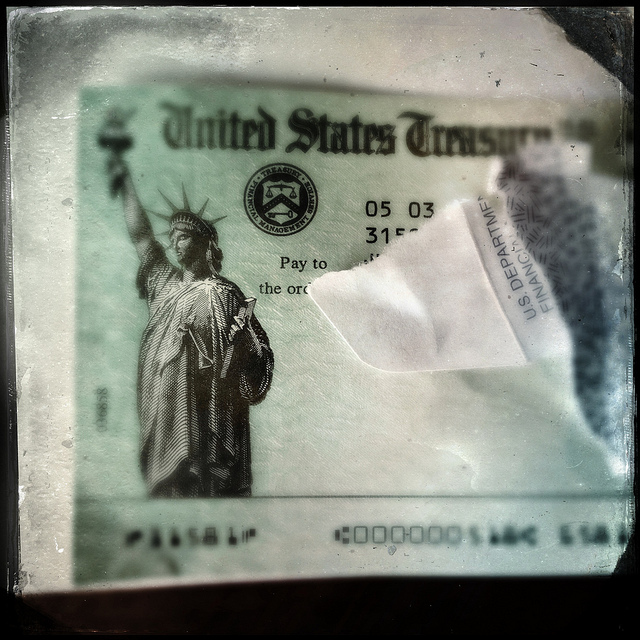

Getting a tax refund examine from the federal government is often an ideal factor.

Or a minimum of, for those who ignore that the federal government is returning YOUR cash as a tax refund. You’ve struggled with out the cash for a 12 months whereas Uncle Sam used it with out curiosity.

However for those who’ve filed chapter throughout the tax 12 months, the chapter trustee might demand you flip over of a portion of the refund as having accrued earlier than you filed chapter.

Ouch! You lose twice.

Lower your collectors out of your tax refund

A part of your pre chapter planning ought to embody a take a look at your present 12 months withholding.

For those who often get a considerable refund, or if one thing in your tax life suggests you’ll get an enormous refund for the 12 months you file chapter, do one thing!

The trustee can demand a portion of the refund provided that there IS a refund.

Lower your withholding as quickly as you determine to file chapter such that your decreased withholding for the final a part of the 12 months brings you near the quantity you count on to owe.

Learn how to plan for no refund

To take a easy instance, assume that your complete earnings tax is $6000, and also you often get a $6000 refund whenever you file your taxes. That signifies that every month, you might be overpaying Uncle Sam by $500 (12 x $500= $6000).

For those who determine to file chapter at mid 12 months, you’ll have already got paid all you count on to owe in taxes for the tax 12 months. (You often pay in $12,000, and get $6000 again). Don’t withhold any extra.

Come subsequent spring whenever you file your return, there gained’t be a refund, and the chapter trustee can pound sand.

I’ve used good spherical numbers and straightforward fractions for example my level. Get out your calculator and determine what your annual complete tax is, and what you’ve paid in so far to seek out the best numbers, and the best withholding in your scenario going ahead.

Or, get assist out of your tax preparer.

Make higher use of your cash

My hope is that you simply’ve diverted that $500 a month that you simply used to lend to Uncle Sam for the 12 months to funding your retirement or creating an emergency fund.

In any case, top-of-the-line causes to file chapter is to remove debt and set cash apart so that you might be financially autonomous.

Extra on planning for chapter

Learn how to spend cash earlier than you file

Don’t make massive adjustments earlier than getting authorized assist

Learn how to interview a chapter lawyer

Picture courtesy of Flickr and Seth Anderson.