The time period doesn’t actually matter, however about half of households will not be doing so nicely.

Reporters at all times need to know “disaster” or “no disaster.” I don’t suppose the time period is especially necessary with respect to retirement safety, however statement after statement paints the identical image – roughly half of households will not be in good monetary form in retirement.

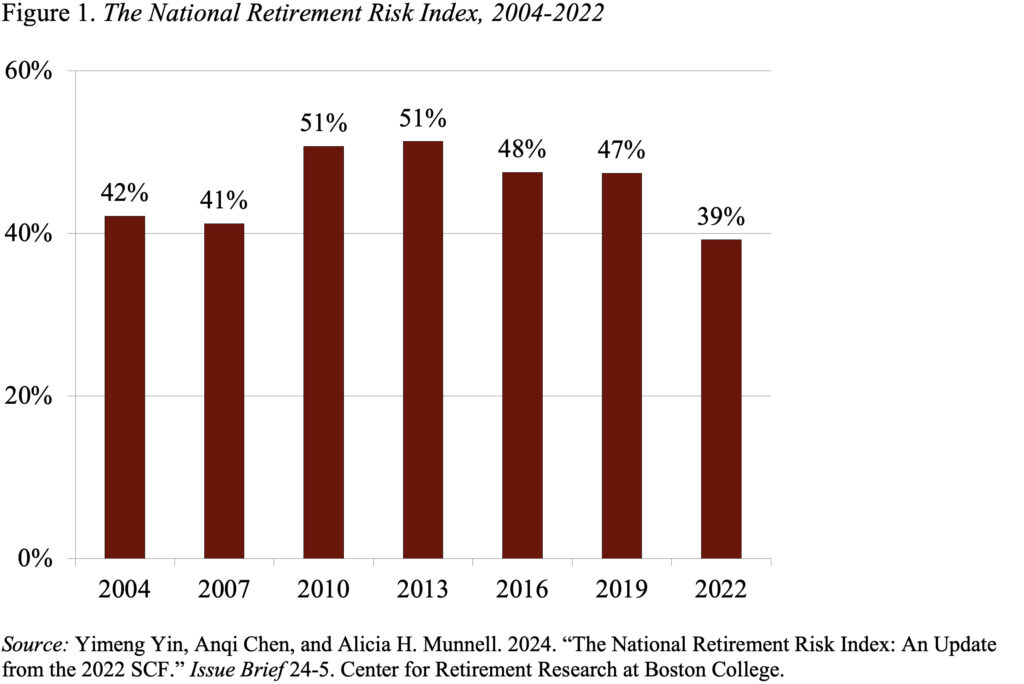

My greatest gauge of how nicely households are doing is the Middle’s Nationwide Retirement Threat Index, which relies on the Federal Reserve’s Survey of Client Funds. The newest estimate exhibits that 39 % of right now’s working-age households will be unable to keep up their lifestyle in retirement (see Determine 1). Distinctive elements led to the bottom degree because the NRRI first began – particularly, quickly rising dwelling costs, new financial savings in the course of the pandemic, and powerful inventory market positive aspects. As a few of these extraordinary elements fade, the Index will most certainly return to fluctuating between 40 % and 50 %.

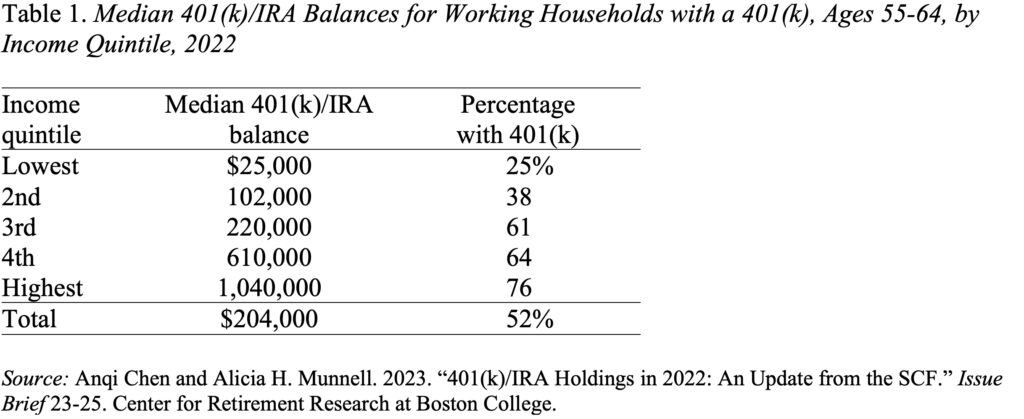

Reinforcing the notion that roughly half of households are in danger is the truth that solely half of working households ages 55-64 have any 401(ok)/IRA saving. Sure, some have outlined profit plans, however most with outlined profit plans even have a 401(ok). Furthermore, the quantities in 401(ok)s/IRAs are fairly modest, aside from the highest quintile of the revenue distribution (see Desk 1). If the couple within the center quintile makes use of their $220,000 to purchase a joint-and-survivor annuity, they are going to obtain about $1,200 monthly. Since this quantity will not be listed for inflation, its buying energy will decline over time. Furthermore, this $1,200 is more likely to be the one supply of extra revenue, as a result of the everyday family holds nearly no monetary belongings outdoors of its 401(ok).

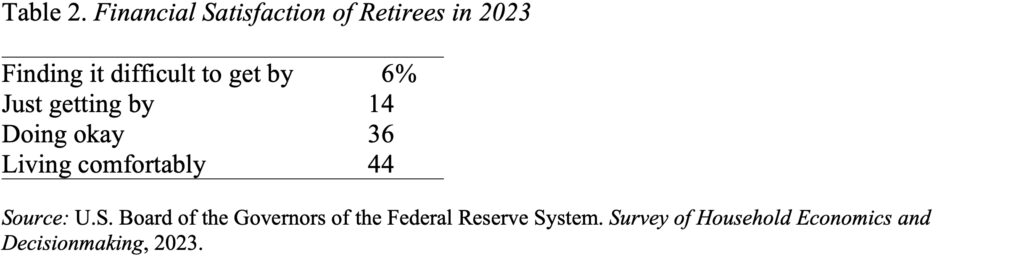

Regardless of the proof on the contrary, when older households are requested about how they’re faring, the overwhelming majority – 80 % – say they find the money for to be doing okay or dwelling comfortably (see Desk 2). Some interpret the excessive satisfaction ranges as proof that retirement financial savings are enough. My guess has at all times been that older individuals are reluctant to say they’re doing poorly and simply alter to their monetary state of affairs, no matter it’s.

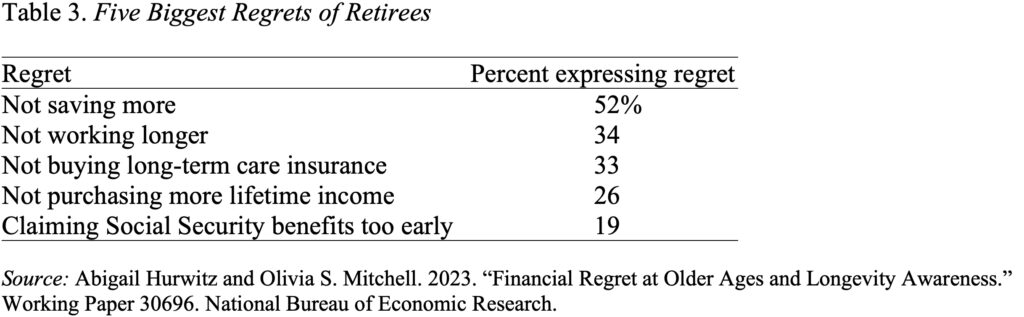

Some proof that individuals are placing on face when requested about their well-being comes from a latest research of regrets. Really, the authors intentionally prevented the time period ‘remorse” and quite requested: “Eager about your saving over your life: do you suppose what you saved was too little, about proper, or an excessive amount of?” The outcomes confirmed that 52 % felt that they’d saved too little. The commonest causes for inadequate saving had been that they lived daily (29 %) and didn’t plan forward (27 %). The opposite areas of remorse are additionally attention-grabbing (see Desk 3).

The underside line right here is that every one the target proof signifies that between 40 and 50 % will not be saving sufficient and, when the query is put to retirees in a non-threatening style, about half admit they wished they’d saved extra. So, sure, undersaving for retirement is a severe difficulty.