The temporary’s key findings are:

- The Earned Earnings Tax Credit score (EITC) encourages low-income folks with youngsters to work – these with out youngsters get a a lot smaller credit score.

- Earlier EITC analysis has targeted on youthful households, however some analysts recommend an expanded childless credit score might increase work amongst close to retirees.

- This examine finds that elevating the EITC by $1,000 would produce a modest rise in employment amongst single ladies ages 55-64.

- Nonetheless, this impression is far smaller than that for youthful single ladies, maybe as a result of older ladies have greater earnings or extra well being limitations.

- Thus, an expanded EITC would primarily profit youthful employees, although with a optimistic aspect impact for a minimum of some older employees too.

Introduction

The Earned Earnings Tax Credit score (EITC) – a refundable credit score that rises with earnings up to a degree earlier than phasing out – is likely one of the federal authorities’s largest poverty discount applications. The EITC’s design – which yields no profit to non-workers – has been discovered to encourage employment amongst lower-income people. This uncommon mixture of poverty discount and work encouragement signifies that enlargement of the EITC has lengthy loved bipartisan help. Probably the most frequent recommendations for enlargement is a rise within the dimension of the credit score for childless households, which is at present so small that few folks use it.1 Certainly, a tripling of the childless profit was a part of a brief bundle enacted through the COVID pandemic.2

An enlargement of the childless profit is often framed as a boon for the well-being of youthful, low-income employees. Nonetheless, some have identified that one other profit could also be to encourage low-income people approaching retirement – who are sometimes susceptible to insufficient retirement sources – to increase their careers.3 For the reason that overwhelming majority of employees close to retirement – outlined right here as ages 55-64 – wouldn’t have dependent youngsters, they’d profit from such an enlargement. Nonetheless, as a result of the present EITC is used primarily by these with youngsters, no analysis has targeted on how older people may reply to any enlargement. However, roughly 15 % of people close to retirement do have dependent youngsters, and this temporary makes use of them as a base for an evaluation of how older people responded to previous expansions relative to their youthful counterparts.4

The dialogue proceeds as follows. The primary part supplies background on the EITC. The second part discusses the methodology used to discover the impression of EITC expansions on older employees, and the third part discusses the outcomes. The ultimate part concludes that whereas previous EITC expansions seemingly have inspired some older employees to increase their careers, the impact is critical only for single ladies and solely at a 3rd the speed of their youthful counterparts. Therefore, expansions of the childless credit score needs to be thought-about primarily within the context of youthful employees, however with the popularity that such an enlargement will seemingly encourage a minimum of some older people to work longer.

Background on the EITC

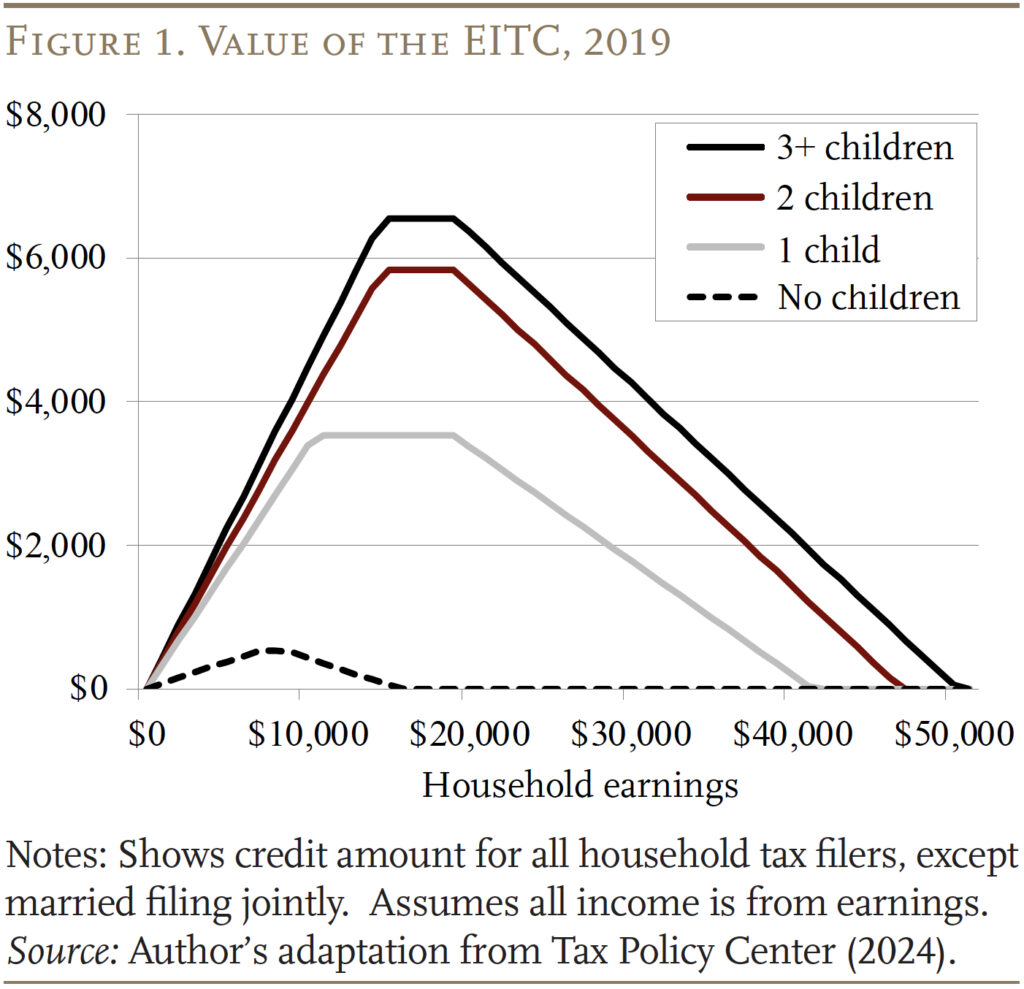

The EITC began as a small, non permanent provision in 1975, however enlargement through the years has made it one of many greatest federal antipoverty insurance policies.5 The credit score is refundable, in order that it could enhance the revenue accessible to a family as an alternative of merely lowering its tax burden. The essential construction of the EITC is illustrated in Determine 1, utilizing the 2019 guidelines for instance (the evaluation stops that yr to keep away from non permanent modifications in EITC guidelines throughout COVID). The determine exhibits 4 distinguished options of this system. First, as talked about above, the EITC could be very small for households with out dependent youngsters.6 Second, the EITC will increase with the variety of dependent youngsters. Third, the credit score will increase as a family goes from no earned revenue as much as a reasonable revenue earlier than plateauing. And fourth, the credit score is step by step phased out as earned revenue will increase. Mixed, these 4 options imply that the EITC at present impacts primarily low-income households with youngsters, usually single moms.

As a result of the EITC solely applies to employees, it goals to encourage folks to go from not working to working. Analysis on the subject strongly means that the coverage achieves this purpose, particularly for youthful single mother and father.7 However, little analysis thus far has targeted on the EITC’s impact on older employees, although non-EITC-based analysis has advised that they could reply otherwise than youthful people to tax incentives.8 The rationale for this lack of focus is straightforward. Simply 15 % of people ages 55-64 nonetheless have dependent youngsters. Nonetheless, although small in proportion, this group who do have dependent youngsters can function a base for analysis.

Methodology

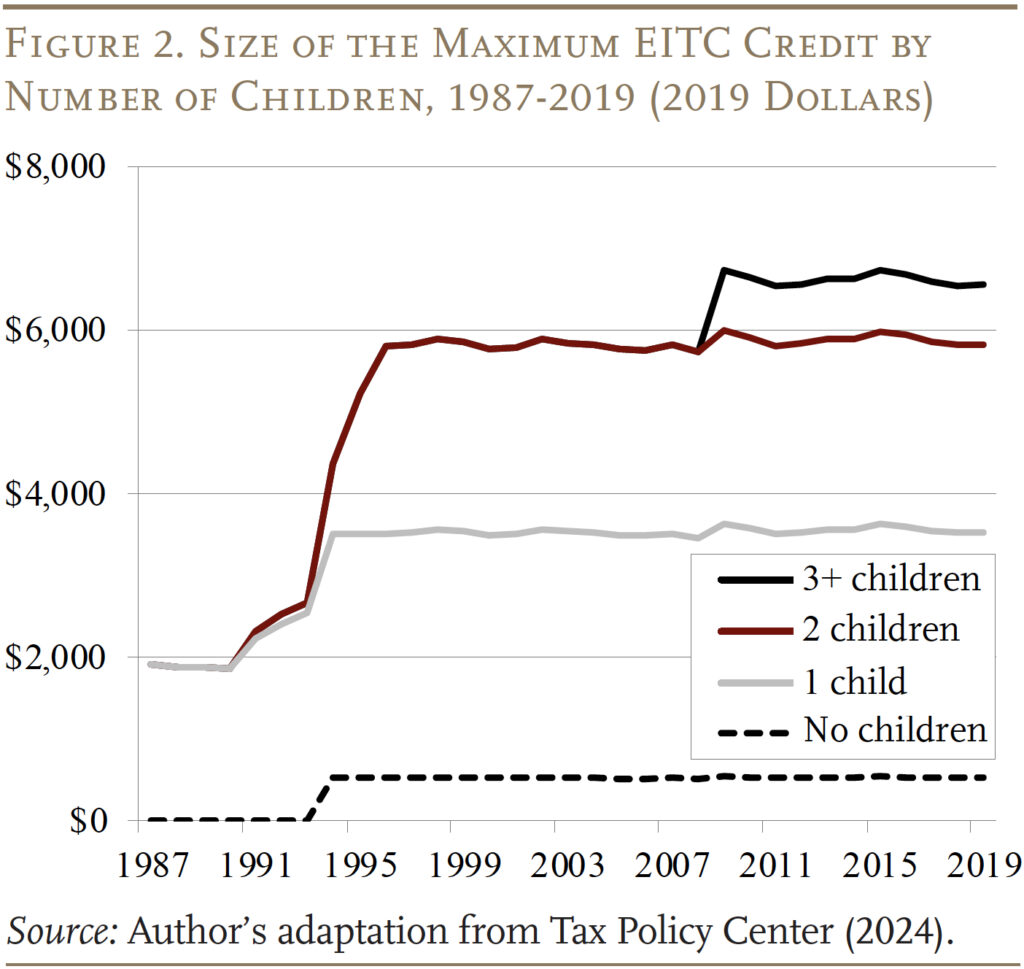

This temporary makes use of the Present Inhabitants Survey (CPS) from 1988-2019 and follows the methodology of Bastian and Jones (2021). That paper exploits variation within the dimension of the EITC each over time and throughout households with completely different numbers of dependent youngsters. Determine 2 exhibits this variation and illustrates two developments. First, in actual phrases, the utmost dimension of the EITC credit score has elevated for the reason that Nineteen Eighties, with discrete jumps in 1991, 1994, and 2009. Second, the utmost credit score has assorted extra by the variety of youngsters in a family as households with extra dependent youngsters got bigger advantages relative to these with fewer.

The evaluation compares the employment of people with completely different entry to the EITC, utilizing the utmost credit score that every group can obtain as a proxy for program generosity. Though Determine 2 exhibits that enormous jumps in EITC advantages happen only a few occasions, these modifications introduce substantial variation within the most profit throughout households. For instance, in 1987, households with dependent youngsters obtained a modest most credit score of $1,915 (in 2019 {dollars}), no matter their household dimension. By 1996, that quantity for households with a single baby had almost doubled to $3,513, and households with two or extra youngsters had seen their most profit triple to $5,796. Additional separation occurred for households with three or extra youngsters in 2009, after they obtained a virtually 20-percent increase of their most profit. Throughout the pattern thought-about right here, the typical most EITC is $2,697, with an ordinary deviation of $2,334.

A regression is used to check the employment price of people dealing with completely different most EITC advantages, controlling for variety of youngsters, training, race, age, state of residence, and yr noticed. Regressions are run solely on these with a highschool diploma or much less, as they’re most certainly to be impacted by any enlargement of the EITC based mostly on their decrease earnings ranges.

Prob(Employment) = f(maxEITC, youngsters, race, training, age, yr, state of residence)

This method takes benefit of the truth that households with the identical variety of youngsters face completely different advantages at completely different occasions, whereas households on the identical time limit face completely different advantages based mostly on their variety of youngsters. So, for instance, to the extent that people in households with three versus one dependent baby work much less in 1987, the regression asks: did that distinction change when a three-child family obtained a relatively bigger EITC profit in 2010? Utilizing this method, Bastian and Jones report that the EITC considerably will increase the employment price of girls, with the impact concentrated amongst single ladies.9

The query right here is, does this end result differ based mostly on the age of the person? Thus, the evaluation is carried out individually for employees ages 25-54 and 55-64. As a result of the consequences of this system seemingly differ for girls relative to males (who are likely to earn extra), the evaluation can also be finished individually by gender. And, as a result of the EITC can impression single versus married households otherwise, the evaluation is additional separated by marital standing.10

Outcomes

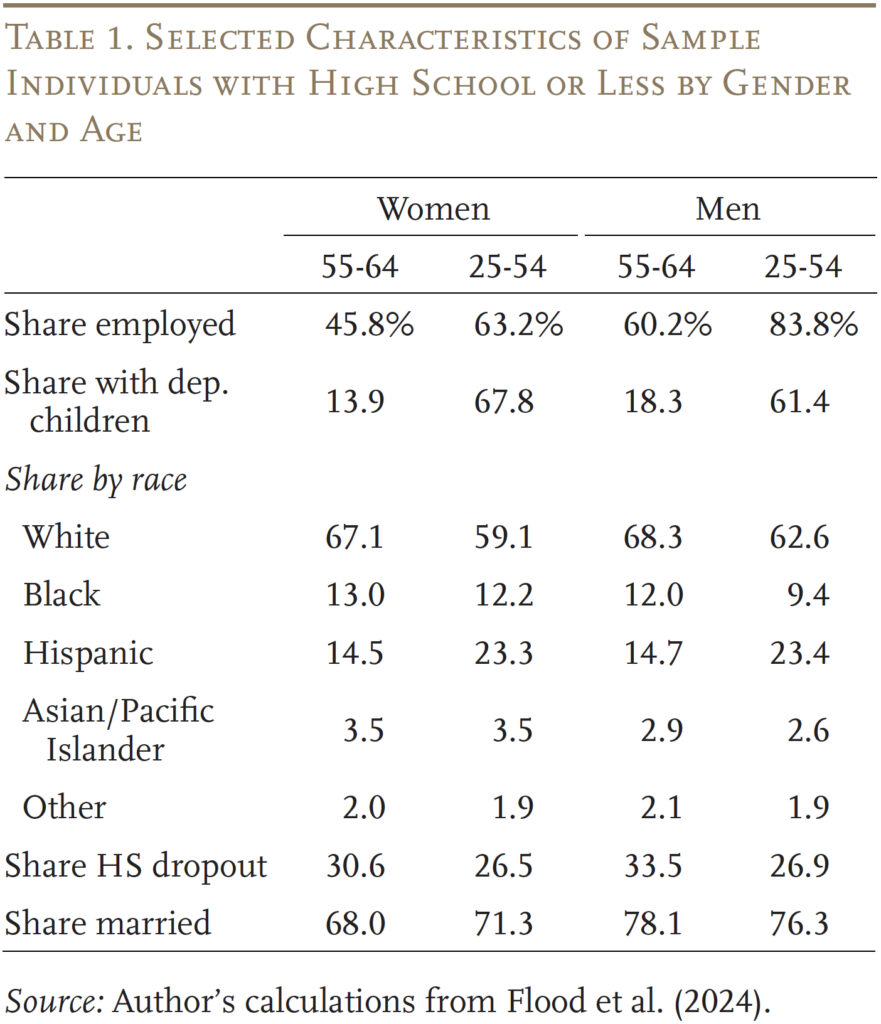

Earlier than turning to the regression outcomes, Desk 1 highlights key traits of the pattern by age. The older people are much less more likely to be employed, to have dependent youngsters, and to be Hispanic, and barely extra more likely to be highschool dropouts.

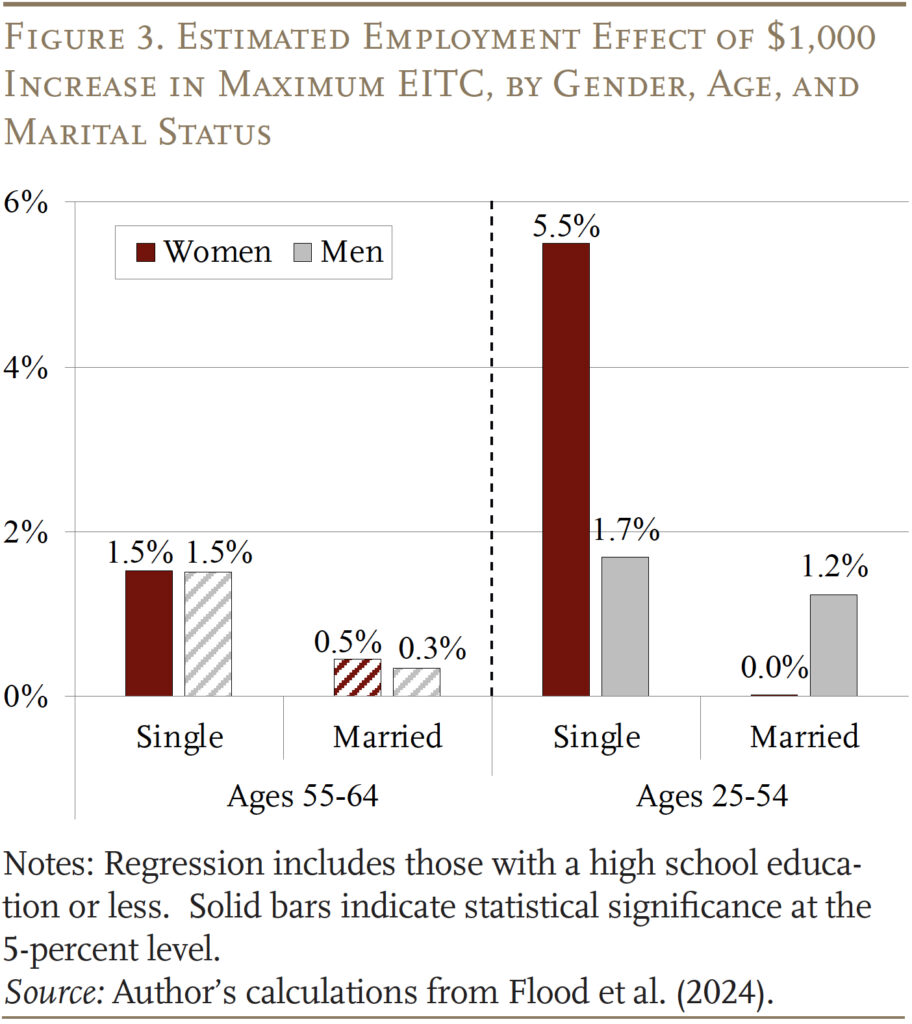

Determine 3 highlights the principle outcomes of the regression evaluation, with full leads to the Appendix. The determine exhibits how the assorted teams’ probability of employment is anticipated to answer a $1,000 enhance within the highest EITC profit accessible to them. For girls, the outcomes recommend that older singles could be anticipated to extend their likelihood of working by 1.5 share factors, which is statistically vital. Nonetheless, the dimensions of the impact is considerably smaller than for youthful single ladies, whose employment could be anticipated to extend by 5.5 share factors. This end result could stem from the truth that older ladies have extra work expertise and better earnings and so are much less affected by expansions. Or, the decrease impact might replicate extra well being limitations amongst this older group.11

The impact for older single males is comparable in magnitude to single ladies, however insignificant statistically. This insignificance is probably going as a result of the pattern of single males ages 55-64 is simply 60 % the dimensions of single ladies of this age, each as a result of greater mortality of males and the (associated) proven fact that males on this age bracket usually tend to be married. Youthful single males are considerably affected however at a decrease price than youthful single ladies, once more seemingly attributable to their greater earnings.

Married ladies in each age brackets aren’t predicted to be considerably affected. Such a discovering is frequent for young women a minimum of, as married {couples} usually earn an excessive amount of to qualify for even the expanded variations of the EITC. Plus, if a girl has decrease potential earnings than her husband, he would be the one to decide on to work for wages and declare the EITC. Certainly, a optimistic vital impact is discovered for youthful married males. Older married males appear to not be affected, seemingly as a result of their greater earnings usually push them out of EITC eligibility no matter whether or not the dimensions of the credit score expands.

Conclusion

Growth of the EITC – and particularly the childless employee profit – is one coverage that might encourage older people to work longer. The outcomes right here recommend that increasing the EITC would seemingly have a statistically vital impression on some older people’ employment. However, that impression is most certainly to happen for older single ladies – who symbolize simply 20 % of these ages 55-64 – and at a price simply one-third that of comparable, youthful people. Whereas this evaluation is predicated totally on expansions to these with youngsters, it supplies among the first proof that older employees could also be much less aware of the EITC than their youthful counterparts.

That mentioned, it’s clear from this evaluation and others prefer it that EITC enlargement has a substantial impact on the labor provide of youthful employees and with a optimistic aspect impact: a minimum of some older employees are more likely to enter the labor pressure. These optimistic results on employment, which cut back poverty and dependence on different authorities applications, could also be cause sufficient to help an enlargement of the coverage.

References

Alpert, Abby and David Powell. 2014. “Estimating Intensive and In depth Tax Responsiveness: Do Older Employees Reply to Earnings Taxes?” Working Paper WR-987. Santa Monica, CA: The RAND Company.

Bastian, Jacob E. 2020. “The Rise of Working Moms and the 1975 Earned Earnings Tax Credit score.” American Financial Journal: Financial Coverage 12(3): 44-75.

Bastian, Jacob E. and Maggie R. Jones. 2021. “Do EITC Expansions Pay for Themselves? Results on Tax Revenues and Authorities Transfers.” Journal of Public Economics 196: 104355.

Breunig, Robert V. and Andrew Carter. 2018. “Do Earned Earnings Tax Credit for Older Employees Lengthen Labor Market Participation and Enhance Earned Earnings? Proof from Australia’s Mature Age Employee Tax Offset.” Working Paper 2018-15. Canberra, AU: Tax and Switch Coverage Institute.

Congressional Analysis Service. 2018. “The Earned Earnings Tax Credit score (EITC): A Temporary Legislative Historical past.” CRS Report R44825. Washington, DC.

Crandall-Hollick, Margot, Nikhita Airi, and Richard C. Auxier. 2024. “How the American Rescue Plan’s Momentary EITC Growth Impacted Employees With out Youngsters.” Tax Coverage Heart Temporary. Washington, DC: City Institute and Brookings Establishment.

Eissa, Nada and Hilary Williamson Hoynes. 2004. “Taxes and the Labor Market Participation of Married {Couples}: the Earned Earnings Tax Credit score.” Journal of Public Economics 88(9-10): 1931-1958.

Flood, Sarah, Miriam King, Renae Rodgers, Steven Ruggles, J. Robert Warren, Daniel Backman, Annie Chen, Grace Cooper, Stephanie Richards, Megan Schouweiler, and Michael Westberry. 2024. IPUMS CPS: Model 12.0 [dataset]. Minneapolis, MN: IPUMS.

Laun, Lisa. 2017. “The Impact of Age-targeted Tax Credit on Labor Power Participation of Older Employees.” Journal of Public Economics 152: 102-118.

Maag, Elaine. 2018. “Tax Reform 2.0 Ought to Increase Childless EITC to Scale back Poverty.” Tax Coverage Heart TaxVox. Washington, DC: City Institute and Brookings Establishment.

Meyer, Bruce D. and Dan T. Rosenbaum. 2001. “Welfare, the Earned Earnings Tax Credit score, and the Labor Provide of Single Moms.” Quarterly Journal of Economics 116(3): 1063-1114.

Moulton, Jeremy G., Alexandra Graddy-Reed, and Lauren Lanahan. 2016. “Past the EITC: The Impact of Lowering the Earned Earnings Tax Credit score on Labor Power Participation.” Nationwide Tax Journal 69(2): 261-284.

Munnell, Alicia H. 2018. “Need Individuals to Preserve Working Longer? Increase the Earned Earnings Tax Credit score.” (November 14). New York, NY: MarketWatch.

Tax Coverage Heart. 2024. “EITC Parameters.” Statistics. Washington, DC: City Institute and Brookings Establishment.

Yin, Yimeng, Anqi Chen, and Alicia H. Munnell. 2024. “The Nationwide Retirement Threat Index: An Replace from the 2022 SCF.” Subject in Temporary 24-5. Chestnut Hill, MA: Heart for Retirement Analysis at Boston Faculty.

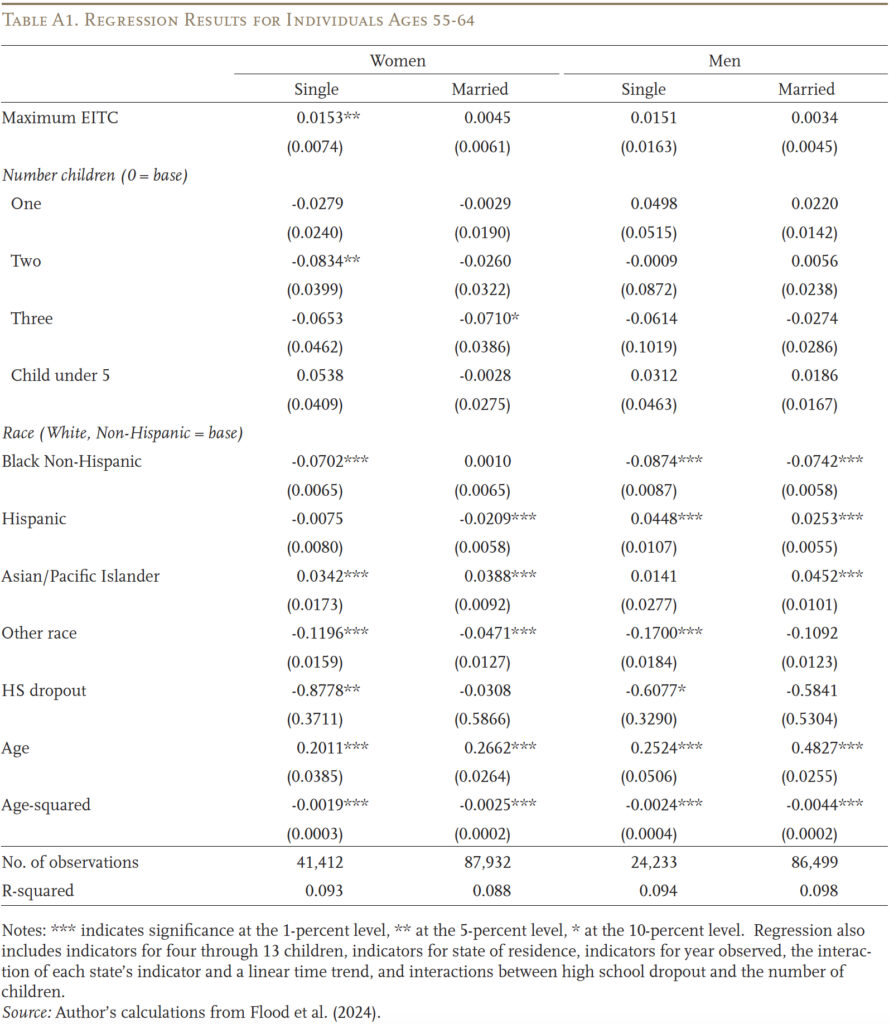

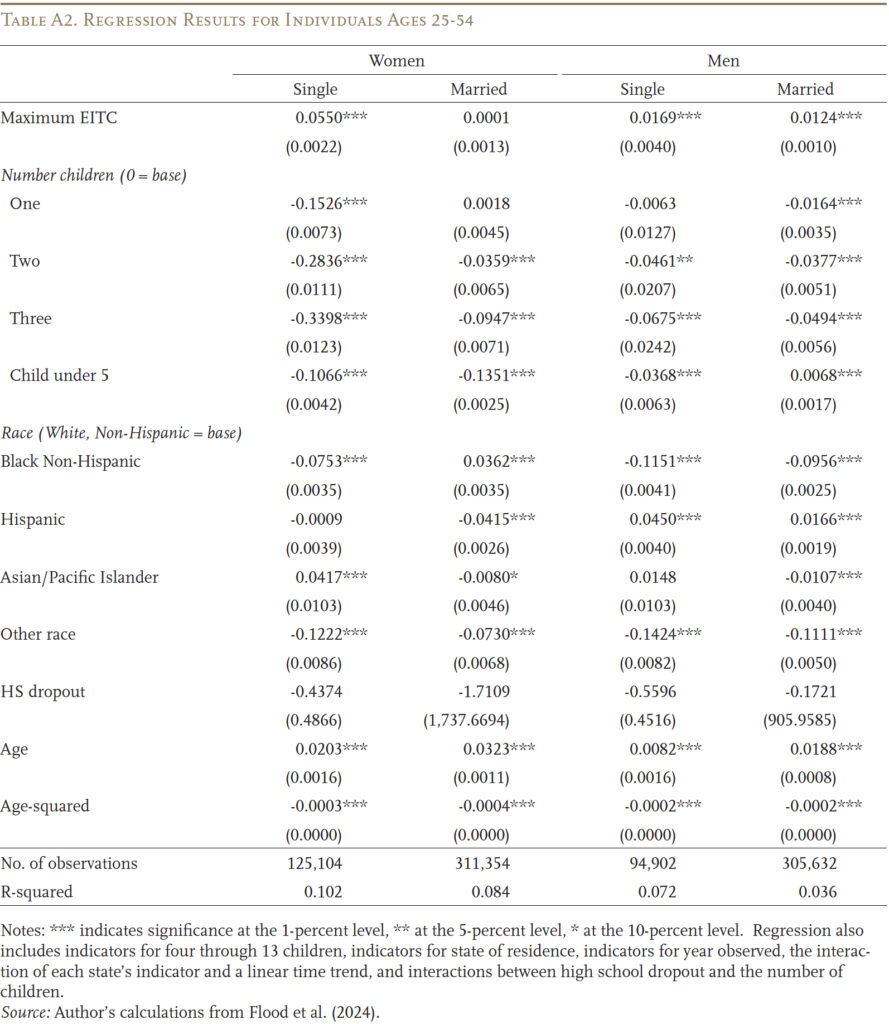

Appendix