The holiday trade presents buyers with a various array of alternatives – however one which typically will get ignored is the timeshare sector. Timeshares are what their title suggests: properties with a number of joint homeowners. The intention is to make trip locations extra inexpensive; vacationers purchase rights to make use of a property at particular instances, fairly than full possession.

The mannequin has confirmed significantly engaging within the millennial demographic, a truth that provides the trade a sound path towards long-term income. Millennials are comparatively younger and are shopping for timeshare rights at a proportionately greater charge than different age teams. For timeshare corporations, this presents the prospect of a sound enterprise base for the subsequent decade or extra.

For now, many timeshare shares have been handed over by buyers, leading to a share worth low cost. The sound future and the present low worth have caught the eye of JMP analyst Aaron Hecht, who’s opening his protection of timeshare shares with a bullish stance.

“In our view, near-term headwinds have been priced into the shares and/or are mirrored in 2024/2025 estimates. We consider any extra near-term weak point in shopper exercise will end in pent-up demand that needs to be monetized as financial circumstances steadily enhance. Shares sit on the backside of historic a number of ranges, making this an opportune time to build up shares, in our opinion,” Hecht opined.

Towards this backdrop, Hecht has picked timeshare trade 3 shares that he thinks are primed to outperform over the long run. We’ve used the TipRanks database to get a have a look at the broader Wall Road view of those shares; listed here are the small print, and the analyst’s feedback.

Hilton Grand Holidays (HGV)

The primary timeshare inventory we’ll have a look at is Hilton Grand Holidays, a timeshare firm carrying a significant title in lodges and leisure. Hilton Grand Holidays spun off from the well-known Hilton lodge firm and since 2017 has been working independently within the timeshare area of interest, with operations in 16 US states. Hilton Grand Holidays is energetic in prime trip locations, and has properties in California, Florida, and Hawaii in addition to DC and Las Vegas. The corporate’s worldwide footprint contains Canada, the UK, Europe, Japan, Mexico, and the Caribbean.

The corporate’s portfolio of locations contains greater than 200 areas, accessible to some 700,000 timeshare homeowners. The corporate’s timeshare homeowners can select from properties with a variety of facilities, together with golf resorts, beachfronts, ski slopes, casinos, and concrete scenes. Most of the resorts additionally embrace facilities for teenagers and households, and vacationers can discover sports activities, purchasing, spas, films, eating places and loads of different sights.

Final yr, Hilton Grand was impacted by the Maui wildfires, which harm revenues on its Hawaii properties. Whereas solely two of the corporate’s properties within the islands have been positioned on Maui, and neither was within the path of the Lahaina hearth, the associated components of lowered vacationer journey to Hawaii and trip cancellations every took their toll.

In one other occasion that impacted the inventory, however one that’s extra idiosyncratic to Hilton Grand, the corporate in November entered an settlement to buy the resort firm Bluegreen Holidays. The acquisition was introduced as accomplished on January 17, in an all-cash transaction for about $1.5 billion, a complete that included web debt. The acquisition provides Bluegreen’s locations to Hilton Grand’s portfolio, an vital achieve for the corporate. HGV shares took a 6% hit on the time of the preliminary announcement, nonetheless, as a result of dimension of the money outlay.

Hilton Grand is anticipated to launch its 4Q23 outcomes on leap day, February 29, however we will look again on the firm’s Q3 outcomes for an concept of its present standing. These outcomes have been considerably combined. The income complete of $1.02 billion was down 9% from the prior-year interval, and missed the forecast by $20 million – however the backside line, the non-GAAP earnings per share of 98 cents, was a penny higher than had been anticipated.

Checking in with JMP’s Hecht, we discover the analyst outlining an upbeat outlook primarily based on HGV’s stable asset portfolio. He says of the corporate, “HGV has a singular fee-for-service enterprise mannequin and ~700K homeowners throughout 200+ resorts and ~735K members by means of its membership choices, together with the addition of Bluegreen Holidays. Hilton’s membership choices embody greater than 738k members throughout HGV Trip Membership, HGV Max, the Hilton Membership change program, and the Legacy-Diamond Membership… On an adjusted EBITDA margin foundation, HGV stays nicely above the peer group at 27.8%… HGV at the moment trades at 6.4x 2025E adj. EBITDA, beneath its long-term historic common of 6.8x…”

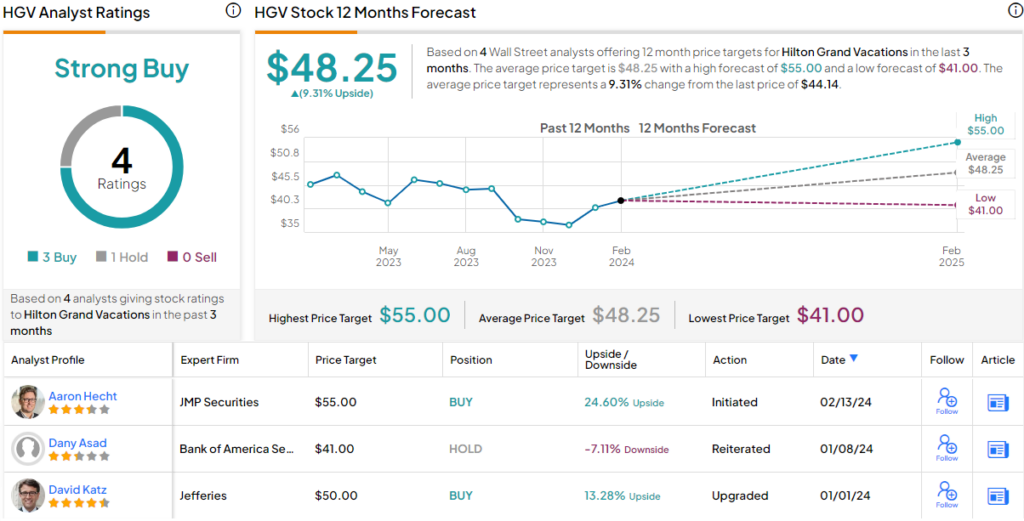

Hecht goes on to provide these shares an Outperform (Purchase) ranking as a begin, with a $55 worth goal that implies the inventory will present a 24.5% achieve over the subsequent yr. (To observe Hecht’s monitor file, click on right here)

This inventory holds a Sturdy Purchase ranking from the Road’s consensus, primarily based on 4 latest opinions that embrace 4 Buys towards a single Maintain. The inventory’s $44.14 buying and selling worth and $48.25 common goal worth collectively suggest a one-year upside potential of 9%. (See HGV inventory forecast)

Journey + Leisure Firm (TNL)

Subsequent up on our JMP-backed record is Journey + Leisure Firm, one other one of many timeshare trade’s well-established names. The corporate makes its residence within the vacation-friendly locale of Orlando, Florida, and its main enterprise is the event, sale, and administration of timeshare properties in prime trip locations. The corporate’s properties are provided by means of a number of manufacturers, and have well-reputed names equivalent to Margaritaville, Worldmark, and Wyndham.

Along with timeshares, TNL additionally works within the timeshare change enterprise. Because the title implies, exchanges contain timeshare homeowners making trades amongst themselves – an proprietor swapping his week at one location for another person’s time at a unique location. This enterprise, which Journey + Leisure operates by means of RCI, counts over 3.5 million members and generated over $170 million in income over the last reported quarter.

On the core timeshare enterprise, TNL facilitates companies for greater than 816,000 homeowners on its properties. This core varieties the bottom of a robust mannequin, that has proven a modest upward pattern in income and earnings in latest quarters. The final reported quarter, 3Q23, had a high line of $986 million, for a 5% year-over-year achieve that was additionally $14.3 million forward of the estimates. The corporate’s backside line, reported as a non-GAAP EPS of $1.54, was 8 cents per share over the forecast.

These have been thought of sound outcomes, and the corporate complemented them with one other function that return-minded buyers ought to discover engaging: a gradual dedication to beneficiant capital returns. The corporate has a share buyback program, which noticed $65 million price of inventory repurchased in Q3, and had $210 million remaining in its buyback authorization on the finish of the quarter. Additionally of observe, the corporate pays out an everyday frequent share dividend, final paid at 45 cents per share on December 29. The annualized fee of $1.80 per frequent share offers a ahead yield of 4.35%, greater than sufficient to beat inflation.

This inventory has additionally piqued Hecht’s curiosity, and he’s simply plain upbeat on the shares, saying of them, “We anticipate TNL will proceed to repurchase inventory at a historic tempo, using this avenue to drive earnings development within the out years… RCI supplies a robust constant earnings stream for TNL, providing some insulation from the macro influence on VOI gross sales, which we view as a optimistic differentiator… TNL at the moment trades at 6.5x 2025E adj. EBITDA, beneath its long-term historic common of seven.8x.”

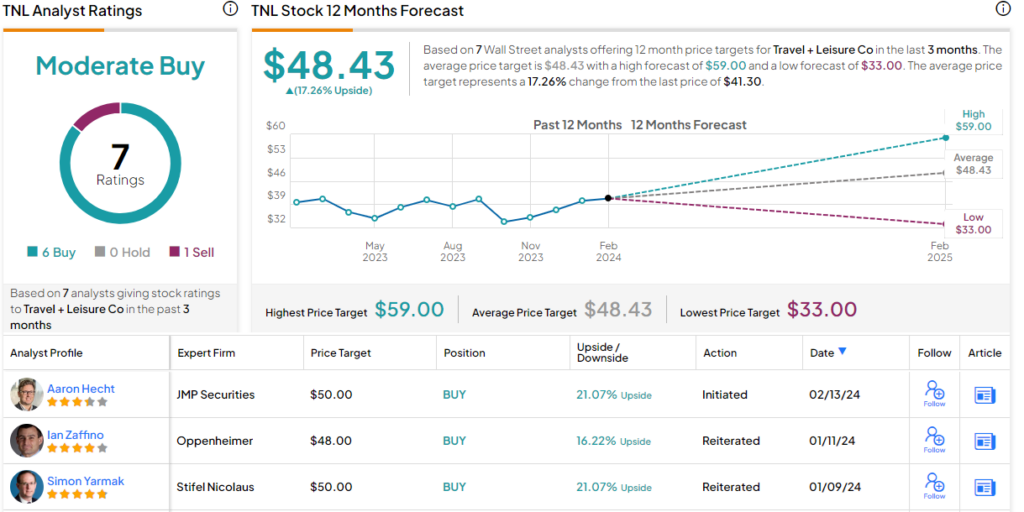

Wanting ahead, Hecht opens his rankings on TNL inventory with an Outperform (Purchase) outlook, and with a $50 worth goal that means a achieve of 21% on the one-year horizon.

The Reasonable Purchase consensus ranking right here relies on 7 latest analyst opinions, that break down to six Buys and 1 Promote. The shares are buying and selling for $41.30 and their $48.43 common worth goal signifies potential for a 12-month achieve of 17%. (See TNL inventory forecast)

Marriott Holidays Worldwide (VAC)

Marriott is without doubt one of the best-known names within the lodge trade, and Marriott Holidays Worldwide, established in 2011 as a separate, pure-play timeshare entity constructing on the Marriott title and status, is without doubt one of the world’s main operators of timeshare locations. The corporate operates its properties by means of a number of manufacturers, together with (however not solely) Marriott Trip Membership, Sheraton Trip Membership, and Westin Trip Membership. Altogether, the corporate controls almost 120 resort and trip locations, with greater than 18,500 villas out there for timeshare buy.

The corporate’s locations embrace the comparatively inexpensive, and the purely luxurious, and timeshare patrons can discover areas within the US, the Caribbean, Central America, Europe, Asia, and Australia. Trip locations embrace such fascinating spots because the South Carolina and Florida coasts, the Colorado mountains, and concrete locales in Washington DC or New York. By way of its change and third-party administration community, the corporate additionally makes out there a broad portfolio of timeshare exchanges and leases for patrons who wish to swap areas.

Some numbers will present the dimensions of Marriott Holidays’ operations. The corporate can boast of greater than 700,000 proprietor and member households in its timeshare possession enterprise, and studies a visitor satisfaction rating of 90%. The corporate’s change community operates in additional than 90 international locations, claims almost 3,200 properties, and has some 1.6 million members. It’s a stable basis to assist a leisure enterprise.

Marriott Holidays Worldwide noticed some headwinds final yr, significantly the wildfires on Maui, the place the corporate has a number of properties. Whereas these properties didn’t report any bodily injury, the corporate did really feel a detrimental influence on revenues. The highest line for the third quarter of 2023, the final reported, got here to $1.19 billion, or 3.3% down from the prior yr and $10 million lower than anticipated. Earnings within the quarter, by non-GAAP measures, got here to $1.20 per diluted share, lacking the forecast by 94 cents per share. The inventory is down roughly 43% during the last 12 months. We’ll see the corporate’s 4Q23 outcomes later this week.

Regardless of the famous short-term headwinds, analyst Hecht sees long-term achieve ready within the wings right here, with the depressed share worth providing a chance. He writes of VAC, “Marriott stays our favourite model affiliate for the timeshare trade given the standard of the related prospects and product… VAC at the moment trades at 5.6x 2025E adj. EBITDA, beneath its long-term historic common of 10.0x, and we see the market as undervaluing the corporate and we anticipate the corporate to outperform over the subsequent 12-14 months… VOI (trip possession curiosity) gross sales margin for VAC is cleanest disclosure throughout the peer set. Margin has clearly been on an upward pattern and we consider there may be extra upside within the mannequin’s long run.”

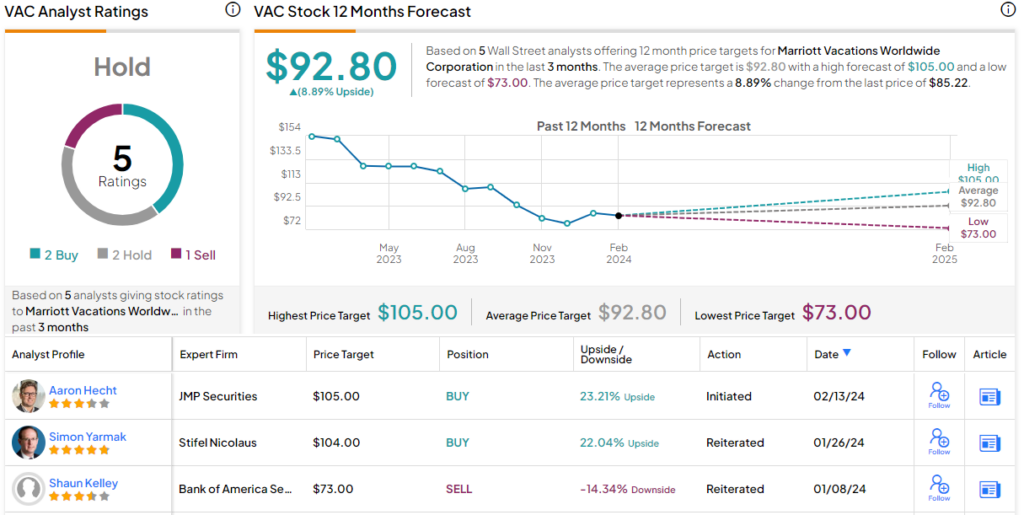

Quantifying his stance, Hecht charges this inventory as Outperform (Purchase) in his initiation-of-coverage write-up, and units a worth goal of $105, implying a one-year upside potential of 23%. (To observe Hecht’s monitor file, click on right here)

On stability, the Road is much less bullish. The inventory will get a Reasonable Purchase consensus ranking, primarily based on 5 latest opinions that embrace 2 to Purchase and Maintain, every, and 1 to Promote. The shares are priced at $85.22 and their $92.8 common worth goal factors towards a 9% share appreciation within the coming yr. (See VAC inventory forecast)

To search out good concepts for shares buying and selling at engaging valuations, go to TipRanks’ Greatest Shares to Purchase, a device that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed on this article are solely these of the featured analysts. The content material is meant for use for informational functions solely. It is vitally vital to do your personal evaluation earlier than making any funding.