The transient’s key findings are:

- Many commentators contend that – at any given time – solely 50 p.c of personal sector employees take part in an employer-sponsored retirement plan.

- The query is whether or not this case has improved lately.

- The evaluation compares the info from a number of main surveys, and the outcomes affirm the “50 p.c” quantity nonetheless holds.

- In fact, protection charges are increased than participation charges, and a few employees decide up protection sooner or later over their worklife.

- However the lack of steady participation in a plan stays a major problem.

Introduction

For many years, we and different commentators have asserted that, at any given time, roughly 50 p.c of personal sector employees take part in an employer-sponsored retirement plan. It was once straightforward to take a look at the “50 p.c” quantity as a result of the federal authorities’s Present Inhabitants Survey (CPS) produced information on protection and participation for private and non-private sector employees. The CPS, nevertheless, now not gives dependable data with regard to retirement plans. In consequence, some commentators have turned to the federal government’s Nationwide Compensation Survey (NCS), which experiences information offered by employers slightly than employees. On the identical time, they’ve shifted the main focus from participation to protection – suggesting a a lot rosier image. The query is whether or not the scenario within the personal sector has improved over time.

To reply that query, this transient makes use of a variety of datasets to have a look at employee participation in personal sector plans. The primary part experiences on the power and limitations of the annual information from the U.S. Bureau of Labor Statistics, each the employer-based NCS and the household-based CPS. The second part describes pension exercise from three different family surveys – the Survey of Revenue and Program Participation (SIPP), the Survey of Shopper Funds (SCF), and the Panel Examine of Revenue Dynamics (PSID). The third part summarizes latest efforts to regulate the CPS to derive extra related figures on protection and participation.

The ultimate part concludes that the NCS, which reveals 53 p.c of personal sector employees collaborating in a retirement plan, is roughly in step with findings from the SIPP and PSID, which present 52 and 50 p.c, respectively. Furthermore, efforts to treatment issues within the CPS additionally produce a personal sector participation estimate of 49 p.c. The one outlier to those estimates is the newest one from the SCF, which reveals a rise from 54 to 58 p.c participation from 2019 to 2022. Taking all of the surveys and changes into consideration, our greatest estimate continues to be that, at any given level, roughly half of personal sector employees take part in any employer-sponsored retirement plan, though a bigger share have entry to a plan.1

Protection & Participation from the Bureau of Labor Statistics

The U.S. Bureau of Labor Statistics releases two experiences that present the share of employees who’re lined by, and take part in, employer-sponsored retirement plans – both outlined profit plans or 401(ok)-like outlined contribution plans. The Present Inhabitants Survey (CPS), which is produced collectively with the U.S. Census Bureau, has been interviewing households on a month-to-month foundation for about 70 years, and, since 1980, the survey’s Annual March Social and Financial Complement has offered information on pension protection. As well as, the Nationwide Compensation Survey (NCS), which has been produced yearly since 1996, at the moment interviews 11,500 personal sector employers (protecting 127 million employees) about whether or not they supply retirement plans and the extent to which their workers take part.2 The next describes the enchantment and limitations of every of those surveys, beginning with the NCS.

Nationwide Compensation Survey

The NCS gives complete measures of occupational earnings, employment value tendencies, profit incidence, and detailed profit provisions. The benefit of this survey is the big pattern measurement and the relative reliability of the info. The disadvantage for these involved about employees and not using a plan is that the NCS contains nothing past trade and earnings; it gives no data by age, marital standing, ethnicity, schooling, gender, and so on. for these with and and not using a office retirement plan. That stated, the NCS is an efficient place to start out.

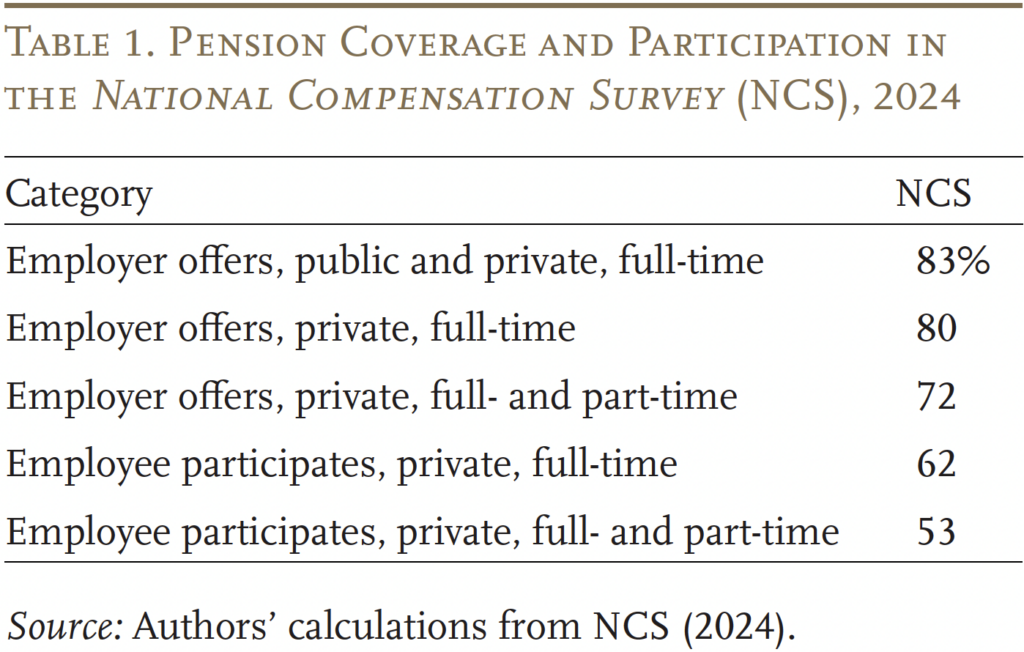

The NCS experiences that, in 2024, 83 p.c of full-time employees had an employer that sponsors a retirement plan (see Desk 1). That quantity appears to be like very totally different from the “50 p.c” that we and different commentators generally cite. A number of changes make the 2 measures extra comparable. First, the 83-percent determine refers to full-time employees in each the personal sector and state and native governments. Nearly all full-time state and native employees are supplied a pension, usually an outlined profit plan. Remove state and native employers and the protection determine for full-time employees within the personal sector drops to 80 p.c. The second situation is full-time versus part-time. Add in part-time employees and the 80 p.c drops to 72 p.c. The third situation is participation versus entry. Solely about three-quarters of personal sector employees who’re supplied a plan select to take part. Thus, the NCS experiences that solely 53 p.c of personal sector employees (together with each full-time and part-time) take part in a retirement plan.

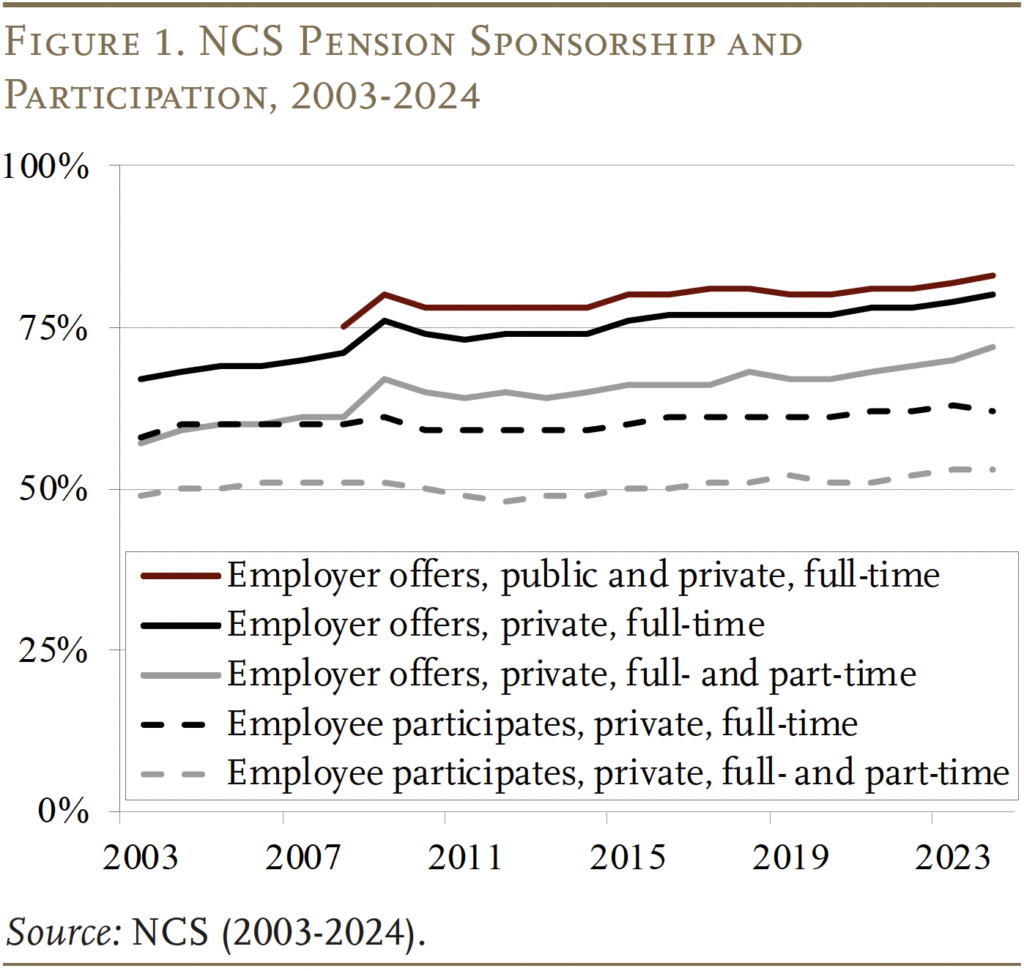

The NCS can be helpful for assessing the extent to which protection and participation have modified during the last 20 years (see Determine 1). At first look, wanting over the entire interval since 2003, it seems that the share of personal sector employers providing a plan has elevated, however the share of employees collaborating has fluctuated round 50 p.c. That sample will not be in step with information reported by Vanguard exhibiting the “take-up charge” rising over time on account of the enlargement of auto-enrollment in 401(ok) plans.3 We might recommend specializing in the years 2009-2024, which present a mainly secure sample, with a slight uptick in each protection and participation within the tight labor market that adopted COVID. The underside line is that the NCS is mainly in step with the “50-percent” participation story. How concerning the CPS?

Present Inhabitants Survey

In idea, the CPS is the proper dataset for figuring out the extent of and tendencies in pension protection. It gives all of the demographic information one may need, it goes again 4 a long time, and it has geographic element. Since 1980 the CPS has persistently requested people two questions on retirement plans: 1) did the employer you labored for have a pension or different sort of retirement plan for any of its workers? and a pair of) have been you included within the plan?4

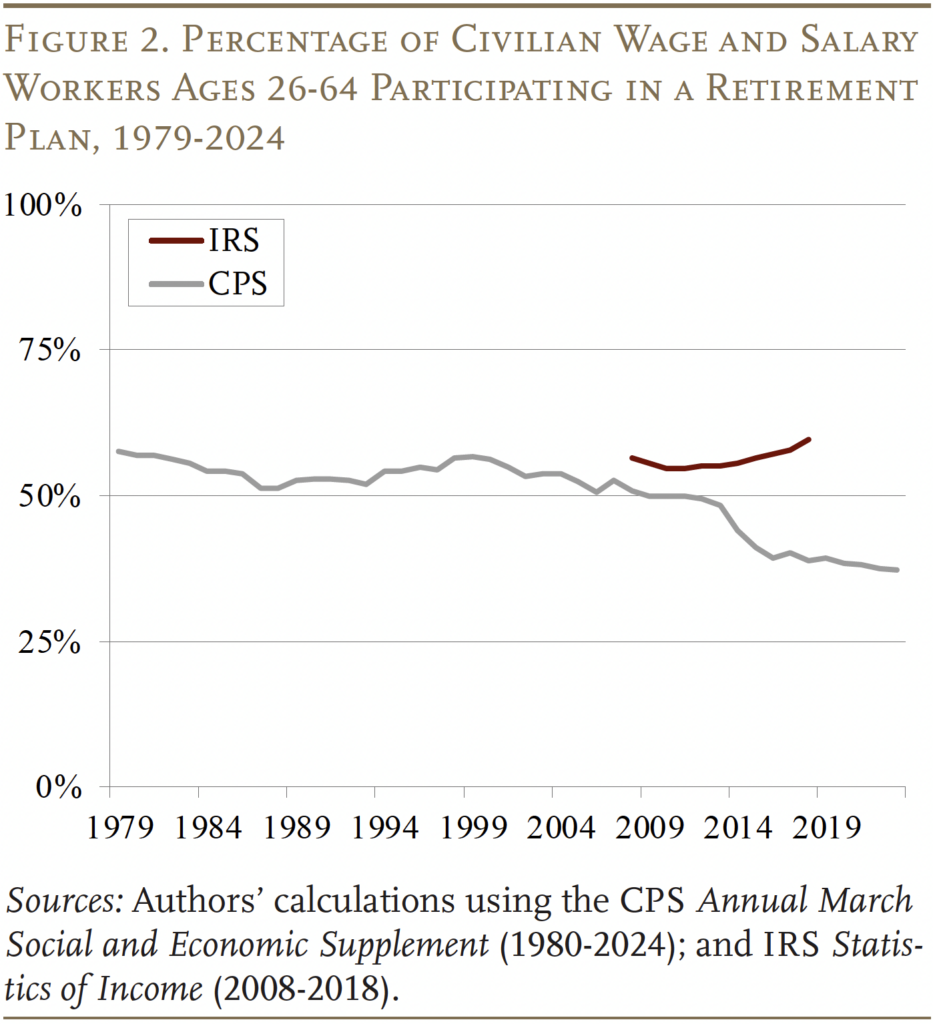

These questions produced affordable outcomes for many years. Importantly, till 2014 the CPS participation charges have been solely barely decrease than these from the IRS Statistics of Revenue for W-2 filings, which experiences the share of complete wage and wage employees who had both: 1) ticked a field saying they’d protection beneath an employer-sponsored retirement plan; or 2) contributed to a office retirement plan. These numbers function an vital benchmark for judging the accuracy of the CPS protection statistics (see Determine 2). (Notice, the info in Determine 2 consult with all “civilian” employees, as a result of the IRS doesn’t separate personal and public sector workers.)

In 2014, nevertheless, the image modified dramatically after a redesign of the CPS. Participation charges instantly fell properly under the IRS numbers and have continued to say no to astonishing ranges. Nobody believes that solely 37 p.c of U.S. civilian employees take part in a retirement plan.

What explains the collapse within the CPS pension participation numbers? Nobody is aware of for certain. Though the CPS protection questions didn’t change in 2014, new questions have been inserted earlier than the protection questions. The brand new questions – designed to get a greater measure of earnings – requested concerning the existence of, and withdrawals from, retirement accounts and referred on to a number of various kinds of accounts, together with 401(ok)s, 403(b)s, and numerous forms of IRAs. One researcher means that when the prevailing protection questions have been requested at a later level within the survey, some respondents may need perceived that they have been asking about further retirement plans and due to this fact didn’t reply affirmatively.5 Regardless of the motive, the CPS undercounts employees collaborating in a retirement plan and, sadly, is now not a significant information supply for pension participation. The query is whether or not helpful data might be gleaned from different family surveys.

Pension Participation in Different Family Surveys

Three main family datasets – the Survey of Revenue and Program Participation (SIPP), the Panel Examine of Revenue Dynamics (PSID), and the Survey of Shopper Funds (SCF)– discover pension protection and participation.6 For researchers and policymakers, the benefit of those surveys is that they embrace intensive demographic and monetary details about the family. The next describes every dataset in flip, starting with the SIPP, which has essentially the most difficult historical past with respect to its plan participation questions.

Survey of Revenue and Program Participation

The Demographic Surveys Division of the U.S. Census Bureau has carried out the SIPP since 1984, though the dataset underwent a substantial redesign in 2014. Previous to that redesign, a brand-new panel of people was began yearly previous to 1993 after which each three to 4 years after that. The final pre-redesign panel occurred in 2008. Every panel of people was requested a sequence of core questions each 4 months for 2 and a half to 5 years. Questions on pension participation weren’t requested on this core set of questions, however as an alternative no less than as soon as per panel as a part of the topical module “Retirement Expectations and Pension Plan Protection.” Inside this module, people have been requested whether or not they have been supplied a plan, whether or not they participated in a plan, and the kind of plan for the first and secondary plans. The design allowed for a biennial or triennial sequence starting in 1985.

Beginning in 2014, the SIPP was modified to an annual interview with out topical modules. Whereas the preliminary panel of this redesigned SIPP collected 4 waves of annual information, questions on present participation in retirement plans have been solely requested a single time, in a particular “Social Safety Complement” in 2014. The questions on this complement have been much like these within the outdated topical modules.

Following that complement, the SIPP didn’t ask questions on participation in present employer-sponsored retirement plans once more till the 2021 SIPP Questionnaire.7 Beginning in January 2021 and persevering with in 2022 and 2023, the SIPP started asking about participation in pension plans supplied by the person’s primary employer in December of the prior yr. As an alternative of asking about main and secondary plans, people have been requested three questions on whether or not their primary employer offered: 1) an IRA; 2) a 401(ok); and/or 3) an outlined profit/money stability plan. People have been then requested questions on contributions to every of those plans. For functions of this transient, employees are stated to be collaborating in an supplied IRA or 401(ok) in the event that they indicated that they have been contributing. All folks whose employers supplied an outlined profit/money stability plan have been assumed to be collaborating.

Panel Examine of Revenue Dynamics

The PSID is a longitudinal survey carried out by the Survey Analysis Heart on the College of Michigan’s Institute for Social Analysis. Since 1969, the PSID has adopted the identical set of households (with minor exceptions) with low pattern attrition charges, which creates a wonderful supply of knowledge for quite a lot of analysis points. Nonetheless, till 1999, pension information from the PSID have been considerably restricted, making the derivation of a constant measurement of pension participation troublesome. In 1999, a brand new part was added to the core questionnaire that launched easy questions on participation in any employer-sponsored retirement plan for each the family’s designated PSID respondent and the partner. As a result of these questions haven’t modified materially since 1999, this part of the PSID makes it attainable to derive a biennial sequence on pension participation from 1999-2021, the newest wave out there.

Survey of Shopper Funds

The U.S. Board of Governors of the Federal Reserve System has carried out the SCF each three years since 1983. The survey samples about 5,000 households and, whereas it oversamples high-income households, is made nationally consultant utilizing survey weights. The SCF asks about inclusion in employer-sponsored plans and, for these included, about the kind of plans concerned. As well as, as a result of the SCF is primarily targeted on analyzing wealth, it additionally asks questions on the degrees of funding that households have in retirement plans in addition to future promised advantages. Like the opposite family surveys, the SCF permits breakdowns by demographic traits.

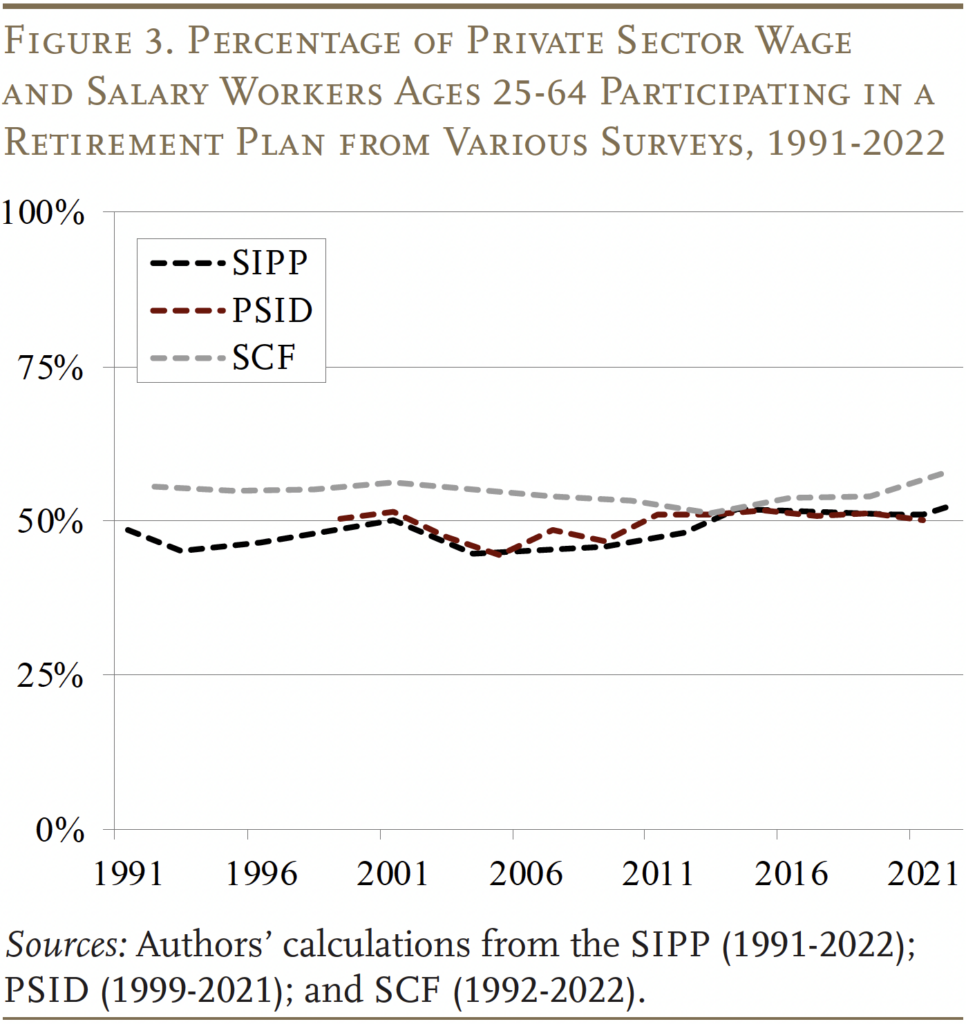

Determine 3 compares pension participation information from the three family surveys for 1991 to the current. The evaluation focuses on personal sector wage and wage employees ages 25-64, though, as indicated above, the years out there and query wording differ from one survey to a different. Whereas pension participation has risen and fallen for brief intervals, all three datasets present comparatively secure participation charges over the interval 1991-2022. The surveys recommend that, during the last three a long time, between 44 and 58 p.c of personal sector workers are collaborating in some type of pension plan in any given yr. The newest SIPP and PSID estimates fall in the midst of the historic vary, at 52 and 50 p.c respectively, whereas the newest yr of the SCF accommodates the upper-end estimate, maybe as a result of it seemingly contains some public sector employees.8

Efforts to Right the CPS Information

Whereas the family surveys present helpful details about participation in retirement plans, their limitations are important. Not one of the datasets present estimates each single yr, and the SCF and PSID have small samples and thus little geographic element. In consequence, researchers proceed to seek for options to the undercounting issues within the CPS, which will get round these points.

A number of economists have recommended that the brand new questions from the CPS 2019 redesign is perhaps useful in getting a greater measure of protection.9 That’s, an individual offering an affirmative response to both the normal protection questions or to having earned curiosity from a retirement account could be thought of collaborating. In a 2022 research, John Sabelhaus, who for years served as assistant director of Analysis and Statistics on the Federal Reserve, constructed an expanded dataset that added the “earned curiosity” response to determine protection. The issue is that including noticed retirement accounts over-corrected for issues within the undercounting within the CPS. The seemingly situation is that some folks with retirement accounts could now not have retirement plan protection by means of their present job. To resolve that downside, Sabelhaus turned to the SCF to calculate the share of these with balances who even have protection at their present job.

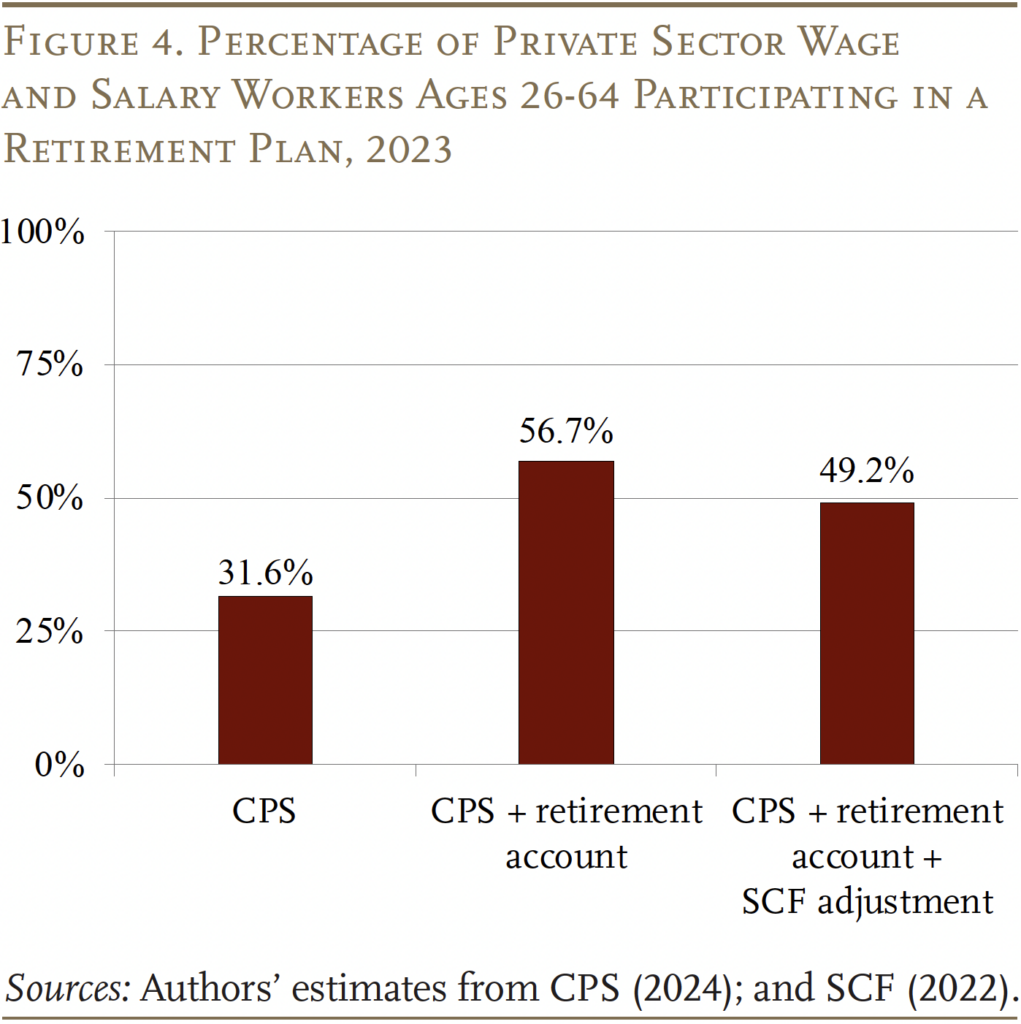

The outcomes of the Sabelhaus research aren’t corresponding to the opposite numbers on this evaluation, since his focus was protection – that’s, entry to a plan – slightly than participation. To get comparable outcomes, we utilized his methodology to the participation charges, and the outcomes are proven in Determine 4. Our estimates present that 49 p.c of personal sector employees participated in a retirement plan in 2023.

Conclusion

The conclusion from this evaluation of present datasets is that, aside from a really latest uptick in protection and participation after COVID within the SCF, participation in personal sector retirement plans has not modified very a lot over the a long time. So, it’s affordable to proceed saying that – at any cut-off date – about 50 p.c of personal sector employees take part in a retirement plan.

In fact, protection charges are increased than participation, and the image appears to be like higher if authorities employees are included. And, the next share will decide up protection someday over their worklife. However these employees who transfer out and in of protection find yourself with insufficient retirement balances, and roughly one-third of households attain their 60s with no retirement plan in any respect.10 So, sure, the shortage of steady participation in an employer-sponsored retirement plan stays a major problem.

References

Citro, Constance F. and Eric A. Hanushek, eds. 1997. Assessing Insurance policies for Retirement Revenue. Wants for Information, Analysis, and Fashions. Washington, DC: Nationwide Analysis Council, Nationwide Academy Press.

Copeland, Craig. 2020. “Retirement Plan Participation and the Present Inhabitants Survey: The Impression of New Revenue Questions on These Estimates.” Challenge Transient 499. Washington, DC: Worker Profit Analysis Institute.

Inside Income Service. 2008-2018. SOI Tax Stats – Particular person Data Return Type W-2 Statistics. Washington, DC.

Munnell, Alicia H., Anek Belbase, and Geoffrey T. Sanzenbacher. 2018. “An Evaluation of Retirement Fashions to Enhance Portability and Protection.” Particular Report. Chestnut Hill, MA: Heart for Retirement Analysis at Boston School.

Munnell, Alicia H. and Dina Bleckman. 2014. “Is Pension Protection a Drawback within the Personal Sector?” Challenge in Transient 14-7. Chestnut Hill, MA: Heart for Retirement Analysis at Boston School.

Sabelhaus, John. 2022. “The Present State of U.S. Office Retirement Plan Protection.” Working Paper 726. Philadelphia, PA: Wharton Pension Analysis Council.

Sanzenbacher, Geoffrey. 2006. “Estimating Pension Protection Utilizing Completely different Information Units.” Challenge in Transient 6-51. Chestnut Hill, MA: Heart for Retirement Analysis at Boston School.

College of Michigan, Institute for Social Analysis. Panel Examine on Revenue Dynamics, 1999-2021. Ann Arbor, MI.

U.S. Division of Labor. Nationwide Compensation Survey, 2003-2024. Washington, DC.

U.S. Board of Governors of the Federal Reserve System. Survey of Shopper Funds, 1992-2022. Washington, DC.

U.S. Census Bureau. Present Inhabitants Survey, 1979-2024. Washington, DC.

U.S. Census Bureau. Survey of Revenue and Program Participation, 1991-2023. Washington, DC.

Vanguard. 2025. “A Q&A with the Writer of How America Saves 2025.” Views: DC Retirement (April 29). Malvern, PA.