Let’s see if fintech and state auto-IRAs are making a distinction.

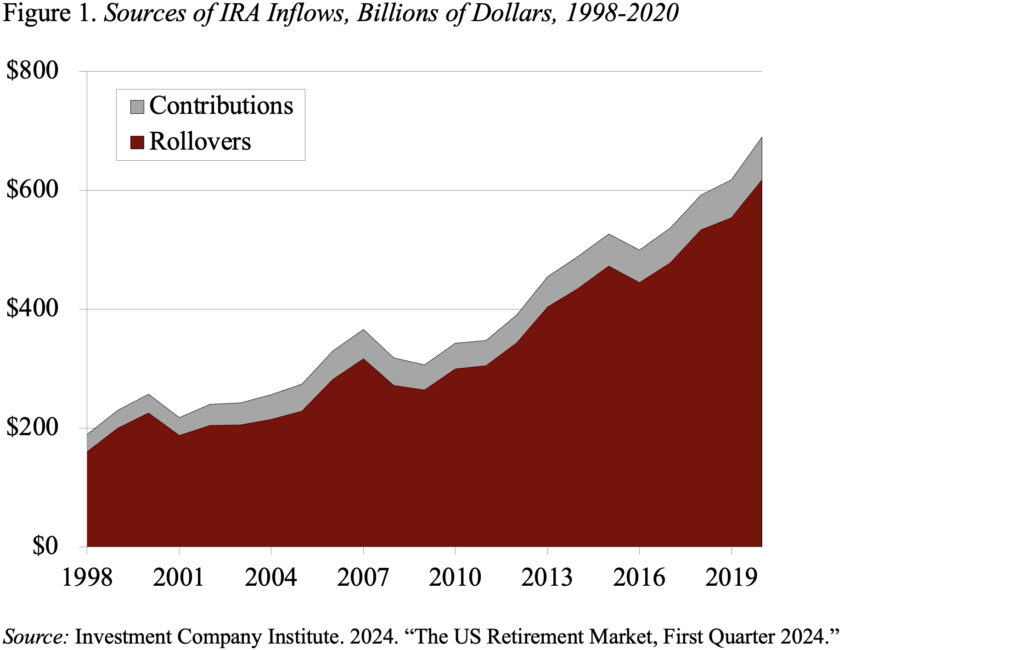

Particular person Retirement Accounts (IRAs), which maintain over half of complete personal retirement belongings, have been launched as a approach for staff with out an employer-sponsored plan to save lots of for retirement. As an alternative, they’ve been primarily used as a car for rollovers from employer-sponsored plans, with direct contributions historically accounting for less than a small share of annual inflows (see Determine 1).

In recent times, nonetheless, two developments might have affected contributions: 1) the unfold of state auto-IRA packages, which enroll staff with out protection right into a Roth IRA; and a couple of) the expansion of fintech platforms providing, and generally incentivizing, IRA contributions.

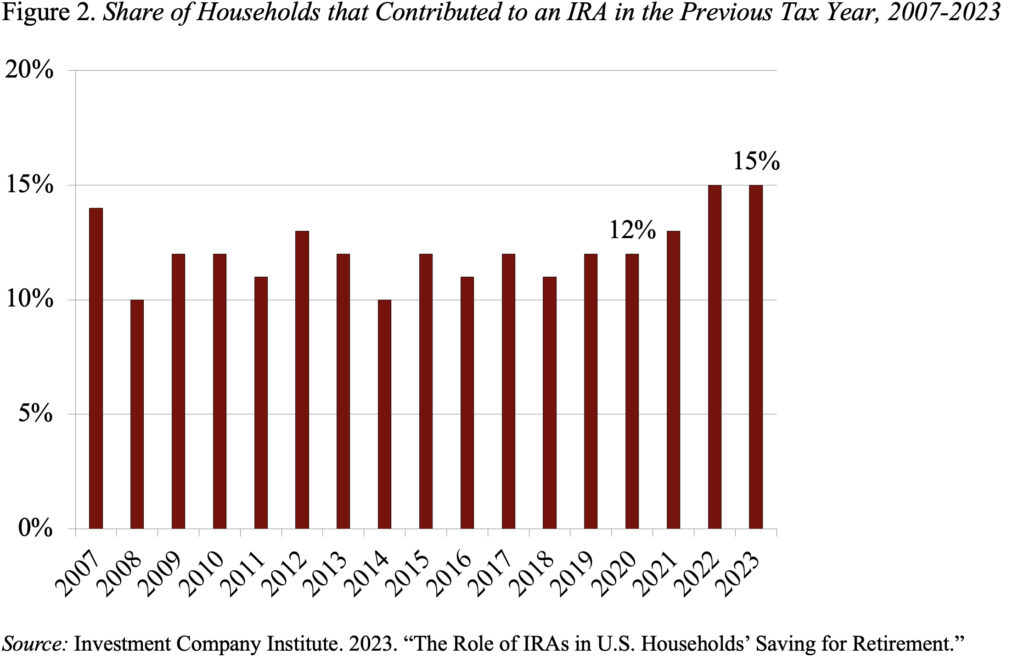

Certainly, the share of households contributing has elevated (see Determine 2). The query is whether or not Auto-IRA packages and fintech performed a job and whether or not the expansion in contributors mirrored a rise in protection or only a bigger tax-preferred footprint for these already lined.

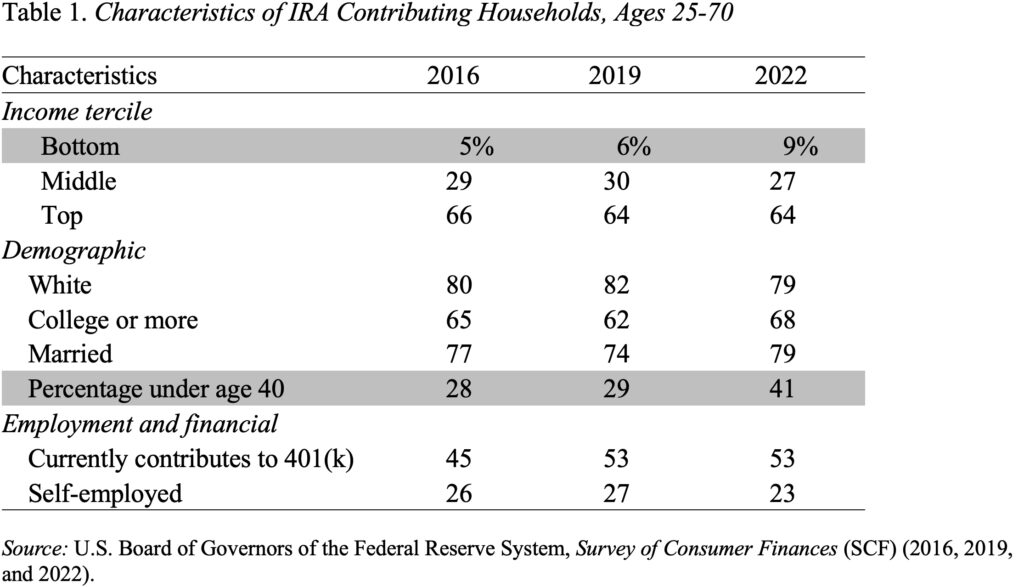

To reply this query, we seemed on the traits of IRA contributing households from the Federal Reserve’s 2016, 2019, and 2022 Survey of Client Funds (see Desk 1). At first, the sample seems a lot the identical throughout the years. Two adjustments, nonetheless, stand out. First, the share of contributors within the backside third of the earnings distribution rose from 5 % to 9 % and, second, the share of contributors below age 40 elevated from 28 % to 41 %.

Any influence of the brand new auto-IRA packages should by definition be modest, because the complete variety of contributors is barely about a million – in comparison with 20 million IRA contributing households in 2022. That mentioned, these packages might effectively clarify the rise between 2019 and 2022 within the share of contributions coming from the underside third of the earnings distribution. These are seemingly new savers who’re having access to tax-advantaged choices by Roth IRAs.

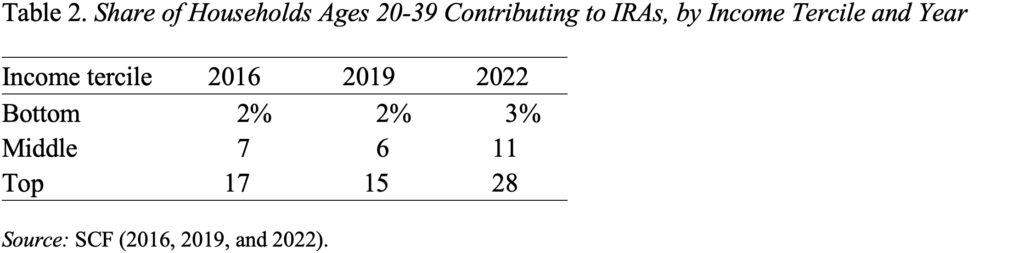

Equally, fintech should certainly clarify the shift within the age distribution of contributors – usually, solely younger tech-savvy traders flip to their cell telephones to save lots of for retirement. However who’re these new younger IRA contributors? It seems that the rise within the share of under-40 households is concentrated amongst households with the best incomes (see Desk 2). The center tercile additionally exhibits a modest enhance – albeit from actually low ranges.

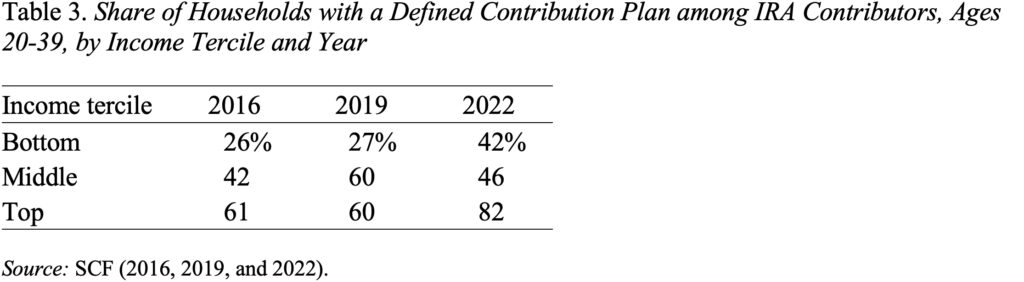

The query stays whether or not the fintech-inspired progress in contributions has produced a rise in protection. Desk 3 exhibits that for the highest tercile – the place with all of the motion – 82 % of contributors already had a 401(ok)-type plan. If know-how makes it very easy to contribute to tax-advantaged financial savings accounts, the tech-savvy with cash will make the most of the chance.

The underside line is that – except for the state Auto-IRA packages – IRAs stay primarily a approach for these with retirement belongings to achieve extra tax-advantaged saving moderately than a mechanism for growing protection.