Virtually 75% of People make New Yr’s Resolutions, and the third most typical decision is finance-related. The second most-common additionally occurs to be self-improvement, which truthfully goes hand in hand with what we’re speaking about right here.

Whether or not you are trying to get out of debt, save extra money, obtain a cash purpose like a trip or home buy, and even construct up sufficient go to hell cash to depart your job, let’s make this 12 months your finest monetary 12 months but.

Sadly, most resolutions get damaged too. Nonetheless, this 12 months goes to be totally different. This 12 months you are going to hold the promise you make to your self and you are going to enhance your funds. Listed here are 5 ideas that will help you succeed within the subsequent 12 months.

1. Get Organized

Regardless of your New Yr’s Decision, you’ll NOT achieve success except you get organized. Some folks name this budgeting, however that is the step even earlier than budgeting. Significantly – simply get organized.

What this implies is taking an correct stock of every part:

- Earnings – what’s coming in (every month)

- Bills – what is going on out (every cash)

- What you personal – asset and account balances

- What you owe – all of your money owed, balances, and minimal quantity due every month

Desire a device to assist? Take a look at this checklist of the very best cash and budgeting apps.

You additionally must take a listing of your time, utilizing your calendar. That is the place most individuals miss – have you learnt precisely the place you are spending your time every day/week/month?

Lastly, it’s essential to spend a bit time fascinated with what you worth. What are an important issues in your life? Is it spending time with your loved ones? Volunteering? Working? Sports activities? Holidays? Determining what you worth probably the most (and doubtless the highest 3-5 stuff you worth probably the most), together with issues you do not worth, goes a good distance in the direction of aligning your funds in a means that can work.

Then What?

When you’re organized, you’ll be able to actually begin to make efficient selections that can make it easier to obtain your New Yr’s decision or different cash purpose. I am not right here to let you know what you must do, that is private. However given you’ve gotten every part laid out – your revenue, bills, time, and values – you can begin making selections.

For instance, in case your purpose is to repay debt, nicely have a look at your revenue and bills and see what the “delta” is (the distinction between the 2 numbers), and use that additional to begin paying down debt.

Do not have a delta? Properly, then begin trying line by line on each your revenue aspect and expense aspect. Are you able to earn extra money (this may occasionally require your calendar and time too)? Can you chop bills (this may occasionally require you to take a look at what you worth and see if you happen to’re losing cash on issues you do not worth)?

The very fact is, cash is private. There’s not proper or unsuitable reply right here – however the reality will align with a combo of revenue, bills, time, and values. If you would like greater budgeting information, test this out: Budgeting For Your Character and Model.

2. Enhance Your Credit score

Regardless of your decision, enhancing your credit score will likely be a game-changer! Trying to save cash? This helps. On the lookout for a brand new job? This helps! Trying to purchase a home or hire an condominium? This helps!

This step truly takes a number of sub-steps to finish. First, you need to begin cleansing up your credit score. Order a credit score report (you are able to do this at no cost at AnnualCreditReport.com). You could discover some adversarial info that’s decreasing your credit score rating. Subsequent, repair the bad credit report listed in your report.

As an illustration, dispute any destructive info that is not true corresponding to late funds. If you wish to repay collectors listed in your credit score report, be sure the money owed aren’t thought-about zombie money owed. Zombie money owed are too previous for collectors to sue you for and even contact you about due to the statute of limitations. Should you contact the creditor concerning the debt you begin the statute of limitations over once more.

It’s also possible to try our full information at How To Enhance Your Credit score Rating.

3. Construct Your Stash

One of the vital widespread monetary targets after paying off debt is saving cash. Whether or not you are constructing an emergency fund, saving for retirement, or saving for a purpose like a home, constructing your stash of cash is essential.

Aspect Word: It would not need to be pay down debt OR save. You possibly can attempt to do each on the identical time. In actual fact, you in all probability ought to!

Financial savings Account: You need to open or use your financial savings account. The account is a means to save cash. As an illustration, you’ll be able to construct an emergency fund utilizing the account. You possibly can select to have a debit card or restrict the entry to it by not having one. Open an account right here: Greatest Excessive-Yield Financial savings Accounts.

IRA: An IRA (or Particular person Retirement Account) is a good device to save lots of for retirement. There are some IRA revenue and contribution limits, however if you happen to qualify, take benefit! Take a look at the very best locations to open an IRA right here.

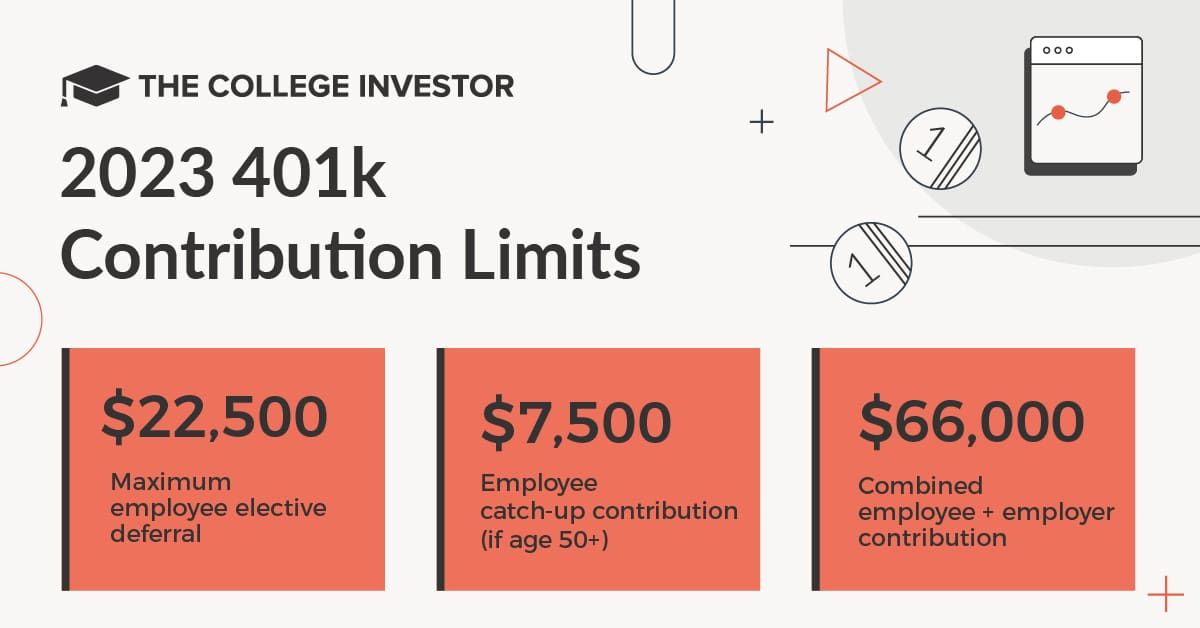

401k: In case your employer provides a 401k, you undoubtedly have to be benefiting from it! In actual fact, many employers provide “matching contributions” – that is FREE cash your employer is providing you with to save lots of for retirement. By not benefiting from it, you are basically taking a pay reduce.

4. Pay Your self First

You could suppose that this is not the way in which to turn into debt-free (or obtain every other cash purpose) this 12 months, however it’s. It is simpler to enter debt once you’re always spending cash. However it is a huge mindset shift on the way you allocate your cash.

As an illustration, say you need to go to the flicks or out to dinner with mates. You do not have the cash, so that you cost it to considered one of your bank cards. Should you pay your self first, you’ll be able to have cash to do the stuff you need to do. Extra importantly, you do not incur new money owed. Go forward and pay your self.

In any case, you are the one working arduous to realize your desires. The simplest solution to pay your self is by having a separate financial savings account. If in case you have direct deposit, you’ll be able to have a small quantity transferred into that account.

5. Reside Inside Your Means (And Values)

All of us need issues that we won’t have. For instance, you might have considered trying that 65″ flat-screen tv. Nonetheless, you’ll be able to’t afford it. The debt-free factor to do is to save lots of up for it or not purchase it. Residing inside your means requires making huge modifications – and aligning your spending to your values.

On a primary stage, you’ll be able to:

- Cease utilizing financial savings or bank cards for objects you actually cannot afford.

- Make a month-to-month funds based mostly in your revenue.

- Monitor your spending.

- Pay payments on time.

However in relation to making a trade-off, it’s essential to return to your value-set and see what actually issues to you. You could really feel such as you want that 65″ TV, however what if watching TV is not one thing that you just notably do or get pleasure from? Perhaps that cash should not be spent, or perhaps it must go in the direction of one thing else you truly worth.

Bonus Tip: Search For Free Cash

As a bonus reminder, I all the time prefer to encourage everybody to search out the free cash of their life. You would be shocked how a lot free cash is on the market that you could be be entitled to. I not too long ago discovered $100 that was owed to me by Wells Fargo for an previous account they closed (and by no means contacted me about).

Plus, there are quite a lot of provides and bonus incentives for issues that you just’re already doing! Perhaps you had been going to open that checking or financial savings account this 12 months? Do you know that banks give you bonus provides only for being a buyer? Should you had been going to enroll anyway, receives a commission for it!

Within the meantime, try this information to discovering free cash.