What occurs if the fertility charge stays low?

The 2025 Social Safety Trustees Report is normal fare. It confirms what has been evident for nearly three a long time – particularly, Social Safety is dealing with a 75-year financing shortfall that presently equals 1.3 p.c of GDP. And, if no motion is taken earlier than 2033, the depletion of reserves within the retirement belief fund will end in an computerized 23-percent reduce in advantages.

In comparison with final yr’s report, the metrics are considerably worse. The projected 75-year deficit rose to three.82 p.c of taxable payroll, in comparison with 3.50 p.c in 2024. The projected depletion date for the Outdated-Age and Survivors Insurance coverage (OASI) belief fund belongings didn’t change; it stays at 2033. Sure, the Incapacity Insurance coverage (DI) belief fund has sufficient to pay advantages for the complete 75-year interval, so the date of depletion for the mixed OASDI belief funds is 2034 – a yr sooner than final yr’s report. However combining the 2 techniques would require a change within the legislation; therefore, underneath present legislation, the action-forcing date is 2033 – eight years from now.

All these numbers, nonetheless, are based mostly on the Trustees’ intermediate assumptions. What occurs to the price of this system ought to the fertility charge stay low, ought to policymakers deport thousands and thousands of immigrants and scale back future immigration ranges, and may folks dwell longer than anticipated? This weblog focuses on the fertility assumptions.

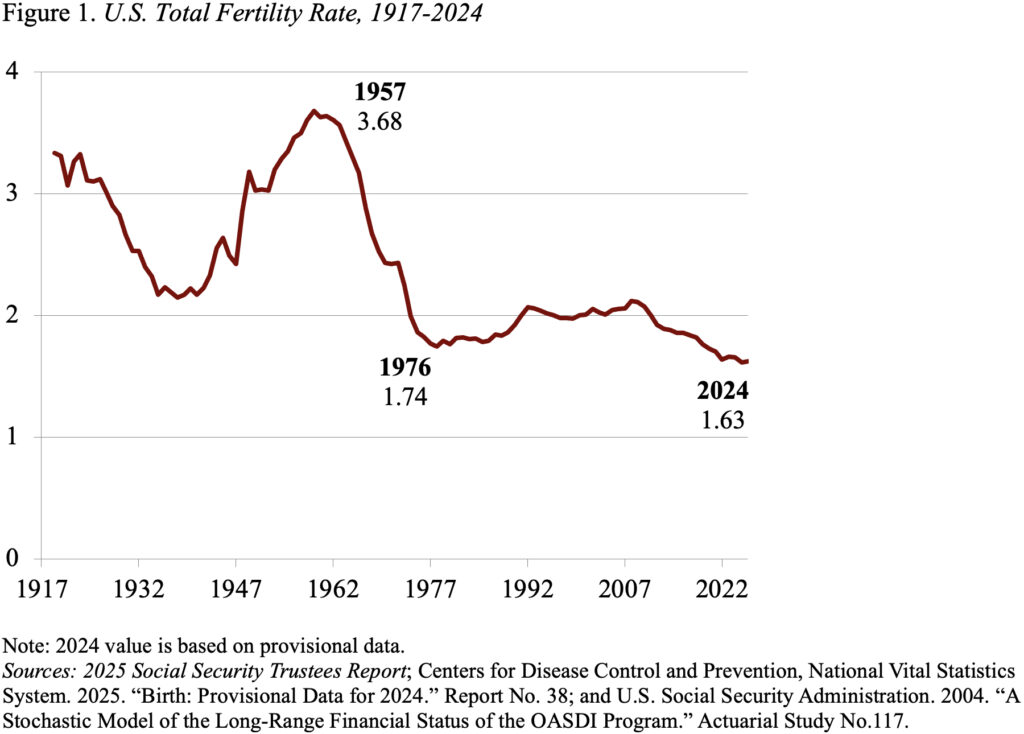

U.S. fertility charges have usually been falling because the finish of the Child Increase within the mid-Sixties, and that decline accelerated after the Nice Recession. Many observers thought that, as soon as the financial system recovered, the fertility charge would rebound. It has not (see Determine 1). At this time, the hypothetical lifetime variety of births for a girl over her childbearing years is 1.63.

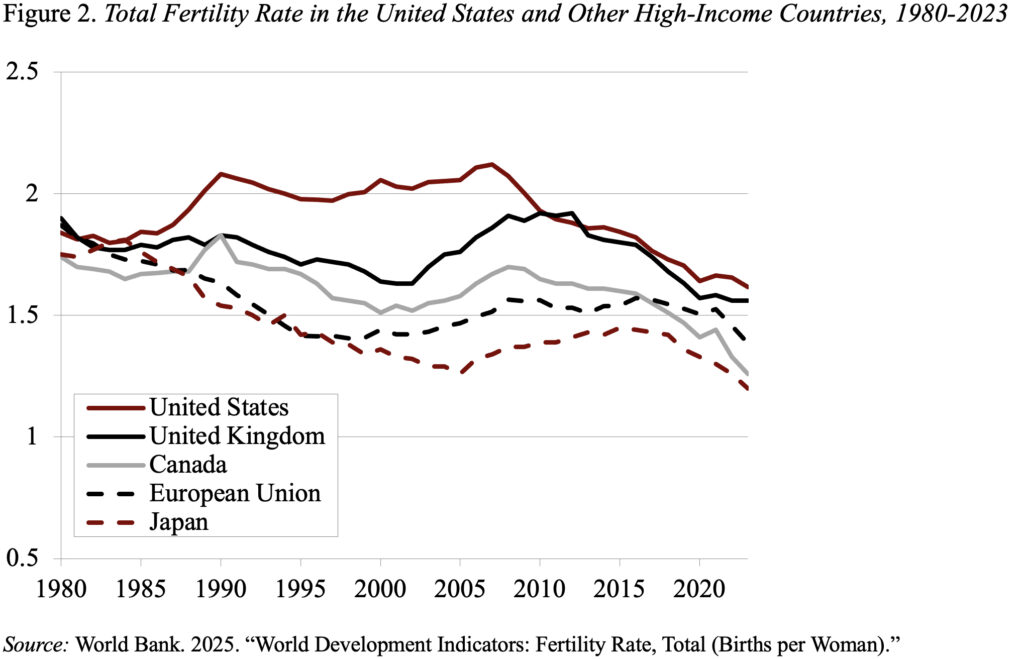

The U.S. present fertility charge just isn’t an anomaly; it’s now roughly in keeping with the charges in different high-income international locations (see Determine 2).

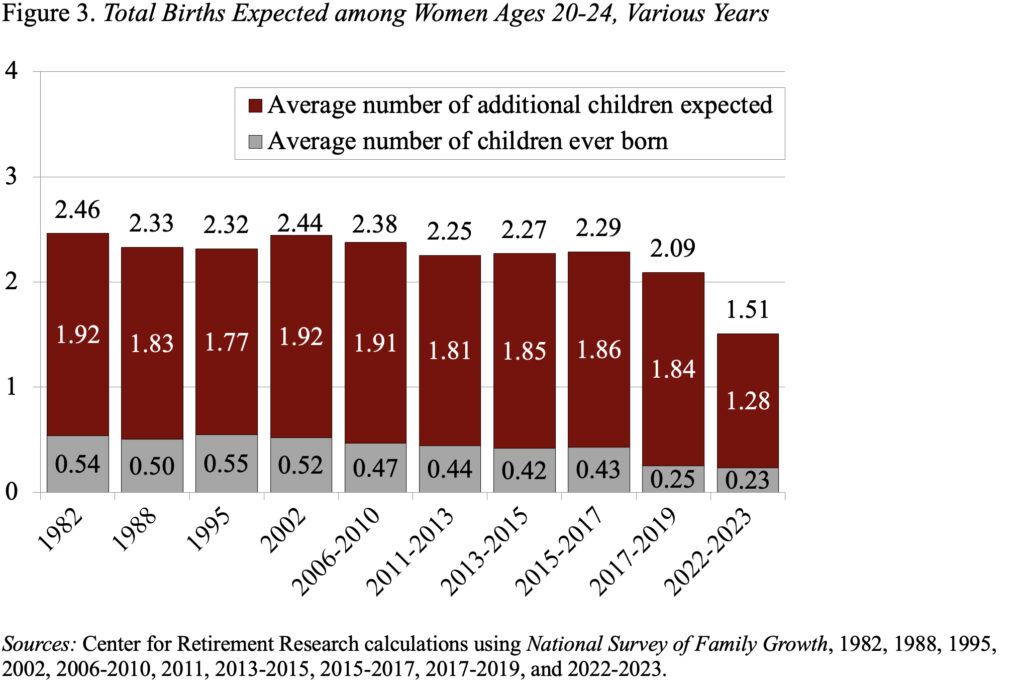

The Social Safety Trustees are nicely conscious of those numbers, however undertaking an final fertility of 1.9 youngsters. The Trustees base their case on two elements. The primary is that repeated surveys of ladies of childbearing age present start expectations above 2.0, suggesting that the present low ranges is not going to be everlasting. Second, they imagine that growing fertility charges for ladies of their 30s assist the notion that girls are merely suspending their childbearing.

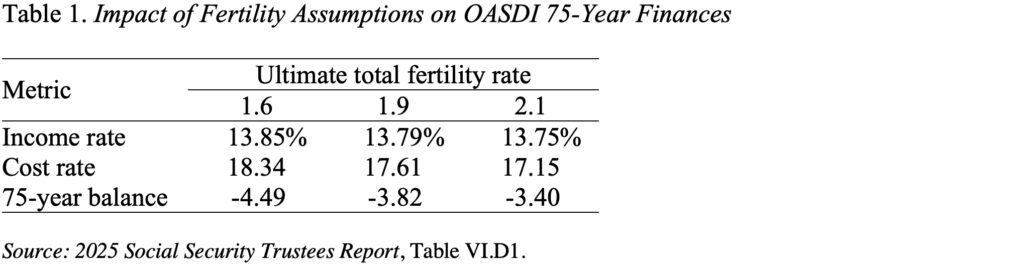

This Trustees’ projected fertility charge, nonetheless, is considerably greater than the Congressional Funds Workplace, which initiatives an final fertility charge of 1.60 by 2035, and the Census Bureau, which initiatives a steady decline in fertility to 1.60 in 2050 and 1.55 in 2100.

Moreover, the newest expectations knowledge – which got here out after the Trustees set their assumptions for this yr’s report – present that girls underneath 35 all anticipate to have fewer than 2.0 youngsters. In truth, at the moment’s 20-24-year-olds solely anticipate to have 1.5 youngsters (see Determine 3).

In line with the Trustees’ sensitivity evaluation, an final fertility charge of 1.6 slightly than 1.9 would improve the 75-year deficit from 3.82 to 4.49 p.c of taxable payroll (see Desk 1).

Might pro-natalist insurance policies improve the fertility charge? The problem is that, over the past 30 years, many international locations have instituted pro-natalist insurance policies – basing advantages on variety of youngsters, offering allowances for newborns, or providing youngster tax credit. The proof means that these efforts haven’t labored. Sweden is a superb instance, as a result of even with soup-to-nuts assist its fertility charge is 1.45 – considerably decrease than the U.S. charge.

If low fertility persists, the Trustees will finally have to scale back their assumptions. Decrease assumed fertility may produce 75-year deficits within the vary of 4 to 4.5 p.c. Nevertheless, even with greater projected deficits, the levers can be found on each the income and profit facet to revive steadiness to Social Safety. Congress simply must act.