Do individuals perceive their publicity to danger?

It’s all the time fascinating to take a look at Vanguard’s most up-to-date version of “How America Saves,” which summarizes the earlier 12 months’s exercise for its 401(ok) purchasers. After all, the exercise at any single firm doesn’t present an entire image of retirement preparedness. People might have a couple of 401(ok) account with a couple of agency, and balances are sometimes rolled over to an IRA, which monetary providers firms don’t observe. Furthermore, by necessity, balances are offered on a person, slightly than a family, foundation.

Whereas an entire image solely emerges from family surveys, the Vanguard report all the time offers meals for thought. This 12 months, the factor that struck me was the share of 401(ok) belongings in equities – about 80 % for these underneath 65. I hadn’t been taking note of fairness holdings, and that determine hit me as very excessive. However earlier than wanting on the fairness difficulty, let me present an replace on 401(ok) balances.

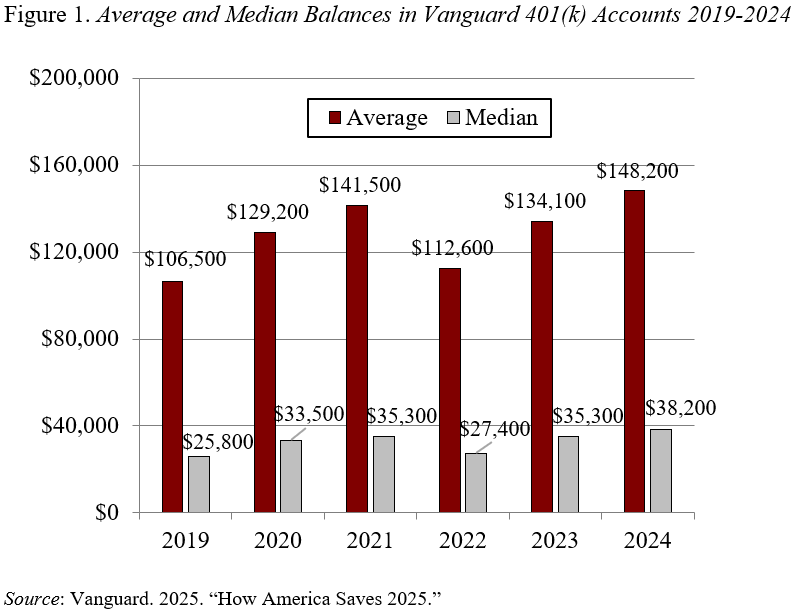

Since 2024 was the second good 12 months in a row for each the economic system and the inventory market, it’s not stunning that participation charges, contribution charges, and median and common balances are near all-time highs. Common balances rose to $148,200 in 2024 from $134,100 in 2023 and median balances to $38,200 from $35,300 in 2023 (see Determine 1). Common balances are extra typical of long-tenured, extra prosperous individuals, whereas the median represents the everyday participant.

As famous above, the share of those balances invested in equities appears excessive. For these of working age, the share is in extra of 85 % for these underneath 45 – declining to 64 % simply earlier than retirement (see Determine 2).

The truth is, fairness holdings are at present the best they’ve been since 2000, simply earlier than the bursting of the dotcom bubble and up from a low of 61 % in 2008 in the course of the monetary disaster (see Determine 3). A lot of the rise was purposeful with the introduction of goal date funds, which elevated age-appropriate fairness allocations and decreased excessive allocations. Furthermore, many households could also be extra diversified if one checked out all their investable belongings – not simply 401(ok) holdings. That mentioned, these with decrease family earnings are much less more likely to have another monetary investments.

Regardless of the mental case for goal date funds, it’s exhausting to not fear right now. Shares are dangerous. Sure, they’re the best yielding publicly traded asset, however the volatility of their returns – as measured by the usual deviation – can be substantial (see Desk 1).

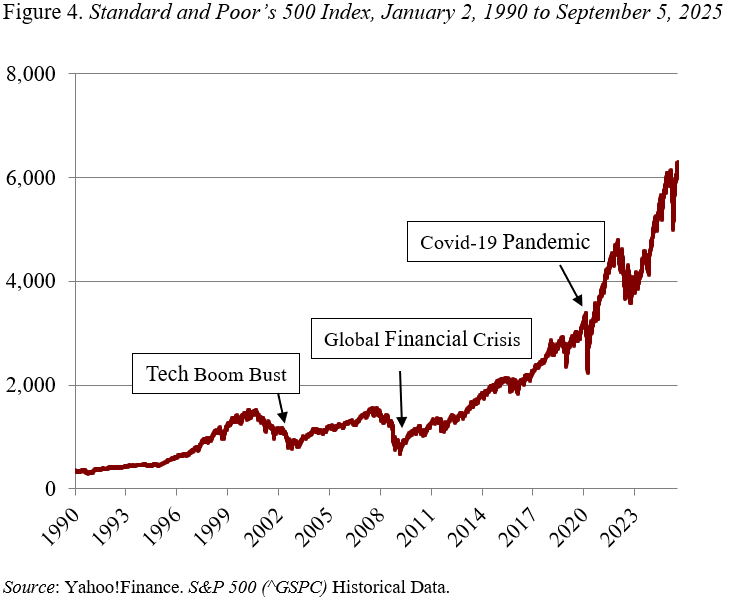

And it’s not true that danger declines over time. Even when short-run returns converge to anticipated values over time, the volatility widens the vary of attainable wealth outcomes. Furthermore, individuals who’re on the verge of retirement face sequence-of-return danger as they begin to withdraw their belongings. That’s, decrease returns within the early years of retirement– with a relentless withdrawal fee – would end in decrease lifetime earnings. Lastly, look the place the Commonplace and Poor’s 500 Index is (see Determine 4).

Clearly equities have been a very good funding for the final three a long time and goal date funds have improved funding patterns. Nevertheless it has taken quite a lot of work to get individuals comfy in saving for their very own retirement. Do they understand how uncovered they’re to the inventory market? Would they be pleased in the event that they knew?