Two completely different measures inform the same story.

Working longer has been usually accepted nearly as good recommendation for a safe retirement. It straight will increase present earnings; it permits folks to contribute extra to their 401(okay)s; it shortens the interval of retirement; and, importantly, delaying claiming of Social Safety leads to a a lot greater month-to-month profit. The excellent news is that folks have responded; the long-term development towards earlier retirement got here to a halt within the mid-Eighties, labor drive participation charges at older ages started to extend within the mid-Nineteen Nineties, and since then the common retirement age has elevated by three years. The query is the extent to which working longer has translated into delayed claiming of Social Safety advantages.

Some data might be gleaned from the claims information revealed yearly by the U.S. Social Safety Administration (SSA). These information present, for all staff claiming advantages in a given yr, the proportion who’re ages 62, 63, 64, and so on., which is informative for any given yr. However when the dimensions of the group turning 62 is rising considerably annually, the claims information underestimate the development towards later claiming. That’s, the information will present age-62 claimants making up a bigger portion of whole new claimants in a given yr even when a smaller proportion of these age 62 declare instantly. To precisely comply with claiming conduct over time, one should take a look at cohort information. Such information present, of the potential claimants turning 62 in a given yr, the proportion who declare as quickly as attainable. In a latest examine, we used each sources of information to have a look at long-term tendencies in claiming.

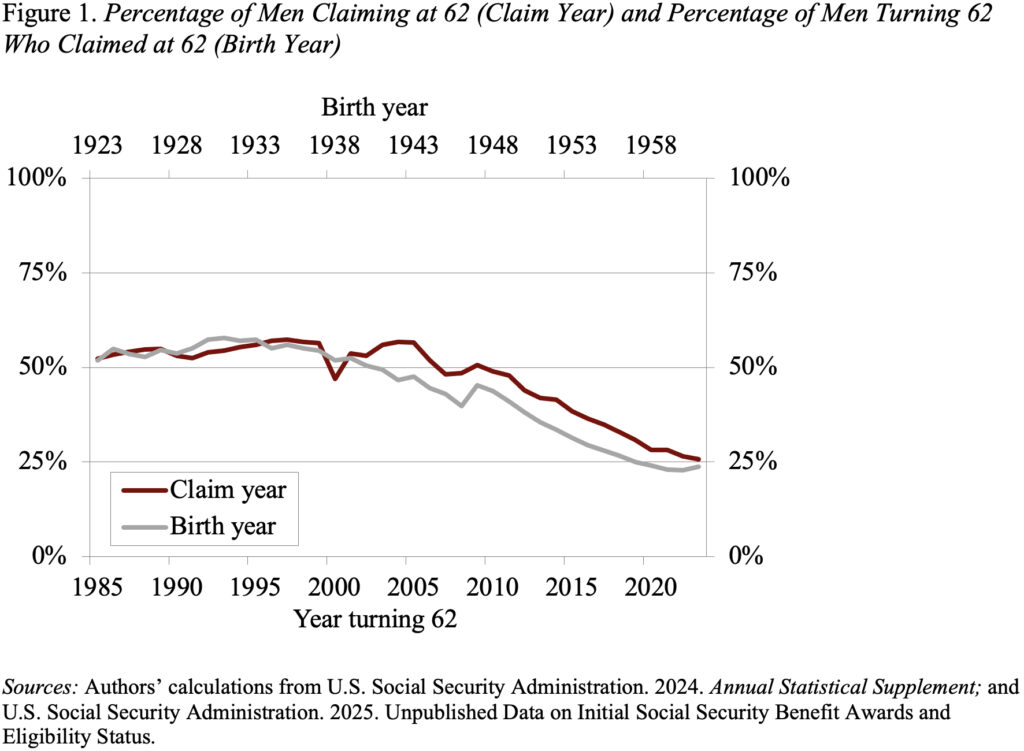

One technique to glean whether or not individuals are claiming later in addition to working longer is to have a look at the proportion of staff who declare as quickly as advantages can be found at age 62. Determine 1 reveals the proportion of males claiming at age 62 beneath the 2 approaches described above. The claim-year line reveals the proportion of all these claiming in a given yr who’re 62; the birth-year line reveals the proportion of these born in a given yr who declare at 62. The 2 approaches present very related outcomes till 1997; afterward, the 2 sequence begin to diverge. The birth-year information replicate the uptick in labor drive exercise starting within the mid-Nineteen Nineties and present a a lot bigger decline over the past three a long time than the claim-age information.

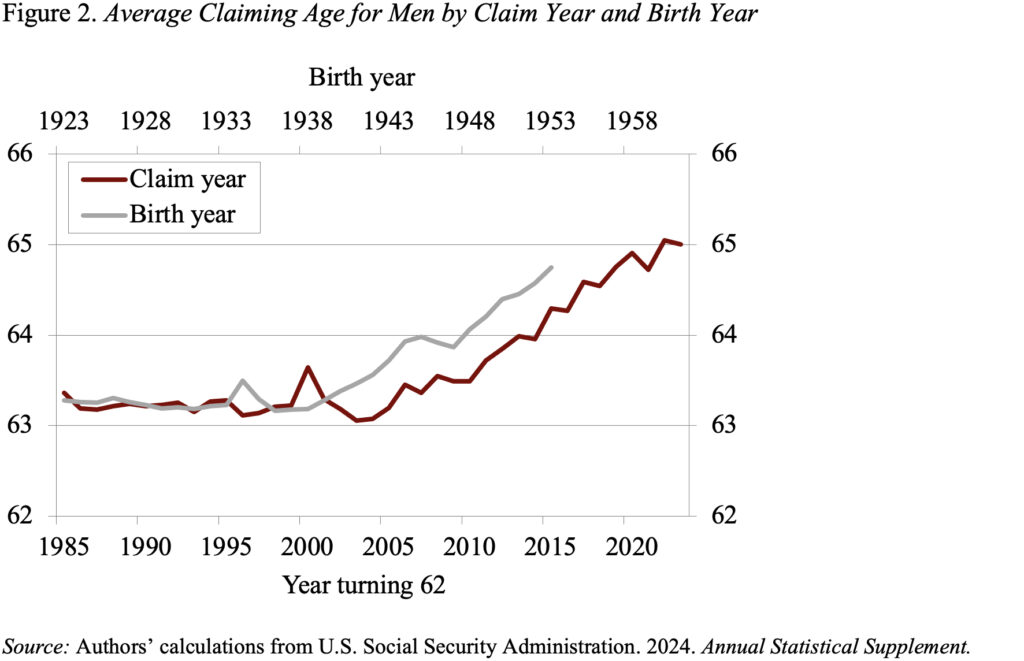

Determine 2 presents the development from 1985-2023 within the common claiming age for males on a claim-year and birth-year foundation (these cohorts turning 62 after 2015 don’t attain age 70 by 2023). As one would anticipate, the rise is bigger utilizing the birth-year information, however each help the competition that the delay in retirement has been accompanied by a delay in claiming. The delay in claiming, nonetheless – even utilizing the birth-year information – is just about two years – barely lower than the three-year improve within the common retirement age.

The underside line is that “sure” individuals are claiming later, however the improve in claiming age is barely lower than what one would anticipate from the rise in work at older ages – and that discovering holds no matter whether or not the main focus is folks claiming in a given yr or folks born in a given yr.