Being on prime of your funds signifies that monetary errors turn out to be fewer and farther between. However tax submitting occurs simply as soon as per 12 months, and it’s straightforward to make errors that result in overpaying the IRS. When that occurs, filers have the chance to right their errors by submitting IRS Type 1040-X. As soon as the amended return is processed, the IRS cuts overpaying taxpayers an additional refund verify.

In case you’ve ever made a mistake in your tax return, you might have the chance to right it. We dive into methods to file an amended tax return.

What Is Amending A Tax Return?

Amending a tax return is the method of correcting a tax return that you simply’ve already filed. Most individuals select to file an amended tax return after they understand they will get a bigger refund based mostly on a mistake they made throughout the submitting course of. Some folks should file amended returns based mostly on IRS notifications. These kind of amendments usually include taxes due.

The IRS permits folks to right their errors (and get the cash they overpaid) by submitting IRS Type 1040-X.

To right points along with your tax return, you typically should file an amended return inside three years of the date you initially filed your return or two years from the time you paid the taxes for that 12 months. In case you paid your 2019 tax return on March 1st, 2020 then you could have till March 1st, 2023 to file an amended tax return.

Why Ought to You Amend Your Tax Return?

The first purpose to amend a return is to right a mistake that impacts the quantity of tax due in a selected 12 months. An amended return could end in owing further taxes due or getting a bigger refund.

A number of main points that may probably have an effect on the quantity owed embrace:

- Incorrect submitting standing.

- Claiming the incorrect variety of dependents.

- Adjustments to your complete revenue (together with deductions in enterprise revenue for those who forgot to deduct respectable enterprise bills).

- Claiming tax deductions or credit that you simply didn’t initially declare.

Not often, the IRS may also difficulty tax legislation adjustments very late (and even retroactively) which might trigger you to need (or want) to amend your tax return. Over the previous few years, this has turn out to be more and more frequent.

When Do You File Your Amended Tax Return?

You have got three years out of your unique submitting date to file an amended return. You don’t wish to sit on it for months, however you additionally don’t wish to file too early.

The IRS warns that people who find themselves anticipating a refund from their unique tax return mustn’t file an amended return till after they’ve acquired the anticipated refund. For instance, for those who’re one of many unfortunate few folks nonetheless ready on a tax refund from 2020, it is best to wait till you obtain it earlier than amending your taxes.

How To Amend A Tax Return

Simply as we advocate utilizing tax software program to file your regular tax return, we advocate utilizing tax software program to file your amended return. The one technique to e-file your amended tax return is to make use of a tax software program product.

Every tax software program has barely totally different steps, however these are the final steps you’ll must observe to amend your tax return.

Step 1: Collect The Appropriate Paperwork

To file your amended tax return, you’ll need your unique tax return and any paperwork that may help the adjustments to the tax return. To get your unique tax return, you’ll be able to both entry the return through your tax software program (you’ll usually have entry for a 12 months or extra) or you may get your tax transcript from the IRS.

Apart out of your unique return, you’ll want paperwork that help the change you’re making to your tax return. For instance, a mum or dad claiming an extra baby on account of a baby custody settlement wants proof of the ultimate settlement.

Those that are claiming forgotten credit or deductions may have receipts supporting the declare. In case you forgot to say a portion of your revenue, you’ll probably want a 1099-NEC, W2, or one other 1099 supply to help the change.

Step 2: Select How To File Your 1040-X

It’s theoretically doable to organize a 1040-X by hand and mail it in. Nevertheless, we advocate utilizing a CPA or tax software program to do the heavy lifting for you.

Filers who used a CPA for the tax 12 months they’re amending ought to discuss to their CPA about the fee construction. You might be able to enlist the CPA to file an amended return for free of charge or a restricted value, particularly if the CPA ought to have caught the problem.

In case you select to make use of tax software program, we usually advocate that you simply use no matter software program you used to initially file your tax return. For instance, for those who used FreeTaxUSA to file your 2019 tax return, then it is best to use FreeTaxUSA to amend your 2019 tax return.

Step 3: Full The 1040-X

To finish your amended return, you’ll must observe directions from the tax software program product you select. These are directions from among the hottest tax firms.

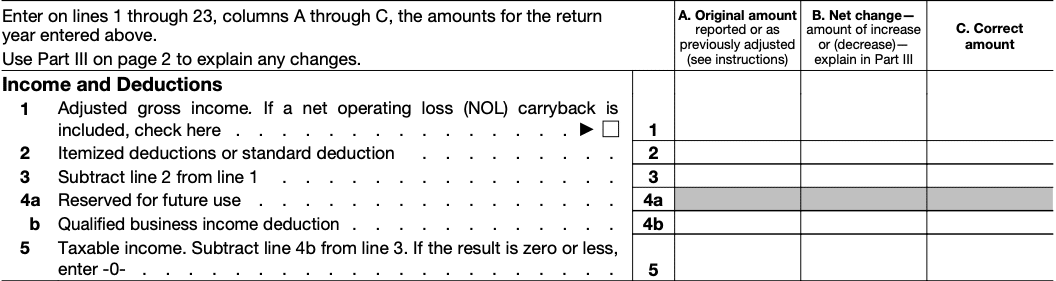

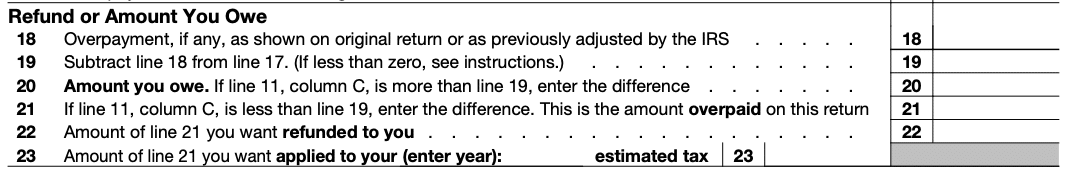

Type 1040-X has solely three main columns that should be stuffed out. Column A reveals the quantity you initially reported on you 1040. Column B reveals the online adjustments (each optimistic and unfavorable) and C reveals the right amount.

When you fill out the fundamental info related along with your revenue and deductions, you’ll be able to simply calculate the right refund quantity.

Most main tax software program presents step-by-step steering to assist filers full their amended returns precisely. The software program asks questions on what modified so customers can resubmit their info extra precisely.

Step 4: Submit The 1040-X With Supporting Info

The IRS helps e-filing utilizing tax software program merchandise such because the software program listed above. Filers can at present e-file returns for tax years from 2019 via 2021. The IRS doesn’t enable filers to e-file types they stuffed out by hand.

Individuals who wish to fill out their 1040-X with out tax software program should mail their return and the supporting documentation to the IRS. Folks selecting to amend their return on their very own ought to mail it to:

Division of the Treasury

Inner Income Service

Austin, TX 73301-0215

In case you are amending your return based mostly on directions from the IRS, mail the return to the handle specified within the official IRS notification.

Keep in mind, it’s good to submit IRS Type 1040-X and any modified schedules or types that help the change.

Step 5: Observe The Standing

You’ll be able to monitor the standing of your amended return utilizing the IRS web site. Throughout peak tax submitting season, amended returns could take 16 weeks or extra to course of. Until there may be some type of error along with your return, the IRS will ultimately get your a reimbursement to you.

Last Ideas

It may be irritating to be taught that you simply left cash on the desk by making a mistake in your taxes. However the IRS permits tax filers to reclaim the cash that’s legitimately theirs. You most likely received’t wish to spend your Saturday afternoon submitting getting ready the return, however it may well result in an additional refund of a whole lot and even hundreds of {dollars}.

Whereas submitting is a trouble, it’s most likely price it to get the cash that is because of you.