ContextLogic (NASDAQ:WISH) has damaged the hearts and accounts of many courageous patrons, however some would possibly truly break even on the inventory now after its giant rally earlier in the present day. That’s lucky, but it’s not essentially an indication that ContextLogic is on the cusp of a turnaround. When all is alleged and carried out, I’m impartial on WISH inventory, and I wouldn’t dare to purchase or short-sell it.

ContextLogic operates a miniature model of Amazon (NASDAQ:AMZN), which is named Want.com and which the corporate describes as “one of many world’s largest cell ecommerce platforms.” Moreover, like Amazon, ContextLogic additionally runs a logistics enterprise.

But, ContextLogic actually doesn’t belong in the identical class as a mega-success like Amazon. Want.com’s merchandise, to be brutally trustworthy, are low-cost and could also be of less-than-stellar high quality. Nonetheless, there could also be a distinct segment viewers for the sort of enterprise – however then, a more in-depth have a look at ContextLogic’s stats and developments ought to make potential WISH inventory traders extraordinarily cautious.

ContextLogic: The Large Discuss and the Actual Information

Whenever you learn sufficient company press releases, you begin to see by the optimistic spin and the large discuss. Within the case of ContextLogic, there’s definitely huge discuss, however the knowledge will inform the true story of what’s taking place with the corporate.

For instance, ContextLogic proudly introduced the launch of WishPost Sensible Parcel, a small parcel supply service. The press launch calls this an “revolutionary service,” however to me, it sounds just like what Amazon’s logistics arm is already doing fairly efficiently.

In one other instance, ContextLogic CEO Joe Yan boasted that his firm “closed the third quarter with income in-line with our expectations and adjusted EBITDA above the excessive finish of our steering.” Certain, that’s true, however is it actually a lot of an accomplishment if an organization exceeds a low set of expectations?

Right here’s the rundown. In 2023’s third quarter, ContextLogic’s income sank 52% year-over-year to $60 million. In the meantime, the corporate’s adjusted EBITDA was -$54 million, and ContextLogic’s quarterly free money stream (FCF) totaled -$86 million.

Turning to the underside line, ContextLogic’s Q3-2023 earnings indicated a web lack of $3.35 per share. For what it’s price, that’s higher than the corporate’s web lack of $5.53 per share within the year-earlier quarter. But, it’s nonetheless a fairly dismal consequence, wouldn’t you agree?

There’s extra to this story, although. Nearly as an afterthought, ContextLogic’s Q3-2023 press launch talked about that the corporate “initiated a course of to discover a variety of strategic options to maximise worth for Want shareholders.” That’s definitely greater than an afterthought, although, because it left the unanswered query of precisely what ContextLogic’s administration had in retailer.

A Reduction Rally and an Unsure Future

On Monday, we lastly acquired an concept of what ContextLogic’s “strategic various” is likely to be. Specifically, ContextLogic disclosed its “settlement to promote considerably all of its working belongings and liabilities, principally comprising its Want ecommerce platform, to Qoo10.”

In case you’re questioning, Qoo10 is an Asian e-commerce platform, and the sale of ContextLogic’s belongings/liabilities will probably be for $173 million. Upon listening to this information, the market despatched WISH inventory 39% increased on Monday.

Clearly, it is a aid rally. ContextLogic’s earlier “strategic various” announcement may have meant plenty of issues, together with chapter proceedings. A minimum of, it seems that ContextLogic received’t should take that path.

There’s additionally a way of aid for the present shareholders as a result of ContextLogic’s press launch specified, “If the ContextLogic Board doesn’t establish alternatives that may enable it to successfully monetize the worth of its [net operating losses] to the good thing about shareholders, it intends to promptly return all capital to shareholders.” Thus, present WISH stockholders most likely aren’t in grave hazard of dropping the complete worth of their funding.

So, in case you’re a present ContextLogic shareholder, it’s comprehensible in case you’re considerably relieved. None of which means it’s clever to take a brand new share place in ContextLogic, although. At this level, ContextLogic’s future is simply too unclear to use any significant evaluation or type a assured funding plan.

Is WISH Inventory a Purchase, Based on Analysts?

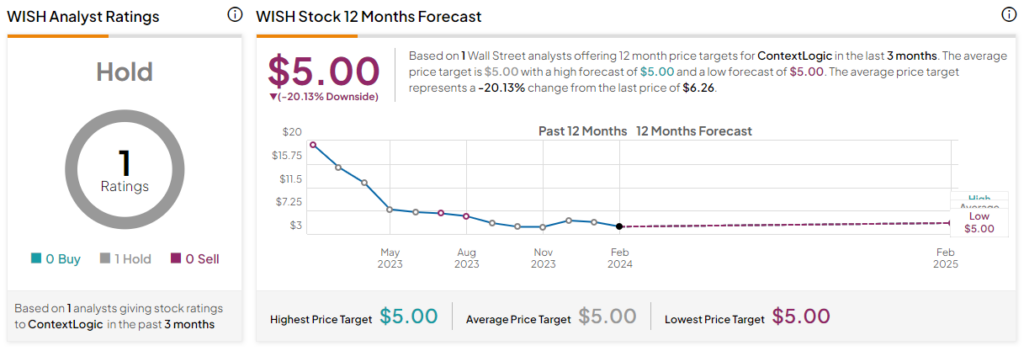

On TipRanks, WISH is available in as a Maintain primarily based on one Maintain ranking assigned previously three months. WISH inventory’s worth goal is $5, implying 20.1% draw back potential. Nonetheless, this worth goal is from one month in the past.

Conclusion: Ought to You Take into account WISH Inventory?

There are knowns and unknowns about ContextLogic. What’s identified from the info isn’t encouraging. What’s unknown is ContextLogic’s subsequent steps and what traders ought to anticipate.

Certain, it’s thrilling to look at ContextLogic inventory shoot 39% increased in a single day. It’s arduous to know the place the inventory would possibly go from right here, although. In any case, aid rallies can fizzle out shortly.

All of this uncertainty makes it tough for traders to use an motion plan. At present, it simply doesn’t make a number of sense to think about a brand new place in WISH inventory. In case you have been already invested and managed to realize breakeven or a revenue, contemplate your self fortunate, and, because the outdated saying goes, take the cash and run.