Lower than every week after a activity drive was launched to “get rid of waste, fraud, and abuse” at HUD, it seems almost half of the Federal Housing Administration (FHA) is ready to be laid off.

The shock growth was reported by Bloomberg, based mostly on “two sources” who’re accustomed to the plan.

Simply final Thursday, HUD Secretary Scott Turner unveiled plans to trim down the company, claiming to determine over $260 million in financial savings, with extra to come back.

And like different authorities departments lately affected by layoffs, DOGE seems to be transferring in a short time and aggressively at HUD as properly.

The massive query is how the layoffs may have an effect on the company, and if they are going to be clawed again if disruptions happen.

FHA Layoffs Are the Newest Shock to the System

In just below a month, there have been numerous authorities layoffs throughout many departments, together with the Division of Vitality, the Division of Training, the EPA, IRS, CDC, and plenty of others.

One other 75,000 authorities staff have accepted voluntary buyouts in addition to the Division of Authorities Effectivity (DOGE) seeks to chop spending.

It seems no part of the federal government is being spared, and the most recent cuts have rattled the businesses that play a significant position within the housing market.

Whereas it’s unclear what number of staff will probably be affected, the dad or mum of the FHA, the U.S. Division of Housing and City Improvement, or HUD for brief, employs about 9,600 staff, per its personal web site.

Final week, DOGE mentioned half of the HUD workforce was being eradicated. However on the time, FHA staff weren’t affected by the information.

It seems issues have modified and now almost half of the FHA is being eradicated as properly.

Inside HUD there are lots of departments, together with the FHA and Ginnie Mae, the latter which supplies ensures on mortgage-backed securities (MBS) issued by the FHA, VA, and USDA.

FHA Loans Play a Large Function within the Mortgage Market

After conforming loans backed by Fannie Mae and Freddie Mac, FHA loans are the most typical kind of mortgage accessible to house patrons right now.

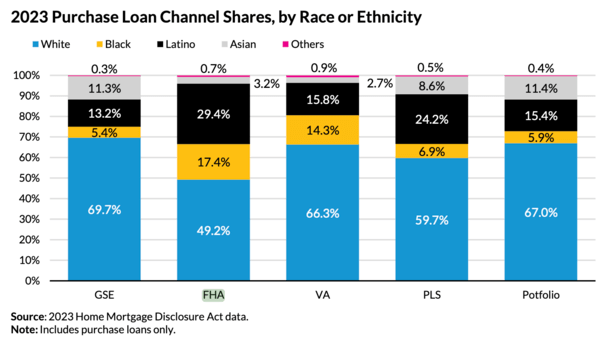

And they’re particularly essential for minority house patrons, together with Black and Latino debtors, per the City Institute.

So to say this can be a very massive deal can be an enormous understatement. The one silver lining, in the event you might even name it that, is that mortgage quantity has been very low recently in comparison with latest years.

This implies disruptions may be much less of a difficulty because the workers that is still could have fewer loans to course of than in recent times.

In spite of everything, with mortgage charges now nearer to 7% than 3%, far fewer debtors are refinancing their mortgages.

And residential purchases are additionally down considerably, with solely about 4 million house gross sales final yr amid deteriorating affordability.

But when delinquencies turn into an even bigger difficulty in coming years, there might be elevated stress on the FHA, particularly if it’s short-staffed.

Can I Nonetheless Get an FHA Mortgage?

The quick reply is sure, you’ll be able to. Whereas the layoffs seem like sizable, I doubt DOGE would do something to jeopardize your capability to get an FHA mortgage.

As famous, they’re quite common kinds of mortgages that utilized by thousands and thousands to buy a house, thanks partly to their low 3.5% down fee and liberal credit score rating necessities.

Whereas the FHA is a authorities company, FHA loans are issued by particular person banks and mortgage lenders.

A lot of the method is carried out by personal sector staff like mortgage officers and mortgage brokers who aren’t employed by the federal government.

In different phrases, the federal authorities doesn’t difficulty FHA loans, it merely units the underwriting tips and insures them as soon as they fund.

Ideally, this implies you must proceed to have the ability to apply for an FHA mortgage and shut the mortgage with out difficulty.

In the event you’re at the moment within the technique of acquiring an FHA mortgage, the identical fundamental rationale applies. Your mortgage will greater than seemingly proceed to maneuver ahead as anticipated.

Nevertheless, given the severity of those layoffs, it’s not a foul concept to anticipate longer processing timelines and to plan accordingly.

This might have an effect on a mortgage charge lock if the funding takes longer than anticipated or if there are every other surprising snags.

Make sure to talk along with your mortgage officer or mortgage dealer to get updates on the FHA’s system standing.

Learn on: FHA vs. typical loans.