Miguel. 2022. “Asset Returns and Labor Pressure Participation Throughout COVID-19.” Financial Synopses (1). St. Louis, MO: Federal Reserve Financial institution of St. Louis.

Faria-e-Castro, Miguel, Serdar Birinci, Kurt See and Gus Gerlach. 2025. “U.S. Retirement Normalization following the COVID-19 Pandemic.” St. Louis Fed On the Financial system. St. Louis, MO: Federal Reserve Financial institution of St. Louis.

Federal Reserve Financial institution of Atlanta. 2025. “Labor Pressure Participation Dynamics.” Out there at: Federal Reserve Financial institution of Atlanta; https://www.atlantafed.org/chcs/labor-force-participation-dynamics, August 4, 2025.

IPUMS USA. 2016-2025. IPUMS CPS: Model 12.0 [dataset]. Minneapolis, MN: College of Minnesota. Out there at: www.ipums.org.

Kaplan, Robert S., Tyler Atkinson, Jim Dolmas, Marc P. Giannoni, and Karel Mertens. 2021. “The Labor Market Might Be Tighter than the Stage of Employment Suggests.” Analysis and Evaluation of Financial Traits and Developments. Dallas, TX: Federal Reserve Financial institution of Dallas.

Kessler Basis. 2022. “June 2022 Jobs Report: Employment Reaches All-time Excessive for Folks with Disabilities.” Nationwide Traits in Incapacity Employment Report. East Hanover, NJ: Kessler Basis.

Kim, Chang Hwan and Christopher R. Tamborini. 2022. “Employment Transitions Amongst Older Individuals In the course of the Preliminary Lockdown and Early Reopening Months of the COVID-19 Recession.” Social Safety Bulletin 82(4).

Lee, Sang, Minsung Park, and Yongseok Shin. 2021. “Hit Tougher, Recuperate Slower? Unequal Employment Results of the COVID-19 Shock.” Federal Reserve Financial institution of St. Louis 103(4).

Liu, Siyan and Laura D. Quinby. 2024. “Has Distant Work Improved Employment Outcomes for Older Folks with Disabilities?” Working Paper 2024-12. Chestnut Hill, MA: Middle for Retirement Analysis at Boston Faculty.

Montes, Joshua, Christopher L. Smith, and Juliana Dajon. 2022. “‘The Nice Retirement Increase’: The Pandemic-Period Surge in Retirements and Implications for Future Labor Pressure Participation.” Finance and Economics Dialogue Sequence, no. 2022-081(November): 1-33.

U.S. Bureau of Labor Statistics. 2025. “Labor Pressure Participation Fee: 55 Years and Over.” Out there at Federal Reserve Financial institution of St. Louis; https://fred.stlouisfed.org/sequence/LNS11324230, July 19, 2025.