The transient’s key findings are:

- This examine explores whether or not residing in a high-wealth, high-cost state – like Massachusetts – helps or hurts retirees meet their primary wants.

- In Massachusetts, the price of residing outweighs greater incomes and wealth, so retirees usually tend to wrestle than these in different states.

- Low-income retirees say they usually want to regulate to a decrease lifestyle and that Social Safety advantages and housing subsidies are key lifelines.

- State policymakers may assist by: 1) enhancing property tax deferrals; and a couple of) adopting an auto-IRA to assist staff save in the event that they haven’t any employer plan.

Introduction

Throughout the nation, many older adults wrestle to make ends meet. The Elder Index, produced by the Gerontology Institute at UMass Boston, means that roughly one-third of older households have incomes under what it takes to fulfill primary wants and age in place. One query is whether or not residing in a high-wealth, high-cost state corresponding to Massachusetts makes issues higher or worse. On the one hand, Massachusetts’ salaries are greater than common and the state’s older households usually tend to be White and have a university diploma, elements which are related to higher monetary stability. Then again, Massachusetts has a very excessive price of residing and chronic financial inequality. Whatever the state’s relative state of affairs, the second query is how do older residents with low incomes cope.

This transient, which is predicated on a latest collaboration between Boston Indicators and the Heart for Retirement Analysis, makes use of quantitative evaluation to discover Massachusetts’ relative standing and a qualitative method – interviews with older residents – to find out how these going through monetary pressures make ends meet.1

The dialogue proceeds as follows. The primary part compares Massachusetts to the remainder of the nation, utilizing the Survey of Earnings and Program Participation (SIPP). The train exhibits that older households in Massachusetts usually tend to have insufficient earnings, as measured by the Elder Index, and that racial disparities are particularly extreme. The second part studies the findings from semi-structured interviews with older residents of higher Boston. Key findings are that many older adults should modify to a decrease lifestyle in retirement; Social Safety and sponsored housing are lifelines; and different authorities advantages additionally play an essential position.

The ultimate part concludes that two initiatives on the state degree may make for a greater future. First, excessive housing prices – together with property taxes – are a serious contributor to financial stress. Massachusetts, like many states, permits qualifying older adults to defer property tax funds for so long as they continue to be of their houses, however this system ought to be reformed to encourage participation and guarantee monetary sustainability. Second, retirees want greater than Social Safety, however many lack significant employer-based saving. Massachusetts may assist shut the financial savings hole by adopting the Safe Selection Financial savings Program – an automated IRA for workers with out entry to an employer-sponsored retirement plan. These two modifications would drastically enhance the longer term monetary well-being of Massachusetts’ older residents.

Monetary Effectively-being of Older Households

Massachusetts is a high-income, high-wealth state, however it is usually marked by excessive prices and chronic financial inequality. To evaluate the monetary safety of older adults in Massachusetts relative to the nation, the evaluation proceeds in three levels. The primary stage paperwork the monetary assets obtainable to older households in Massachusetts and compares these outcomes with different states. The second compares older households’ monetary assets to the native price of residing to estimate the share of households unable to pay for his or her primary wants. The third replicates this evaluation for various racial and ethnic teams.

Monetary Sources: MA vs. Remainder of U.S.

This evaluation makes use of information from the 2019-2023 waves of the Survey of Earnings and Program Participation (SIPP). The SIPP has detailed info on the worth of the home, monetary property, enterprise possession, and different non-financial property, in addition to mortgage and different debt. Crucially, it additionally identifies the place the family resides and has enough pattern measurement to look at Massachusetts particularly.2

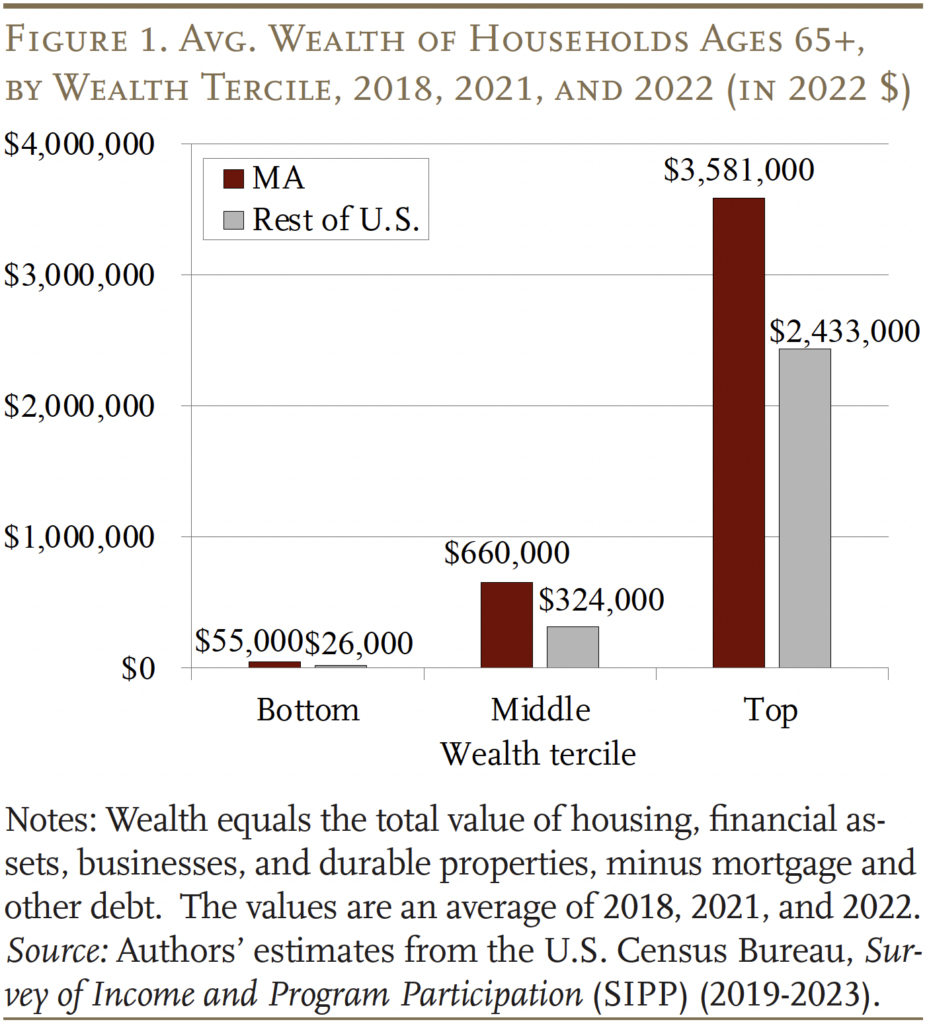

Determine 1 compares the wealth holdings for the underside, center, and prime third of older households when it comes to wealth.3 Two factors stand out. First, as anticipated, older households in Massachusetts are wealthier than their counterparts in different states. Even the underside third of older households in Massachusetts has twice the assets, on common, as the underside third in different states. Second, the distribution of wealth is extremely skewed, with the underside third of older households in Massachusetts having simply over $50,000, on common, and the highest third over $3.5 million.

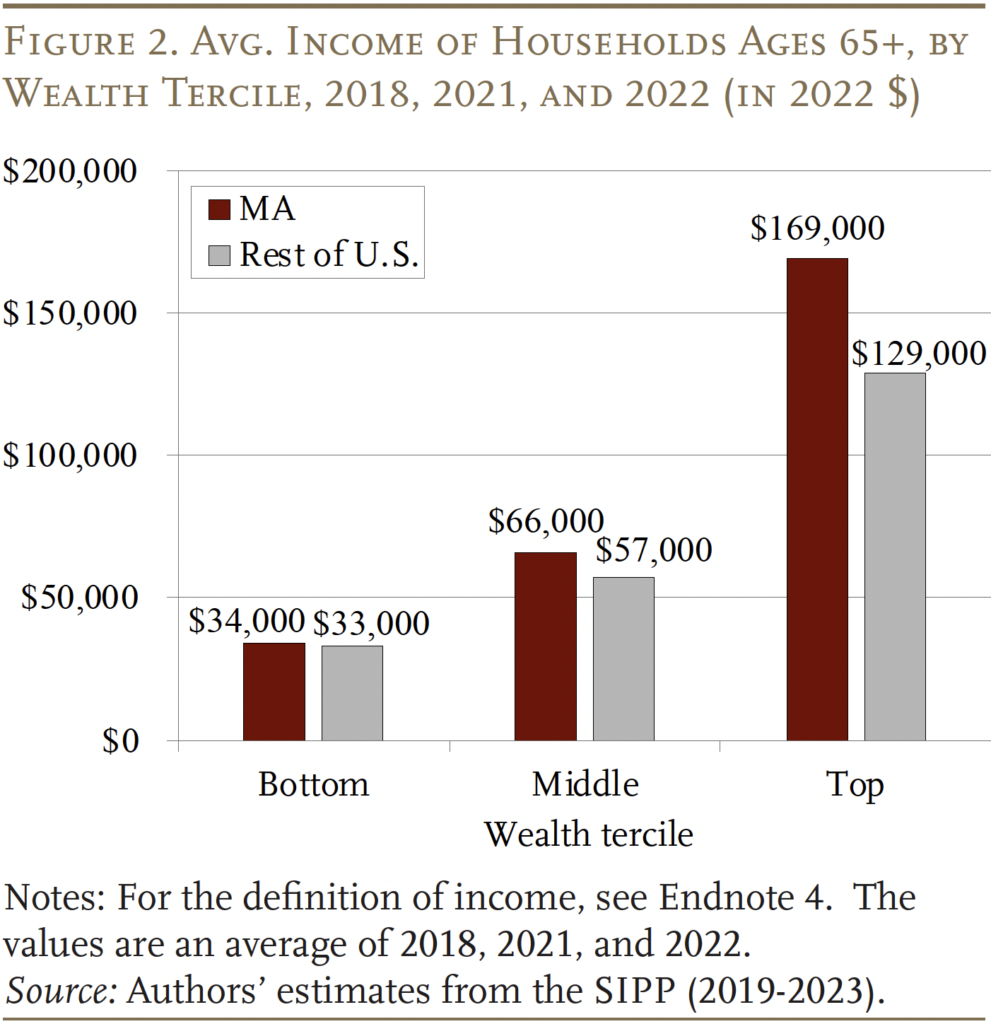

Apparently, nevertheless, giant disparities in wealth don’t at all times translate into comparable gaps in earnings (see Determine 2).4 Certainly, whereas earnings can also be greater in Massachusetts than in the remainder of the nation, the gaps are comparatively modest. For instance, older households in Massachusetts within the backside third have twice as a lot wealth as their counterparts in different states, however solely 5 p.c extra earnings.

Price of Residing

The query is how the excessive price of residing in Massachusetts impacts the well-being of older households. The reply requires evaluating every family’s earnings to a sufficiency price range to estimate the share of households unable to cowl primary bills. The sufficiency price range comes from the Elder Index, which measures the disposable earnings obligatory for a family in a particular county to age in place.5 The price range contains groceries, housing, transportation, and well being bills.6 Along with geography, the Elder Index varies by marital and residential possession standing.

In observe, assessing the share of households falling brief requires three intermediate steps. First, because the Elder Index is an after-tax idea, the evaluation estimates the federal and state earnings tax burden confronted by every older family within the SIPP and subtracts these taxes from reported earnings.7 Then, the evaluation aggregates the county-level Elder Index as much as the state degree by taking a mean inside every state, weighted by the county inhabitants. Lastly, the evaluation matches SIPP households with the Elder Index primarily based on state, marital standing, homeownership and mortgage standing, and well being. Evaluating after-tax earnings with the Elder Index sufficiency price range yields the share of older households falling brief.

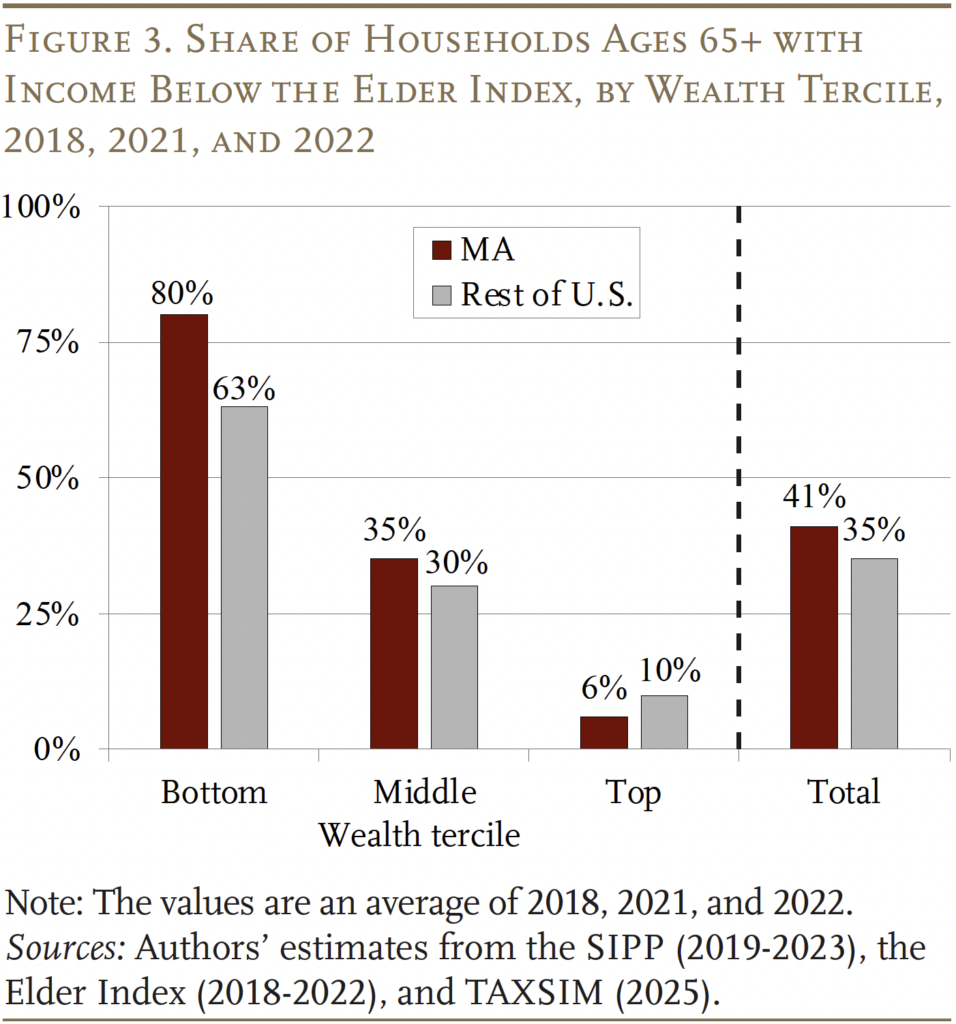

Finally, Determine 3 suggests {that a} full 80 p.c of low-wealth older households in Massachusetts have inadequate earnings. In distinction, solely 63 p.c of low-wealth older households fall brief elsewhere within the nation. The share drops sharply to 35 p.c for middle-wealth households in Massachusetts – not meaningfully greater than different states – and solely 6 p.c for high-wealth households.

Racial and Ethnic Disparities

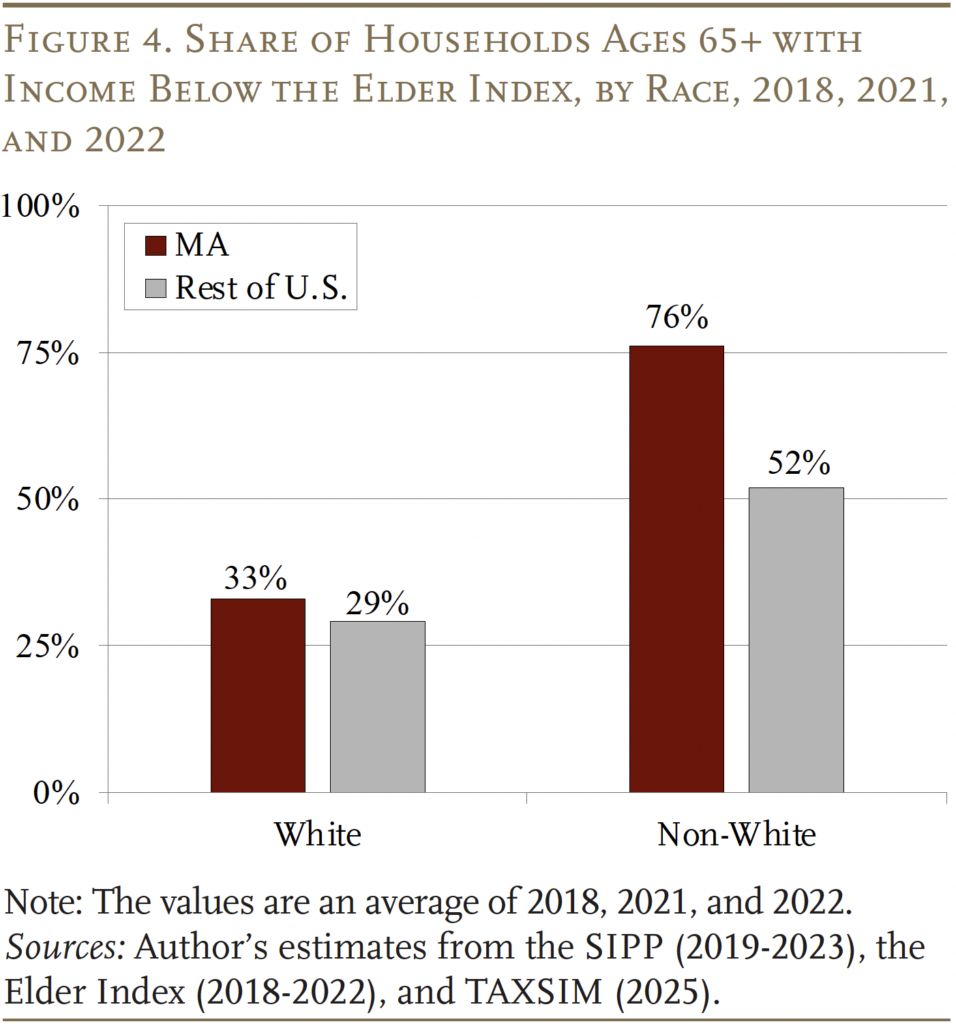

The burden posed by Massachusetts’ excessive price of residing hits older households of colour notably onerous. As proven in Determine 4, about three-quarters of non-White older households in Massachusetts have disposable earnings under the Elder Index, in comparison with one-third of White households. This share is far greater than the remainder of the U.S., the place 52 p.c of non-White older households fall brief (and 29 p.c of White households).

The query, after all, is how low-income older households are capable of make ends meet in such an costly state. The subsequent part explores that query.

Insights from Interviews

Whereas the quantitative evaluation paperwork the monetary pressures confronted by older households in Massachusetts, it doesn’t seize what life appears like for seniors with little or no wealth or how they make ends meet.

To handle these points, we carried out 29 interviews with low-income (lower than $50,000) Massachusetts seniors (ages 65+), residing in Boston and its speedy suburbs. Nearly all of individuals (22) determine as Black, three as Hispanic, one as White, and two most popular to not reply. Two individuals had been males, and the rest had been ladies. Annual family incomes vary from $7,200 to $50,000, with a median of $20,369. Native senior-serving nonprofits offered steerage for individuals on how to enroll. The interviews had been one-hour conversations, both by cellphone or in individual, carried out in English or Spanish. They adopted a set of predetermined inquiries to information the dialogue. Contributors had been compensated for his or her time with a present card.8

5 main findings emerged from the interviews.

1. Many Noticed Their Normal-of-Residing Decline

The transition from working to retirement introduced vital monetary and psychological changes, as seniors shifted from a interval of monetary flexibility to one in every of cautious budgeting and restraint. Many described how, once they had been working, they spent extra freely:

“Once I was working, it was completely different, as a result of I’d spend, spend, spend, spend, spend, I didn’t care, as a result of I knew I had cash coming in. However now that I’m not working…I gotta decelerate.”

The shift to a lowered earnings forces retirees to regulate their spending habits, reducing again on non-essential purchases, as one individual shares:

“I simply retired in December, so I’m simply going into being retired. For me, it’s like simply studying find out how to separate spending once I don’t have to spend, solely spend when I’ve to.”

For others, bills that had been as soon as manageable – like eating out or touring – can grow to be troublesome decisions, weighed in opposition to requirements like housing, healthcare, and utilities. As one individual put it:

“I had every little thing I wished, every little thing I wanted, or something I wished to purchase, however, you realize, I perceive that’s now not there anymore.”

Retirement isn’t just a monetary adjustment – it is usually a shift in mentality. Those that as soon as had monetary safety however have seen their circumstances change really feel a way of loss, but are reluctant to simply accept assist. One individual described this shift, saying:

“Some folks have been on that pedestal and unexpectedly they’re not on the pedestal anymore.”

2. Low-income Seniors Rely Closely on Social Safety

The survey additionally requested in regards to the participant’s main supply of earnings. As one would anticipate, it turned out to be Social Safety, provided that low-income households are unlikely to have substantial property or earnings from employer-based retirement plans.

Among the many 29 seniors interviewed, solely two presently had financial savings in a 401(okay) plan and one held an IRA. A number of others reported having 401(okay) financial savings earlier in life, however stated they’d been compelled to withdraw from these accounts previous to retirement.

“So, once I retired or stopped working for them, I went by means of what I had in there [in a 401(k)], and that was going again into the early 90s, as a result of I wanted it…”

4 individuals had a conventional pension from their previous jobs or these of their partner. Nonetheless, the extent of stability offered by the pension different. One individual reported that the pension and the investments by her union gave her good monetary stability, receiving well being and dental insurance coverage by means of the union. Different individuals had been grateful, however famous the constraints:

“I’m not begging, that’s what I’ll say. Positive, I don’t get every little thing, however I’m grateful. I’m right here. I pay my hire out of my pension. I get my meals out of my pension. And I pay my mild invoice out of my pension.”

Given the restricted help from retirement plans, an important supply of earnings was Social Safety. Over half of survey individuals (17 of the 29) relied on Social Safety for 90 p.c of their help.9 Many individuals had retired early as a result of incapacity or different well being points, which implies their month-to-month Social Safety advantages had been a lot decrease than if they’d delayed claiming.

Since Social Safety was by no means meant to be a retiree’s sole supply of help, these advantages left many residing in a high-cost state developing brief.10 In consequence, one participant was working full-time and three had been working part-time. One employee defined:

“My earnings that I get from Social Safety, I don’t assume is sufficient for me to pay my payments, for my automotive, my automotive insurance coverage, life insurance coverage, all that. I’ve to work.”

Whereas some turned to work, different individuals turned to means-tested profit packages. Whereas they lamented this shift in life-style, they’re extraordinarily grateful that these advantages can be found:11

“You already know, we’re residing once more, a really sponsored life, and that is what it has come to. It hasn’t at all times been like that…however these are completely different instances now for us in my well being and age, and that is working for us.”

“…for those that really want it, it’s such a blessing to have these type of assets in place.”

3. Sponsored Housing is Essential

For a lot of low-income seniors, sponsored housing offers a lifeline, making certain they’ll safe secure residing circumstances and keep away from falling into monetary misery. One participant defined:

“I need to preserve having a roof over my head, as a result of being homeless just isn’t a joke. So my first precedence might be ensuring, if I don’t do anything, I be certain that my hire is paid.”

On the identical time, others discover themselves caught in an earnings hole – incomes an excessive amount of to qualify for low-income housing, however too little to afford market-rate models.

“… why are they making so many models so costly for seniors? It’s not serving to folks like myself and others that retire.”

Others described the lengthy and unsure waitlists for sponsored housing, saying:

“You simply must be hopeful and say, you’re going to get referred to as, you’re going to get picked for the lottery. However, you realize, there’s hundreds of purposes that go right into a lottery.”

For the older adults who personal their houses, holding onto their property stays essential – not solely as a result of mortgage funds could also be extra reasonably priced than hire, but additionally as a result of homeownership represents a long-term funding for his or her households. A number of owners defined:

“What do I would like with a one-family home? However proper now, once I pay for my mortgage, it was cheaper than if I’m going out right here and get a one-bedroom…”

“The one factor that type of throws me off is the true property invoice…not the mortgage, it’s the property tax.”

“I knew once I retired my earnings could be completely different, so I wouldn’t need that expense, these bills, as a result of proudly owning a home, it’s dearer…property actual property taxes are simply…loopy now.”

Finally, whether or not renting or proudly owning, housing stays the only most essential monetary concern for low-income seniors. For almost all, sponsored housing is a key technique for sustaining monetary stability and assembly primary wants.

4. Assist Networks Are Key for Data on Sources

One respondent articulated the difficulties many older adults face to find and utilizing the assets obtainable in Boston:

“…I turned very resourceful in studying what all of the assets that Boston [has]…as a result of relying on who we’re, and who we all know, we might not…have entry to all of that…typically don’t hear about it, don’t know find out how to go about it.”

One other participant spoke about how being new to Boston and, as a local Spanish-speaker, not talking the language made accessing companies particularly troublesome:

“…up to now it was very onerous to enroll in advantages. I didn’t have the data, I didn’t know the language, I didn’t know what assets existed, I didn’t know the place they had been positioned.”

Whereas Boston has a variety of assets for seniors, the participant highlights how troublesome it may be for older adults to navigate these choices and entry may be contingent on one’s community and social capital.

Within the absence of satisfactory formal help, low-income seniors lean on casual networks to share assets. One individual described a tradition of mutual support amongst their friends:

“If it’s one thing that I don’t need, I share with them, that’s how we do. We share with one another. We swap off. ‘If you need this, take it. If you need that, take it.”

The overarching theme that emerges from these feedback is the need for extra strong help methods which are simply accessible and well-known to those that want them.

5. Household Present Non-Financial Assist

Retirement usually reshapes household roles and expectations, particularly for seniors who as soon as offered monetary help to family members. Some retirees discover themselves setting new boundaries, as they’ll now not give cash as freely as they as soon as did:

“There’s a giant distinction now…they’re so used to me giving, giving, giving, giving, so now it’s caught of their head, like, ‘Even when she isn’t bought, I’m gonna go ask her.’”

Many older adults highlighted a widespread recognition that youthful generations face excessive housing prices, pupil mortgage debt, and different monetary challenges, making it troublesome to justify searching for their help:

“I don’t attain out to them for something like that financially, as a result of I do know…they’re simply making ends meet and with a mortgage and placing a son by means of school…”

Nonetheless, some seniors do view household as a final resort in emergencies. One individual, when requested whether or not they had emergency financial savings, responded with laughter:

“Sure and no: my daughter.”

Whereas these older adults favor to keep away from asking for cash, many obtain help by means of caregiving, small presents, or sensible assist. One older grownup described how their daughter offers small however significant gestures:

“…typically she’ll say, ‘Mommy, right here’s an additional $20 or one thing. Go purchase your self some lunch.’ A number of the time she’s within the grocery retailer purchasing for her family, and she or he’ll see issues that I would like…”

One other senior emphasised the significance of emotional relatively than monetary help:

“We do the ethical help factor, the household love, the emotional help.”

Whereas few older adults depend on their households financially, these relationships stay an important supply of stability – by means of caregiving, emotional help, and the data that household is there if actually wanted.

Conclusion

Probably the most highly effective instruments for enhancing the monetary safety of low-wealth seniors are in federal arms, the place insurance policies have the broadest attain and scale. However the rising unpredictability of nationwide coverage is making state and native motion extra important. Massachusetts can not resolve this problem alone, however it might probably take significant steps to ease monetary pressures for as we speak’s older adults and assist tomorrow’s retirees construct higher stability. Two lively coverage concepts illustrate how state-level efforts may make a distinction.

First, for the seniors we spoke with who do personal houses, property taxes – not mortgage funds – emerged as one in every of their most urgent monetary burdens. Massachusetts, like many states, permits qualifying older adults to defer property tax funds for so long as they continue to be of their houses. This selection can release much-needed month-to-month money, however present participation stays low as a result of advanced utility processes and restrictive eligibility guidelines. The Heart for Retirement Analysis recommends three reforms to strengthen this system: 1) get rid of earnings limits to widen entry; 2) simplify enrollment to encourage participation, and three) shift the monetary burden from municipalities to the state to make sure sustainability.12 These modifications would make this system extra accessible and impactful, serving to extra older adults keep of their houses with out the stress of rising property taxes.

Second, for staff nonetheless a long time away from retirement, Massachusetts may assist shut the financial savings hole by adopting a Safe Selection Financial savings Program – an automated IRA for workers with out entry to employer-sponsored retirement financial savings. Auto-IRAs are a long-term technique, unlikely to help as we speak’s retirees, however they maintain huge potential for rising future retirement safety. Analysis from the Heart finds {that a} Massachusetts Safe Selection program may considerably scale back the variety of staff approaching retirement with little to no financial savings and wouldn’t pose a long-run burden to state budgets.13 Passing this laws now could be a forward-looking funding, laying the groundwork for extra financially safe senior generations to return.

Whereas the state’s relative wealth provides some benefits, its excessive price of residing and chronic financial inequality create vulnerabilities for a lot of seniors. Addressing these points would require focused efforts to enhance retirement safety and scale back disparities, making certain that each one older adults can age in place with dignity and monetary stability.

References

Aubry, Jean-Pierre. 2024. “A Massachusetts Auto-IRA Program.” Particular Report. Chestnut Hill, MA: Heart for Retirement Analysis at Boston Faculty.

Aubry, Jean-Pierre and Laura D. Quinby. 2024. “How Does Inflation Affect Close to Retirees and Retirees?” Subject in Temporary 24-12. Chestnut Hill, MA: Heart for Retirement Analysis at Boston Faculty.

Chen, Anqi, Alicia H. Munnell, and Nilufer Gok. 2025. “Do Households Have a Good Sense of Their Lengthy-Time period Care Dangers?” Subject in Temporary 25-3. Chestnut Hill, MA: Heart for Retirement Analysis at Boston Faculty.

Dushi, Irena, Brad Trenkamp, Charles Adam Bee, and Joshua W. Mitchell. 2025. “Measuring Earnings of the Aged in Family Surveys: Proof from Linked Administrative Data.” Journal of Pension Economics and Finance 24(1): 95-112.

Elder Index. 2018-2022. The Elder Index™ [Public Dataset]. Boston, MA: College of Massachusetts Boston, Gerontology Institute.

Harrington, Kelly, Luc Schuster, and Laura D. Quinby. 2025. “Wealth Gaps within the Golden Years: Financial Insecurity for Older Adults in a Excessive-Price State.” Report. Boston, MA: Boston Indicators.

Munnell, Alicia H., Wenliang Hou, and Abigail N. Walters. 2022. “Property Tax Deferral: Can a Public-Non-public Partnership Assist Present Lifetime Earnings?” In New Fashions for Managing Longevity Danger: Public Non-public Partnerships, edited by Olivia S. Mitchell, 231-257. Oxford, UK: Oxford College Press.

Nationwide Bureau of Financial Analysis. 2025. TAXSIM. Cambridge, MA.

U.S. Census Bureau. Survey of Earnings and Program Participation, 2019-2023. Washington, DC.