I’m deep in my e-book writing work discussing federal debt once I see a tweet that merely epitomizes your entire style.

Full disclosure: My priors on federal debt are that I don’t know the place the road of an excessive amount of ought to be drawn, however I do know that not one of the horrible issues we have been warned about over the previous 50 years attributable to extra debt have come to move.

NOT. ONE. THING.

We have been warned that deficit spending would crowd out Non-public Capital, choke off innovation and new firm formation; it can ship the prices of US borrowing skyrocketing greater, making the debt unattainable to handle; drive the US Greenback to be radically devalued in opposition to all different currencies, thereby devastating the US Financial system; trigger rampant inflation, spiking costs to ranges not seen earlier than; final, act as a drag on the general economic system.

That none of these items occurred makes me marvel why we nonetheless take note of these deficit hawks.

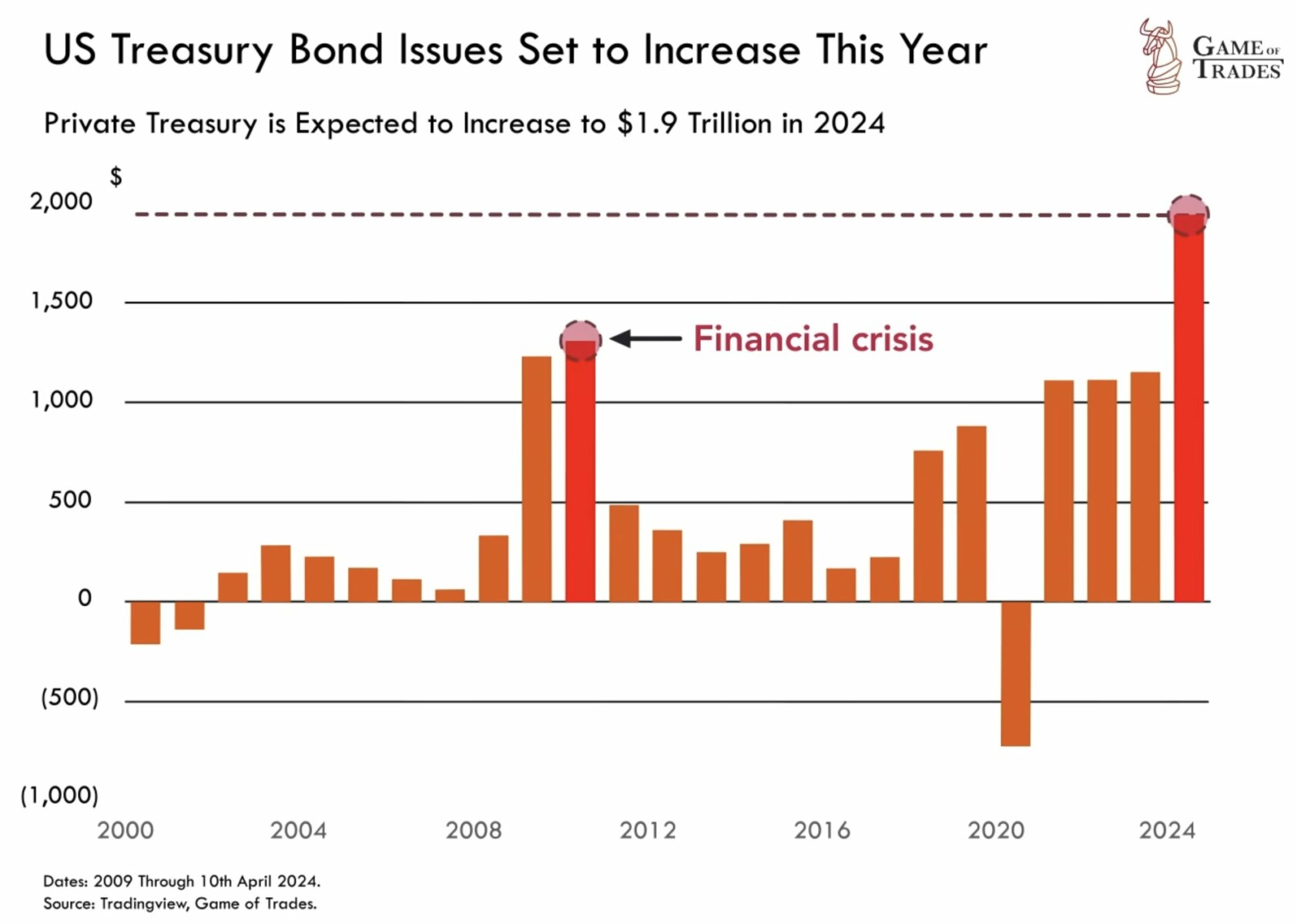

So once I see a chart like this two issues come to thoughts the primary is that disaster peaks — GFC and Covid-19 — is inherently problematic; you’re taking outliers that come alongside as soon as each 15-20 years versus the unusual treasury issuances.

And second, ought to we ignore adjustments which have taken place over that 15-year interval? Will we merely ignore the expansion within the measurement of the economic system and the U.S. inhabitants? The US inhabitants at this time is 341,814,420; in 2009 it was 308,512,035. Will we simply ignore that? The U.S. Financial system in 2022 was $25,439.70B; in 2009, it was $14,478.06B; ignore that additionally?

Will we faux that there was no inflation? By the way in which, inflation-adjust that $1.3T from 2009, and by June 2024 you get (look forward to it) $193.44T.

Are we hellbent on the conclusion that this new debt is unexpectedly extreme, that we should subsequently ignore all different contextualizing information?

~~~

Speaking concerning the future requires much more humility than most of us on Wall Avenue appear to own; we don’t know what the longer term will convey, we do not know of the random occasions that happen to derail our overconfident forecasts. Too many people undertake a confident, know-it-all persona as a result of we all know the investing public prefers that to the reality: No one is aware of something, and the longer term is inherently unknown and unknowable.

Sorry, however “pretend it until you make it,” and making wild unsupported ideological guesses looks like a poor plan for excited about the longer term…

Beforehand:

Time to Cease Believing Deficit Bullshit (September 3, 2021)

Stimulus, Extra Stimulus and Taxes (January 25, 2021)

Price of Financing US Deficits Falls (December 18, 2020)

Can We Please Have an Trustworthy Debate About Tax Coverage? (October 2, 2017)

Deficit Hen Hawks vs Ronald Reagan (July 13, 2010)