Overview

As the worldwide push to halt local weather change positive factors momentum, the European Fee is seeking to regionalize the battery provide chain to capitalize on the speedy electrical automobile (EV) development and restrict its dependency on different international locations by heavy funding and coverage adjustments. Europe’s electrical automobile market worth reached US$29.49 million in 2021 and is projected to extend as much as US$143.08 million by 2027, indicating a compounded annual development fee of 23.4 p.c in that interval.

Despite the fact that Europe is without doubt one of the largest international producers of motor automobiles, it at present doesn’t have a neighborhood provide of lithium hydroxide which is closely utilized in EV battery expertise. Based on specialists, the market is ready to stay in a structural scarcity till 2025

One firm that goals to turn into the primary native lithium provider into an built-in European battery provide chain is European Lithium (ASX:EUR,FRA:PF8), a mining exploration and improvement firm centered on exploring, figuring out and buying lithium in Europe. The corporate is led by a administration crew with a long time of expertise and success within the mining and finance markets.

“Our goal is to be the primary provider of lithium from Europe, for Europe,” European Lithium chairman Tony Sage mentioned.

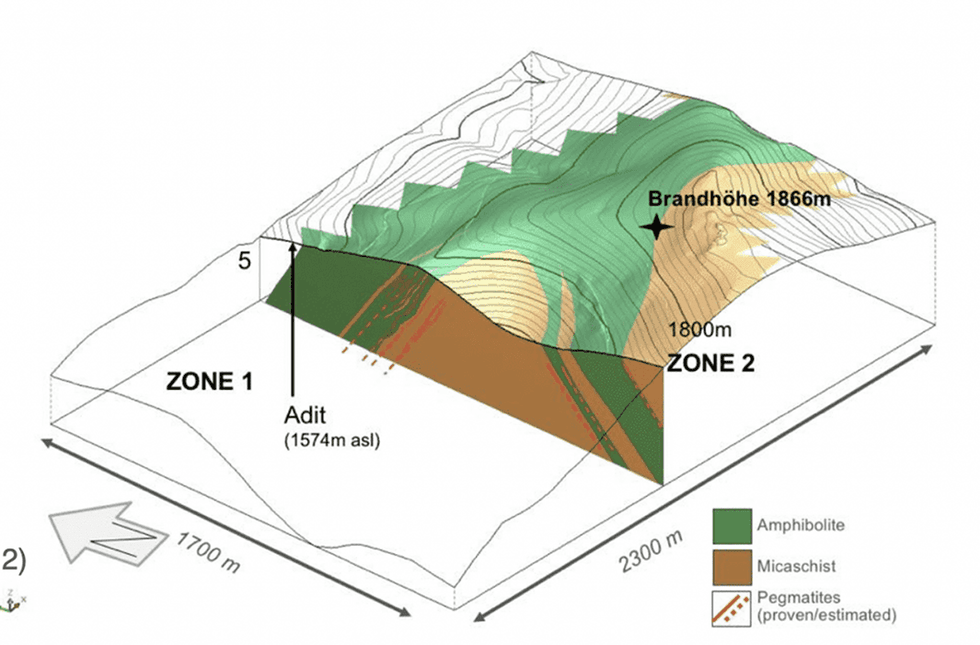

The corporate is targeted on its wholly owned Wolfsberg Lithium undertaking positioned in Carinthia, Austria. The pre-existing mine is positioned in a mining-friendly area with a number of mineral discoveries within the surrounding space. The property includes a high-grade lithium useful resource at a mean grade of 1 p.c lithium hydroxide, with a complete useful resource of 12.88 million tonnes based mostly on sources measured, indicated and inferred in zone 1 solely.

The Wolfsberg Lithium undertaking useful resource has the potential to double based mostly on optimistic drill ends in one other zone on the property.

Based mostly on the definitive feasibility examine (DFS) launched in March 2023, Wolfsberg Lithium Undertaking is nicely positioned to turn into a number one producer of battery-grade lithium hydroxide in Europe. It’s set to ship excessive returns, leveraging low working prices, and benefiting from a lithium market that’s anticipated to be in structural undersupply throughout a lot of the lifetime of mine. The battery-grade lithium hydroxide monohydrate (LHM) costs modeled within the DFS are projected to be at a 39-percent low cost to present spot costs in 2025 after which escalate by 2 p.c every year. The estimated capex is US$866 million which helps a post-tax NPV of US$1.5 billion.

European Lithium has established a number of strategic relationships with an goal to ship worth to the Wolfsberg Lithium Undertaking by improvement and through manufacturing. This features a partnership with KMI for liaising with Austrian authorities.

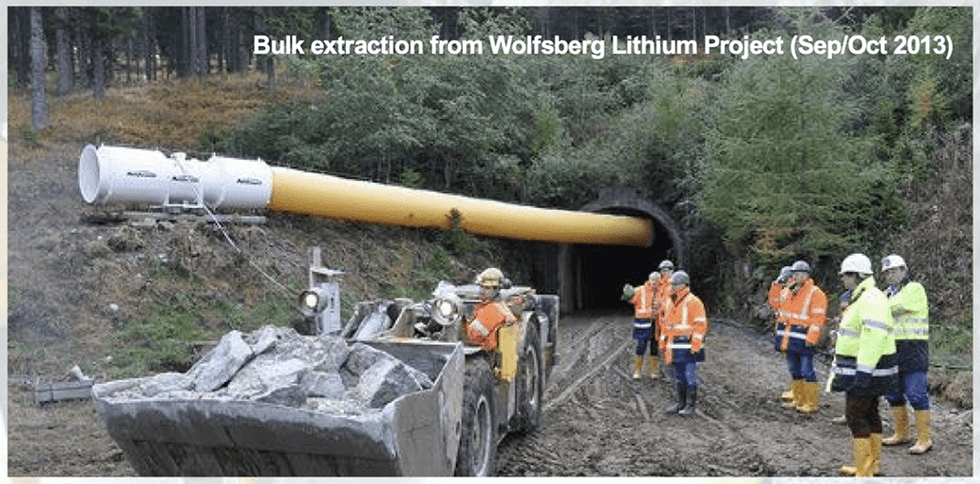

The corporate commissioned Dorfner Anzaplan to assemble the pilot plant, which was efficiently accomplished on schedule. Anzaplan has additionally overseen the completion of metallurgical take a look at work on bulk ore extractions. Testing will permit considerably increased restoration charges in the beginning of manufacturing versus solely assessing metallurgical information from the core as different mining firms typically do, giving European Lithium the benefit of a streamline refinement course of.

The corporate has help from the European Battery Alliance, GREENPEG and different authorities initiatives, believing it has the potential to turn into a significant, first-to-market producer of lithium in Europe. The corporate additionally stays dedicated to scrub manufacturing in an effort to help sustainability.

Based mostly on the DFS, the corporate plans to start the allowing technique of its Wolfsberg Lithium undertaking and put together the mining plan for the mining authority to authorize the mine and concentrator building. Afterward, the corporate will decide the approval necessities of the carbonate hydroxide conversion plant with the Vitality Data Administration (EIA) after which provoke the ultimate financing plan.

European Lithium, by its wholly owned Austrian subsidiary ECM Lithium Aľ GmbH (ECM), signed a binding long-term lithium offtake settlement with top-tier European auto producer BMW to safe the corporate’s first offtake of battery grade lithium hydroxide from its Wolfsberg Lithium Undertaking in Austria.

The corporate is aiming to start manufacturing of lithium hydroxide from the undertaking in 2027 — topic to funding and approvals by the Austrian authorities.

In a bid to develop its undertaking portfolio, European Lithium executed a binding Heads of Settlement with 2743718 Ontario Inc., a subsidiary of Richmond Minerals (TSXVRMD), to accumulate 100% of the rights, title and curiosity within the Bretstein-Lachtal Undertaking, Klementkogel Undertaking and the Wildbachgraben Undertaking, a bunch of exploration licenses overlaying 114.6 sq. kilometers, concentrating on lithium with recognized occurrences within the Styria mining district of Austria.

Firm Highlights

- European Lithium is a mining exploration and improvement firm centered on exploring, figuring out and buying lithium in Europe.

- The corporate goals to turn into the primary native lithium provider into an built-in European battery provide chain.

- The corporate’s focus is on its wholly owned superior Wolfsberg Lithium Undertaking (Wolfsberg) positioned in Carinthia, Austria.

- Wolfsberg is a high-grade lithium useful resource at a mean grade of 1 p.c lithium oxide, with a complete useful resource of 12.88 million tonnes based mostly on measured, indicated and inferred sources in zone one solely.

- Wolfsberg’s definitive feasibility examine outcomes show potential to ship excessive returns, leveraging low working prices, and benefiting from a lithium market that’s anticipated to be in structural undersupply throughout a lot of the lifetime of mine.

- The Wolfsberg useful resource estimate has important upside with the potential to double based mostly on optimistic drill outcomes.

- By means of its wholly owned Austrian subsidiary ECM Lithium Aľ GmbH (ECM), European Lithium signed a binding long-term lithium offtake settlement with top-tier European auto producer BMW AG (BMW) to safe the corporate’s first offtake of battery-grade lithium hydroxide from Wolfsberg.

- The corporate has signed a binding settlement to construct a Saudi Arabia-based hydroxide processing plant in partnership with Obeikan and ship important value financial savings.

- The corporate is led by a administration crew with a long time of expertise and success within the mining and finance markets.

- European Lithium entered right into a enterprise mixture settlement with Sizzle Acquisition, a US particular objective acquisition firm, to which European Lithium will promote down its curiosity in its wholly owned Wolfsberg Lithium Undertaking (Wolfsberg and Wolfsberg Lithium Undertaking) and merge with Sizzle by way of a newly fashioned, lithium exploration and improvement firm named, Important Metals Corp.

- European Lithium has acquired 100% of the rights, title and curiosity within the Bretstein-Lachtal Undertaking, Klementkogel Undertaking and the Wildbachgraben Undertaking, a bunch of exploration licenses overlaying 114.6 sq. kilometers, concentrating on lithium with recognized occurrences within the Styria mining district of Austria and close by the Wolfsberg Lithium Undertaking

- The corporate obtained high-grade lithium assays from sampling undertaken at numerous prospects throughout the Japanese Alps Lithium Satellite tv for pc Tasks, positioned in Austria, that are held 20 p.c by European Lithium and 80 p.c by EV Assets Restricted (ASX: EVR).

Key Undertaking

Wolfsberg Lithium Undertaking

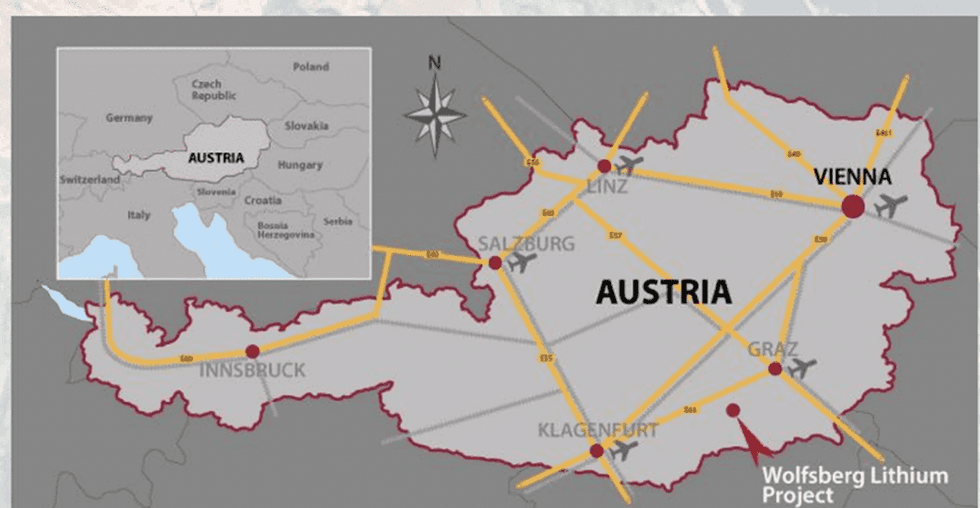

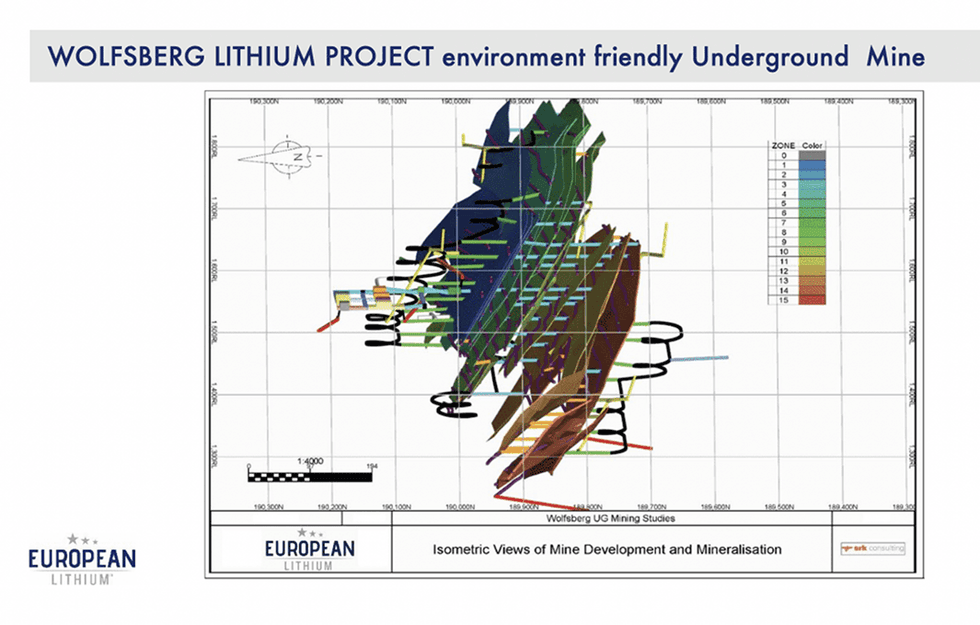

The Wolfsberg Lithium Undertaking is a high-grade lithium undertaking positioned in Carinthia in Austria. The undertaking is 20 kilometers east of the city of Wolfsberg which is an industrial city with established infrastructure and sources of power in place. European Lithium has a complete of 54 exploration licenses, overlaying its two recognized zones and mining licenses that could be completely issued if situations are met. The corporate not too long ago secured further mining licenses and extensions that develop the Wolfsberg undertaking space to a complete of 20 licenses over two mining fields, the unique Andreas and new Barbara mining fields.

The property is an present, developed exploration mine with substantial exploration and improvement work accomplished by earlier house owners. These initiatives had been backed by the Austrian authorities and included in depth metallurgical testing, geological mapping, mining, and pre-feasibility research within the Eighties.

The corporate accomplished its personal optimistic PFS in addition to an intensive evaluation. The property includes a high-grade lithium useful resource with a mean of 1 p.c lithium hydroxide. Moreover, it includes a whole measured, indicated, inferred and JORC-compliant useful resource of 12.88 million tonnes of lithium hydroxide in zone one solely.

In 2023, European Lithium launched the outcomes of its definitive feasibility examine (DFS) for the Wolfsberg Lithium Undertaking, demonstrating potential excessive returns, leveraging low working prices, and benefiting from a lithium market which is anticipated to be in structural undersupply throughout a lot of the lifetime of mine.

DFS highlights:

- Battery-grade lithium hydroxide monohydrate (LHM) manufacturing is ~8,800 tpa for 14.6 years;

- LHM opex (after byproducts) is US$17,016/t LHM on common in comparison with reported spot costs for LHM in February 2023 of US$79,500 DDP Antwerp;

- LHM costs modelled within the DFS are projected to be at a 39-percent low cost to present spot costs in 2025 after which escalate by 2 p.c every year;

- Estimated capex is US$866 million which helps a post-tax NPV of US$1.5 billion @ weighted common value of capital (WACC) 6 p.c (WACC is decided by the cut up of debt and fairness associated to the BMW offtake settlement);

- Acceleration of decarbonization and power transition in Europe mixed with the speedy adoption of electrical automobiles gives additional upside.

Optimistic drill outcomes from the 2018 drilling program affirm that zone two on the property may mirror zone one, which might double the undertaking useful resource. Drilling on the property additionally revealed grades as excessive as 2.49 p.c of lithium hydroxide.

European Lithium entered right into a enterprise mixture settlement with Sizzle Acquisition Corp.(NASDAQ:SZZL), a US particular objective acquisition firm, to which European Lithium will sell-down its curiosity in its wholly owned Wolfsberg Lithium Undertaking (Wolfsberg and Wolfsberg Lithium Undertaking) and merge with Sizzle by way of a newly fashioned, lithium exploration and improvement firm named, Important Metals Corp. European Lithium can be issued US$750 million value of bizarre shares in Important Metals, equal to roughly 80 p.c of the bizarre shares in Important Metals.

As soon as the enterprise mixture is accomplished, European Lithium will focus its actions on its present portfolio of initiatives and investments, together with the newly acquired Austrian Lithium Tasks, consisting of 245 exploration licenses overlaying a complete space of 114.6 sq. kilometers positioned roughly 70 kilometers north of the corporate’s Wolfsberg Lithium Undertaking. The licenses cowl floor that’s thought of potential for lithium occurrences and preliminary floor sampling exhibiting 3.98 p.c lithium oxide.

The next summarizes the corporate’s curiosity in initiatives and investments:

- CRML – As outlined above, the corporate can be issued US$750 million value of bizarre shares in CRML upon closing of the transaction.

- Listed investments – The corporate holds:

- 1,180,256,849 shares (representing 11.5 p.c curiosity) in Cyclone Metals (ASX: CLE). CLE has not too long ago acquired 100% of the Block 103 magnetite iron ore undertaking positioned within the Labrador trough area of Canada.

- 15 million shares in Cufe Ltd (ASX: CUF).

- Unlisted investments – European Lithium holds a 7.5-percent fairness curiosity in Tanbreez Mining Greenland A/S, which holds an exploitation allow for uncommon earths in Greenland.

- Exploration belongings – European Lithium has an curiosity in:

- Austrian Lithium Undertaking –100% of the rights, title and curiosity within the Bretstein-Lachtal, Klementkogel and Wildbachgraben initiatives overlaying an space of 114.6 sq. kilometers in whole, that are potential for lithium in Austria.

- Ukraine Tasks – On 28 February 2023, the corporate introduced that it had renegotiated the phrases underneath which EUR will purchase European Lithium Ukraine LLC (European Lithium Ukraine), a Ukraine-incorporated firm making use of (by both courtroom proceedings, public public sale and/or manufacturing sharing settlement with the Ukraine Authorities) for 20-year particular permits for the extraction and manufacturing of lithium on the Shevchenkivske Undertaking and Dobra Undertaking in Ukraine. On 28 February 2023, the corporate introduced the tip date to finish the acquisition has been prolonged to 2 November 2025.

Along with the above, the corporate continues to overview undertaking alternatives within the mineral exploration space as a part of its development technique.

Administration Group

Dietrich Wanke – Chief Government Officer

Dietrich Wanke has greater than 30 years of expertise in administration on the operational degree for underground and open-cut mines. Wanke has held statutory positions as registered supervisor underneath the relevant mining acts in a number of international locations and commodities, most notably gold, silver, nickel, diamonds, coal, and iron. He has lived and served professionally for mining operations in Germany, Australia, Indonesia, Papua New Guinea, and Sierra Leone. Wanke has managed mining operations by all phases, ranging from greenfield exploration to full-scale manufacturing, in addition to the extension of present mines. Wanke at present holds a place as normal supervisor for Marampa Iron Ore in Sierra Leone. He’s labored prior to now as normal supervisor for Tolukuma Gold Mines in Papua New Guinea, mine supervisor for Atlas Iron in Western Australia, technical providers supervisor for Thiess in Indonesia. Wanke served as mine supervisor for Kimberley Diamonds in Western Australia, technical providers supervisor for Lightning Nickel in Western Australia, technical director for LMV, an engineering and surveying service supplier for coal mines in Germany, technical providers supervisor, and licensed surveyor for Laubag in Germany. Wanke holds a mine engineering/mine surveying diploma from Technical College Bergakademie Freiberg, a licensed mine surveyor’s certificates in Germany and firstclass mine supervisor’s certificates in Western Australia and Papua New Guinea.

Melissa Chapman – CFO and Firm Secretary

Melissa Chapman is an authorized working towards accountant with over 14 years of expertise within the mining business. She has labored extensively in Australia and the UK, together with 5 years as group monetary controller for the Beny Steinmetz Group. Chapman has a bachelor of accounting from Murdoch College and has been a member of CPA Australia since 2000. Chapman has accomplished a graduate diploma in company governance with Chartered Secretaries of Australia.

Tony Sage – Chairman

Tony Sage has greater than 35 years of expertise in company advisory providers, funds administration, and capital elevating, predominantly throughout the useful resource sector. Sage relies in Western Australia and has been concerned within the administration and financing of listed mining firms for the final 22 years. Sage has operated in Argentina, Brazil, Peru, Romania, Russia, Sierra Leone, Guinea, Côte d’Ivoire, Congo, South Africa, Indonesia, China, and Australia. He at present holds the positions of govt chairman of ASX-listed Fe and govt director of ASX-listed Cyclone Metals.

Malcolm Day – Director

Malcolm Day holds a Bachelor’s of utilized science diploma in surveying and mapping. Day commenced his profession working within the civil building business for 10 years, six of which had been spent in senior administration as a licensed surveyor after which later as a civil engineer. While working as a surveyor, Day spent three years conducting mining and exploration surveys in distant Western Australia. He’s a member of the Australian Institute of Firm Administrators. Day is the managing director of Delecta (ASX:DLC).

Michael Carter – Non-executive Director

Michael Carter graduated from the College of Western Australia in 1998 with a bachelor of commerce diploma, majoring in accounting and finance. Carter additionally accomplished a graduate diploma in utilized finance and funding at Finsia in 2002. He’s skilled in structuring company transactions, specializing in junior useful resource firms, and has additionally labored in ongoing company advisory roles with quite a few ASX-listed entities during the last 18 years. Carter has been employed as a stockbroker since 1999, beforehand served as a director of Indian Ocean Capita’ and is at present an affiliate director of CPS Capital.