The temporary’s key findings are:

- To repair Social Safety’s funds, broad assist exists for elevated income to be at the least a part of the answer.

- This examine focuses on one approach to broaden the payroll tax base: together with the worth of employer-sponsored medical insurance (ESI).

- The outcomes counsel including ESI would increase payroll taxes by about $400 per yr on common and scale back Social Safety’s 75-year shortfall by about 25 p.c.

- This feature is considerably regressive – as it could acquire no extra taxes from earners above the wage cap – but it surely might be half of a bigger reform package deal.

Introduction

Social Safety faces a long-term financing hole that, if not addressed by policymakers, may erode profit adequacy. Since 2021 profit funds have exceeded revenues, and the hole has been stuffed by the belief fund that Social Safety constructed up during the last 4 many years. As soon as the belongings within the belief fund are depleted in 2035, nevertheless, this system’s trustees forecast that Social Safety may pay solely 83 p.c of scheduled advantages – declining to 73 p.c by 2098.1 Many specialists suggest that elevated income needs to be at the least a part of the answer to Social Safety’s financing imbalance, and public opinion polls present that almost all Individuals favor rising program revenues over chopping advantages.2

Most of Social Safety’s revenues come from the payroll tax, which is levied on wages and salaries as much as a cap, set at $176,100 in 2025. Annual earnings above that cap are exempt from the Social Safety payroll tax. The worth of most fringe advantages, that are typically not topic to federal earnings taxes, are additionally excluded from the payroll tax base. Policymakers may enhance Social Safety revenues by elevating the payroll tax fee, increasing the payroll tax base, or taxing earnings above $176,100. This temporary, which relies on a current examine, makes use of information from federal earnings tax data to discover one particular growth of the payroll tax base – particularly, together with the worth of employer-sponsored medical insurance (ESI).3

The dialogue proceeds as follows. The primary part offers some background on the payroll tax. The second part discusses the information and methodology. The third part presents the outcomes, which present that including the worth of ESI to the payroll tax base would enhance Social Safety’s revenues by about 7 p.c. It additionally compares the affect of increasing the payroll tax base with varied approaches to elevating the earnings cap. The ultimate part concludes that the growth of the bottom to include ESI would scale back Social Safety’s 75-year deficit by about 25 p.c (considerably smaller than the Social Safety actuaries’ estimate of 31 p.c.4) By itself, this feature can be considerably regressive – rising the tax burden for some low-wage employees, whereas gathering no extra income from employees with earnings above the cap – however maybe might be half of a bigger package deal of reforms.

Background

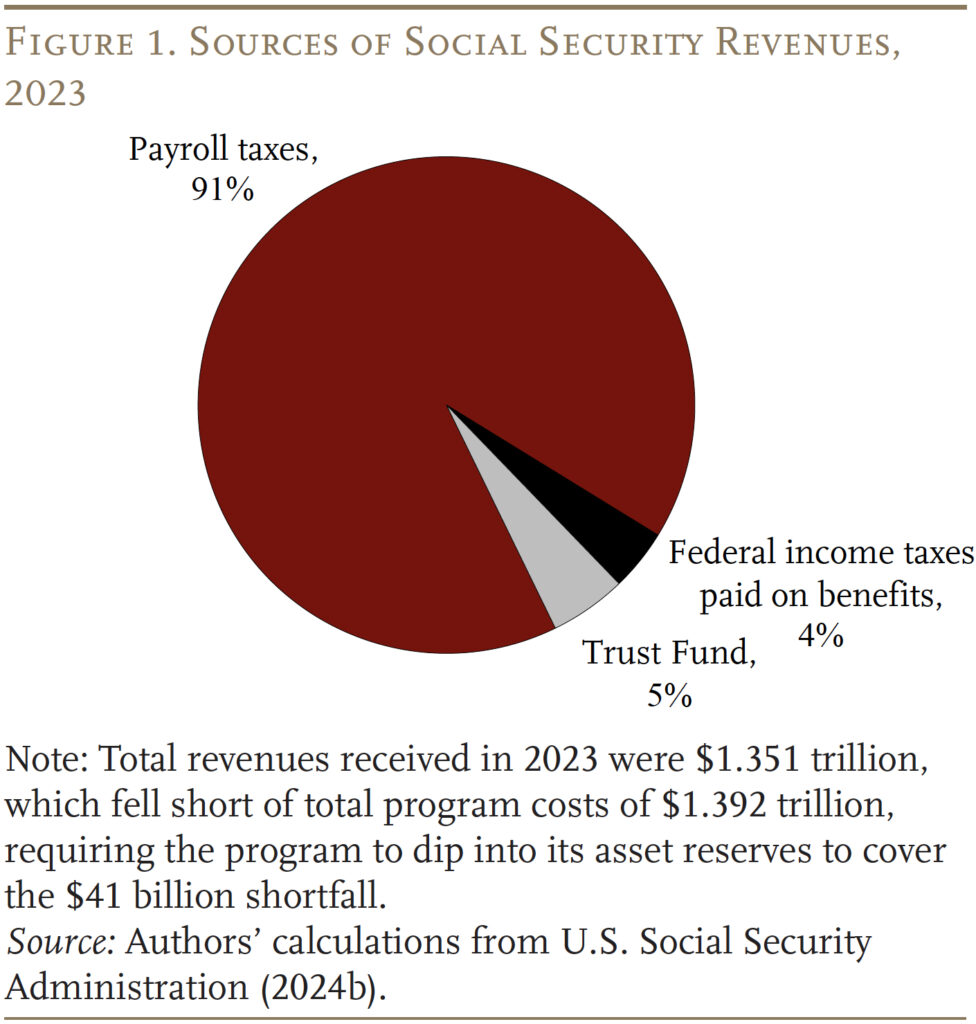

Payroll taxes present 91 p.c of the income acquired annually by Social Safety, with 4 p.c coming from federal earnings taxes paid on advantages and 5 p.c from curiosity earned on belief fund belongings (see Determine 1). The payroll tax fee for Social Safety is at present 12.4 p.c, cut up evenly between staff and their employers.

Some earnings are usually not topic to the Social Safety payroll tax. Most significantly, the contribution base is at present capped at $176,100, and this cover will enhance over time with the expansion within the economy-wide common wage. Furthermore, as a result of earnings have been rising a lot quicker for high-wage employees than low-wage employees just lately, the share of whole earnings included within the payroll tax base has been shrinking – from 89 p.c in 1985 to 83 p.c in 2023.5

Most employers complement the money compensation supplied to staff with fringe advantages, reminiscent of medical insurance, a retirement plan, incapacity protection, and/or life insurance coverage.6 Contributions employers make to fund these advantages are typically not included as compensation beneath the federal earnings tax or the payroll tax. Furthermore, staff typically contribute towards the price of a few of these advantages, often with pre-tax {dollars}, and people wage reductions are additionally typically excluded from the tax base. The one exception is worker deferrals for certified 401(ok)-type retirement plans, that are included within the payroll tax base although pre-tax deferrals are usually not topic to earnings taxation till they’re withdrawn from the plan.

Increasing the Social Safety contribution base to incorporate extra fringe advantages, particularly employer-sponsored medical insurance (ESI), may considerably increase revenues. Nevertheless, not like elevating this system’s earnings cap, which might have an effect on solely increased earners, including ESI to the bottom would enhance tax burdens solely on employees beneath the cap, together with these with comparatively low earnings. To evaluate the potential affect of such an growth on employees at varied earnings ranges, higher data is required on how the provision of ESI is distributed throughout the workforce.

Information and Strategies

The evaluation relies on IRS tax return information, which had been obtained by the IRS-sponsored Joint Statistical Analysis Program. The primary data comes from Kind W-2, which incorporates uncapped money wages, wages topic to Social Safety payroll tax, and the mixed tax-exempt contributions made by each employers and staff for medical insurance.7 The information additionally embrace a working file of all particular person tax occasions, together with refunds, funds, penalties, and taxpayer standing.

The 2021 tax information – the latest accessible – are used to create a 1-percent random pattern of all individuals with a Social Safety quantity, producing a file of two,491,471 distinctive people. As a result of self-employed employees don’t obtain Kind W-2s, they’re excluded from the evaluation.

The evaluation begins by computing the proportion of Social Safety-covered earners receiving ESI, the mixed quantity paid by staff and their employers, and the ratio of contributions to earnings. The subsequent step is to simulate the potential affect of including ESI advantages to the Social Safety payroll tax base. The simulation is completed beneath two various situations. The primary assumes no change within the taxable most earnings cap, in order that employees wouldn’t pay payroll taxes on any growth of the contribution base above $142,800, the taxable most in 2021. The second situation expands the bottom by rising the taxable most and subjecting extra earnings to the payroll tax. Each situations assume that each the worker and employer parts of the payroll tax can be levied on the expanded contribution base.

Outcomes

The outcomes first present the prevalence and worth of ESI advantages, then display how including ESI to the payroll tax base would have an effect on employees’ payroll taxes, and at last how increasing the tax base by together with ESI compares to varied choices for elevating the cap on taxable earnings.

Prevalence and Worth of ESI

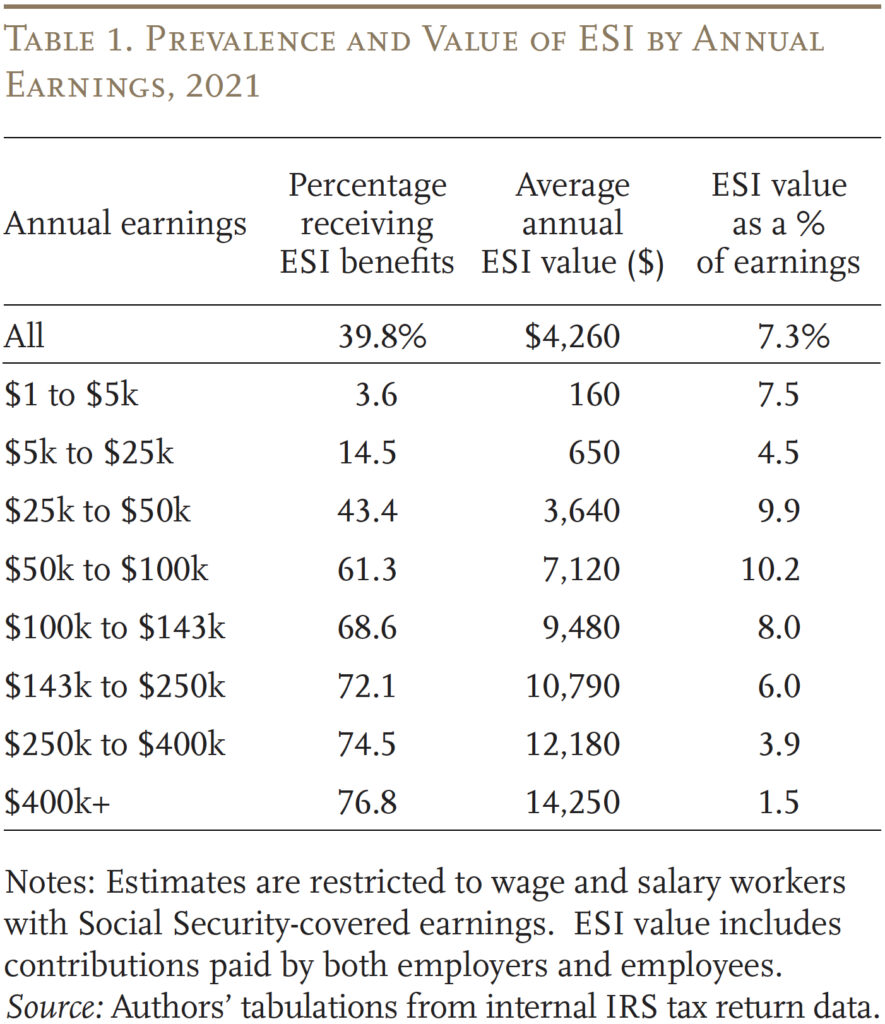

In 2021, 39.8 p.c of wage and wage employees acquired ESI (see Desk 1).8 Protection charges enhance with earnings. Solely 3.6 p.c of wage and wage employees incomes lower than $5,000 yearly acquired ESI, in contrast with 43.4 p.c of these incomes $25,000 to $49,999 yearly, 68.6 p.c of these incomes $100,000 to $142,800 (the taxable most in 2021), and 76.8 p.c of these incomes $400,000+.

Amongst wage and wage earners coated by ESI, the typical worth of ESI in 2021, funded by employer and worker contributions, was $10,710, equal to 11.8 p.c of annual whole wages.

Potential Affect of Broadening the Payroll Tax Base on Taxes Paid

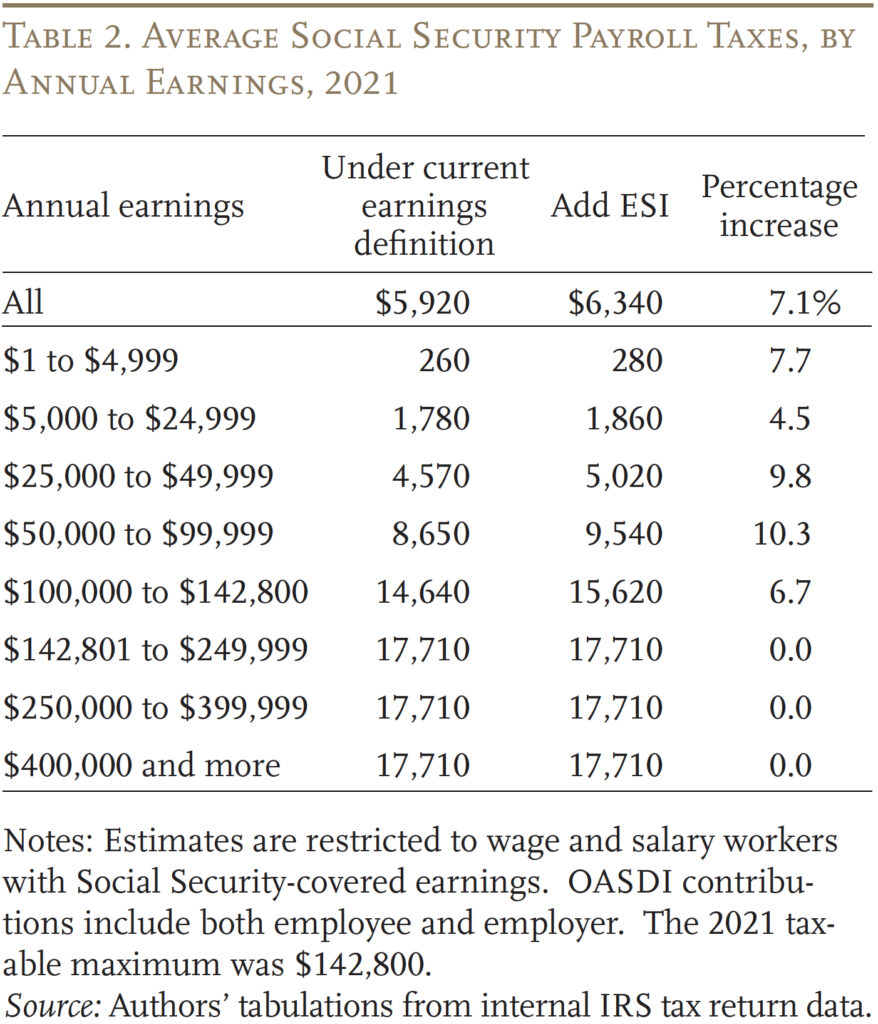

Desk 2 seems on the affect of broadening the payroll tax base to incorporate the worth of ESI, whereas sustaining the current-law earnings cap. Such a change would have boosted common annual 2021 Social Safety payroll taxes by $420, from $5,920 to $6,340, a 7.1-percent enhance. After all, the estimated affect can be bigger if contemplating solely these with ESI.

Increasing the Dialogue to Embrace Elevating the Cap

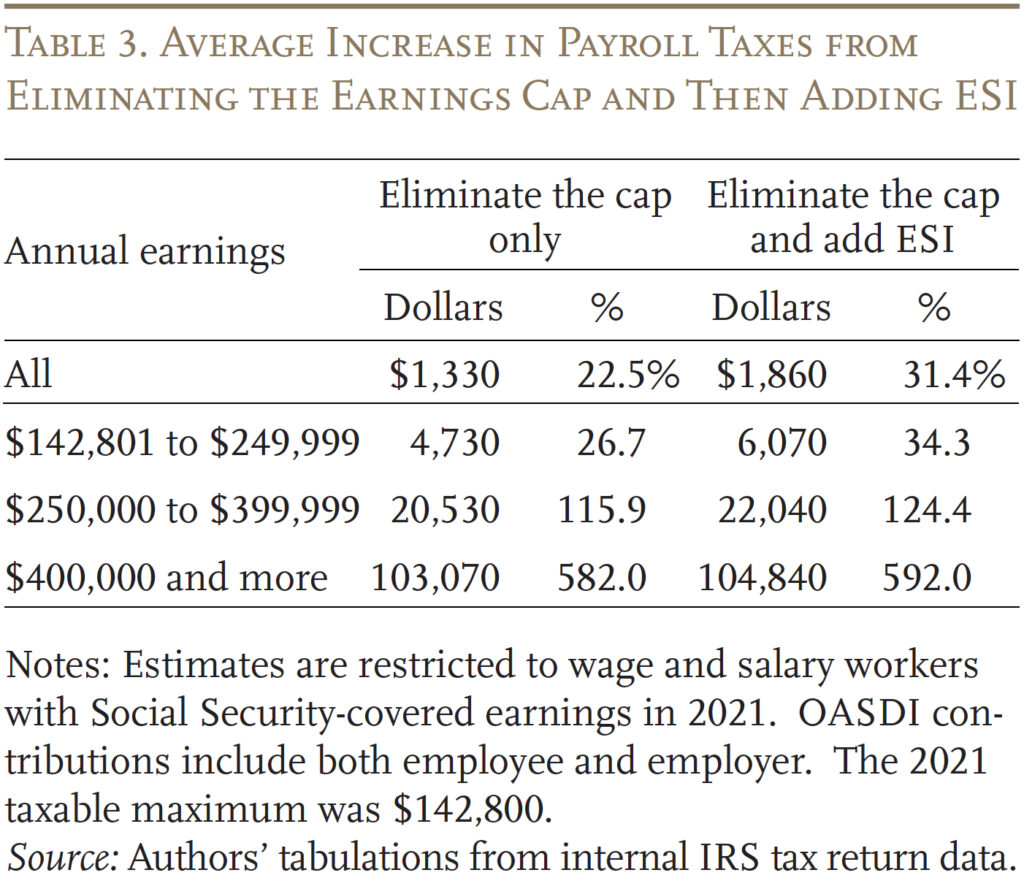

In distinction to including ESI to the tax base, eliminating the earnings cap – by itself – would have elevated common annual 2021 OASDI contributions by $1,330, or 22.5 p.c, about 3 times greater than including ESI to the payroll tax base (see Desk 3).

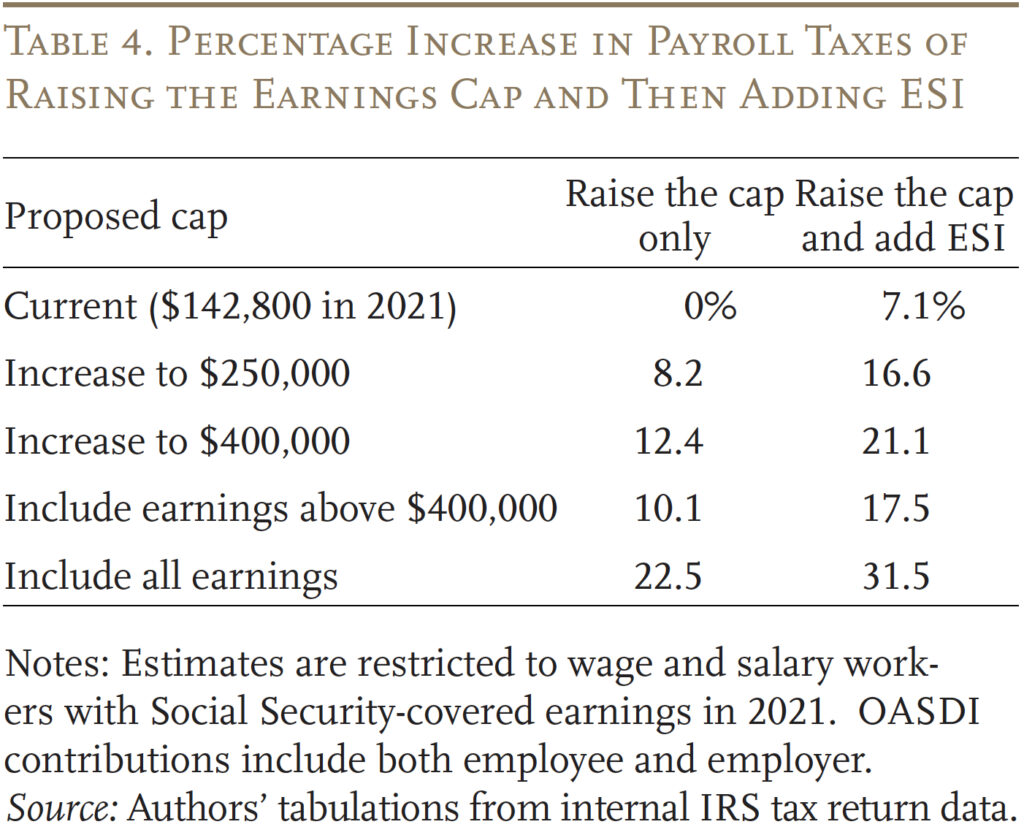

The ultimate train seems on the affect of extra proposals to extend the earnings cap, interacted with increasing the bottom by including ESI. Elevating the 2021 cap from $142,800 to $250,000 with out including ESI would have elevated annual 2021 revenues by 8.2 p.c, whereas revenues would have elevated 12.4 p.c if the cap had been elevated to $400,000 and, as famous above, by 22.5 p.c if the taxable most had been eradicated (see Desk 4). Protecting the taxable most at its present stage however including annual earnings over $400,000 – a well-liked proposal often called the “donut gap” – would have generated a rise of 10.1 p.c, barely greater than including ESI by itself (with no earnings cap change). When ESI is added to the taxable compensation base – on prime of adjusting the earnings cap – the entire enhance rises to 17 to 32 p.c relying on which cap choice is included.

Conclusion

Including ESI advantages to the Social Safety taxable wage base would have raised the typical tax by $420, a rise of about 7 p.c, and supplied an extra $70 billion to Social Safety. Amongst employees receiving ESI advantages, common annual contributions would have elevated by $1,070, or about 12 p.c.

The extra income generated from broadening the payroll tax base would noticeably enhance Social Safety’s funds. In 2024, Social Safety’s actuaries estimated that this system’s 75-year actuarial deficit equaled 3.5 p.c of taxable payroll; including ESI advantages to the payroll tax base – assuming the affect is identical as our estimate for 2021 – would minimize the deficit by about 25 p.c. The idea underlying this calculation is that future employees wouldn’t earn increased wages or advantages to replicate the rise within the tax base. As a result of our evaluation excludes self-employed employees, our estimates understate considerably the potential income affect of increasing the contribution base.9

Including ESI advantages to the payroll tax base would generate barely much less income than both rising the annual taxable most by about $100,000 or levying the payroll tax on earnings above $400,000. Clearly these coverage choices would have an effect on decrease earners and better earners very otherwise. Elevating the taxable most would require extremely paid earners to pay barely increased taxes. Including ESI advantages to the payroll tax base would require lower-paid earners to contribute extra whereas gathering no extra income from the very best earners. These distributional penalties might be useful to think about as the talk over Social Safety’s solvency intensifies and policymakers choose varied choices to incorporate in a package deal of reforms.

References

Bond, Tyler and Kelly Kenneally. 2024. “Individuals’ Views of Social Safety.” Washington, DC: Nationwide Institute on Retirement Safety.

Cook dinner, Fay Lomax and Rachel L. Moskowitz. 2012. “What Individuals Assume In regards to the Way forward for Social Safety.” Boston, MA: Students Technique Community.

Information for Progress. 2024. “Polling on Medicare and Social Safety (Might 2024).”

Gallup. 2024. “Social Safety.” Washington, DC.

Pew Analysis Middle. 2024. “Individuals’ Views of Authorities’s Function: Persistent Divisions and Areas of Settlement.” Washington, DC.

Smith, Karen E. and Richard W. Johnson. 2025. “Leveraging Tax Information to Measure the Potential Affect of Broadening Social Safety’s Income Base.” Working Paper 2025-7. Chestnut Hill, MA: Middle for Retirement Analysis at Boston School.

Tucker, Jasmine V., Virginia P. Reno, and Thomas N. Bethell. 2013. “Strengthening Social Safety: What Do Individuals Need?” Washington, DC: Nationwide Academy of Social Insurance coverage.

U.S. Bureau of Labor Statistics. 2024. “Worker Advantages in the US, March 2024.” Washington, DC.

———. 2025. “Employment Scenario Information Launch.” Washington, DC.

U.S. Social Safety Administration. 2024a. “Abstract of Provisions that Would Change the Social Safety Program: Protection of Employment or Earnings, or Inclusion of Different Sources of Income, Possibility F3.” Washington, DC.

———. 2024b. The Annual Studies of the Board of Trustees of the Federal Outdated-Age and Survivors Insurance coverage and Federal Incapacity Insurance coverage Belief Funds. Washington, DC: U.S. Authorities Printing Workplace.

Walker, Elisa A., Virginia P. Reno, and Thomas N. Bethell. 2014. “Individuals Make Laborious Decisions on Social Safety: A Survey with Commerce-Off Evaluation.” Washington, DC: Nationwide Academy of Social Insurance coverage.