Moreover, Russia additionally dedicated to a voluntary manufacturing lower of 471 thousand barrels per day for the second quarter of 2024, alongside reductions in exports.

OPEC’s choice to curb output within the identify of stability was an element Eric Nuttall accomplice and senior portfolio supervisor at Ninepoint Companions pointed to as a Q1 catalyst.

“Oil volatility has really fallen,” mentioned Nuttall throughout an April 5 interview. “You would not realize it essentially when trying on the oil worth, however volatility is low. I believe you possibly can attribute that to the OPEC lower, that was one of many largest objectives of OPEC’s intervention into the market was to cut back volatility.”

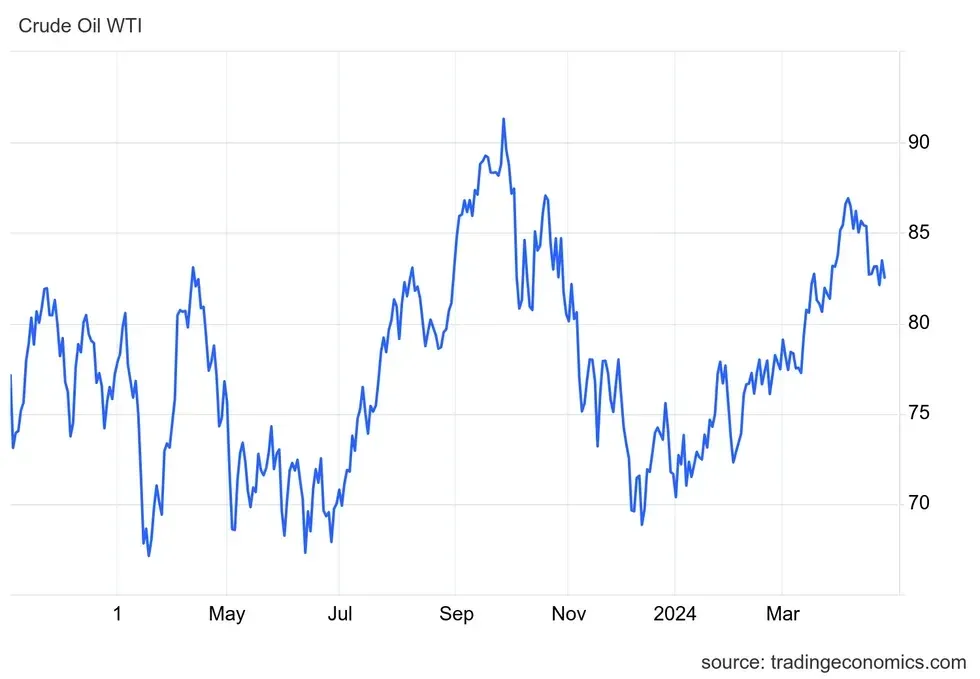

As Nuttall defined, the trouble to attenuate volatility was profitable and helped maintain the benchmarks between US$70 – US$87 per barrel all through the 90-day session.

Oil market replace: Rebounding costs

Chart through TradingEconomics

After reaching a 2023 excessive of US$93.10 (Brent) on September 11, costs spent the rest of the 12 months sliding till bottoming at US$75.80 on December 4.

WTI adopted the same trajectory displaying barely extra volatility, reaching a yearly excessive of US$91.43 in late September, then slipping to US$68.71 in early December.

Chart through TradingEconomics

The next upswing in costs could be attributed to a number of components, in response to Nuttall, Firstly, values are rebounding from a interval of low exercise, pushed by unfounded considerations about weak demand and exaggerated fears of elevated US shale manufacturing.

Secondly, OPEC’s manufacturing cuts which performed a big position in decreasing oil inventories.

He defined that usually, demand is weakest originally of the 12 months, however this time, inventories have solely seen a minimal improve in comparison with the substantial buildup final 12 months. This underscores the effectiveness of OPEC’s cuts in counteracting the affect of strategic petroleum reserve releases and stabilizing oil costs.

“Lastly, we do have a geopolitical danger premium and the oil worth now, I am guessing US$5 a barrel,” mentioned Nuttall.

He continued: “We have not had a danger premium in fairly some time. However what we’re seeing within the Center East, what we’re seeing [with] Russia, Ukraine, it simply quick forwarded the place I assumed we had been going to be, I assumed we might be at US$90bbl within the summertime, we’re there just a few months sooner than I assumed.”

Oil market replace: Strategic reserves

On the finish of January oil costs dipped beneath US$77bbl (Brent) following a rally that took futures into overbought territory. Regardless of army tensions escalating within the Center East, plentiful provides contributed to the decline, with OPEC+ exports exerting further stress on costs.

Costs started to recuperate in early February, breaking by the US$80bbl stage on February 5, and remaining above the edge for the rest of the quarter.

On February 26, The US Division of Power launched a solicitationto buy as much as 30 million barrels of crude oil for the Strategic Petroleum Reserve (SPR), geared toward enhancing the nation’s vitality safety.

In 2022 the Biden administration withdrew 32.3 million barrels from the SPR for home consumption.

“Evaluation from the Division of the Treasury signifies that SPR releases in 2022, together with coordinated releases from worldwide companions, decreased gasoline costs by as a lot as 40 cents per gallon,” the federal government announcementfamous.

Lower than per week later the administration scrapped a purchase order that will have added 3 million barrels again to the SPR, citing excessive costs.

Whereas Ninepoint’s Nuttall doesn’t suppose SPR restocking will affect broader oil costs, he was shocked by the federal government’s choice to restock.

“The largest risk to his re-election is inflation. And the most important enter to inflation is vitality pricing, particularly oil and gasoline,” mentioned Nuttall. “So, it was counterintuitive to me, and I believe it was purely for political theater, that he began to refill it.”

By the top of March costs had breached US$85bbl and closed the three-month interval above US90bbl.

Oil market replace: Long run bullishness

In a particular report from FocusEconomics, panelists are forecasting a ten p.c decline in spot costs for Brent and WTI crude oil over the following decade in comparison with 2023 ranges.

Nevertheless, costs are anticipated to stay traditionally excessive within the close to time period resulting from elevated demand from China and India.

The consensusamong the many FocusEconomics panelist is for Brent crude oil costs to

common round US$85 per barrel for the rest of the 12 months.

Nuttall is taking a extra bullish stance, supported by a rise in demand whereas international inventories are already at multi-year lows.

Utilizing the Days of Provide metric, a calculation that estimates what number of days present stock ranges will final, primarily based on the present consumption charge, Nuttall expects inventories to achieve the “lowest stage in historical past later this 12 months.”

“That is very supportive of a excessive worth,” he mentioned.

Much like FocusEconomics’ evaluation, Nuttall sees oil costs remaining within the US$90bbl vary.

He famous that geopolitical occasions have accelerated the method to this worth goal, and the next trajectory of costs will rely upon when Saudi Arabia decides to return barrels, the tempo of that return, and developments within the Center East and Russia.

Whereas there are uncertainties, corresponding to potential infrastructure injury and the affect on oil circulate, components like stronger US demand, better-than-expected European efficiency, and stable demand from India contribute to his bullish outlook.

“However we’re not calling for US$150 oil, we simply do not suppose that is affordable proper now.”

Fuel market replace: Q1 2024 in assessment

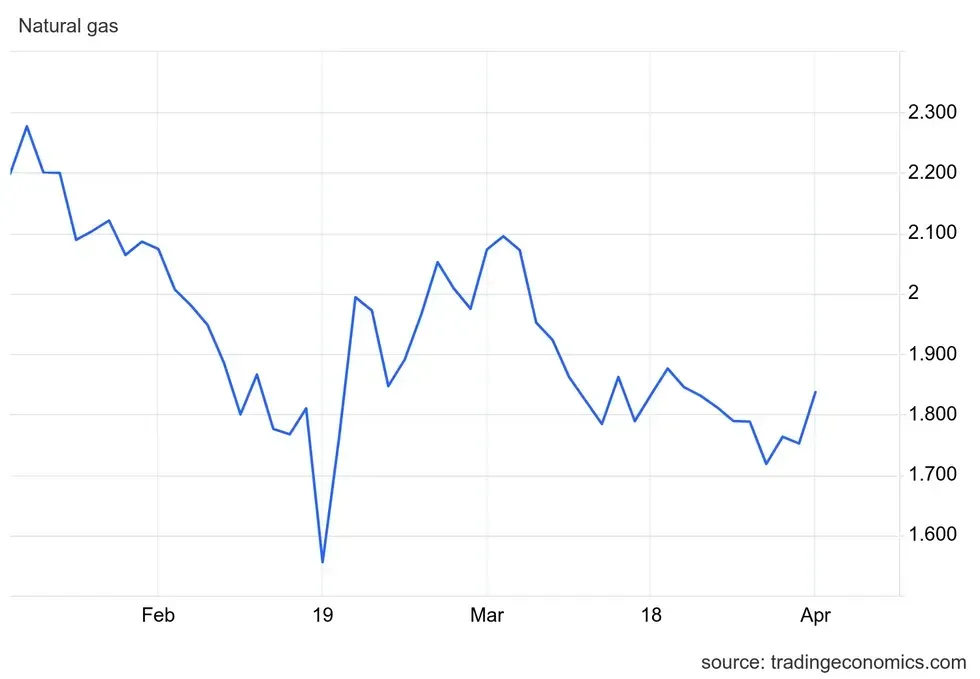

Whereas oil costs remained comparatively secure all through Q1 2024, fuel costs sank to multi decade lows, hitting US$1.55 per Metric Million British Thermal Unit (MMBtu).

The decline was attributed to a hotter than anticipated winter within the Northern Hemisphere and ample provide.

Chart through TradingEconomics

“Increased LNG manufacturing (up by 3 p.c y-o-y), along with stronger piped fuel deliveries to Europe and China, additional eased provide fundamentals and supported demand development,” the Worldwide Power Company’s (IEA) newest fuel report acknowledged.

The market overview additionally famous that international demand was up 2 p.c for the quarter however was greater than offset by the manufacturing uptick.

Fuel market forecast: Geopolitical fragility

Trying ahead costs are anticipated to stay nicely beneath the highs set in 2022 when values neared US$10MMBtu, propelled by market uncertainty introduced on by Russia’s invasion of Ukraine and fears round provide safety.

After a steep decline in late 2022, costs have remained beneath US$5MMBtu all through 2023. Though considerations in regards to the Panama Canal and Purple Sea disruptions led to hypothesis a few geopolitical premium, the uptick has but to materialize within the fuel market.

For the rest of the 12 months, FocusEconomics panelists anticipate pure fuel costs to lower in Asia and Europe in comparison with 2023 averages, whereas remaining regular within the US, staying beneath the pre-pandemic 10-year common.

Costs might see declines introduced on by an abundance in fuel inventories in all areas, attributed to delicate climate circumstances from the El Niño sample and subdued industrial exercise.

Europe will proceed to be the area to look at as ongoing sanctions on Russian fuel, battle in Ukraine and provide safety traits might add tailwinds to costs.

“The structural deficit in European pure fuel has but to be totally resolved with elevated LNG provide not but totally making up for misplaced Russian imports. Thus, European fuel costs stay weak to produce interruptions or will increase in demand,” a Goldman Sachs (NYSE:GS) analyst mentioned. “That is particularly the case throughout winter, when weather-dependent heating includes the majority of demand and bouts of chilly climate can result in quickly falling shares and better costs.”

Transferring into 2025, elevated US LNG export capability might facilitate a worth convergence amongst areas by the top of the 12 months.

“In 2025, US pure fuel costs are anticipated to surpass the pre-pandemic common, with Europe seeing a slight improve and Asia sustaining stability,” FocusEconomics Pure Fuel Market Outlook learn.” The absence of El Niño is predicted to spice up heating demand, whereas industrial output development will drive up consumption.”

Don’t neglect to observe us @INN_Resource for real-time updates!

Securities Disclosure: I, Georgia Williams, maintain no direct funding curiosity in any firm talked about on this article.

Editorial Disclosure: The Investing Information Community doesn’t assure the accuracy or thoroughness of the knowledge reported within the interviews it conducts. The opinions expressed in these interviews don’t replicate the opinions of the Investing Information Community and don’t represent funding recommendation. All readers are inspired to carry out their very own due diligence.