The know-how and social media big Meta Platforms (NASDAQ:META) posted strong This autumn earnings. The corporate witnessed speedy development in its income and earnings, together with elevated person engagement. Additional, the corporate declared its first dividend payout throughout the This autumn convention name. Given stellar earnings, Meta has efficiently positioned itself as a development and revenue inventory.

Earlier than we dig deeper, it’s value highlighting that Meta inventory appreciated over 109% in a single yr. Additional, it gained over 15% in Thursday’s after-hours buying and selling.

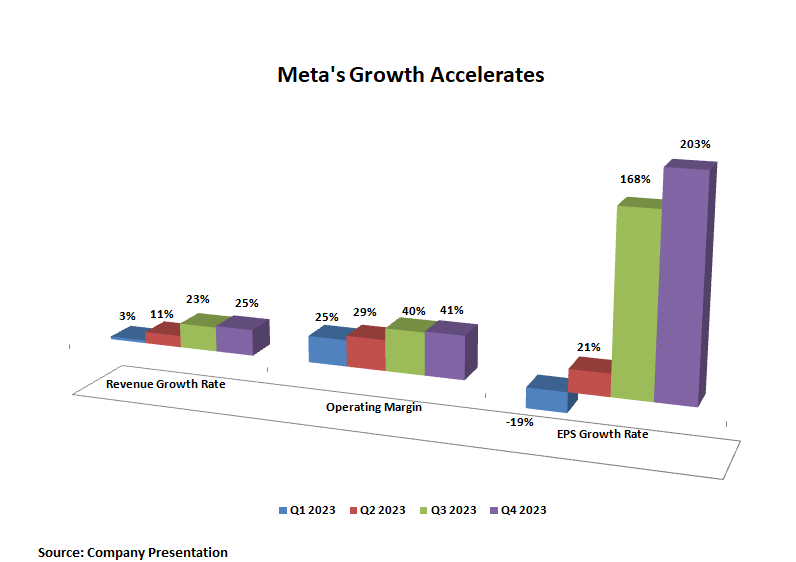

Meta’s Progress Accelerates

The graph beneath exhibits that Meta’s income, working margin, and EPS development accelerated sequentially. Its means to drive greater engagement led by reels and video, incorporation of Generative Synthetic Intelligence (AI) in its merchandise, and concentrate on decreasing prices led to a strong restoration in its income and profitability.

What stands out is that Meta’s year-over-year top-line development price accelerated from about 3% in Q1 of 2023 to roughly 25% in This autumn. Additional, its working margin expanded from 25% in Q1 to 41% in This autumn. Because of the upper gross sales and decrease working prices, Meta’s EPS marked a considerable restoration, from witnessing a decline of 19% in Q1 to rising by 203% in This autumn.

Meta is Now an Revenue Inventory

Because of its robust development and increasing earnings base, Meta continues to put money into the enterprise and focuses on returning capital to its shareholders. Whereas the corporate has traditionally returned money within the type of share repurchases, it surprisingly introduced its first dividend payout throughout the This autumn convention name.

Meta introduced a quarterly money dividend of $0.50 per share, payable on March 26, 2024, to stockholders of document as of February 22, 2024.

What’s the Prediction for Meta Inventory?

Wall Avenue analysts are bullish about Meta inventory’s prospects. Nevertheless, analysts’ common value goal suggests a restricted upside potential because of the rally in its share value over the previous yr.

It’s value noting that a lot of the value targets had been set earlier than the This autumn earnings report. This raises the likelihood that META inventory would possibly witness upward changes in value targets from analysts as a result of aggressive investments in AI, promising development prospects, enhanced income and profitability, and the initiation of dividend funds.

With 27 Buys and two Holds, Meta inventory has a Robust Purchase consensus ranking. Analysts’ common value goal of $426.11 implies 7.94% upside potential from present ranges.

Backside Line

Meta’s investments in AI to drive person engagement and advert gross sales augur properly for development. Furthermore, the corporate’s emphasis on optimizing operational effectivity is predicted to cushion its margins and EPS, doubtlessly supporting its share value. That is mirrored in analysts’ bullish outlook on META inventory.