If you happen to’re eager about investing in enterprise capital or any personal fund, it’s good to perceive these 5 key phrases: MOIC, TVPI, DPI, Loss Ratio, and IRR. With out them, it’s like strolling right into a poker sport with out understanding the foundations. And on this sport, the stakes—and potential payouts—are large.

I’ve been investing in enterprise capital since 2003, sometimes allocating about 10% of my investable capital to the area in the hunt for multi-bagger winners. Since I don’t have a lot of an edge or the time as an angel investor, I’m comfortable to outsource the work to basic companions (GPs) who supposedly do have the sting, for a payment.

My hope is that I’ll choose the fitting GPs who will spend their careers trying to find winners on behalf of me and different restricted companions. In the event that they succeed, everyone wins.

To date, I’ve had respectable success. A number of funds have returned over 20% yearly for 10 years, whereas others have solely produced excessive single-digit returns. Fortunately, I haven’t invested in a single fund that’s misplaced me cash. The identical couldn’t be stated if I have been investing immediately in particular person offers, so watch out.

Deciding Whether or not To Make investments In A New Enterprise Capital Classic

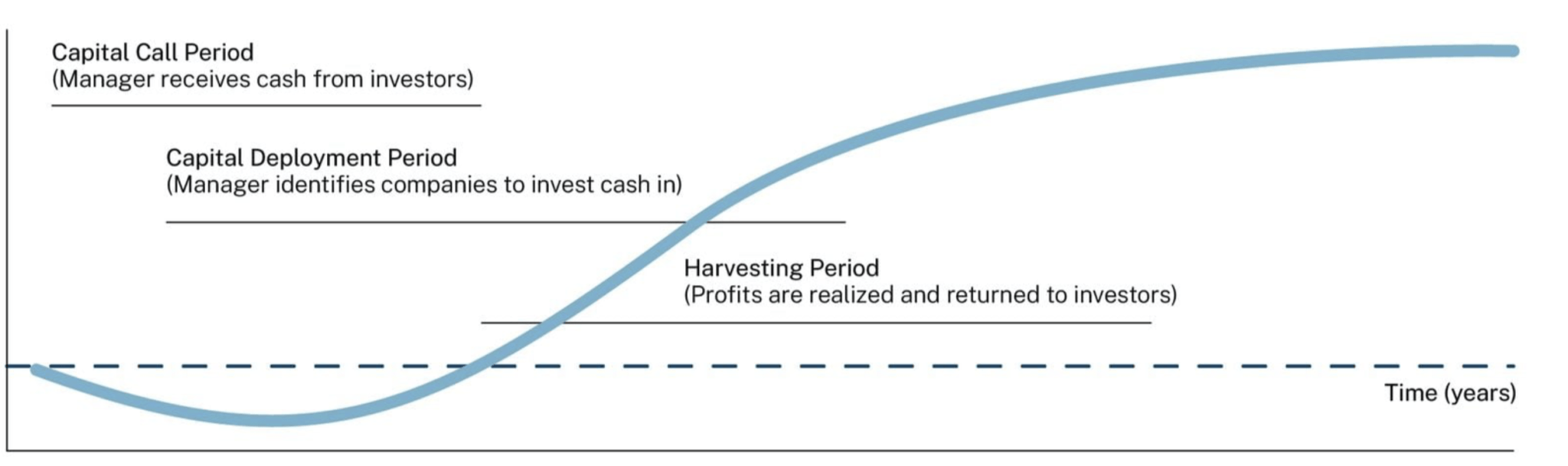

Proper now, I’m debating whether or not to commit $200,000 to a brand new closed-end VC fund that focuses on seed and Sequence A corporations. I already dedicated $200,000 to its prior classic a number of years in the past, however to date the outcomes have been restricted. There’s nearly at all times a loss for the primary few years till the potential earnings come. That is referred to as the “J-curve.“

At this early stage, investing is loads like betting on a promising highschool participant finally making it to the NBA. Roughly 80% of those corporations will go bust. About 10% will turn out to be “zombie corporations” or solely mildly worthwhile—like gamers who find yourself enjoying abroad. That leaves the ultimate 10% to ship outsized returns—ideally 30×—to drive the classic towards a 25% IRR over 5 years.

Let’s break down the 5 key metrics utilizing my hypothetical $200,000 funding so you’ll be able to see precisely how they work.

MOIC — A number of on Invested Capital

MOIC is easy: it’s every little thing your funding is price (each the money you’ve gotten again and the businesses you’re nonetheless holding) divided by what you set in.

Instance: I make investments $200,000. Over time, I get $50,000 in money distributions and my remaining holdings are valued at $250,000. That’s $300,000 complete ÷ $200,000 invested = 1.5× MOIC. Not dangerous, however not life-changing cash.

MOIC says nothing about how lengthy it took to attain it. That is why LPs additionally have a look at IRR (inner fee of return). A 3X in 10 years is a 11.6% IRR, however a 3X in 5 years is a 25% IRR. An enormous distinction.

IRR — Inner Price of Return

IRR is the annualized return you’ve earned in your funding, taking into consideration each the timing and the scale of money flows out and in. It’s not nearly how a lot you made, however when you made it.

- A 2× MOIC achieved in three years might imply a 26% IRR.

- That very same 2× MOIC over ten years is barely a few 7% IRR.

For funds, IRR is usually the quantity they brag about as a result of it captures each magnitude and pace of returns — however watch out. IRR will be gamed early on by fast partial returns that make the quantity look flashy, even when the fund’s later exits are mediocre.

TVPI — Whole Worth to Paid-In

For many functions, that is principally the similar as MOIC. It’s simply the VC means of sounding fancier. Method: (Residual Worth + Distributions) ÷ Paid-In Capital. So similar math, similar end result — 1.5× in our instance.

DPI — Distributions to Paid-In

DPI is the “cash-on-cash” quantity. How a lot have you ever truly gotten again in actual, spendable cash? In our case: $50,000 ÷ $200,000 = 0.25× DPI. Paper positive factors don’t pay the payments, and DPI is your actuality examine.

Loss Ratio

This one’s a intestine punch: the proportion of your invested capital that’s gone to zero. If $40,000 of my $200,000 is in failed startups, that’s a 20% loss ratio.

Pulling All The Enterprise Capital Funding Definitions Collectively

Seven years in, our $200,000 may seem like this:

- Distributions: $50,000

- Unrealized worth: $250,000

- Losses: $40,000

- MOIC/TVPI = 1.5× ($300,000 / $200,000)

- DPI = 0.25× ($50,000 / $200,000)

- Loss Ratio = 20% ($40,000 / $200,000)

Greatest-Case Situation (5× MOIC)

High tier enterprise capital companies return a 5X MOIC over a 10-year interval. Let’s check out what that would seem like.

- $500,000 in distributions + $500,000 in unrealized worth for a complete of $1,000,000

- DPI = 2.5× ($500,000 / $200,000)

- Loss Ratio = 10% ($10,000 / $200,000)

- IRR = 26.23% over 10 years

A 26.23% inner fee of return (IRR)—the annualized fee at which an funding grows over time—over 10 years is phenomenal, about 16% increased than the S&P 500’s common annual return. Simply pretty much as good is that the enterprise capital restricted companion stayed invested for the complete decade, partly as a result of they needed to. With public equities, it’s far simpler to panic promote or lock in earnings early, which may derail long-term compounding.

Real looking Worst-Case Situation (0.7× MOIC)

Backside tier enterprise capital companies return a 1X MOIC or much less. This is what a 0.7X MOIC might seem like on a $200,000 funding.

- $50,000 in distributions + $90,000 in unrealized worth ($140,000 / $200,000)

- DPI = 0.25× ($50,000 / $200,000)

- Loss Ratio = 40% ($80,000 / $200,000)

- IRR = –4.24% over 10 years

So though the dangerous fund “solely” loses ~30% of its worth on paper, the time issue drags the annualized return deep into adverse territory. If the S&P 500 returned 10% a yr over the identical 10-year interval, you’d have $519,000 versus simply $140,000. That’s a large hole, which is why choosing the proper enterprise capital funds is vital.

Betting on a brand-new VC is dangerous because of the lack of a monitor report. To offset this, the final companion must both decrease their charges and carry, or seed the portfolio with some early winners to scale back the J-curve interval of losses and enhance the chances of reaching a robust MOIC and IRR.

Enterprise Capital Is A Hit-Pushed Enterprise

The fact is most investments fail, a number of go sideways, and one or two house runs make the fund. A excessive MOIC with a low DPI means you’re taking a look at “paper riches.” A excessive loss ratio tells you the supervisor is swinging for the fences, however lacking typically. Be certain the ratios align with what you need.

Earlier than writing a examine, at all times:

- Test the monitor report — throughout a number of funds and vintages (years), not simply the shiny final one.

- Ask concerning the loss ratio — you’ll rapidly see in the event that they’re disciplined or gamblers.

- Discover out the time to liquidity — as a result of a 5× MOIC in yr 15 is loads much less thrilling than it sounds.

- Be sincere about your individual danger tolerance — might you watch 90% of your portfolio corporations fail with out shedding sleep?

Realizing MOIC, TVPI, DPI, Loss Ratio, and IRR gained’t magically make you choose the subsequent Sequoia Capital. However it’s going to cease you from investing blind. And in enterprise capital, avoiding large errors is necessary. You do not need to lock up your capital for 10-plus years solely to considerably underperform. The chance price could also be too nice to bear.

Various Selection: Open-Ended Enterprise Capital Funds

If you’d like publicity to enterprise capital with out the painful drawbacks, open-ended VC funds are price a tough look. These autos don’t simply supply liquidity, additionally they allow you to see the portfolio earlier than you make investments. That’s type of like sitting down at a Texas Maintain’em desk already understanding your opponents’ playing cards and seeing the flop earlier than it’s revealed.

With that type of visibility, you’ll be able to determine whether or not the businesses are thriving or floundering and place your bets with a real edge. Certain, the flip and river can nonetheless deliver surprises, however not less than investing is not a complete leap of religion like the way in which you’re with conventional closed-end funds. Over time, that information benefit might add up.

Your Age Issues When You Make investments In Enterprise

The older I get, there danger there’s in locking up cash for a decade with much less visibility and liquidity. With closed-end VC funds, you normally don’t understand how issues are going till yr three, on the earliest.

10 years is a very long time to attend for returns and capital again. At 48, I can’t assure I’ll even be alive at 58 to benefit from the positive factors. If an emergency arises, I additionally need the choice of tapping some liquidity, which conventional funds merely don’t permit. That’s why it is best to solely put money into them with cash you’re 100% positive you gained’t want for a decade.

Then there’s the 20%–35% carry payment. I get it. Basic companions earn their hold by discovering high-return corporations. As an economist, I ought to settle for paying if I’m nonetheless making a living. But when there’s an alternate option to put money into personal corporations with out coughing up that hefty slice of earnings, why wouldn’t I take it? That is the place platforms like Fundrise Enterprise shine.

Personally, I’m diversified throughout early-, mid-, and late-stage VC, however my candy spot is Sequence A, B, and C. These corporations normally have actual traction, recurring income, and product-market match. As a substitute of praying for a 100X moonshot from a seed-stage gamble, I’ll fortunately take “constant” 10–20X winners. At this stage in my life, likelihood and visibility matter excess of chasing lottery tickets.

Flexibility And Visibility Are Engaging Attributes To Investing

Open-ended VC funds provide you with one thing uncommon in personal investing: flexibility and readability. They cut back lock-up danger, eradicate hefty carry charges in some circumstances, and provide you with visibility into what you’re truly shopping for. You may skip the J-curve with an open-ended VC fund.

For youthful buyers with many years to attend, conventional closed-end funds makes extra sense. The capital calls over a three-to-five-year interval are nice for constant investing. However for these of us who or older and worth optionality, open-ended funds really feel just like the extra pragmatic alternative.

So there you may have it. Now the principle enterprise capital funding phrases and choices that will help you higher allocate your capital. Bear in mind to remain disciplined as you construct extra wealth for monetary freedom.

Readers, are you a enterprise capital investor? In that case, what proportion of your investable capital do you allocate to the asset class? With progress corporations staying personal for longer, why don’t extra buyers put extra capital into personal markets to seize that upside?

Subscribe To Monetary Samurai

Hear and subscribe to The Monetary Samurai podcast on Apple or Spotify. I interview specialists of their respective fields and talk about among the most attention-grabbing matters on this website. Your shares, rankings, and critiques are appreciated.

To expedite your journey to monetary freedom, be a part of over 60,000 others and subscribe to the free Monetary Samurai publication. It’s also possible to get my posts in your e-mail inbox as quickly as they arrive out by signing up right here. Monetary Samurai is among the many largest independently-owned private finance web sites, established in 2009. Every thing is written based mostly on firsthand expertise and experience.