So that you’re investing whereas nonetheless dwelling your life as a working grownup quickly climbing your profession ladder, or maybe an overwhelmed working mum or dad juggling your 9-5 job and your childrenon high of it. Or possibly you’re the entire above, similar to I’m.

In that case, you positively know the way troublesome it may be to stability your entire commitments…whereas nonetheless staying on high of the monetary markets and your funding portfolio. As a result of that’s the precise journey I went by way of –I now not had the luxurious of time to learn as a lot as I used to and hunt for good inventory concepts within the wild anymore.

My life adjustments warranted new options and new fixes. And that’s how I (lastly) forked out money to subscribe to a number of inventory funding companies to assist me lower by way of all of the noise and give attention to what’s extra necessary i.e. The Motley Idiot, In search of Alpha and Zacks. I noticed these as a solution to:

- Save time

- Get curated inventory concepts (as a substitute of filtering by way of dozens to a whole lot of firms on free inventory screeners)

- Enhance my funding abilities by studying from different analysts (like how I self-taught my solution to an ‘A’ at school by studying different college students’ mannequin essays)

Over time, I’ve terminated the subscriptions that I now not felt labored for me (Zacks was the primary I terminated, adopted by a number of authors’ paid work on In search of Alpha), however I proceed search and check out new potential options.

The newest being Moby.

Some folks name Moby a stock-picking service, whereas others name it an funding analysis app. For those who requested me, I feel it’s all of that – and extra.

My first encounter with Moby began once they popped up on my Discover web page on Instagram (which is usually social finance and motivational content material, in case you needed to know), which led to me following their web page. Shortly after, they DM-ed me to ask if I’d like to take a look at their Premium service, so I did.

The concept of having the ability to observe politicians’ trades intrigued me, so I gave it a shot – though to start with I used to be principally utilizing it to kaypoh their inventory picks (and get concepts!) and browse their day by day newsletters on what occurred within the markets.

In simply 2 weeks, I knew this may be a paid service I’ll be sticking with – and if I had the funds to pay for less than ONE funding subscription service? Moby could be my selection.

Whereas Moby Premium gives a number of totally different advantages for buyers and learners (even inexperienced persons) in any respect phases and types, I personally used it to assist me resolve 2 of my most necessary wants:

Requirement 1: Preserve me up to date on the monetary markets

I don’t have the time or bandwidth to learn each single monetary information, and if I needed to be actually important about it, I’ve realized that lately, on-line media is now so stuffed with muddle and clickbait articles that it takes numerous effort to chop by way of the noise and keep grounded.

Studying (an excessive amount of) information too usually may have an opposed impression in your investing as a result of some articles are inclined to sway you to both emotional extremes (concern or greed). I don’t blame the media retailers, as a result of that’s what catches eyeballs and a spotlight.

Nevertheless it doesn’t assist ME as an investor.

Moby, then again, delivers me sufficient monetary information and updates that hasn’t performed with my feelings but.

As an example, I learnt in regards to the Iran-Israel assaults and the rationale behind Tesla’s in a single day 15% positive aspects from simply spending 3 minutes on Moby every day. And when Shopify dropped 20% in a single day? I now not needed to spend 10 – quarter-hour Googling and studying for solutions as Moby solved that for me inside simply 3 minutes.

That has been an unimaginable time saver, and I can not say sufficient how that helps me as a working mom with 2 preschool youngsters and a number of aspect hustles.

Requirement 2: Give me some respectable inventory concepts

To make it value my subscription charges, I demand that each funding service I’m on should have sufficient good inventory picks featured that it provides no less than one good inventory to my portfolio in a yr.

That was why I cancelled my Zacks subscription and a pair of authors’ paid companies on In search of Alpha, as a result of I personally wasn’t getting any such worth out from them. It’s also the rationale why I nonetheless hold my Motley Idiot subscription, as a result of they cowl a number of of the shares in my portfolio and I’ve added no less than 2 new positions (which I wouldn’t have found in any other case if I hadn’t learn it on their picks).

Though I’ve not acted on any of Moby’s picks but, I already added a number of of their concepts to my watchlist for future analysis. Right here’s 2 latest examples of names I’ve but to come back throughout anyplace else:

- Embraer: the world’s 3rd largest industrial plane producer, proper behind Boeing and Airbus

- FTAI Aviation: MRO companies of plane engines to keep up the security and effectivity of worldwide industrial fleets

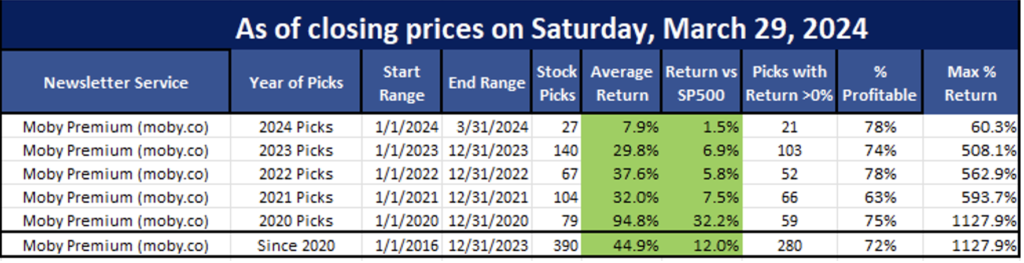

For those who’re questioning how their inventory selecting efficiency has been to date, a US blogger went to dig up and tracked their yearly picks and efficiency since 2020:

Personally, I care extra about what their picks do for me than how ALL their picks carried out as a complete (because it’s not as if I spend money on each single inventory they characteristic), however it’s good to know that somebody has executed the digging to carry them accountable and that they’ve fared fairly decently right here in outperforming the S&P 500.

If any subscription service you’re on doesn’t no less than beat the S&P 500, you have to be cancelling it ASAP. And if it doesn’t assist YOU beat the S&P 500, then it is best to most likely be rethinking whether or not your cash is being effectively spent.

Moby’s background and aggressive edge

Moby’s founding group comprise of seasoned finance of us from Morgan Stanley and Goldman Sachs, in addition to senior leaders from Gemini, amongst others.

However I wasn’t satisfied – you guys know me, as somebody who was previously educated in investigative journalism throughout my education years (and later constructed my profession within the investigative background checking business), so I wanted to dig deeper.

I requested Moby extra about their knowledge sources and strategies, amongst different issues. They agreed to fulfill with me of their New York workplace and deal with all of my questions (once I was up there final month for a NASDAQ web site go to), however unexpectedly acquired sick so we needed to reschedule it for a web-based one as a substitute after I flew again.

Throughout the assembly, I requested deeper questions on their knowledge sources and 20-step inventory choice methodology (stuff you may’t discover on-line):

The place does Moby get its knowledge and sources from?

How this works is that Moby buys knowledge from lots of sources – whether or not or not it’s scraping net knowledge, B2B API’s, and in-house analysis algo’s, that every one gas Moby’s proprietary knowledge sources, because the full complete checklist is in fact a commerce secret), earlier than utilizing AI to search out key factors and distill it down. Lastly, their very own content material group then writes the articles and visuals you see to make it jargon-free and comprehensible for each investor.

What standards does Moby apply for its inventory picks?

Moby’s group of former hedge fund analysts takes a complete method to inventory choice, primarily specializing in the long-term analysis of publicly traded firms within the US. Right here’s a deeper look into their standards:

- Monetary Well being and Stability: Moby evaluates the monetary well being of firms by inspecting key metrics akin to income progress, revenue margins, debt ranges, and money move. They prioritize firms with robust stability sheets and constant monetary efficiency.

- Market Place and Aggressive Benefit: The group seems for firms which have a robust market place and a sustainable aggressive benefit. This consists of business leaders with a confirmed observe report and progressive firms with the potential to disrupt their markets.

- Progress Potential: Moby identifies firms with vital progress potential. This consists of not solely established blue-chip shares with regular progress prospects but additionally high-growth sectors like know-how and biotech, the place rising firms are creating cutting-edge options and applied sciences.

- Administration High quality: The standard and expertise of an organization’s administration group are essential elements. Moby’s analysts assess the management’s observe report, strategic imaginative and prescient, and skill to execute plans successfully.

- Valuation: Moby performs thorough valuation analyses to make sure that they’re investing in firms at cheap costs. They use numerous valuation strategies, akin to price-to-earnings (P/E) ratios, price-to-sales (P/S) ratios, and discounted money move (DCF) evaluation, to find out an organization’s honest worth.

- Business Traits and Financial Circumstances: The group retains a detailed eye on business developments and broader financial circumstances. They choose firms which are well-positioned to learn from optimistic business developments and might climate financial downturns.

- Sustainability and ESG Elements: More and more, Moby additionally considers environmental, social, and governance (ESG) elements of their analysis. Firms with robust ESG practices are seen as higher long-term investments as a result of their potential for sustainable progress and decrease danger.

By making use of these complete standards, Moby goals to construct a diversified portfolio that balances stability with progress potential, catering to the funding objectives of the millennial demographic.

There’s numerous options in Moby Premium that not everybody could have the time for. How would Moby suggest the most effective utilization of the app for all of the working dad and mom or busy profession professionals (much like Funds Babe)?

For those who don’t have numerous time, the Moby group advised me that they’d suggest you to do the next:

- (Every day) learn the Morning E-newsletter and Finish of Day Report

- (Weekly) take a look at their 3 inventory picks to get concepts

- (Weekends) discover another options you’re eager on e.g. the politicians’ trades / hedge funds / crypto analysis / quant portfolios, and many others

Comparability of Moby vs. different companies

I’ve tabled the widespread ones that Moby usually will get in comparison with under:

| Moby | The Motley Idiot | Zacks | In search of Alpha | |

| Value (USD) | $199 yearly | $199 yearly (Inventory Advisor) |

$249 yearly | $239 yearly |

| Inventory picks | Sure | Sure | Sure | Sure |

| Every day market updates | Sure | No | Restricted | Depends upon which service |

| Monitor the politician’s trades | Sure | No | Restricted | Relies upon |

| Any upsell companies | No | Sure | Sure | Sure, there are a number of companies and totally different authors paid subs |

As I discussed, if I solely had the funds (or time) for ONE funding subscription service, Moby could be my selection.

For those who’re unsure whether or not Moby is appropriate for you but, I’d counsel you signal as much as their free publication checklist right here first, the place you’ll get delivered day by day updates on what’s transferring the markets. This can assist you to keep on high of all the pieces in slightly below 3 minutes a day, particularly when you’ve got no time to learn the information.

In spite of everything, that was how I began – and the emails alone satisfied me shortly after to present their Premium companies a go. Attempt it out for your self!

The Moby group has kindly prolonged a 50% off low cost to Funds Babe readers, so now you can attempt Moby out for simply $99 right here.

Provided that this instantly unlocks over 100+ distinctive inventory concepts so that you can take a look at, I’d say it’s completely definitely worth the $99 as a result of there’s virtually no approach you may’t get no less than a number of good investible inventory concepts from there!

And in case you actually assume it isn’t for you, there’s a 30-day assured refund coverage so no hurt attempting it out.

TLDR Abstract of Moby

After having used them myself for two months now, I discover Moby to be a fantastic analysis service for newbie to skilled buyers who need:

- One thing they will digest in simply 3 – 5 minutes every day

- Simple to know; free from an excessive amount of technical jargon

- Respectable inventory concepts for his or her funding portfolio

Having stated that, there are some teams of folks that Moby received’t be as appropriate for:

- Merchants: be it in choices, shares or crypto.

- Of us who need to have the ability to chart or display screen on the app

- Of us who want to sync their portfolios to the app

Whereas some inventory funding companies supply customers the flexibility to sync their portfolios and create a watchlist of shares to be notified for, there may be at present no such characteristic in Moby.

Nevertheless, in case your essential challenge is an absence of time, then Moby shall be a fantastic asset to you as an investor. And so long as you will get simply 1 – 2 actionable inventory concepts from it yearly, I’m positive you’ll positively earn again what you pay for Moby Premium a number of instances over.

With love,

Daybreak

Disclaimer: This submit is just not sponsored, however incorporates affiliate hyperlinks for in case you select to join Moby Premium. I am at present utilizing Moby on high of The Motley Idiot Inventory Advisor and In search of Alpha Premium, along with a number of choose Patreon subscriptions from my favorite finance creators, however discover Moby to be the #1 that I'd suggest to my readers for the explanations detailed above. For those who're uncertain, I counsel that you just give their e-mail publication a attempt first to examine if it will be a match for you - the publication is free (for now) anyway!