The temporary’s key findings are:

- For the reason that mid-Nineties, the typical retirement age has risen by three years.

- The query is, to what extent has working longer translated into delayed claiming of Social Safety advantages?

- Two metrics are related right here: 1) the share of all preliminary claimants who’re age 62; and a pair of) the share of all employees turning age 62 who declare at 62.

- Each present a steep drop within the share of individuals claiming at 62 over the previous 20 years, a development that continued even by means of COVID.

- In consequence, the typical claiming age has risen throughout this era by about two years, considerably lower than the typical retirement age.

Introduction

Working longer – when doable – has been typically accepted nearly as good recommendation for a safe retirement. It straight will increase present revenue; it permits individuals to contribute extra to their 401(okay)s; it shortens the interval of retirement; and, importantly, delaying claiming of Social Safety ends in a a lot larger month-to-month profit. The excellent news is that individuals have responded; the long-term development towards earlier retirement got here to a halt within the mid-Eighties, labor pressure participation charges at older ages started to extend within the mid-Nineties, and since then the typical retirement age has elevated by three years. The query is the extent to which working longer has translated into delayed claiming of Social Safety advantages.

Some data may be gleaned from the claims information revealed yearly by the U.S. Social Safety Administration (SSA). These information present, for all employees claiming advantages in a given yr, the proportion who’re ages 62, 63, 64, and so forth., which is informative for any given yr. However when the dimensions of the group turning 62 is rising considerably annually, the claims information underestimate the development towards later claiming. That’s, the information will present age-62 claimants making up a bigger portion of complete new claimants in a given yr even when a smaller proportion of these age 62 declare instantly. To precisely observe claiming habits over time, one should have a look at cohort information. Such information present, of the potential claimants turning 62 in a given yr, the proportion who declare as quickly as doable. This temporary makes use of each sources of information to take a look at the short-term – pre- and post-COVID – and long-term tendencies in claiming.

The dialogue proceeds as follows. The primary part makes use of the annual claims information to doc the change in claiming from 2019 to 2023 and the proportion claiming at 62 from 1985-2023. The second part describes the change starting within the mid-Nineties within the variety of individuals turning 62 annually and discusses how this “cohort impact” exaggerates the quantity claiming at 62 within the revealed numbers. It additionally notes that, just lately, 62-year-olds have stabilized as a share of the inhabitants so shifting sizes of age teams is just not distorting present comparisons going ahead. However birth-year information are important for any historic comparisons, so the third part compares from 1985 to 2023 the claim-age and birth-year information for claiming at age 62 and the typical claiming age utilizing the 2 sources of information. The ultimate part concludes that, it doesn’t matter what the information supply, persons are delaying claiming, though the two-year enhance within the common claiming age from 63 to 65 falls barely in need of the three-year enhance within the common retirement age.

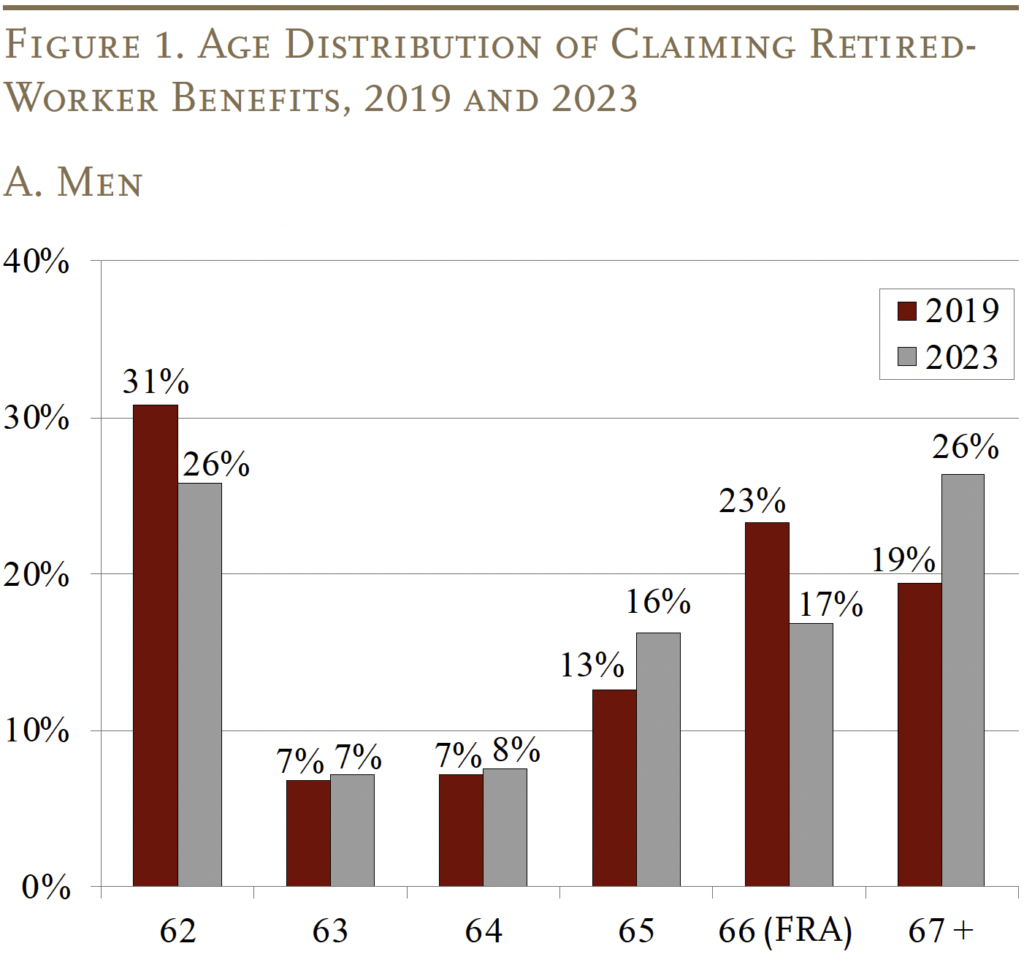

Information by Declare Yr

A lot has been written in regards to the affect of COVID on the work patterns of older adults. The consensus was that whereas the pandemic pushed many older adults out of labor, it didn’t end in earlier self-reported retirement or Social Safety claiming.1 Certainly, the distribution of each women and men by claiming age helps that early evaluation. Of these claiming advantages in 2019 and 2023, a smaller share of each women and men claimed at age 62, and a a lot bigger share claimed at ages 67+ (see Figures 1a and 1b).

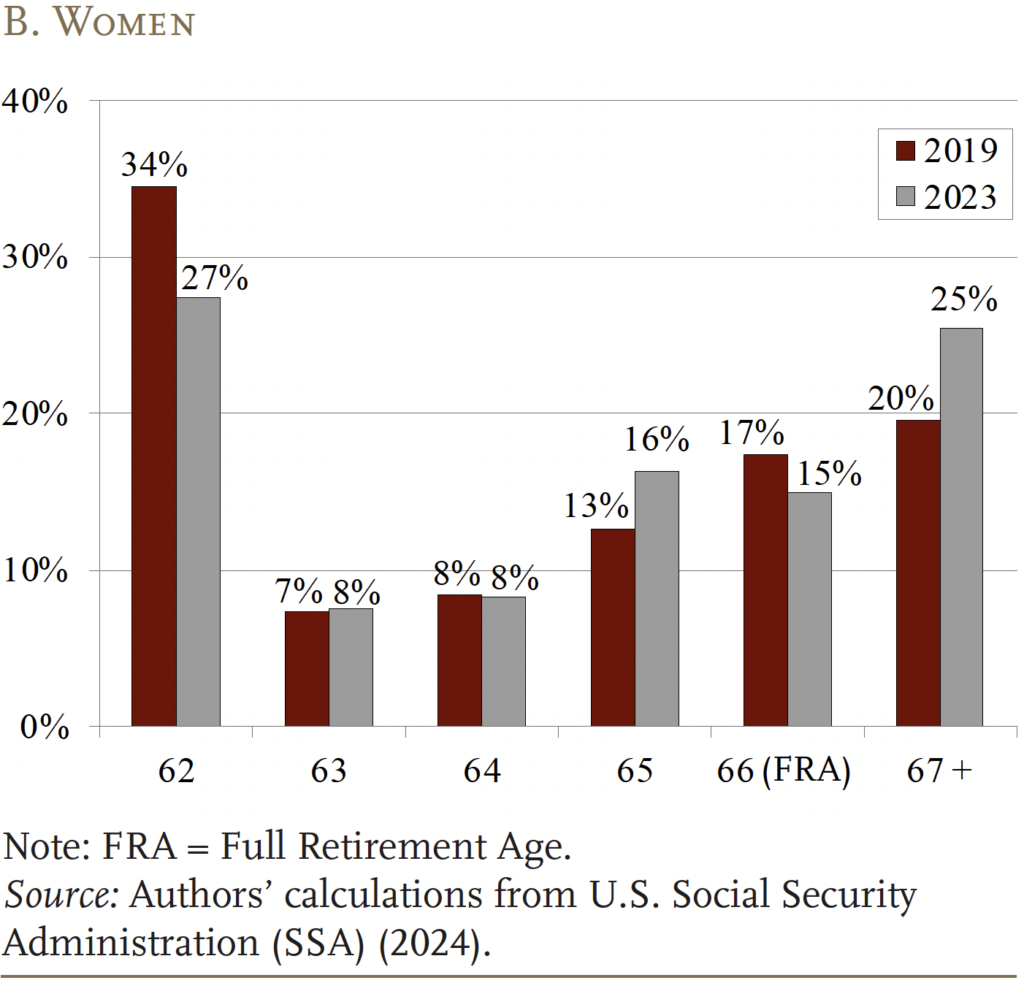

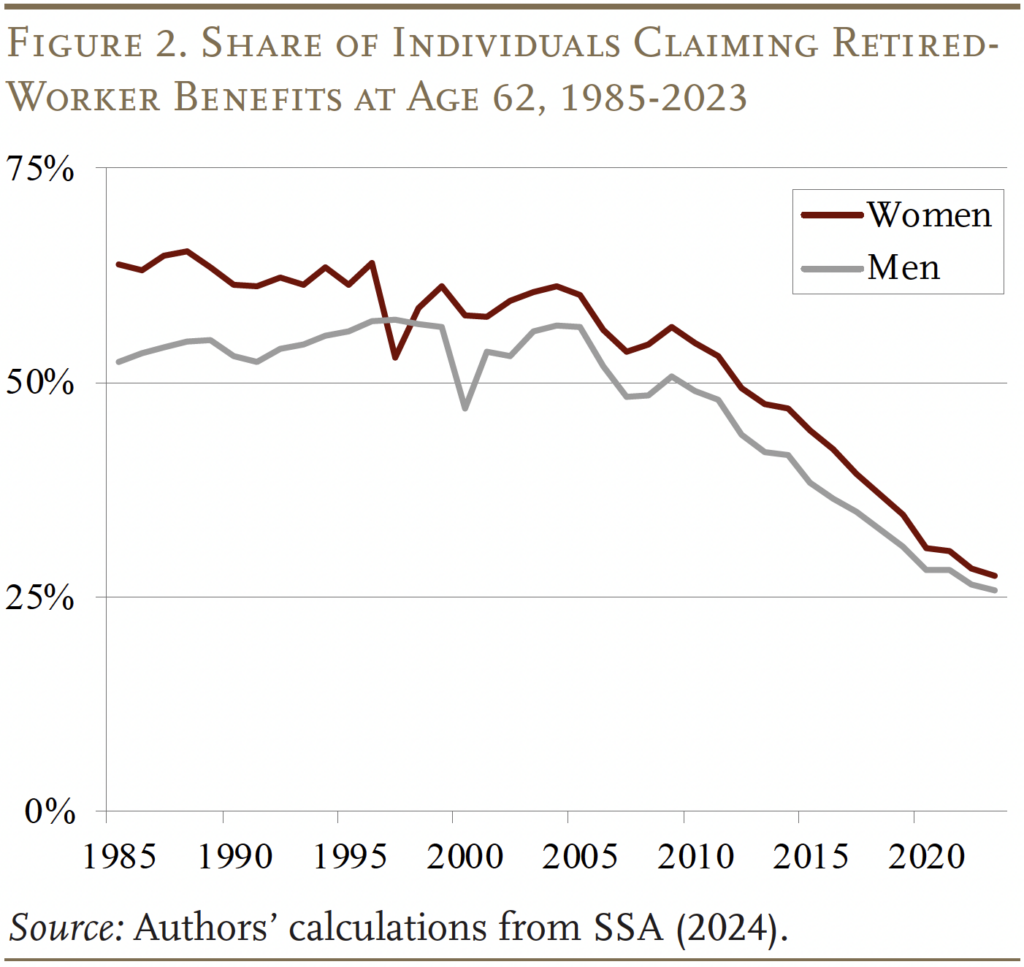

These similar information can be utilized to create a historic document of early claiming for the interval 1985-2023 (see Determine 2). Over that point, regardless of the bias created by quickly rising numbers of 62-year-olds, the proportion claiming early started to drop in 2005 – declining from round 60 p.c to lower than 30 p.c.

The issue with this determine is that the sample is inconsistent with the truth that the uptick in work effort really started within the mid-Nineties not in 2005. The inconsistency arises as a result of the variety of individuals turning age 62 began to extend dramatically in 1997, making the claim-year information appear to be many have been choosing early claiming – the so-called “cohort” impact.2

The “Cohort” Impact

An instance supplies the instinct behind the “cohort” impact. Suppose that beneficiaries can solely declare at age 62 or 63 and that 55 p.c of all individuals born in any given yr will declare at age 62 and the opposite 45 p.c will declare the next yr once they flip 63. If the quantity of people that attain ages 62 and 63 stays fixed from one yr to the following, then the SSA revealed information on declare yr and the cohort information will inform the identical story. If, as a substitute, the variety of individuals attaining age 62 grows by 10 p.c in a given yr, then the SSA revealed information will present that 57 p.c of people that declare advantages annually are age 62 and that 43 p.c are age 63.3 On this case, the SSA revealed information will exceed the unchanged claiming fee at 62 for every cohort.

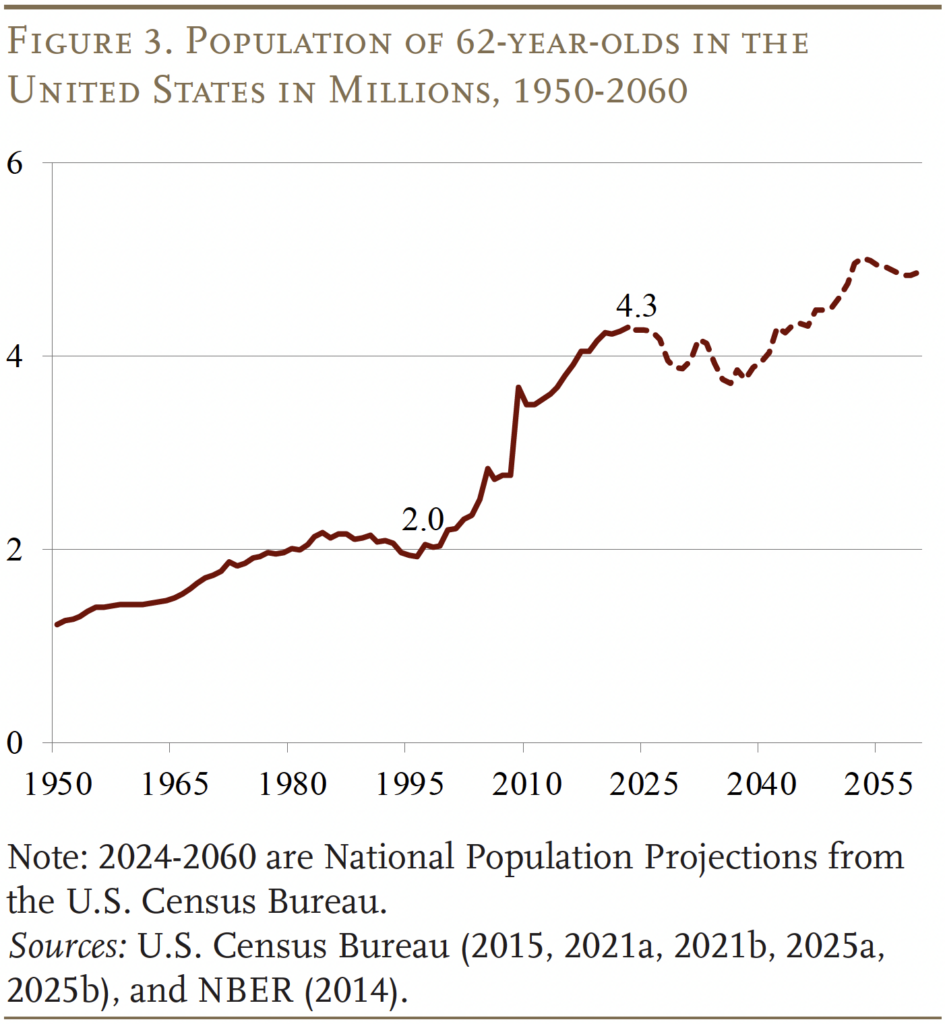

The truth is, the variety of people turning 62 started to extend considerably round 1997. Between 1997 and 2023, the annual circulation greater than doubled from 2.0 million to 4.3 million (see Determine 3). The rise dramatically altered the age construction of the inhabitants eligible for retirement advantages.

The one method to isolate the habits of, say, 62-year-olds is to find out the proportion of all people born in a given yr who claimed retired employee advantages at 62. The calculation is feasible as a result of SSA has unpublished information on the variety of individuals eligible for retired-worker advantages by beginning yr. The duty is then to allocate cohort totals amongst claiming ages based mostly on SSA’s revealed information.4

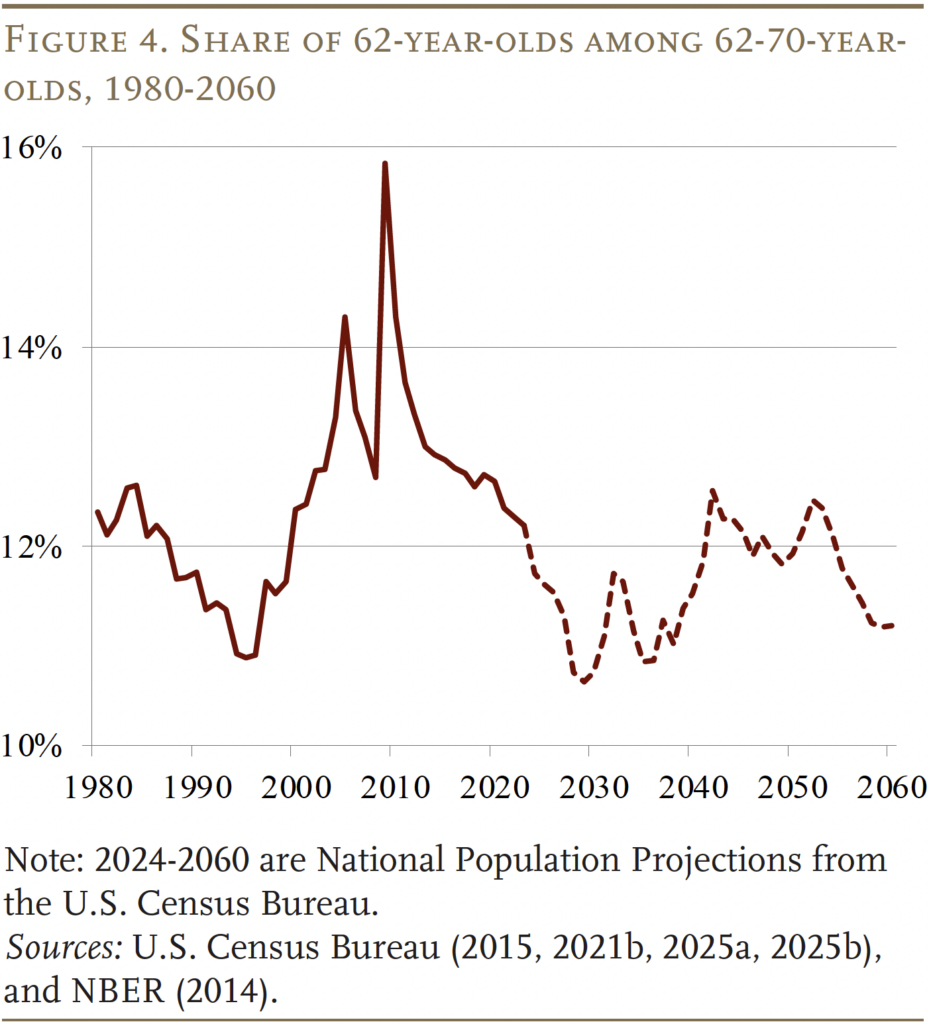

Earlier than reporting the outcomes by beginning yr, it ought to be famous that the “cohort impact” is simply related for evaluating long-term tendencies. The share of 62-year-olds amongst these 62-70 has now returned to roughly 12 p.c of the whole (see Determine 4), which implies that, at the moment, the revealed information by declare age will present a significant depiction of claiming tendencies. That’s, the revealed information for claiming between 2019 and 2023 don’t embody any cohort results. For a historic perspective, nevertheless, the birth-year information stay important.

Evaluating Outcomes by Declare Yr and Delivery Yr

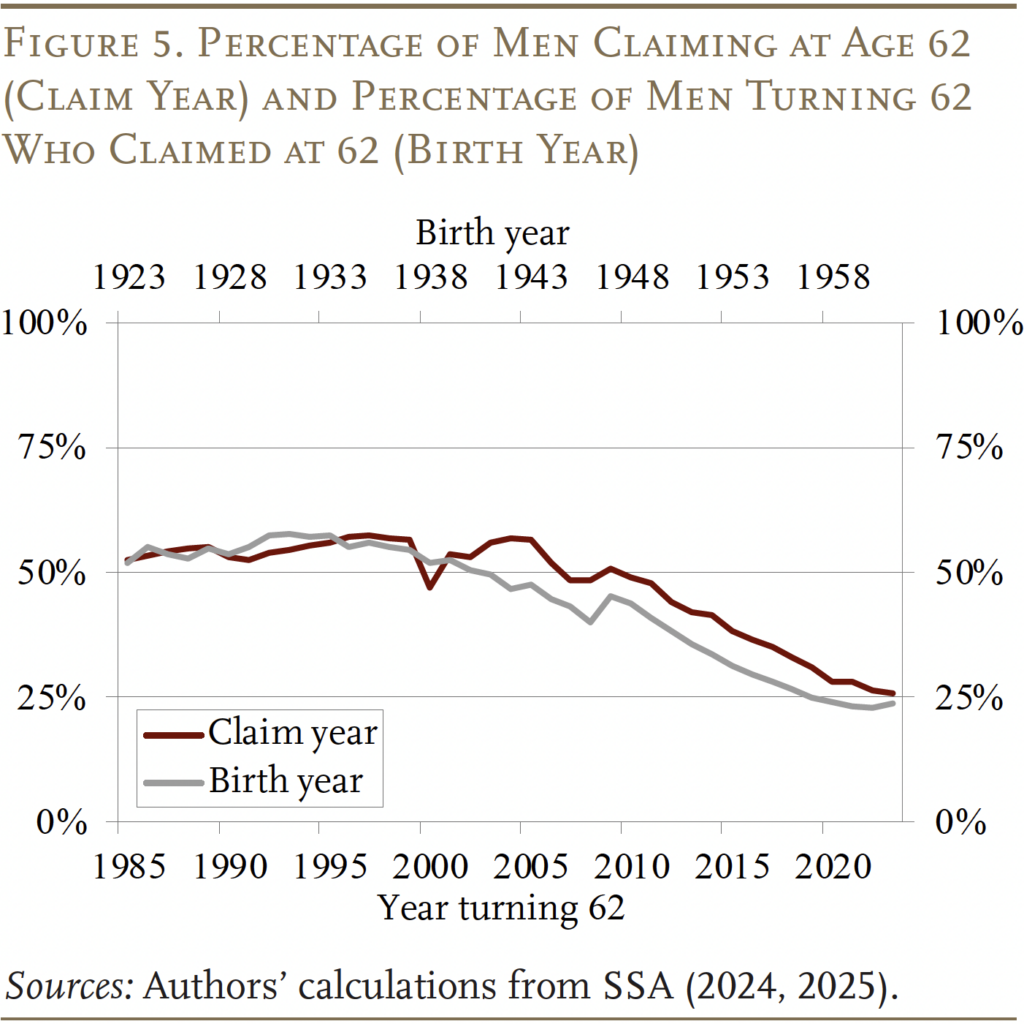

Determine 5 compares the proportion of males claiming at age 62 on a claim-year and birth-year (cohort) foundation. The 2 approaches present very related outcomes till 1997; afterward, the 2 sequence begin to diverge. The cohort information mirror the uptick in labor pressure exercise starting within the mid-Nineties – with longer work lives resulting in later claiming – and present a a lot bigger decline during the last three a long time than the claim-age information.

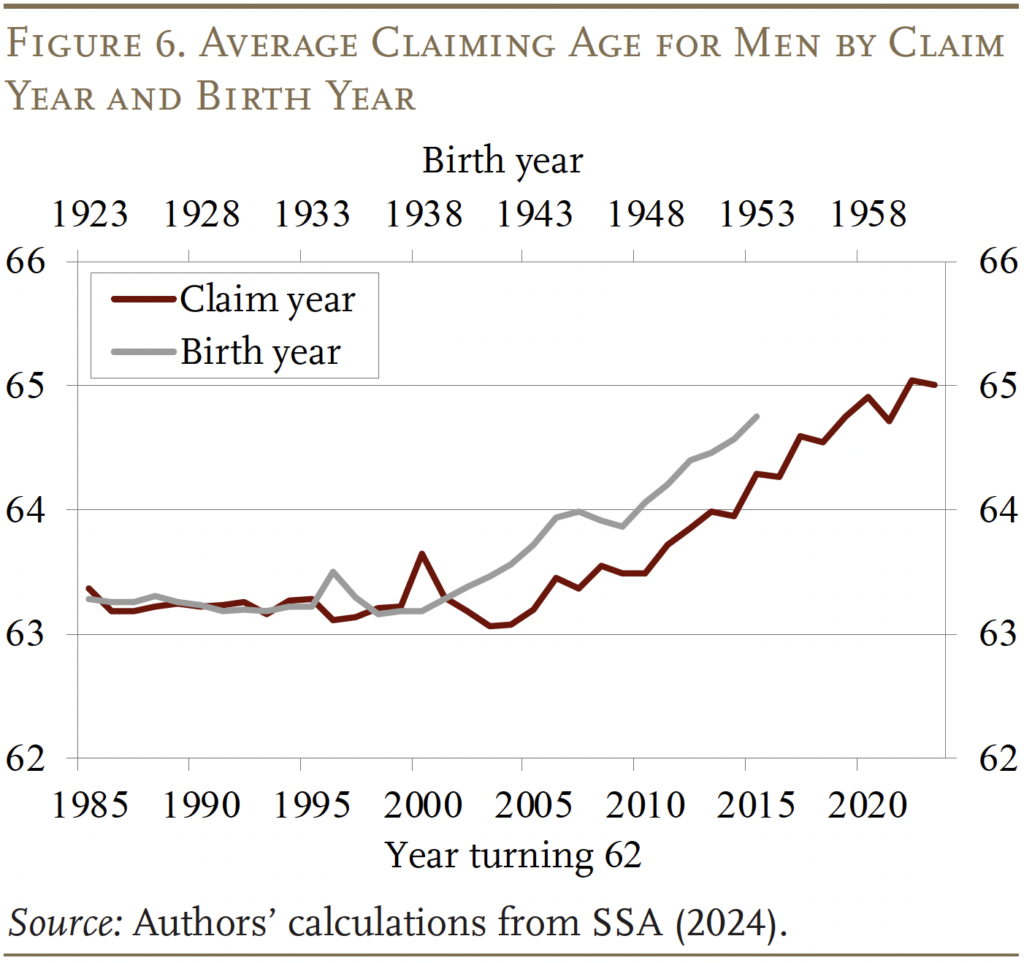

Determine 6 reveals the development from 1985-2023 within the common claiming age for males on a claim-year and birth-year foundation (these cohorts turning 62 after 2015 don’t attain age 70 by 2023). As one would count on, the rise is bigger utilizing the birth-year information, however each help the rivalry that the delay in retirement has been accompanied by a delay in claiming. The delay in claiming, nevertheless – even utilizing the birth-year information – is simply about two years – barely lower than the three-year enhance within the common retirement age.5

Conclusion

The excellent news is that, previous to COVID, the development during the last 20 years confirmed a dramatic decline within the proportion of 62-year-olds claiming advantages as quickly as they grew to become eligible, and that development continued by means of COVID. In consequence, the typical claiming age has elevated, though each the birth-year information and claim-age information present a rise that falls in need of the three-year enhance within the common retirement age.

References

Munnell, Alicia H. 2025. “Will the Common Retirement Age Preserve Rising?” Subject in Temporary 25-8. Chestnut Hill, MA: Heart for Retirement Analysis at Boston School.

Nationwide Bureau of Financial Analysis. 2014. “U.S. Census Intercensal Inhabitants Estimates.” Cambridge, MA.

Quinby, Laura D., Matthew S. Rutledge, and Gal Wettstein. 2021. “How Has COVID-19 Affected the Labor Power Participation of Older Staff?” Working Paper 2021-13. Chestnut Hill, MA: Heart for Retirement Analysis at Boston School.

U.S. Census Bureau. 2025a. “Nationwide Inhabitants Traits: 2010-2019.” Washington, DC.

__________. 2025b. “Nationwide Inhabitants Traits: 2020-2024.” Washington, DC.

__________. 2021a. “Nationwide Intercensal Tables: 1900-1990.” Washington, DC.

__________. 2021b. “Nationwide Intercensal Tables: 2000-2010.” Washington, DC.

__________. 2015. “Nationwide Inhabitants Projections: United States by Age, Intercourse, Ethnicity and Race for Years 2014-2060” on CDC WONDER On-line Database. Washington, DC.

U.S. Social Safety Administration. 2025. Unpublished Information on Preliminary Social Safety Profit Awards and Eligibility Standing. Baltimore, MD.

__________. 2024. Annual Statistical Complement, 2024. SSA Publication No. 13-11700. Baltimore, MD.