Semiconductor shares have been having fun with an prolonged second within the solar. Pushed by final yr’s important theme – the rise of AI – with many names within the area poised to profit from AI adoption, buyers have been leaning closely into chip shares since total market sentiment shifted from bear to bull within the ultimate months of 2022.

The inventory market, nonetheless, is understood to be a forward-thinking beast, and as such, the surge in chip names really started whereas a downturn within the sector was nonetheless happening. Now that the business cycle has begun to show optimistic once more, does that imply the share good points have already been realized?

Not essentially, says Cantor analyst C.J. Muse, who notes that going by previous habits, one other sturdy yr lies in anticipate semi shares.

“Sure, the SOX bottomed October thirteenth, 2022 and has risen by ~95% since that point,” says the 5-star analyst. “However fundamentals bottomed in 2Q23, and we’re solely 3 quarters right into a elementary upturn, which compares to the everyday 9 Q’s over the past 7 cycles. If we assume the market reductions 2 Q’s forward, this might recommend one other sturdy yr for Semiconductor shares in 2024, with buyers searching for an exit technique late 2024/early 2025.”

So, which shares characterize the most effective alternative for the approaching yr? Muse has an thought about that too, and has earmarked chip giants Nvidia (NASDAQ:NVDA) and AMD (NASDAQ:AMD) as names buyers ought to search out. And it’s not solely Muse who thinks these equities are value a punt. In response to the TipRanks database, each are rated as Robust Buys by the analyst consensus. Let’s see why.

Nvidia

As famous by Muse, the Sox (the PHLX Semiconductor Index – the principle business barometer) has delivered some large returns for buyers over the previous 15 months. Nonetheless, these have been put within the shade by the efficiency through the interval of the sector’s famous person – Nvidia.

Since bottoming out in October 2022, the inventory has delivered returns of 431%; Traders have piled in as a result of firm’s positioning as the AI inventory. And never for nothing has it claimed that title.

Put merely, Nvidia has transitioned from primarily being a graphics firm targeted on the gaming sector to a number one supplier of chips utilized in knowledge facilities. Its best-in-class merchandise have been the primary port of name for anybody concerned within the AI sport. To wit, it instructions greater than an 80% share of the AI chip market.

Whereas hype typically helps shares rack up the good points no matter real-world efficiency, right here the inventory’s ascendancy relies on the massive numbers Nvidia has been producing. Final yr, Wall Road was surprised by the extent of the beat-and-raises provided within the firm’s quarterly readouts.

The final assertion launched, for the corporate’s fiscal third quarter (October quarter), confirmed a top-line of $18.12 billion, representing a year-over-year enhance of 205.6% and surpassing the Road’s forecast by a major $2.01 billion. Inside that, the Information Middle numbers had been much more spectacular, rising by 279% from the identical interval a yr in the past to $14.51 billion. Equally, on the different finish of the equation, adjusted internet earnings delivered an virtually 600% y/y enhance, reaching $1.46 billion and translating to adjusted EPS of $4.02, which was $0.63 forward of consensus.

The final assertion launched, for the corporate’s fiscal third quarter (October quarter), confirmed a top-line of $18.12 billion, representing a year-over-year enhance of 205.6% and beating the Road’s forecast by a conclusive $2.01 billion. Inside that, the Information Middle numbers had been much more spectacular, rising by 279% from the identical interval a yr in the past to $14.51 billion. Likewise on the different finish of the equation, adj. internet earnings delivered an virtually 600% y/y enhance to succeed in $1.46 billion, translating to adj. EPS of $4.02 whereas coming in $0.63 forward of consensus.

Looking forward to the fourth fiscal quarter (FQ4), Nvidia anticipates income will attain $20 billion, give or take 2%, a rise of almost 231% in comparison with final yr. The Road was solely anticipating $17.82 billion.

Even so, Muse thinks with the best way issues are shaping up for generative AI, the chance remains to be in its early days and that makes Nvidia a ‘Prime Decide’ for 2024.

“Generative AI is essentially the most important platform transition in historical past – far higher than prior expertise cycles (PC, Cellular, Web), and we’re solely 12 months into it ― merely put, it’s too early to name a peak,” the analyst stated. “NVDA is ‘the AI Platform’, providing each {hardware} and end-to-end software program stack capabilities to assist this once-in-a-generation funding cycle (with open-ended TAM); add in the truth that NVDA is shifting to an annual expertise cadence in addition to a historic willingness to do something to remain aggressive/stay the chief, and we count on NVDA’s main aggressive place to proceed.”

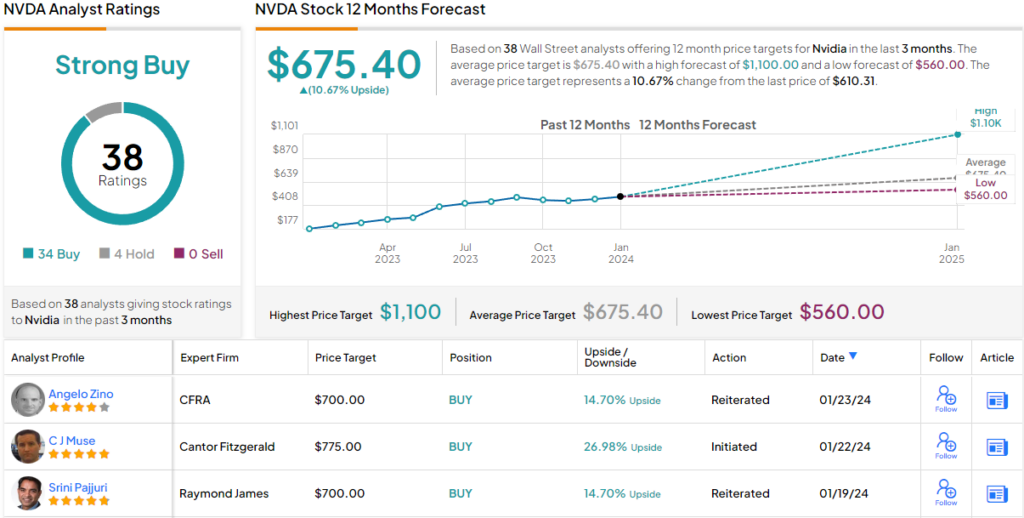

Accordingly, Muse initiated protection of NVDA inventory with an Obese (i.e., Purchase) score and $775 worth goal, suggesting the shares will put up development of one other 27% over the next yr. (To look at Muse’s observe file, click on right here)

Trying on the consensus breakdown, primarily based on a complete of 34 Buys vs. 4 Holds, NVDA claims a Robust Purchase consensus score. Going by the $675.40 common worth goal, a yr from now, the inventory will ship returns of ~11%. (See Nvidia inventory forecast)

Superior Micro Units

Okay, so Nvidia has established itself because the early runaway chief within the AI chip sport, and its dominance is evident to see. However that doesn’t imply that it has the area all for itself. Different corporations are going to be attempting to eat away at its market share, and the one seen by many as its closest rival is Superior Micro Units.

Don’t estimate this firm’s potential to pose a severe menace as AMD has carried out an analogous factor previously. The CPU area used to solely belong to Intel however boosted by its personal line of wonderful merchandise and profiting from a collection of unsuitable strikes by the semi colossus, over time, AMD has steadily eaten away at Intel’s dominance.

Whereas not fairly as gorgeous as Nvidia’s efficiency, each on the share good points entrance (up by 200% since hitting the October 2022 trough) and quarterly updates, AMD has additionally impressed over the previous yr.

Its most up-to-date readout, for 3Q23 noticed income rise by 4.1% year-over-year to $5.8 billion, beating the consensus estimate by $110 million. On the backside line, adj. EPS of $0.70 got here in 2 cents above the analysts’ expectations. That stated, there was some disappointment with the information as the corporate referred to as for This autumn income of $6.1 billion, plus or minus $300 million, on the midpoint, beneath the Road at $6.39 billion.

Nonetheless, as Muse notes, it’s the prospect of the corporate being the one respiration down Nvidia’s neck that ought to be attractive for buyers.

“With the market eagerly trying to find options to NVDA in accelerated computing, we view AMD as a key beneficiary,” Muse defined. “Add in sustained energy in DC CPUs, a modest restoration in PCs, and wonderful working leverage led by higher-margin Information Middle and we count on buyside to proceed to push to an estimated $6 in EPS as a stretch objective.”

“Our view is prospects clearly need a 2nd supply provider to NVDA; the corporate is clearly helped by a deep partnership with MSFT, together with different key companions introduced on December sixth (assume META, and many others.). With consensus modeling NVDA DC at $75B in CY24, it’s not unreasonable to assume an upside case of nearer to $5B+ – so long as the availability chain can assist this development (and AMD is clearly working very laborious right here),” the analyst went on so as to add.

As such, Muse initiated protection of AMD with an Obese (i.e. Purchase) score to go alongside a $190 worth goal. That determine components in development of seven% over the one-year timeframe.

AMD inventory additionally claims a Robust Purchase consensus score, primarily based on a mixture of 28 Buys vs. 8 Holds. Nonetheless, some assume the shares have overshot considerably; to wit, the $159.47 common goal represents draw back of 10% from present ranges. (See AMD inventory forecast)

To seek out good concepts for shares buying and selling at engaging valuations, go to TipRanks’ Finest Shares to Purchase, a device that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed on this article are solely these of the featured analysts. The content material is meant for use for informational functions solely. It is rather essential to do your personal evaluation earlier than making any funding.