It has been fairly some time since I tinkered with the CPF web site.

I bear in mind how I used to go to the web site fairly often again within the days once I was actively plotting tips on how to make full use of the CPF system.

Anyway, as I shut in on 55 years of age, I made a decision to revisit the CPF web site.

That’s once I get a Retirement Account arrange.

I believed it will be a good suggestion to test on how a lot my Full Retirement Sum can be by then.

This was what I discovered:

So, it will be $220,400 for me.

My CPF-SA has greater than that proper now and it’ll proceed to develop primarily based on curiosity earned yearly alone.

Subsequently, it is not a fear for me.

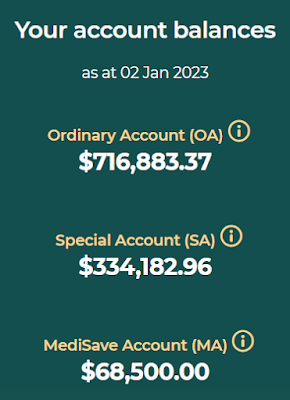

This was the way it seemed initially of the yr:

Then, I checked how a lot I might get when CPF LIFE kicks in for me at age 65.

For this, I used the CPF LIFE estimator: HERE.

I needed to inform the AI that I’m 55 years previous now to ensure that it to work after which enter the FRS for my age group.

It’s a enjoyable calculator to make use of as a result of I used to be ready to make use of sliders to vary the payout age and likewise the quantity of funds concerned to see how issues would seem like.

Anyway, if I simply caught with the FRS of $220,400 and had the payout begin routinely at age 70, I might be paid $2,380 month-to-month.

If I ought to request for payouts to start out at age 65 as a substitute, I might be paid $1,760 month-to-month.

Again in 2014, I revealed a preferred weblog put up that has obtained nearly 50,000 pageviews by now.

It was “To retire by age 45, have a plan.“

In that weblog put up, I mentioned that I needed to retire by age 45 and thought I might be fairly snug with $2,500 a month in passive earnings.

I accounted for inflation and by age 65, I would wish $5,081 a month in passive earnings.

I calculated the required month-to-month passive earnings until age 75.

In case you are to see all of the numbers at numerous ages, please go the weblog put up and I’ve hyperlinked the title earlier.

So, what’s the level I’m making an attempt to make?

For me, a minimum of, the Full Retirement Sum shouldn’t be sufficient to retire comfortably on.

At age 65, there can be an estimated shortfall of $5,081 – $1,760 = $3,321 a month.

Please do not get me unsuitable.

I feel that the CPF LIFE is an excellent thought as a result of many individuals are usually not excellent with cash and even worse at planning for retirement funding.

So, with CPF LIFE, a minimum of there’s some form of minimal security web.

Nevertheless, that’s what it’s.

A minimal security web.

In case you’re questioning what triggered this weblog put up, it was a information article on how Singaporeans are falling behind in financial savings and extra can solely afford primary bills.

See article in The Enterprise Instances: HERE.

“Extra Singaporeans can afford solely primary spending, do not have sufficient financial savings, a survey by OCBC discovered.”

“Most should not have ample “emergency funds” or sufficient financial savings to satisfy their households’ wants over the subsequent yr.”

We actually need to take motion early to assist guarantee retirement funding adequacy.

Throughout good instances, do not turn into complacent as a result of dangerous instances might hit us once we least anticipate them to.

At all times have a disaster mentality.

It won’t be enjoyable however we must always do higher than those that do not.

If AK can do it, so are you able to!

Notice: Numbers are primarily based on CPF LIFE Normal Plan.

Just lately revealed:

3.75% p.a. cut-off yield for T-bill.