Hiya there, fellow finance adventurers! I’m thrilled to be your information in the present day on our journey to understanding contribution margins. I do know, I do know, you’re most likely picturing me as some Wall Avenue guru, crunching numbers with a steely gaze. However let me inform you somewhat secret – it wasn’t all the time like this.

As soon as upon a time, I used to be similar to you – staring wide-eyed at monetary paperwork, questioning why they couldn’t simply be in plain English. I imply, who even comes up with these phrases, proper? “Contribution Margin” sounded extra like a charity occasion to me than a monetary metric.

However right here’s the factor: understanding your contribution margin is like having a secret key to your small business’s treasure chest. It unlocks insights into how worthwhile your services or products are, and may help you make sensible choices about pricing, manufacturing, and extra.

By the tip of this information, you’ll be chatting about contribution margins like a professional at your subsequent ceremonial dinner. Let’s dive in!

Key Takeaways

- In easy phrases, the contribution margin is the income remaining after subtracting the variable prices that go into producing a product. This remaining income is used to cowl an organization’s mounted prices, and any leftover cash contributes to revenue.

- The system for calculating the contribution margin is Contribution Margin = Whole Gross sales – Variable Prices.

Understanding the Fundamentals

Alright, let’s get all the way down to enterprise (actually!). So what on earth is that this contribution margin factor? Within the easiest phrases, the contribution margin is like your small business’s report card. It tells you the way a lot cash every services or products is contributing to cowl your mounted prices and begin making a revenue.

Think about you’re working a lemonade stand. Every glass of lemonade you promote is contributing not solely to cowl the price of lemons, sugar, and water (these are your variable prices), but additionally to repay that fancy lemon squeezer you acquire (that’s a hard and fast value). The cash left over after paying for the lemons, sugar, and water is your contribution margin. It helps you see what number of glasses of lemonade it’s essential promote earlier than you begin truly making a revenue.

Now, why does this matter? Properly, realizing your contribution margin is like having a GPS for your small business. It reveals you in the event you’re on the fitting path to profitability or if it’s essential make some changes — perhaps increase the worth of your lemonade, or discover a cheaper provider for lemons.

The Math Behind Contribution Margin

So, now that we’ve acquired our journey hats on, let’s delve into the center of the matter. Don’t fear, I can already see a few of you breaking into a chilly sweat on the considered math. However keep in mind, this isn’t like that dreaded highschool algebra take a look at. It’s extra like baking a cake – simply comply with the recipe, and also you’ll do superb!

Let’s break down the system for contribution margin: it’s so simple as Gross sales Income minus Variable Prices.

Now, earlier than you panic, let’s decode these phrases. ‘Gross sales Income’ is only a fancy phrase for the entire amount of cash your small business makes from promoting its services or products. Consider it as the entire money you’d have in the event you offered each single glass of that scrumptious lemonade at your stand.

Then again, ‘Variable Prices’ are these pesky bills that change relying on what number of merchandise you promote. In our lemonade stand situation, these can be the prices of lemons, sugar, and water. The extra glasses of lemonade you promote, the extra lemons, sugar, and water you’ll want, proper?

So, whenever you subtract your variable prices (lemons, sugar, and water) out of your income (cash from promoting lemonade), you get your contribution margin. That is the cash you’re left with to cowl any mounted bills (like that fancy lemon squeezer) after which begin making a revenue.

Step-by-Step Information to Calculating Contribution Margin

Alright, my fellow finance adventurers, it’s time to roll up our sleeves and dive into the nitty-gritty of calculating contribution margins. Don’t fear, I’ll be proper by your facet, guiding you thru every step. Let’s create a fictitious enterprise situation to make issues extra relatable. Meet Bob, the proud proprietor of “Bob’s Sensible Bagels.”

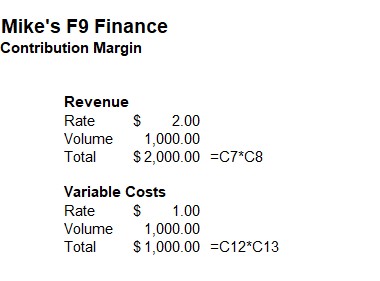

Be sure that to obtain our free Excel template for contribution margin to comply with alongside:

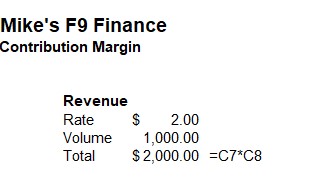

Step 1: Calculate Income

First off, let’s work out Bob’s complete income. Bob sells every bagel for $2 and he’s offered a whopping 1000 bagels this month. So, his complete income is $2 x 1000 = $2000. Wow, go Bob! And take a look at you, already crunching numbers like a professional!

Step 2: Decide Variable Prices

Subsequent, we have to work out Bob’s variable prices. These are the prices that change relying on what number of bagels Bob bakes. For simplicity’s sake, let’s say Bob spends $1 on elements for every bagel. So, his complete variable prices for 1000 bagels can be $1 x 1000 = $1000.

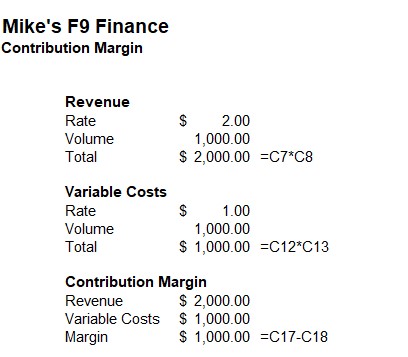

Step 3: Subtract Variable Prices from Income

Now comes the magic second. We subtract Bob’s variable prices ($1000) from his complete income ($2000). Drumroll, please… Bob’s contribution margin is $2000 – $1000 = $1000!

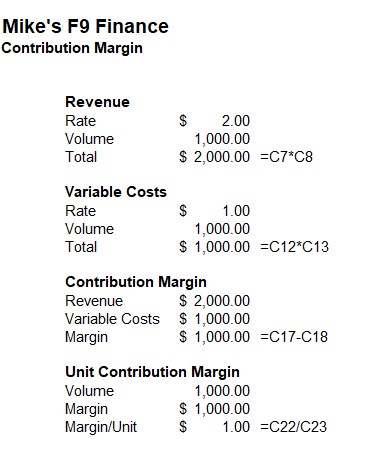

Step 4 (Non-compulsory): Calculate Unit Contribution Margin

We will additionally calculate Bob’s unit contribution margin, which is the contribution margin per bagel. To do that, we divide his complete contribution margin ($1000) by the variety of bagels offered (1000). So, Bob’s unit contribution margin is $1000 / 1000 = $1.

Deciphering the Outcomes

Okay, my fellow finance gurus, we’re again and able to make sense of this shiny new quantity we’ve calculated. Bear in mind Bob’s Sensible Bagels? We found that Bob’s contribution margin was $1000. However what does that basically imply for Bob’s enterprise?

Consider the contribution margin because the monetary gasoline for your small business engine. It’s the cash that retains every part working easily. In Bob’s case, that $1000 is the money he has left after masking the prices of elements (variable prices) for his bagels. That is the cash Bob can use for masking mounted prices, just like the lease for his bakery or his snazzy new bagel-making machine.

Now, let’s discuss technique. Contribution margin evaluation may help Bob make necessary enterprise choices. For instance, perhaps Bob is considering introducing a brand new kind of bagel. By calculating the contribution margin for this new product, Bob can work out if it’s financially value it. Or maybe Bob is contemplating elevating the worth of his bagels. He can use his contribution margin to see how this value improve would have an effect on his profitability.

What is an effective contribution margin?

An excellent contribution margin varies by business and firm, however usually a better contribution margin is healthier. A constructive contribution margin implies that income is out there to cowl mounted prices and generate revenue. A low or detrimental contribution margin signifies {that a} enterprise might not be producing sufficient income to cowl its variable prices, which might result in monetary points in the long term.

Widespread Errors and Learn how to Keep away from Them

It’s time to navigate the difficult terrain of widespread errors individuals make whereas calculating or decoding contribution margins. However right here’s the factor: errors are simply stepping stones on the trail to mastery. So, let’s take a look at these missteps not as blunders, however as alternatives to be taught and develop.

Mistake #1: Mixing Up Mounted and Variable Prices

The primary pitfall that may journey up even essentially the most diligent of us is complicated mounted prices with variable prices. Bear in mind our pal Bob from earlier? His bagel elements have been variable prices as a result of they modified primarily based on what number of bagels he offered. His lease, then again, stayed the identical regardless of what number of bagels he baked, making it a hard and fast value.

Tip: Preserve a transparent listing of your mounted and variable prices. Repeatedly evaluate and replace this listing as your small business evolves.

Mistake #2: Overlooking Some Variable Prices

One other widespread mistake is forgetting to incorporate all variable prices in your calculations. Perhaps you remembered the price of your uncooked supplies, however forgot in regards to the packaging? Or maybe you missed the fee you pay for every sale?

Tip: Be thorough. Each penny counts whenever you’re calculating your contribution margin. Be sure that to account for all prices related to producing and promoting your services or products.

Mistake #3: Misinterpreting the Contribution Margin

Lastly, it’s essential to keep in mind that a excessive contribution margin doesn’t all the time imply your small business is swimming in income. Why? As a result of contribution margin doesn’t have in mind mounted prices. You may have a excessive contribution margin, but when your mounted prices are sky-high, you may nonetheless be struggling to show a revenue.

Tip: All the time think about your contribution margin in context. Take a look at it alongside your mounted prices to get a real image of your small business’s profitability.

Fast Recap

Properly, my monetary comrades, we’ve journeyed by means of the fascinating world of contribution margins collectively, and what a trip it’s been! We began with the fundamentals and realized methods to calculate contribution margins, utilizing our pal Bob’s Sensible Bagels as a relatable instance.

We then explored methods to interpret these outcomes and use them to make knowledgeable enterprise choices. Bear in mind, your contribution margin is like the heart beat of your small business – it offers priceless insights into the well being and potential profitability of your enterprise.

We additionally navigated the widespread pitfalls that may journey us up alongside the way in which. However keep in mind, errors aren’t failures – they’re stepping stones on our path to turning into finance-savvy entrepreneurs.

I’d love to listen to from you. Acquired any questions on contribution margins? Or perhaps you’d wish to share your individual experiences? Be at liberty to drop a remark under. Let’s preserve this dialog going and proceed to construct our group of finance adventurers.

Incessantly Requested Questions

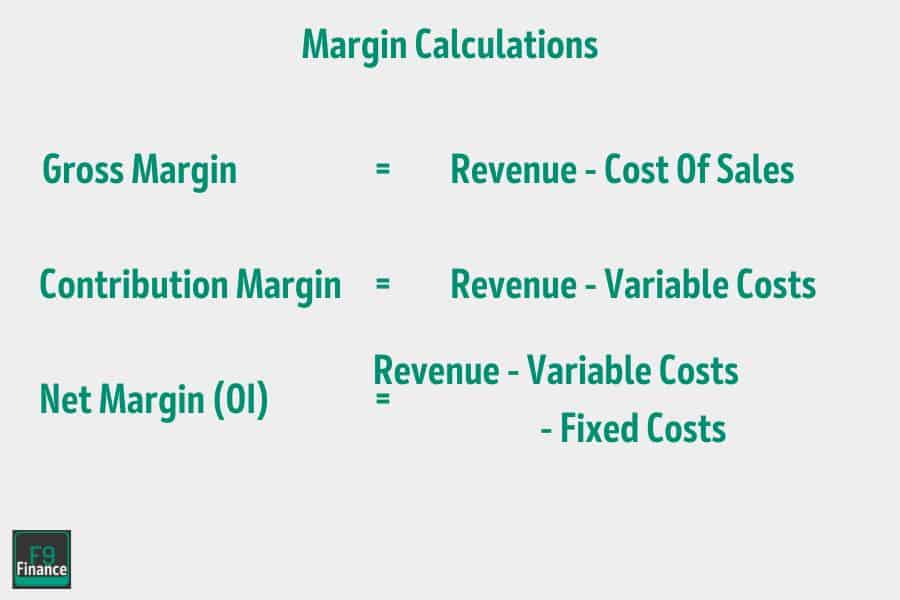

Is contribution margin the identical as gross margin?

No, the contribution margin and gross margin should not the identical. Whereas each present priceless details about an organization’s profitability, they’re calculated in another way and serve completely different functions. Gross revenue margin considers solely the value of products offered (COGS), whereas the contribution margin takes into consideration all variable prices.

Is contribution margin the identical as web earnings?

No, contribution margin and web earnings should not the identical. Web earnings takes into consideration all bills, together with mounted prices, whereas contribution margin solely considers variable prices. Moreover, web earnings is a measure of total profitability whereas contribution margin is a measure of profitability on a per unit foundation.

How do you calculate contribution margin per unit?

The unit contribution margin is calculated by subtracting the variable value per unit from the gross sales value per unit.

What’s contribution per unit system?

The system for contribution per unit is: Contribution Per Unit = Gross sales Worth Per Unit – Variable Value Per Unit.

What’s the contribution margin ratio?

The contribution margin ratio is the proportion of every sale that contributes to mounted prices and revenue after variable prices have been paid. It’s calculated utilizing the system: Contribution Margin Ratio = Contribution Margin / Whole Gross sales.

What’s CM1 and CM2?

CM1 and CM2 are phrases utilized in value accounting. CM1 refers back to the contribution margin after deducting variable prices, whereas CM2 refers back to the contribution margin after deducting each variable and stuck prices.

Is contribution margin all the time a share?

Whereas the contribution margin is usually expressed as a ratio or share, it may also be expressed as a complete greenback quantity or on a per unit foundation.

Have any questions? Are there different matters you prefer to us to cowl? Go away a remark under and tell us! Additionally, keep in mind to subscribe to our Publication to obtain unique monetary information in your inbox. Thanks for studying, and blissful studying!