Basin Power Ltd (ASX:BSN) (‘Basin’, or the ‘Firm’) is happy to announce that it has obtained agency commitments to boost A$3.3 million (earlier than prices) through a share placement (‘Placement’ or ‘Provide’) to institutional, refined {and professional} traders. The Placement will concern roughly 20.9 million new absolutely paid abnormal shares at A$0.16 per share. Canaccord Genuity, Discovery Capital and Cumulus Wealth Administration acted as joint lead managers to the Provide.

Key Highlights

- Basin has obtained agency commitments to boost A$3.3 million at A$0.16 per share

- Distinctive help from present and new home and offshore establishments

- Proceeds to increase ongoing exploration applications at Basin’s Athabasca uranium initiatives, together with proposed maiden drilling at its North Millennium mission

- Firm well-funded for aggressive 2024 Athabasca Basin uranium exploration applications together with;

- Completion of Q1 floor geophysics at its North Millennium and Marshall initiatives

- Q1 drilling at its Geikie mission

- Q2 drilling at its North Millennium mission

Basin’s Managing Director, Pete Moorhouse, commented:

“Basin is delighted by the help obtained by the Provide, and the distinctive commonplace of institutional funding we now add to our present high quality register.

Basin controls a premium land package deal with a number of distinctive uranium exploration prospects. The extra funding permits us to increase on our ongoing exploration applications, together with commencing plans for maiden drilling at North Millennium in Q2 2024.

On behalf of the Basin Board, I wish to thank our present shareholders for his or her ongoing help and welcome new holders as we proceed to discover within the heartland of the world’s premier uranium district.”

Placement

Basin obtained sturdy help from quite a lot of high-quality new and present institutional traders each domestically and internationally for the Placement.

Underneath the Placement, the Firm will concern new absolutely paid abnormal shares at $A0.16 per share. The Placement represents a 13.5% low cost to the last-close on 31 January 2024 (A$0.185 per share) and a ten.4% low cost to the 15-day VWAP (A$0.179 per share).

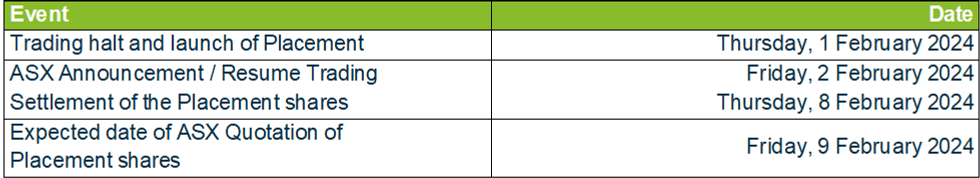

The Placement shares might be issued throughout the Firm’s present placement capability beneath ASX Itemizing Guidelines 7.1 and seven.1A. Settlement of the Placement shares is predicted to happen on Thursday, 8 February 2024. All Placement shares will rank equally with the Firm’s present shares on concern.

The Placement timetable is indicative solely and topic to variation. The Firm reserves the correct to change the timetable at its discretion and with out discover, topic to the ASX Itemizing Guidelines and the Companies Act (Cth).

Click on right here for the complete ASX Launch

This text contains content material from Basin Power, licensed for the aim of publishing on Investing Information Australia. This text doesn’t represent monetary product recommendation. It’s your duty to carry out correct due diligence earlier than performing upon any info supplied right here. Please consult with our full disclaimer right here.